Stock Portfolio Organizer

The ultimate porfolio management solution.

Shares, Margin, CFD's, Futures and Forex

EOD and Realtime

Dividends and Trust Distributions

And Much More ....

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

Advanced Adaptive Indicators

Advanced Pattern Exploration

Neural Networks

And Much More ....

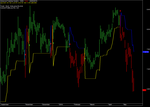

Advanced Trailstop System for Amibroker (AFL)

Rating:

3 / 5 (Votes 4)

Tags:

amibroker, stop loss

Advanced Trailstop System

www.tatechnics.in

Screenshots

Similar Indicators / Formulas

DODA BAND BUY SELL

Submitted

by saas almost 11 years ago

JMA Stoploss

Submitted

by kuzukapama almost 13 years ago

TSL & HL & New

Submitted

by morgen almost 12 years ago

Stop Loss Indicator

Submitted

by nabcha about 14 years ago

ABKP Benchmark Bar

Submitted

by amitabh about 14 years ago

Indicator / Formula

Copy & Paste Friendly

_SECTION_BEGIN("Advanced Trailstop System");

///Advanced Trailing stop - www.tatechnics.in

mult=Param("multi", 2.0, 0.1, 10, 0.05);

Aper=Param("ATR period", 7, 2, 100, 1 );

atrvalue=(mult*ATR(aper));

Bs[0]=0;//=L;

L[0]=0;

C[0]=0;

for( i = 9; i < BarCount; i++ )

{

if ( L[ i ] > L[ i - 1 ] AND L[ i ] > L[ i - 2 ] AND L[ i ] > L[ i - 3 ] AND L[ i ] > L[ i - 4 ] AND

L[ i ] > L[ i - 5 ] AND L[ i ] > L[ i - 6 ] AND L[ i ] > L[ i - 7 ] AND L[ i ] > L[ i - 8 ] AND

L[ i ] > L[ i - 9 ] AND C[ i ] > bs[ i - 1 ])

{

bs[ i ] = L[ i ] - ATRvalue[ i ] ;

}

else

{

if ( H[ i ] < H[ i - 1 ] AND H[ i ] < H[ i - 2 ] AND H[ i ] < H[ i - 3 ] AND H[ i ] < H[ i - 4 ] AND

H[ i ] < H[ i - 5 ] AND H[ i ] < H[ i - 6 ] AND H[ i ] < H[ i - 7 ] AND H[ i ] < H[ i - 8 ] AND

H[ i ] < H[ i - 9 ] AND C[ i ] < bs[ i - 1 ] )

{

bs[ i ] = H[ i ] + ATRvalue[ i ];

}

else

{

bs[ i ] = bs[ i - 1];

} }}

//====================================================

Mycolor=IIf(C>bs,colorLime,colorRed);

bcolor=IIf(C>bs,colorYellow,colorBlue);

PlotOHLC( Open, High, Low, Close, "", Mycolor, styleBar| styleThick );

Plot(bs,"ATS",bcolor,1|styleThick);

Buy=Cover=Cross(C,bs);

Sell=Short=Cross(bs,C);

shape=Buy*shapeUpArrow + Sell*shapeDownArrow;

PlotShapes(shapeUpArrow*Buy, colorLime, 0, L, -35 );

PlotShapes(shapeDownArrow*Sell, colorRed, 0, H, -30 );

SellPrice=ValueWhen(Sell,C,1);

BuyPrice=ValueWhen(Buy,C,1);

Long=Flip(Buy,Sell);

Shrt=Flip(Sell,Buy );

_SECTION_END();

Filter= Buy OR Sell OR Short OR Cover;

//=================TITLE================================================================================================

_SECTION_BEGIN("Title");

if( Status("action") == actionIndicator )

(

Title = EncodeColor(colorWhite)+ "Advanced Trailstop System " + " - " + Name() + " - " + EncodeColor(colorRed)+ Interval(2) + EncodeColor(colorWhite) +

" - " + Date() +" - "+"\n" +EncodeColor(colorYellow) +"Op-"+O+" "+"Hi-"+H+" "+"Lo-"+L+" "+

"Cl-"+C+" "+ "Vol= "+ WriteVal(V)+"\n"+

EncodeColor(colorLime)+

WriteIf (Buy , " GO LONG / Reverse Signal at "+C+" ","")+

WriteIf (Sell , " EXIT LONG / Reverse Signal at "+C+" ","")+"\n"+EncodeColor(colorWhite)+

WriteIf(Sell , "Total Profit/Loss for the Last Trade Rs."+(C-BuyPrice)+"","")+

WriteIf(Buy , "Total Profit/Loss for the Last trade Rs."+(SellPrice-C)+"","")+

WriteIf(Long AND NOT Buy, "Trade : Long - Entry price Rs."+(BuyPrice),"")+

WriteIf(shrt AND NOT Sell, "Trade : Short - Entry price Rs."+(SellPrice),"")+"\n"+

WriteIf(Long AND NOT Buy, "Current Profit/Loss Rs."+(C-BuyPrice)+"","")+

WriteIf(shrt AND NOT Sell, "Current Profit/Loss Rs."+(SellPrice-C)+"",""));

_SECTION_END();1 comments

Leave Comment

Please login here to leave a comment.

Back

THANKYOU SIR !