Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

Behgozin Slope Finder for Amibroker (AFL)

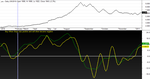

This is a very simple and useful formula-Simply buy when lines are positive and sell when they became negative- there are 2 lines based on 7 and 15 days- thanks in advance for your good comment

Screenshots

Similar Indicators / Formulas

Indicator / Formula

SetChartBkGradientFill(1,23);

_SECTION_BEGIN("Behgozin Slope Finder");

Tr2 = Ref(C,1);

Tr3=Ref(C,7);

Trend2 = MA(Tr2,7);

Trend3=MA(Tr3,7);

Slope=((Trend3-Trend2)/Trend3)*100;

Plot(Slope,"Buy When Slope was positive and sell when became negative",colorYellow,styleLine+styleDots|styleThick);

Tr4 = Ref(C,7);

Tr5=Ref(C,15);

Trend3 = MA(Tr4,15);

Trend4=MA(Tr5,15);

Slope=((Trend4-Trend3)/Trend4)*100;

Plot(Slope,"",colorGreen,styleLine+styleDots|styleThick);

Plot(0,"",colorWhite,styleLine);

_SECTION_END();17 comments

Leave Comment

Please login here to leave a comment.

Back

hi

excellent. gives oppertunity to buy and sell before any indicators . try your self. can some one add alert, buy and sell arrows and explorations for this

ravi

qatar

Its a amazing indicator bro hataro3…simple but great, looking to me exceptional & obviusly leading one.. thanks for nice sharing.

Simply Superb……..

My rating 100

Hotato3, Will this also work any time frame? I mean small Time Frames

Thanks

Viswanath MK

One more clarification required is : Is this forwarding Looking. As per me this is not as no zigzag used. But “shariful” in the above comments saying that it is “obviusly leading one”.

CAn anybody tested on live charts???

Plz update

Thanks

Viswanath

Buy sell signals & exploration added. But its forward looking indicator. Becaefull….

lot of mistakes here for5.50

Dear Friends, Thank you for your comments helping me work harder. unfortunatly this indicator is the second indicator that I tried to generate, in other word I am really unskillful in this field. this indicator has many deficiency as I recognised. Due to its nature of calculation every point by mean value of several points, all points will be re calculated so in some cases that there is abrupt change in price, shift of curve will be clear. and due to this mater please do not consider the value of Slope and consider only its position with respect to zero line. More again I appologize for my poor ability to writing better indicator

Behgozin

dear kv malgi

thanks for the quick response. but the edition of exploration and scan shows lot of syntex errorcan u correct them?i am using 5.0 version of ami

ravi

please be careful before making a decision to sell or buy, you should first be compared to other indicators. I get doubts with this indicator when I do a “bar reply” because the result is always changing.

Ravi, plz use exploration. I am getting results like this below in ami v5.5.

Ticker Date/Time Buy Sell Close High

JSWSTEEL_F1 8/23/2012 16:37:00 1 0 719.500 719.500

SESAGOA_F1 8/23/2012 16:37:00 1 0 191.250 191.250

CNX-IT 8/23/2012 15:33:00 0 1 6207.600 6213.550

RPOWER_F1 8/23/2012 15:30:00 1 0 84.200 84.350

ONGC_F1 8/23/2012 15:30:00 1 0 283.500 283.600

HCLTECH_F1 8/23/2012 15:00:00 0 1 560.650 564.200

INFY_F1 8/23/2012 14:00:00 0 1 2459.000 2467.350

EDUCOMP_F1 8/23/2012 13:00:00 0 1 164.100 164.950

TATAPOWER_F1 8/23/2012 12:59:00 0 1 100.500 100.650

TATASTEEL_F1 8/23/2012 12:00:00 0 1 402.850 403.400

JINDALSTEL_F1 8/23/2012 12:00:00 0 1 411.050 412.700

RCOM_F1 8/23/2012 12:00:00 1 0 53.800 53.800

ICICIBANK_F1 8/23/2012 11:00:00 0 1 984.850 986.600

HINDALCO_F1 8/23/2012 11:00:00 0 1 114.800 115.500

DRREDDY_F1 8/23/2012 11:00:00 0 1 1689.000 1690.500

NIFTY_F2 8/23/2012 11:00:00 0 1 5477.000 5482.450

CNX-DEFTY 8/23/2012 11:00:00 0 1 3413.000 3419.200

MINIFTY_F2 8/23/2012 11:00:00 0 1 5475.150 5481.000

NIFTY_F1 8/23/2012 10:00:00 0 1 5444.000 5453.950

HDFCBANK_F1 8/23/2012 10:00:00 0 1 603.100 606.750

JPASSOCIAT_F1 8/23/2012 10:00:00 0 1 78.250 79.200

CNX500 8/23/2012 10:00:00 0 1 4263.550 4269.100

CNX100 8/23/2012 10:00:00 0 1 5291.050 5300.650

NIFTY 8/23/2012 10:00:00 0 1 5428.500 5439.050

MINIFTY_F1 8/23/2012 10:00:00 0 1 5445.000 5453.950

BANKNIFTY_F2 8/23/2012 10:00:00 0 1 10587.000 10614.000

BANKNIFTY_F1 8/23/2012 10:00:00 0 1 10549.000 10579.000

TITAN_F1 8/23/2012 10:00:00 0 1 225.350 226.800

Dear Kv-Maligi

thank you for your helping to write more for completing my program. Only I must mention that for decision I think it is better to consider only one condition be bigger than zero, ie. only Slope1> 0 and not 2 of them.So please change your program to this condition. I also confirmed that all points will be recalculate every day so shift in curve specially in new days can be happened, but the trend can be understood by watching slope in upper or lower case of zero.

no errors for 5.5 thanks

Hi hotaro3,

Also, I have tried for only slope1 alone, its not reliable. you will be chopped into pieces in choppy market.

You can use following, more reliable.

Use this.

Vishvanath and KV Malgi sir, it is totally useless in live market…………!!!

This afl is of No use … better use Expo moving averages for far better results then wt this alf is giving. Better avoid it

GOOD ONE SIR AND THANKS FOR SHARING

PRASAD

guys ….. this code looks as far as 15 bars into the future ….. I loaded the code and tested it without looking at the code itself and for a moment I felt this fuzzy warm feeling again …. but …. as usual returns like this can not be made in reality (only if you can manipulate the markets like the big banks do). It is easy to check if the code can be traded in real time. Just use the Amibroker playback tool and see how good it will work for you in real time.