Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

PRA TTS v1.1 for Amibroker (AFL)

technical added—-

1-tow type exploration(mrkt exp or buy/sell switch in prameter),(switchable)

2-trend line added,(switchable),

3-regreshion trend,(switchable),

4-buy/sell label,(switchable)/

5-accurate buy/sell signal,

6-magnified price two type(switchable)

7-pivot already…..

enjoy trading..

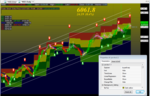

Screenshots

Similar Indicators / Formulas

Indicator / Formula

Explorer= ParamToggle("Explorer","buysell exp|market exp",1);

font = ParamToggle("font","Show|Hide",1);

TrendLines= ParamToggle("TrendLines","Show|Hide",0);

LinearRegression= ParamToggle("LinearRegression","Show|Hide",0);

Buyselllable= ParamToggle("Buyselllable","Show|Hide",0);

ChangeTitle= ParamToggle("ChangeTitle","Show|Hide",1);

_SECTION_BEGIN("Background_Setting");

SetChartBkGradientFill( ParamColor("BgTop", colorDarkYellow),

ParamColor("BgBottom", colorDarkTeal),ParamColor("titleblock",colorDarkGrey ));

SetChartBkColor(colorTeal); // color of outer border

_SECTION_END();

SetChartOptions(0,chartShowArrows | chartShowDates);

if(TrendLines==1)

{

_SECTION_BEGIN("Trend Lines");

p1 = Param("TL 1 Periods", 20, 5, 50, 1);

p2 = Param("TL 2 Periods", 5, 3, 25, 1);

TL1 = LinearReg(C, p1);

TL2 = EMA(TL1, p2);

Col1 = IIf(TL1 > TL2, ParamColor("TL Up Colour", colorGreen), ParamColor("TL Dn Colour", colorRed));

Plot(TL1, "TriggerLine 1", Col1, styleLine|styleThick|styleNoLabel);

Plot(TL2, "TriggerLine 2", Col1, styleLine|styleThick|styleNoLabel);

_SECTION_END();

}

//================================================End Chart Configuration===============================================================================

if(font==0)

{

_SECTION_BEGIN("Name");

GfxSetOverlayMode(0);

GfxSelectFont("Tahoma", Status("pxheight")/8 );

GfxSetTextAlign( 6 );// center alignment

GfxSetTextColor( ColorHSB( 42, 42, 42 ) );

GfxSetBkMode(0); // transparent

GfxTextOut( Name(), Status("pxwidth")/2, Status("pxheight")/12 );

GfxSelectFont("Tahoma", Status("pxheight")/18 );

GfxTextOut("" , Status("pxwidth")/2, Status("pxheight")/4 );

GfxSelectFont("Tahoma", Status("pxheight")/18 );

GfxSelectFont("Tahoma", Status("pxheight")/36 );

GfxTextOut( "", Status("pxwidth")/2, Status("pxheight")/3 );

_SECTION_END();

//Magfied Market Price

FS=Param("Font Size",72,11,100,1);

GfxSelectFont("Times New Roman", FS, 700, True );

GfxSetBkMode(0); // transparent

GfxSetTextColor( ColorHSB( 42, 42, 42 ) );

Hor=Param("Horizonta Position",615,1,1200,1);

Ver=Param("Vertica Position",152,1,830,1);

GfxTextOut(""+C, Hor , Ver );

YC=TimeFrameGetPrice("C",inDaily,-1);

DD=Prec(C-YC,2);

xx=Prec((DD/YC)*100,2);

FS2=Param("Font Size2",35,11,100,1);

GfxSelectFont("Times New Roman", FS2,11, 700, True );

GfxSetBkMode( colorBlack );

Hor1=Param("Horizontal Position",615,1,1200,1);

Ver1=Param("Vertical Position",188,1,830,1);

GfxSetTextColor( ColorHSB( 42, 42, 42 ) );

GfxTextOut(""+DD+" ("+xx+"%)", Hor1 , Ver1+45 );

}

else

{{

//Magfied Market Price

fse=Param("Font Sizee",35,11,100,1);

GfxSelectFont("Times New Roman", fse, 700, True );

GfxSetBkMode( colorGold );

GfxSetTextColor( ParamColor("Color",colorGold) );

Hora=Param("Horizontal Positiona",525,1,1200,1);

Vera=Param("Vertical Positiona",17,1,830,1);

GfxTextOut(""+C, Hora , Vera );

YCa=TimeFrameGetPrice("C",inDaily,-1);

DDa=Prec(C-YCa,2);

xxa=Prec((DDa/YCa)*100,2);

FSb=Param("Font Sizeb",16,11,100,1);

GfxSelectFont("Times New Roman",fsb, 700, True );

GfxSetBkMode( colorBlack );

GfxSetTextColor(ParamColor("Color",colorYellow) );

GfxTextOut(""+DDa+" ("+xxa+"%)", Hora , Vera+45 );

_SECTION_END();

}}

//====================================Start of Linear Regression Code==================================================================================

if(LinearRegression==1)

{

P = ParamField("Price field",-1);

Length = 150;

Daysback = Param("Period for Liner Regression Line",Length,1,240,1);

shift = Param("Look back period",0,0,240,1);

//=============================== Math Formula ========================================================================================================

x = Cum(1);

lastx = LastValue( x ) - shift;

aa = LastValue( Ref(LinRegIntercept( p, Daysback), -shift) );

bb = LastValue( Ref(LinRegSlope( p, Daysback ), -shift) );

y = Aa + bb * ( x - (Lastx - DaysBack +1 ) );

//==================Plot the Linear Regression Line ====================================================================================================

LRColor = ParamColor("LR Color", colorCycle );

LRStyle = ParamStyle("LR Style");

LRLine = IIf( x > (lastx - Daysback) AND BarIndex() < Lastx, y, Null );

LRStyle = ParamStyle("LR Style");

Angle = Param("Angle", 0.05, 0, 1.5, 0.01);// A slope higher than 0.05 radians will turn green, less than -0.05 will turn red and anything in between will be white.

LRLine = IIf( x > (lastx - Daysback) AND BarIndex() < Lastx, y, Null );

Pi = 3.14159265 * atan(1); // Pi

SlopeAngle = atan(bb)*(180/Pi);

LineUp = SlopeAngle > Angle;

LineDn = SlopeAngle < - Angle;

if(LineUp)

{

Plot(LRLine, "Lin. Reg. Line Up", IIf(LineUp, colorBrightGreen, colorWhite), LRStyle);

}

else

{

Plot(LRLine, "Lin. Reg. Line Down", IIf(LineDn, colorDarkRed, colorWhite), LRStyle);

}

//========================== Plot 1st SD Channel ======================================================================================================

SDP = Param("Standard Deviation", 1.5, 0, 6, 0.1);

SD = SDP/2;

width = LastValue( Ref(SD*StDev(p, Daysback),-shift) ); //Set width of inside chanels here.

SDU = IIf( x > (lastx - Daysback) AND BarIndex() < Lastx, y+width , Null ) ;

SDL = IIf( x > (lastx - Daysback) AND BarIndex() < Lastx, y-width , Null ) ;

SDColor = ParamColor("SD Color", colorCycle );

SDStyle = ParamStyle("SD Style");

Plot( SDU , "Upper Lin Reg", colorWhite,SDStyle ); //Inside Regression Lines

Plot( SDL , "Lower Lin Reg", colorWhite,SDStyle ); //Inside Regression Lines

//========================== Plot 2d SD Channel ========================================================================================================

SDP2 = Param("2d Standard Deviation", 2.0, 0, 6, 0.1);

SD2 = SDP2/2;

width2 = LastValue( Ref(SD2*StDev(p, Daysback),-shift) ); //Set width of outside chanels here.

SDU2 = IIf( x > (lastx - Daysback) AND BarIndex() < Lastx, y+width2 , Null ) ;

SDL2 = IIf( x > (lastx - Daysback) AND BarIndex() < Lastx, y-width2 , Null ) ;

SDColor2 = ParamColor("2 SD Color", colorCycle );

SDStyle2 = ParamStyle("2 SD Style");

Plot( SDU2 , "Upper Lin Reg", colorWhite,SDStyle2 ); //OutSide Regression Lines

Plot( SDL2 , "Lower Lin Reg", colorWhite,SDStyle2 ); //OutSide Regression Lines

Trend = IIf(LRLine > Ref(LRLine,-1),colorGreen,colorRed);//Changes LR line to green if sloping up and red if sloping down.

Plot( LRLine , "LinReg", Trend, LRSTYLE );

//============================ End Indicator Code =========

}

_SECTION_BEGIN("Flower");

Show_color = ParamToggle("Display CandleColor", "No|Yes", 1);

r1 = Param( "ColorFast avg", 5, 2, 200, 1 );

r2 = Param( "ColorSlow avg", 10, 2, 200, 1 );

r3 = Param( "ColorSignal avg", 5, 2, 200, 1 );

Prd1=Param("ATR Period",4,1,20,1);

Prd2=Param("Look Back",7,1,20,1);

green = HHV(LLV(L,Prd1)+ATR(Prd1),Prd2);

red = LLV(HHV(H,Prd1)-ATR(Prd1),Prd2);

flowerClose = EMA((Open+High+Low+Close)/4,3) ;

flowerOpen = EMA((Ref(Open,-1) + Ref(flowerClose,-1))/2,3);

Temp = Max(High, flowerOpen);

flowerHigh = EMA(Max(Temp, flowerClose),3);

Temp = Min(Low,flowerOpen);

flowerLow = EMA(Min(Temp, flowerClose),3);

m1=MACD(r1,r2);

s1=Signal(r1,r2,r3);

mycolor=IIf(m1<0 AND m1>s1, colorYellow,IIf(m1>0 AND m1>s1,colorGreen,IIf(m1>0 AND m1<s1,colorCustom12,colorRed)));

if(Show_color)

{

ColorHighliter = myColor;

SetBarFillColor( ColorHighliter );

}

barColor=IIf(C>Green ,colorBrightGreen,IIf(C < RED,colorRed,colorWhite));

PlotOHLC( IIf(flowerOpen<flowerClose, flowerOpen, flowerClose),flowerHigh,flowerLow,IIf(flowerOpen<flowerClose, flowerClose, flowerOpen), "Close", barColor, styleNoTitle | styleCandle);

_SECTION_END();

//**********************************************************************************

// Plot price horizontal line *

//**********************************************************************************/

_SECTION_BEGIN("Price Line");

PriceLineColor=ParamColor("PriceLineColor",ColorRGB(82,82,82));

PriceLevel = ParamField("PriceField", field = 3 );

Daysback = Param("Bars Back",100,10,500,1);

FirstBar = BarCount - DaysBack;

YY = IIf(BarIndex() >= Firstbar,EndValue(PriceLevel),Null);

Plot(YY,"Current Price",PriceLineColor,ParamStyle("LineStyle",styleLine|styleDashed|styleNoTitle|styleNoLabel|styleThick,maskAll));

side = Param("side",1,0,1000,1);

dist = 0;

for( i = 0; i < BarCount; i++ )

{

if(i+side== BarCount) PlotText( "\n " + PriceLevel[ i ], i, YY[ i ]-dist[i], colorLightBlue );

}

_SECTION_END();

_SECTION_BEGIN("Color_Me_Bad");

a =5; //Param("Average Pds", 5, 1, 10, 1 );

n =8; //Param("Short Pds", 8, 5, 21, 1 );

m =60; //Param("Long Pds", 60, 0, 90, 1 );

Var4 =(Low+High+2*Close)/4;

OP = EMA(Var4,a);

res1 = HHV(OP,n);

res2 =HHV(OP,m);

sup2 =LLV(OP,m);

sup1 =LLV(OP,n);

Linecolor1 = IIf(Op==sup1,ColorRGB(48,0,81),IIf(Op==res1,colorGreen,ColorRGB(80,80,80)));

Linecolor2 = IIf(Op==sup1,ColorRGB(38,0,60),IIf(Op==res1,colorGreen,colorDarkGrey));

Linecolor3 = IIf(Op==sup1,ColorRGB(27,0,70),IIf(Op==res1,colorGreen,ColorRGB(77,70,75)));

_SECTION_END();

_SECTION_BEGIN("ATR");

ParmCloud1 = ParamToggle("TrailingCloud", "No|Yes", 1);

Pp1=Param("Ray_Period1",2,1,20,1); // or 4

Pp2=Param("ATR_Period1",3,1,20,1); // or 2

avgClose = EMA((Open+High+Low+Close)/4,3) ;

avgOpen = EMA((Ref(Open,-1) + Ref(avgClose,-1))/2,3);

Temp = Max(High, avgOpen);

avgHigh = EMA(Max(Temp, avgClose),3);

Temp = Min(Low,avgOpen);

avgLow = EMA(Min(Temp, avgClose),3);

Plot(HHV(LLV(avgHigh,Pp1)-ATR(Pp2),4),"",Linecolor1 ,ParamStyle("styleLine 1",styleLine|styleThick|styleNoTitle|styleNoLabel,maskAll));

Plot(HHV(LLV(avgHigh,Pp1)-ATR(Pp2),5),"",Linecolor2 ,ParamStyle("styleLine 2",styleLine|styleThick|styleNoTitle|styleNoLabel,maskAll));

Plot(HHV(LLV(avgHigh,Pp1)-ATR(Pp2),6),"",Linecolor1 ,ParamStyle("styleLine 3",styleLine|styleThick|styleNoTitle|styleNoLabel,maskAll));

Plot(HHV(LLV(avgHigh,Pp1)-ATR(Pp2),7),"",Linecolor1 ,ParamStyle("styleLine 4",styleLine|styleThick|styleNoTitle|styleNoLabel,maskAll));

CS33=HHV(LLV(avgHigh,Pp1)-ATR(Pp2),4);

CR33=HHV(LLV(avgHigh,Pp1)-ATR(Pp2),5);

CT33=HHV(LLV(avgHigh,Pp1)-ATR(Pp2),6);

CM33=HHV(LLV(avgHigh,Pp1)-ATR(Pp2),7);

if(parmCloud1 == 1)

{

PlotOHLC( CS33, CS33, CR33,CR33, "Band1", LineColor1, styleCloud | styleNoLabel|styleNoTitle);

PlotOHLC( CR33, CR33, CT33, CT33, "Band2", LineColor2, styleCloud | styleNoLabel|styleNoTitle);

PlotOHLC( CR33, CR33, CM33, CM33, "Band3", LineColor3, styleCloud | styleNoLabel|styleNoTitle);

}

_SECTION_END();

_SECTION_BEGIN("Bands");

SupResB =Param("Sup-Res Short",6,0,100,1);

nn=SupResB;

Bandlinecol=ParamColor("SupResLineColor",ColorRGB(82,82,82));

ParmCloud = ParamToggle("Cloud", "No|Yes", 0);

BoxCloudColor=ParamColor("BoxCloudColor",ColorRGB(27,27,27));

Line2=Param("ResLineLength",100,2,500,0.1);

Daysback1 = Line2;

FirstBar1 = BarCount - DaysBack1;

Hh=HHV(flowerHigh,nn);

LL=LLV(flowerLow,nn);

Res2=Hh;

Sup2=LL;

BandRes=IIf(BarIndex() >= Firstbar1,EndValue(Res2),Null);

BandSup=IIf(BarIndex() >= Firstbar1,EndValue(Sup2),Null);

Plot(BandRes,"",Bandlinecol,ParamStyle("ShortSupBand",styleLine|styleDashed|stylehidden|styleNoTitle|styleNoLabel|styleThick,maskAll));

Plot(BandSup,"",Bandlinecol,ParamStyle("ShortResBand",styleLine|styleDashed|stylehidden|styleNoTitle|styleNoLabel|styleThick,maskAll));

CS=BandRes;

CR=BandSup;

if(parmCloud == 1)

{

PlotOHLC( CS, CS, CR,CR, "Band",BoxCloudColor, styleCloud | styleNoLabel|styleNoTitle);

}

_SECTION_END();

_SECTION_BEGIN("TSKPPIVOT4");

CHiPr = 0;

CLoPr = 9999999;

blsLong = 0;

PrevCOBar = 0;

NumBars = 0;

PrePP = 0;

PrevLowVal = 9999999;

BuySig = 0;

blsShort = 0;

PrevHiVal = 0;

blsNewCO = 0;

BarDif = 0;

KPA900Val = MA(C,10);

KPAutoStopVal = IIf(High,Low,Close);

// -- Create 0-initialized arrays the size of barcount

aHPivs = H - H;

aLPivs = L - L;

aHiVal = H - H;

aLoVal = L - L;

Ctmpl=Param("Ctmpl",45,1,20,1);

tskp_colortmplcnd0=colorTan;

tskp_colortmplcnd1=colorWhite;

tskp_colortmplcnd2=colorTan;

tskp_colortmplcnd3=colorWhite;

tskp_colortmplcnd4=colorTan;

tskp_colortmplcnd5=colorWhite;

tskp_colortmplcnd6=colorTan;

tskp_colortmplcnd7=colorWhite;

tskp_colortmplcnd8=colorTan;

sctotal = 0;

sctotal = sctotal + IIf(tskp_colortmplcnd0 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd1 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd2 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd3 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd4 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd5 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd6 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd7 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd8 > 0, 1, -1);

for (curBar=0; curBar < BarCount-1; curBar++)

{

if ( curBar == 0 )

{

CHiPr = flowerHigh[curBar];

CHiBar = curBar;

CLoPr = flowerLow[curBar];

CLoBar = curBar;

blsLong = 0;

blsShort = 0;

blsNewCO = 0;

PrePP = 0;

PrevCOBar = 0;

PrevHiVal =flowerHigh[curBar];

PrevLowVal = flowerLow[curBar];

BuySig = 0;

SellSig = 0;

blsLL = 0;

}

if (flowerHigh[CurBar] >= CHiPr) {

CHiPr = flowerHigh[CurBar];

ChiBar = CurBar;

}

if (flowerLow[CurBar] <= CLoPr) {

CLoPr = flowerLow[CurBar];

CLoBar = CurBar;

}

if ( (KPA900Val[curBar] >= KPAutoStopVal[curbar]) AND (PrePP != -1) AND (blsLong != 1) ){

BarDif = CurBar - PrevCOBar;

if (BarDif >= NumBars) {

blsLong = 1;

blsShort = 0;

blsNewCO = 1;

PrevCOBar = CurBar;

}

}

if ( (KPA900Val[curBar] <= KPAutoStopVal[curbar]) AND (PrePP != 1) AND (blsShort != 1) ){

BarDif = CurBar - PrevCOBar;

if (BarDif >= NumBars) {

blsLong = 0;

blsShort = 1;

blsNewCO = 1;

PrevCOBar = CurBar;

}

}

if ( (blsNewCO == 1) AND (sctotal[CurBar] >= 5) AND (blsLong == 1) ) {

LVal = CurBar - CLoBar;

for (j= CLoBar-1; j <= CLoBar+1; j++)

{

if (j >=0) {

aLPivs[j] = 1;

aLoVal[j] = CLoPr;

}

}

PrePP = -1;

blsNewCO = 0;

CHiPr = flowerHigh[CurBar];

CHiBar = CurBar;

CLoPr = flowerLow[Curbar];

CLoBar = CurBar;

}

else if ((blsNewCO == 1) AND (sctotal[CurBar] <= -5) AND (blsShort == 1) ) {

HVal = CurBar - CHiBar;

for (j= CHiBar-1; j <= CHiBar+1; j++)

{

if (j >=0) {

aHPivs[j] = 1;

aHiVal[j] = CHiPr;

}

}

PrePP = 1;

blsNewCO = 0;

CHiPr = flowerHigh[CurBar];

CHiBar = CurBar;

CLoPr = flowerLow[Curbar];

CLoBar = CurBar;

}

}

PlotShapes(

IIf(aHPivs == 1,shapeHollowSmallCircle,shapeNone),colorYellow ,0, aHiVal+0.05, offset = 5);

PlotShapes(

IIf(aLPivs == 1,shapeHollowSmallCircle,shapeNone), colorPink,0, aLoVal-0.05, Offset = -5);

_SECTION_END();

_SECTION_BEGIN("SupRes_Short");

supresshortcolor=ParamColor("SupResShort",ColorRGB(82,82,82));

//this is for short term support line

TimeFrameSet(inWeekly);

ShortSupLenght=Param( "ShortResistLength", 4, 1, 55 ,1);

ShortSupCond1=HHV(High,ShortSupLenght);

ShortSupCond2=Close<Ref(LLV(Low,4),-1);

ShortSupA=IIf(L>Ref(ShortSupCond2,-1),1,IIf(H<Ref(ShortSupCond1,-1),-1,0));

ShortSupB=ValueWhen(ShortSupA!=0,ShortSupA,1);

ShortSupResult=IIf(ShortSupB==1,ShortSupCond1,ShortSupCond2);

TimeFrameRestore();

FinalShortSup=TimeFrameExpand(ShortSupResult,inWeekly,expandFirst);

Plot(FinalShortSup ,"ShortResistance",supresshortcolor,styleLine|styleStaircase|styleThick|styleNoRescale|styleNoLabel|styleNoTitle);

//this is for short term resistance line

TimeFrameSet(inWeekly);

ShortResLenght=Param( "ShortSupportLenght", 4, 1, 55 ,1);

ShortResCond1=Close>Ref(HHV(High,4),-1);

ShortResCond2=LLV(Low,ShortResLenght);

ShortResA=IIf(H>Ref(ShortResCond1,-1),1,IIf(L<Ref(ShortResCond2,-1),-1,0));

ShortResB=ValueWhen(ShortResA!=0,ShortResA,1);

ShortResResult=IIf(ShortResB==1,ShortResCond2,ShortResCond1);

TimeFrameRestore();

FinalShortRes=TimeFrameExpand(ShortResResult,inWeekly,expandFirst);

Plot(FinalShortRes ,"ShortSupport",supresshortcolor,styleLine|styleThick|styleStaircase|styleNoRescale|styleNoLabel|styleNoTitle);

CS=FinalShortSup;

CR=FinalShortRes;

Step = (CR-CS)/4;

KC = CS + Step;

KB = KC + Step;

KA = KB + Step;

CloudColor1 = ParamColor("CloudColor1",ColorRGB(128,31,17));

CloudColor2 = ParamColor("CloudColor2",ColorRGB(139,139,0));

CloudColor3 = ParamColor("CloudColor3",ColorRGB(1,70,1));

CloudColor4 = ParamColor("CloudColor4",ColorRGB(41,105,05));

PlotOHLC( CS, CS, KC,KC, "Band", CloudColor1, styleCloud | styleNoLabel|styleNoTitle|styleNoRescale);

PlotOHLC( KC, KC, KB,KB, "Band", CloudColor2, styleCloud | styleNoLabel|styleNoTitle|styleNoRescale);

PlotOHLC( KB, KB, KA,KA, "Band", CloudColor3, styleCloud | styleNoLabel|styleNoTitle|styleNoRescale);

PlotOHLC( KA, KA, CR,CR, "Band", CloudColor4, styleCloud | styleNoLabel|styleNoTitle|styleNoRescale);

_SECTION_END();

_SECTION_BEGIN("SupRes_Long");

supreslongcolor=ParamColor("SupReslong",ColorRGB(0,0,234));

//this is for long term resistance line

TimeFrameSet(inWeekly);

LongResLength=Param( "ResistanceLength", 30, 1, 55 ,1);

LongResCond1=HHV(H,LongResLength);

LongResCond2=Close<Ref(LLV(Low,4),-1);

LongResA=IIf(L>Ref(LongResCond2,-1),1,IIf(H<Ref(LongResCond1,-1),-1,0));

LongResB=ValueWhen(LongResA!=0,LongResA,1);

LongResResult=IIf(LongResB==1,LongResCond1,LongResCond2);

TimeFrameRestore();

FinalResResult=TimeFrameExpand(LongResResult,inWeekly,expandFirst);

Plot(FinalResResult ,"Resistance",supreslongcolor,styleLine|styleThick|styleNoRescale|styleNoLabel|styleNoTitle);

//this is for long term support line

TimeFrameSet(inWeekly);

LongSupLenght=Param( "SupportLenght", 30, 1, 55 ,1);

LongSupCond1=Close>Ref(HHV(High,4),-1);

LongSupCond2=LLV(Low,LongSupLenght);

LongSupA=IIf(H>Ref(LongSupCond1,-1),1,IIf(L<Ref(LongSupCond2,-1),-1,0));

LongSupB=ValueWhen(LongSupA!=0,LongSupA,1);

LongSupResult=IIf(LongSupB==1,LongSupCond2,LongSupCond1);

TimeFrameRestore();

FinalSupResult=TimeFrameExpand(LongSupResult,inWeekly,expandFirst);

Plot(FinalSupResult ,"Support",supreslongcolor,styleLine|styleThick|styleNoRescale|styleNoLabel|styleNoTitle);

CloudResColor=ParamColor("LongColor",ColorRGB(0,0,45));

CS1=FinalResResult;

CR1=FinalSupResult;

PlotOHLC( CS1, CS1, CR1,CR1, "", CloudResColor, styleCloud |styleStaircase|styleNoRescale| styleNoLabel|styleNoTitle);

_SECTION_END();

_SECTION_BEGIN("PanDora");

///////////////////////////////////

Title =

EncodeColor(colorWhite)+ Title = Name () + " | "

+EncodeColor(colorYellow) + Date() + " | "

+EncodeColor(colorTurquoise)+ "Open : "+ EncodeColor(colorLightGrey)+ O + " | "

+EncodeColor(colorTurquoise)+ "High : "+ EncodeColor(colorLightGrey)+ H + " | "

+EncodeColor(colorTurquoise)+ "Low : "+ EncodeColor(colorLightGrey)+ L + " | "

+EncodeColor(colorTurquoise)+ "Close : "+ WriteIf(C> Ref(C, -1),EncodeColor(colorBrightGreen),EncodeColor(colorRed))+ C + " | "

+EncodeColor(colorTurquoise)+ "Change : ("+ WriteIf(C> Ref(C, -1),EncodeColor(colorBrightGreen),EncodeColor(colorRed)) + WriteVal(C-Ref(C,-1))+" Tk."

+EncodeColor(colorTurquoise)+ " /"+ WriteIf(C> Ref(C, -1),EncodeColor(colorBrightGreen),EncodeColor(colorRed))+ WriteVal( ROC( C, 1 ))+""+ " % "

+EncodeColor(colorTurquoise)+ ") | Volume : " + WriteIf(V> Ref(V, -1),EncodeColor(colorBrightGreen),EncodeColor(colorRed))+ WriteVal(V,1)

;

/////////////////////////////////////////////////////////

// //

// General Market Exploration by XeL //

// //

// Ver: 1.00.beta //

// //

// Free to Distribute under LGPL 2012 . //

// Portions of Code are property of their original //

// authors, Cleaning, some new code and Preparation //

// are derived by @XeL_Arjona. //

// Some Original Code credits: //

// //

// * Volume Price Analysis by Karthikmarar //

// http://vpanalysis.blogspot.mx/ //

// //

// * Jurik Research DMX (Free) //

// http://jurikres.com/catalog/ms_dmx.htm //

// //

// * Extract of some exploration Methodology //

// by Manish. //

// //

// //

/////////////////////////////////////////////////////////

/////////////////

// AFL START //

/////////////////

//_SECTION_BEGIN("VPA, Momentum & Signal Explorer by XeL");

//////////////////////

// Main Variables //

//////////////////////

// Count Index value for TrendScore

i = 0;

// Display Colors

// Main Color

Color_buy = colorLime ;

Color_bull = colorGreen ;

Color_bull1 = colorDarkYellow ;

Color_bear1 = colorLightOrange ;

Color_bear = colorOrange ;

Color_sell = colorRed ;

Color_prev = colorGold ;

Color_acc = colorPaleTurquoise ;

Color_null = colorLightGrey ;

// Background Colors

BColor_vpa = colorBlack ;

BColor_mas = colorDefault ;

BColor_mam = colorDefault ;

BColor_mal = colorDefault ;

// Alternate Colors

Color_acc1 = colorBlueGrey ;

// 52 High Low

High52 = HHV(High,250);

Low52 = LLV(Low,250);

// T3 Function

function T3(price,periods)

{

s = 0.84;

e1=EMA(price,periods);

e2=EMA(e1,Periods);

e3=EMA(e2,Periods);

e4=EMA(e3,Periods);

e5=EMA(e4,Periods);

e6=EMA(e5,Periods);

c1=-s*s*s;

c2=3*s*s+3*s*s*s;

c3=-6*s*s-3*s-3*s*s*s;

c4=1+3*s+s*s*s+3*s*s;

Ti3=c1*e6+c2*e5+c3*e4+c4*e3;

return ti3;

}

////////////////////////////////////////////////

// Time to Date % Change and Beta Correlation //

////////////////////////////////////////////////

_SECTION_BEGIN("P/L % Change over Time with Beta Correlation");

// PARAMETERS

TtD_Param = ParamList("Period","Day to Date|Week to Date|Month to Date|Year to Date",0);

IDX_Param = ParamStr("Reference Market Index Symbol","$IME-MEX");

// VARIABLES

FDayMonth = BarsSince(Month() != Ref(Month(),-1));

FDayYear = BarsSince(Year() != Ref(Year(),-1));

TtD_Period = IIf(TtD_Param == "Day to Date",1,

IIf(TtD_Param == "Week to Date",DayOfWeek(),

IIf(TtD_Param == "Month to Date",FDayMonth,

IIf(TtD_Param == "Year to Date",FDayYear,0))));

IDX_Close = Foreign(IDX_Param,"Close");

// FORMULA

// P/L % Change

TtD_Change = 100 * (Close - Ref(Close, -TtD_Period) ) / Ref(Close, -TtD_Period);

// Beta Correlation in Time from Index

Beta = (( TtD_Period * Sum(ROC( C,1) * ROC(IDX_Close,1),TtD_Period )) -

(Sum(ROC(C,1),TtD_Period) *

Sum(ROC( IDX_Close,1),TtD_Period))) /

((TtD_Period * Sum((ROC(IDX_Close,1)^2 ),TtD_Period)) -

(Sum(ROC(IDX_Close,1 ),TtD_Period)^2 ));

_SECTION_END();

///////////////////////////

// Volume Price Analysis //

///////////////////////////

_SECTION_BEGIN("Volume Price Analysis");

// FORMULA

SetChartOptions(0,chartShowArrows|chartShowDates);

DTL=Param("Linear regression period",60,10,100,10);

wbf=Param("WRB factor",1.5,1.3,2.5,.1);

nbf=Param("NRB factor",0.7,0.3,0.9,0.1);

TL=LinRegSlope(MA(C, DTL),2);

Vlp=Param("Volume lookback period",30,20,300,10);

Vrg=MA(V,Vlp);

St = StDev(Vrg,Vlp);

Vp3 = Vrg + 3*st;

Vp2 = Vrg + 2*st;;

Vp1 = Vrg + 1*st;;

Vn1 = Vrg -1*st;

Vn2 = Vrg -2*st;

rg=(H-L);

arg=Wilders(rg,30);

wrb=rg>(wbf*arg);

nrb=rg<(nbf*arg);

Vl=V<Ref(V,-1) AND V<Ref(V,-2);

upbar=C>Ref(C,-1);

dnbar=C<Ref(C,-1);

Vh=V>Ref(V,-1) AND Ref(V,-1)>Ref(V,-2);

Cloc=C-L;

x=rg/Cloc;

x1=IIf(Cloc=0,arg,x);

Vb=V>Vrg OR V>Ref(V,-1);

ucls=x1<2;

dcls=x1>2;

mcls=x1<2.2 AND x1>1.8 ;

Vlcls=x1>4;

Vhcls=x1<1.35;

j=MA(C,5);

TLL=LinRegSlope(j,40) ;

Tlm=LinRegSlope(j,15) ;

tls=LinRegSlope(j,5);

mp=(H+L)/2;

// VOLUME VARIABLES

// TrendScore Count

IIf( V>Vp2, i+3,i);

IIf( V>Vp1, i+2,i);

IIf( V>VRG, i+1,i);

// Indicators

VPAv_Status = WriteIf( V>Vp2, "VERY HIGH",

WriteIf( V>Vp1, "High",

WriteIf( V>Vrg, "Above Average",

WriteIf( V<Vrg AND V>Vn1, "Less than Average",

WriteIf( V<Vn1, "L o w", "" )))));

VPAv_Color = IIf( V>Vp2, Color_buy,

IIf( V>Vp1, Color_bull,

IIf( V>Vrg, Color_bull1,

IIf( V<Vrg AND V>Vn1, Color_bear,

IIf( V<Vn1, Color_sell, Color_null )))));

// SPREAD VARIABLES

// Indicators

IIf( rg>(arg*2), i+2,i);

IIf( rg>arg, i+1,i);

VPAs_Status = WriteIf( rg>(arg*2), "Wide",

WriteIf( rg>arg, "Above Average","Narrow"));

VPAs_Color = IIf( rg>(arg*2), Color_buy,

IIf( rg>arg, Color_bull,Color_bear));

// CLOSE VARIABLES

// TrendScroe Count

IIf( Vhcls, i+2,i);

IIf( ucls, i+1,1);

// Indicators

VPAc_Status = WriteIf( Vhcls, "VERY HIGH",

WriteIf( ucls, "High",

WriteIf( mcls, "Mid",

WriteIf( dcls, "Down","VERY LOW"))));

VPAc_Color = IIf( Vhcls, Color_buy,

IIf( ucls, Color_bull,

IIf( mcls, Color_bull1,

IIf( dcls, Color_bear,Color_sell))));

// VOLUME ZONE

// FORMULA

C1 = Ref(C, -1);

uc = C > C1; dc = C <= C1;

ud = C > O; dd = C <= O;

green = 1; blue = 2; yellow = 3; red = 4; white = 5;

VType = IIf(ud,

IIf(uc, green, yellow),

IIf(dd,

IIf(dc, red, blue), white));

/* green volume: up-day and up-close*/

gv = IIf(VType == green, V, 0);

/* yellow volume: up-day but down-close */

yv = IIf(VType == yellow, V, 0);

/* red volume: down-day and down-close */

rv = IIf(VType == red, V, 0);

/* blue volume: down-day but up-close */

bv = IIf(VType == blue, V, 0);

uv = gv + bv; uv1 = Ref(uv, -1); /* up volume */

dv = rv + yv; dv1 = Ref(dv, -1); /* down volume */

VolPer = Param("Adjust Vol. MA per.", 34, 1, 255, 1);//12

ConvPer = Param("Adjust Conv. MA per.", 9, 1, 255, 1);//6

MAuv = TEMA(uv, VolPer ); mauv1 = Ref(mauv, -1);

MAdv = TEMA(dv, VolPer ); madv1 = Ref(madv, -1);

MAtv = TEMA(V, VolPer );//total volume

Converge = (TEMA(MAuv - MAdv, ConvPer));

Converge1 = Ref(Converge, -1);

ConvergeUp = Converge > Converge1;

ConvergeOver = Converge > 0;

rising = ConvergeUp AND ConvergeOver;

falling = !ConvergeUp AND ConvergeOver;

// VOLUME ZONE

// VARIABLES

// TrendScore Count

IIf( rising, i+1,i);

// Indicators

VPAz_Status = WriteIf(rising,"Accumulation",

WriteIf(falling,"Distribution","Flat"));

VPAz_Color = IIf(rising,Color_acc,

IIf(falling,Color_prev,Color_null));

// VOLUME STATUS

// PARAMETERS

Pp1=Param("Number Of Days",30,1,200,1);

Pp2=Param("Volume Of Days",15,1,200,1);

// FORMULA

numDays = Pp1;

dwWideSpread = 1.8;

dwNarrowSpread = 0.8;

dwSpreadMiddle = 0.5;

dwHighClose = 0.7;

dwLowClose = 0.3;

volNumDays = Pp2;

dwUltraHighVol = 2;

dwVeryHighVol = 1.75; // was 1.8

dwHighVol = 1.75; // was 1.8

dwmoderateVol = 1.10; // was 1.8

dwLowVol = 0.75; // was 0.8

/* Classify each bar... */

upBar = C > Ref(C,-1);

downBar = C < Ref(C,-1);

spread = H-L;

avgRange = Sum(spread, numDays) / numDays;

wideRange = spread >= (dwWideSpread * avgRange);

narrowRange = spread <= (dwNarrowSpread * avgRange);

testHighClose = L + (spread * dwHighClose);

testLowClose = L + (spread * dwLowClose);

testCloseMiddle = L + (spread * dwSpreadMiddle);

upClose = C > testHighClose;

downClose = C < testLowClose;

middleClose = C >= testLowClose AND C <= testHighClose;

avgVolume = EMA(V, volNumDays);

highVolume = V > (avgVolume * dwHighVol);

moderateVol= V > (avgVolume * dwmoderateVol);

veryHighVolume = V > (avgVolume * dwVeryHighVol);

ultraHighVolume = V > (avgVolume * dwUltraHighVol);

LowVolume = V < (avgVolume * dwLowVol);

/* direction AND Title */

/* Basic patterns... */

upThrustBar = downClose AND H > Ref(H,-1) AND (C == L) AND downClose AND (NOT narrowRange);

noDemandBar = narrowRange AND LowVolume AND upBar AND (NOT upClose);

//noDemandBar = narrowRange AND LowVolume AND upBar AND (V < Ref(V,-1)) AND (V < Ref(V,-2));

noSupplyBar = narrowRange AND LowVolume AND downBar AND (V < Ref(V,-1)) AND (V < Ref(V,-2));

absorption = Ref(downbar, -1) AND Ref(highVolume, -1) AND upBar;

support = Ref(downBar,-1) AND (NOT Ref(downClose,-1)) AND Ref(highVolume,-1) AND upBar;

stoppingVolume = Ref(downBar,-1) AND Ref(highVolume,-1) AND C > testCloseMiddle AND (NOT downBar);

bullishsign=moderateVol+UpThrustBar;//OR moderateVol+upBar;

//rallyEnd = (Ref(highVolume,-1) AND Ref(upBar,-1) AND wideRange AND downBar) OR

// (narrowRange AND highVolume AND H > Ref(HHV(H, 250), -1));

/* Strength AND Weakness */

weakness = upThrustBar OR noDemandBar OR

(narrowRange AND (H > Ref(H,-1)) AND highVolume) OR

(Ref(highVolume,-1) AND Ref(upBar,-1) AND downBar AND (H < Ref(H,-1)));

// VARIABLES

// TrendScore Count

IIf( bullishsign, i+3,i);

IIf( upThrustBar, i+2,i);

IIf( absorption, i+1,i);

// Indicators

VPAst_Status = WriteIf(Weakness,"W e a k",

WriteIf(StoppingVolume,"Stopping Volume",

WriteIf(noSupplyBar,"No Supply",

WriteIf(support,"Support",

WriteIf(noDemandBar,"No Demand",

WriteIf(absorption,"Absorption",

WriteIf(upThrustBar,"Up Thrust",

WriteIf(bullishsign,"-=STRONG=-","Neutral"))))))));

VPAst_Color = IIf(Weakness,Color_sell,

IIf(StoppingVolume,Color_bear,

IIf(noSupplyBar,Color_bear1,

IIf(support,Color_bear,

IIf(noDemandBar,Color_prev,

IIf(absorption,Color_bull1,

IIf(upThrustBar,Color_bull,

IIf(bullishsign,Color_buy,Color_null))))))));

_SECTION_END();

//////////////////////////

// EMA Terms and Trend //

//////////////////////////

_SECTION_BEGIN("EMA Short, Mid and Long Terms and Trend");

// PARAMETERS

EMAs1Pds = Param("1st. Short Term Period",9,5,14,1);

EMAs2Pds = Param("2nd. Short Term Period",20,15,45,1);

EMAmPds = Param("Mid Term Period",50,46,90,1);

EMAlPds = Param("Long Term Perdiod",200,100,300,1);

// FORMULA

// EMA Short term signals

EMAsBuy = Cross(EMA(C,EMAs1Pds), EMA(C,EMAs2Pds));

EMAsSell = Cross(EMA(C,EMAs2Pds),EMA(C,EMAs1Pds));

EMAsBuy = ExRem(EMAsBuy, EMAsSell);

EMAsSell = ExRem(EMAsSell, EMAsBuy);

EMAsBull = EMA(C,EMAs1Pds) > EMA(C,EMAs2Pds);

EMAsBear = EMA(C,EMAs1Pds) < EMA(C,EMAs2Pds);

// EMA Mid term signals

EMAmBuy = Cross(EMA(C,(EMAs1Pds+EMAs2Pds)/2), EMA(C,EMAmPds));

EMAmSell = Cross(EMA(C,EMAmPds), EMA(C,(EMAs1Pds+EMAs2Pds)/2));

EMAmBuy = ExRem(EMAmBuy, EMAmSell);

EMAmSell = ExRem(EMAmSell, EMAmBuy);

EMAmBull = C > EMA(C,EMAmPds);

EMAmBear = C < EMA(C,EMAmPds);

// EMA Long term signals

EMAlBuy = Cross(EMA(C,EMAmPds), EMA(C,EMAlPds));

EMAlSell = Cross(EMA(C,EMAlPds), EMA(C,EMAmPds));

EMAlBuy = ExRem(EMAlBuy, EMAlSell);

EMAlSell = ExRem(EMAlSell, EMAlBuy);

EMAlBull = C > EMA(C,EMAlPds);

EMAlBear = C < EMA(C,EMAlPds);

// EMA Positional Price Trend (Long-Term)

EMA_rc = C > EMA (C,EMAmPds) AND C < EMA(C,EMAlPds) AND EMA(C,EMAmPds) < EMA(C,EMAlPds);

EMA_ac = C > EMA (C,EMAmPds) AND C > EMA(C,EMAlPds) AND EMA(C,EMAmPds) < EMA(C,EMAlPds);

EMA_bl = C > EMA (C,EMAmPds) AND C > EMA(C,EMAlPds) AND EMA(C,EMAmPds) > EMA(C,EMAlPds);

EMA_pr = C < EMA (C,EMAmPds) AND C > EMA(C,EMAlPds) AND EMA(C,EMAmPds) > EMA(C,EMAlPds);

EMA_ds = C < EMA (C,EMAmPds) AND C < EMA(C,EMAlPds) AND EMA(C,EMAmPds) > EMA(C,EMAlPds);

EMA_br = C < EMA (C,EMAmPds) AND C < EMA(C,EMAlPds) AND EMA(C,EMAmPds) < EMA(C,EMAlPds);

// VARIABLES

// TrendScore Count

IIf(EMAsBuy,i+1,i);

IIf(EMAmBuy,i+1,i);

IIf(EMAlBuy,i+1,i);

IIf(EMA_rc,i+3,i);

IIf(EMA_ac,i+2,i);

IIf(EMA_bl,i+1,1);

EMAs_Status = WriteIf(EMAsBuy, "-=BUY=-",

WriteIf(EMAsSell, "-=SELL=-",

WriteIf(EMAsBull, "Bullish",

WriteIf(EMAsBear, "Bearish","Neutral"))));

EMAs_Color = IIf(EMAsBuy, Color_buy,

IIf(EMAsBull, Color_bull,

IIf(EMAsBear, Color_bear,

IIf(EMAsSell, Color_sell,Color_null))));

EMAm_Status = WriteIf(EMAmBuy, "-=BUY=-",

WriteIf(EMAmSell, "-=SELL=-",

WriteIf(EMAmBull, "Bullish",

WriteIf(EMAmBear, "Bearish","Neutral"))));

EMAm_Color = IIf(EMAmBuy, Color_buy,

IIf(EMAmBull, Color_bull,

IIf(EMAmBear, Color_bear,

IIf(EMAmSell, Color_sell,Color_null))));

EMAl_Status = WriteIf(EMAlBuy, "-=BUY=-",

WriteIf(EMAlSell, "-=SELL=-",

WriteIf(EMAlBull, "Bullish",

WriteIf(EMAlBear, "Bearish","Neutral"))));

EMAl_Color = IIf(EMAlBuy, Color_buy,

IIf(EMAlBull, Color_bull,

IIf(EMAlBear, Color_bear,

IIf(EMAlSell, Color_sell,Color_null))));

EMAp_Status = WriteIf(EMA_rc, "RECOVERY",

WriteIf(EMA_ac, "Accumulation",

WriteIf(EMA_bl, "Bullish",

WriteIf(EMA_pr, "Preventive",

WriteIf(EMA_ds, "Distribution",

WriteIf(EMA_br, "Bearish","Neutral"))))));

EMAp_Color = IIf(EMA_rc, Color_buy,

IIf(EMA_ac, Color_acc1,

IIf(EMA_bl, Color_bull,

IIf(EMA_pr, Color_prev,

IIf(EMA_ds, Color_bear1,

IIf(EMA_br, Color_bear,Color_null))))));

_SECTION_END();

////////////////////////

// Initial Buy signal //

////////////////////////

_SECTION_BEGIN("IBuy Signal");

// FORMULA

I_buy = Cross(RSI(14), EMA(RSI(14),9));

I_sell = Cross(EMA(RSI(14),9), RSI(14));

I_buy = ExRem(I_buy, I_sell);

I_sell = ExRem(I_sell, I_buy);

I_bull = RSI(14) > EMA(RSI(14),9);

I_bear = RSI(14) < EMA(RSI(14),9);

// VARIABLES

// TrendScore Count

IIf(I_buy,i+2,i);

IIf(I_bull,i+1,i);

// Indicators

I_Status = WriteIf(I_buy,"-=BUY=-",

WriteIf(I_bull,"Bullish",

WriteIf(I_bear,"Bearish",

WriteIf(I_sell,"-=SELL=-","Neutral"))));

I_Color = IIf(I_buy,Color_buy,

IIf(I_bull,Color_bull,

IIf(I_bear,Color_bear,

IIf(I_sell,Color_sell,Color_null))));

_SECTION_END();

/////////////////////

// Price Smoothing //

/////////////////////

_SECTION_BEGIN("T3 Price Smoothing Signal");

// FORMULA

T3_buy = Cross (T3(C,3), T3(C,5));

T3_sell = Cross (T3(C,5), T3(C,3));

T3_buy = ExRem(T3_buy, T3_sell);

T3_sell = ExRem(T3_sell, T3_buy);

// VARIABLES

// TrendScore Count

IIf(T3_buy,i+1,i);

// Indicators

T3_Status = WriteIf(T3_buy,"-=BUY=-",

WriteIf(T3_sell,"-=SELL=-","Neutral"));

T3_Color = IIf(T3_buy,Color_buy,

IIf(T3_sell,Color_sell,Color_null));

_SECTION_END();

////////////////////

// Bollinger Band //

////////////////////

_SECTION_BEGIN("Bollinger Bands");

// FORMULA

BB1 = C>BBandTop(C,20,2) AND Ref(C,-1)<Ref(BBandTop(C,20,2),-1);

BB2 = C<BBandBot(C,20,2) AND Ref(C,-1)>Ref(BBandBot(C,20,2),-1);

// VARIABLES

// TrendScore Count

IIf(BB1,i+1,i);

// Indicators

BB_Status = WriteIf(BB1,"Above Top",

WriteIf(BB2,"Below Bottom",

WriteIf(IsNull(MA(C,20)),"N/A","Neutral")));

BB_Color = IIf(BB1,Color_bull,

IIf(BB2,Color_bear,Color_null));

_SECTION_END();

//////////

// MACD //

//////////

_SECTION_BEGIN("MACD Signal");

// FORMULA

MACDBull = MACD(12,26)>Signal(12,26,9);

// VARIABLES

// TrendScore Count

IIf(MACDBull,i+1,i);

// Indicators

MACD_Status = WriteIf(MACDBull,"Bullish",

WriteIf(IsNull(MACD(12,26)),"N/A","Bearish"));

MACD_Color = IIf(MACDBull,Color_bull,

IIf(IsNull(MACD(12,26)),Color_null,Color_bear));

_SECTION_END();

/////////////////

// RSI of MACD //

/////////////////

_SECTION_BEGIN("RSI of MACD Signal");

// PARAMETERS

RSItPds=Param("Period",14,7,33,1);

RSItOb_Parm=Param("OverBought Level",70,-200,200,5);

RSItOs_Parm=Param("OverSold Level",30,-200,200,5);

// FORMULA

Var=MACD();

Up=IIf(Var>Ref(Var,-1),abs(Var-Ref(Var,-1)),0);

Dn=IIf(Var<Ref(Var,-1),abs(Var-Ref(Var,-1)),0);

Ut=Wilders(Up,RSItPds);

Dt=Wilders(Dn,RSItPds);

RSIt=100*(Ut/(Ut+Dt));

//RSItBuy = RSIt < RSItOs_Parm AND RSIt > Ref(RSIt,-1);

//RSItOs = RSIt < RSItOs_Parm AND RSIt < Ref(RSIt,-1);

//RSItNu = RSIt < RSItOs_Parm AND RSIt > RSItOb_Parm AND RSIt > Ref(RSIt,-1);

//RSItNd = RSIt < RSItOs_Parm AND RSIt > RSItOb_Parm AND RSIt < Ref(RSIt,-1);

//RSItOb = RSIt < RSItOb_Parm AND RSIt > Ref(RSIt,-1);

//RSItSell = RSIt < RSItOb_Parm AND RSIt < Ref(RSIt,-1);

RSItOs = RSIt < RSItOs_Parm;

RSItOb = RSIt > RSItOb_Parm;

// VARIABLES

// TrendScore Count

IIf(RSItOs, i+1,i);

// Indicators

RSIt_Status = WriteIf(RSItOs,"OverSold",

WriteIf(RSItOb,"OverBought","In Range"));

RSIt_Color = IIf(RSItOs,Color_bull,

IIf(RSItOb,Color_sell,Color_null));

_SECTION_END();

///////////

// Aroon //

///////////

//_SECTION_BEGIN("AROON Signal");

//// PARAMETERS

// ArPeriod=Param("Period",14,7,33,1);

//// FORMULA

// LLVBarsSince=LLVBars(L,ArPeriod)+1;

// HHVBarsSince=HHVBars(H,ArPeriod)+1;

// AroonDown=100*(ArPeriod-LLVBarsSince)/(ArPeriod-1);

// AroonUp=100*(ArPeriod-HHVBarsSince)/(ArPeriod-1);

// AroonOsc=AroonUp-AroonDown;

// Aroon=AroonOsc>0;

//// VARIABLES

// IIf(Aroon,i+1,i);

// AROON_Status = WriteIf(Aroon,"Bullish",

// WriteIf(IsNull (RSI(14)),"N/A","Bearish"));

// AROON_Color = IIf(Aroon,Color_bull,

// IIf(IsNull(RSI(14) ),Color_null,Color_bear));

//_SECTION_END();

/////////

// WAD //

/////////

//_SECTION_BEGIN("Williams Accumulation-Distribution Signal");

// PARAMETERS

// WADPds=Param("Period",20,7,33,1);

// FORMULA

// TrueRangeHigh=Max( Ref(Close,-1), High );

// TrueRangeLow=Min( Ref(Close,-1), Low );

// WAD = Cum(IIf(C > Ref(C,-1),C-TrueRangeLow, IIf(C < Ref(C,-1),C-TrueRangeHigh,0)));

// wadup = WAD > EMA (WAD,WADPds);

// waddn = WAD < EMA (WAD,WADPds);

// wadbl = Cross(WAD, EMA(WAD,WADPds));

// wadbr = Cross(EMA(WAD,WADPds), WAD);

// VARIABLES

// WAD_Status = WriteIf(wadup, "Bullish Zone",

// WriteIf(waddn, "Bearish Zone",

// WriteIf(wadbl, "Bullish Cross",

// WriteIf(wadbr, "Bearish Cross","Neutral"))));

// WAD_Color = IIf(wadup,Color_bull,

// IIf(wadbl,Color_bear,

// IIf(wadbr,Color_bull1,

// IIf(waddn,Color_bear1,Color_null))));

//_SECTION_END();

/////////////

// Coppock //

/////////////

_SECTION_BEGIN("Coppock Indicator");

// FORMULA

CKr1=ROC(C,14);

CKr2=ROC(C,11);

CK=EMA((CKr1+CKr2),10);

CK_upt=IIf(ck>0 AND ROC(ck,1)>0,ck,0);

CK_ups=IIf(ck>0 AND ROC(ck,1)<0,ck,0);

CK_dws=IIf(ck<0 AND ROC(ck,1)>0,ck,0);

CK_dwt=IIf(ck<0 AND ROC(ck,1)<0,ck,0);

// VARIABLES

// TrendScore Count

IIf(CK_upt,i+2,i);

IIf(CK_ups,i+1,i);

// Indicators

Coppock_Status = WriteIf( CK_upt,"UPTREND",

WriteIf( CK_ups,"UpT Sideways",

WriteIf( CK_dws,"DnT Sideways",

WriteIf( CK_dwt,"DownTrend","Flat"))));

Coppock_Color = IIf( CK_upt,Color_buy,

IIf( CK_ups,Color_bull,

IIf( CK_dws,Color_bear,

IIf( CK_dwt,Color_sell,Color_null))));

_SECTION_END();

////////////////

// Stochastic //

////////////////

_SECTION_BEGIN("Stochastic %D %K Signal");

// FORMULA

StochKBull = StochK(14,3)>StochD(14,3,3);

// VARIABLES

// TrendScore Count

IIf(StochKBull,i+1,i);

// Indicators

STOCH_Status = WriteIf( StochKBull,"Bullish",

WriteIf( IsNull(StochK(14,3)),"N/A","Bearish"));

STOCH_Color = IIf(StochKBull,Color_bull,

IIf( IsNull(StochK(14,3)),Color_null,Color_bear));

_SECTION_END();

//////////

// ARSI //

//////////

_SECTION_BEGIN("ARSI Signal");

// PARAMETERS

ARSI_Pds = Param("Period",14,7,33,1);

ARSIOb_Parm = Param("OverBought Level",70,-200,200,5);

ARSIOs_Parm = Param("OverSold Level",30,-200,200,5);

// FORMULA

Chg = C - Ref( C, -1 );

UpCount = Sum( Chg >= 0, ARSI_Pds );

DnCount = ARSI_Pds - UpCount;

UpMove = AMA( Max( Chg, 0 ), Nz(1/UpCount) );

DnMove = AMA( Max( -Chg, 0 ), Nz(1/DnCount) );

RS = UpMove/DnMove;

ARSI = 100-(100/(1+RS));

ARSIOs = ARSI < ARSIOs_Parm;

ARSIOb = ARSI > ARSIOb_Parm;

//ARSIUt = ARSI > Ref(ARSI,-1);

//ARSIDt = ARSI < Ref(ARSI,-1);

//ARSIBuy = ARSI < ARSIOs AND ARSIUt;

//ARSISell = ARSI > ARSIOb AND ARSIDt;

//ARSIBuy = ExRem(ARSIBuy, ARSISell);

//ARSISell = ExRem(ARSISell,ARSIBuy);

// VARIABLES

// TrendScroe Count

IIf(ARSIOs,i+1,i);

// Indicators

ARSI_Status = WriteIf(ARSIOs,"OverSold",

WriteIf(ARSIOb,"OverBought","In Range"));

//WriteIf(ARSIBuy,"-=BUY=-",

//WriteIf(ARSI>ARSIOs,"OverSold",

//WriteIf(ARSIUt,"Improving",

//WriteIf(ARSIDt,"Declining",

//WriteIf(ARSI<ARSIOb,"OverBought",

//WriteIf(ARSISell,"-=SELL=-",""))))));

ARSI_Color = IIf(ARSIOs,Color_bull,

IIf(ARSIOb,Color_sell,Color_null));

//IIf(ARSIBuy,Color_buy,

//IIf(ARSI>ARSIOs,Color_bull,

//IIf(ARSIUt,Color_bull1,

//IIf(ARSIDt,Color_bear1,

//IIf(ARSI<ARSIOb,Color_bear,

//IIf(ARSISell,Color_sell,Color_null))))));

_SECTION_END();

/////////

// RSI //

/////////

//_SECTION_BEGIN("RSI Signal");

// PARAMETERS

// RSIPds=Param("Period",14,7,33,1);

// RSIOb=Param("OverBought Level",70,-200,200,5);

// RSIOs=Param("OverSold Level",30,-200,200,5);

// FORMULA

// R1=RSI(RSIPds)>RSIOs AND Ref(RSI(RSIPds),-1)<RSIOs AND Ref(RSI(RSIPds),-2)<RSIOs;

// R2=RSI(RSIPds)<RSIOb AND Ref(RSI(RSIPds),-1)>RSIOb AND Ref(RSI(RSIPds),-2)>RSIOb;

// VARIABLES

// IIf(R1,i+1,i);

// RSI_Status = WriteIf(R1,"Improving",

// WriteIf(R2,"Declining",

// WriteIf(IsNull(RSI(14)),"N/A","Neutral")));

// RSI_Color = IIf(R1,Color_bull1,

// IIf(R2,Color_bear1,Color_null));

//_SECTION_END();

/////////

// MFI //

/////////

_SECTION_BEGIN("MFI Signal");

// PARAMETERS

MFIPds=Param("Period",14,7,33,1);

MFIOb=Param("OverBought Level",80,-200,200,5);

MFIOs=Param("OverSold Level",20,-200,200,5);

// FORMULA

M1=MFI(MFIPds)>MFIOb;

M2=MFI(MFIPds)<MFIOs;

// VARIABLES

// TrendScroe Count

IIf(M2,i+1,i);

// Indicators

MFI_Status = WriteIf(M1,"OverBought",

WriteIf(M2,"OverSold",

WriteIf(IsNull(MFI(MFIPds)),"Null","Neutral")));

MFI_Color = IIf(M1,Color_sell,

IIf(M2,Color_buy,Color_null));

_SECTION_END();

/////////////////////////////////

// ADX Trend Strenght with ADX //

/////////////////////////////////

_SECTION_BEGIN("ADX Signal");

// JSB Lib Version

// INITIALIZATION

SetBarsRequired(100000, 100000);

// JSB_InitLib();

// PARAMETERS

ADX_Parm = Param( "ADX Period", 8, 5, 50,1);

ADX_Parma = Param( "ADX Perioda", 15, 5, 50,1);

ADX_Parmb = Param( "ADX Periodb", 25, 5, 50,1);

ADX_Parmc = Param( "ADX Periodc", 35, 5, 50,1);

ADX_Parmd = Param( "ADX Periodd", 50, 5, 50,1);

// FORMULA

// ADX Buy, Sell & Choppy Signal

ADX_up = MA(C,ADX_Parm) > 0;

ADX_dn = MA(C,ADX_Parm) < 0;

ADX_ch = MA(C,ADX_Parma) < MA(C,ADX_Parmb) AND MA(C,ADX_Parmc) < MA(C,ADX_Parmd);

ADX_Buy = Cross(MA(C,ADX_Parm), MA(C,ADX_Parmb));

ADX_Sell = Cross(MA(C,ADX_Parmb), MA(C,ADX_Parm));

ADX_Buy = ExRem(ADX_Buy, ADX_Sell);

ADX_Sell = ExRem(ADX_Sell, ADX_Buy);

ADX_bull = MA(C,ADX_Parm) > MA(C,ADX_Parmb);

ADX_bear = MA(C,ADX_Parm)> MA(C,ADX_Parma);

// ADX Trend Confirmation Signal

ADXwk = ADX(ADX_Parm) < 25;

ADXst = ADX(ADX_Parm) > 25 AND ADX(ADX_Parm) < 50;

ADXvs = ADX(ADX_Parm) > 50 AND ADX(ADX_Parm) < 75;

ADXex = ADX(ADX_Parm) > 75 AND ADX(ADX_Parm) < 100;

ADXchoppy = ADX(ADX_Parm) < PDI(ADX_Parm) AND ADX(ADX_Parm) < MDI(ADX_Parm);

// VARIABLES

// TrendScore Count

IIf(ADX_Buy,i+2,i);

IIf(ADX_bull,i+1,i);

// IIf(ADXst,i+1,i);

// Indicators

ADX_Status = WriteIf(ADX_Buy,"-=BUY=-",

WriteIf(ADX_bull,"Bullish",

WriteIf(ADX_bear,"Bearish",

WriteIf(ADX_Sell,"-=SELL=-","Neutral"))));

ADX_Color = IIf(ADX_Buy,Color_buy,

IIf(ADX_bull,Color_bull,

IIf(ADX_bear,Color_bear,

IIf(ADX_Sell,Color_sell,Color_null))));

//ADXc_Status = WriteIf(ADXwk,"Weak",

// WriteIf(ADXst,"Good",

// WriteIf(ADXvs,"Strong",

// WriteIf(ADXex,"EXCELENT",

// WriteIf(ADXchoppy,"Choppy","Neutral")))));

//ADXc_Color = IIf(ADXwk,Color_sell,

// IIf(ADXst,Color_bull1,

// IIf(ADXvs,Color_bull,

// IIf(ADXex,Color_buy,

// IIf(ADXchoppy,Color_prev,Color_null)))));

_SECTION_END();

_SECTION_BEGIN("Unnamed 1");

threshold = 5;

uptrend = StochK(39,3) > StochD(39,3,3);

downtrend =StochK(39,3) < StochD(39,3,3);

Buy = uptrend AND H >= Ref(H,-1) + threshold; BuyPrice = Max(O,Ref(H,-1) + threshold);

Sell = downtrend AND L <= Ref(L,-1) - threshold; SellPrice = Min(O,Ref(L,-1) - threshold);

Buy = ExRem(Buy,Sell);

Sell = ExRem(Sell,Buy);

Cover=Buy;

Short=Sell;

SellPrice=ValueWhen(Short,C,1);

BuyPrice=ValueWhen(Buy,C,1);

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorGreen, 0, L, Offset=-40);

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorLime, 0,L, Offset=-50);

PlotShapes(IIf(Buy, shapeUpArrow, shapeNone),colorWhite, 0,L, Offset=-45);

PlotShapes(IIf(Sell, shapeSquare, shapeNone),colorRed, 0, H, Offset=40);

PlotShapes(IIf(Sell, shapeSquare, shapeNone),colorOrange, 0,H, Offset=50);

PlotShapes(IIf(Sell, shapeDownArrow, shapeNone),colorWhite, 0,H, Offset=-45);

///////////////////////

// Trend Score Count //

///////////////////////

_SECTION_BEGIN("Trend Score Count");

TrendScore = IIf(V>Vp2,3,0) +

IIf(V>Vp1,2,0) +

IIf(V>VRG,1,0) +

IIf(rg>(arg*2),2,0) +

IIf(rg>arg,1,0) +

IIf(rising,1,0) +

IIf(bullishsign,3,0) +

IIf(upThrustBar,2,0) +

IIf(absorption,1,0) +

IIf(EMAsBuy,1,0) +

IIf(EMAmBuy,1,0) +

IIf(EMAlBuy,1,0) +

IIf(EMA_rc,3,0) +

IIf(EMA_ac,2,0) +

IIf(EMA_bl,1,0) +

IIf(I_buy,2,0) +

IIf(I_bull,1,0) +

IIf(T3_buy,1,0) +

IIf(BB1,1,0) +

IIf(MACDBull,1,0) +

//IIf(Aroon,1,0) +

IIf(CK_upt,2,0) +

IIf(CK_ups,1,0) +

IIf(StochKBull,1,0) +

IIf(RSItOs,1,0) +

IIf(ARSIOs,1,0) +

//IIf(R1,1,0) +

IIf(M2,1,0) +

IIf(ADX_Buy,2,0);

IIf(ADX_bull,1,0);

//IIf(ADXst,1,0);

ScoreRank = 100 * TrendScore / 30;

_SECTION_END();

if(Explorer==0)

{

//////////////////////

// Exploration Code //

//////////////////////

_SECTION_BEGIN("Explorer");

// PARAMETERS

EXPfil_Parm = ParamList ( "Filter","All Symbols|Buy Signals|Sell Signals",0);

EXPvol_Parm = Param ( "20 Day Min. Vol. Cap.", 50000,0,100000000,1000);

EXPvol_Parm = Param ( "Min. Price Close",15,0,5000000,1);

// FILTER

Filter = 1;

// DISPLAY COLUMNS

//AddColumn (High52,"52 Week High");

//AddColumn (Low52,"52 Week Low");

AddColumn (C,"P.Close",1.2,IIf(C>Ref(C,-1), colorGreen,colorRed));

AddColumn (V,"Volume",1,IIf(V>Ref(V,-1), colorGreen,colorRed));

AddTextColumn (VPAv_Status,"VPA Volume",1, VPAv_Color,BColor_vpa);

AddTextColumn (VPAs_Status,"VPA Spread",1, VPAs_Color,BColor_vpa);

AddTextColumn (VPAc_Status,"VPA Close",1, VPAc_Color,BColor_vpa);

AddTextColumn (VPAz_Status,"VPA Zone",1, VPAz_Color,BColor_vpa);

AddTextColumn (VPAst_Status,"VPA Status",1, VPAst_Color,BColor_vpa);

AddTextColumn (EMAs_Status,"EMA Short",1, EMAs_Color,BColor_mas);

AddTextColumn (EMAm_Status,"EMA Mid",1, EMAm_Color,BColor_mam);

AddTextColumn (EMAl_Status,"EMA Long",1, EMAl_Color,BColor_mal);

AddTextColumn (EMAp_Status,"EMA Trend",1, colorWhite,EMAp_Color);

AddTextColumn (I_Status,"I Signal",1, colorWhite,I_Color);

AddTextColumn (T3_Status,"T3 Signal",1, colorWhite,T3_Color);

AddTextColumn (BB_Status,"Bol. Band",1, colorWhite,BB_Color);

AddTextColumn (MACD_Status,"MACD",1, colorWhite,MACD_Color);

AddTextColumn (RSIt_Status,"MACD(RSI)",1, colorWhite,RSIt_Color);

//AddTextColumn (AROON_Status,"Aroon",1, colorWhite,AROON_Color);

//AddTextColumn (WAD_Status,"Williams A/D",1, colorWhite,WAD_Color);

AddTextColumn (COPPOCK_Status,"Coppock",1, colorWhite,COPPOCK_Color);

AddTextColumn (STOCH_Status,"Stochastic",1, colorWhite,STOCH_Color);

AddTextColumn (ARSI_Status,"ARSI",1, colorWhite,ARSI_Color);

//AddTextColumn (RSI_Status,"RSI",1, colorWhite,RSI_Color);

AddTextColumn (MFI_Status,"MFI(14)",1, colorWhite,MFI_Color);

AddTextColumn (ADX_Status,"DMX (ADX)",1, colorWhite,ADX_Color);

//AddTextColumn (ADXc_Status,"ADX Confirm",1, colorWhite,ADXc_Color);

//AddColumn (RSIt,"TEST L",1, colorWhite,colorBlack);

AddColumn (TtD_Change,"P/L %",1.2,IIf(TtD_Change>0, colorGreen,colorRed));

AddColumn (Beta,"( ß )",1.2,IIf(Beta>0,colorGreen,colorRed));

AddColumn (ScoreRank,"% Rank",1.0,colorWhite,colorBlue);

_SECTION_END();

}

else

{

AlertIf( Buy, "", "BUY @ " + C, 1 );

AlertIf( Sell, "", "SELL @ " + C, 2 );

no=Param( "Swing", 8, 1, 55 );

tsl_col=ParamColor( "Color", colorLightGrey );

res=HHV(H,no);

sup=LLV(L,no);

avd=IIf(C>Ref(res,-1),1,IIf(C<Ref(sup,-1),-1,0));

avn=ValueWhen(avd!=0,avd,1);

tsl=IIf(avn==1,sup,res);

//no = Optimize("TSL",Param("A (Change To Optimise)",10, 1, 55 ,1),1, 55 ,1);

tsl_col=ParamColor( "Color", colorLightGrey );

res=HHV(H,no);

sup=LLV(L,no);

avd=IIf(C>Ref(res,-1),1,IIf(C<Ref(sup,-1),-1,0));

avn=ValueWhen(avd!=0,avd,1);

dtsl=IIf(avn==1,sup,res);

SellPrice=ValueWhen(Short,C,1);

BuyPrice=ValueWhen(Buy,C,1);

Long=Flip(Buy,Sell);

Shrt=Flip(Short,Cover);

Relax = NOT Long AND NOT Buy AND NOT shrt AND NOT Sell AND NOT Sell AND NOT Cover;

SellSL=ValueWhen(Short,DTSL,1);

BuySL=ValueWhen(Buy,DTSL,1);

BuyDifference= BuyPrice - BuySL;

SellDifference = SellSL - SellPrice;

tar1 = IIf(Buy OR Long AND NOT Relax AND NOT Sell AND NOT Cover, (BuyPrice + BuyDifference), (SellPrice - SellDifference));

tar2 = IIf(Buy OR Long AND NOT Relax AND NOT Sell AND NOT Cover, (BuyPrice + (2*BuyDifference)), (SellPrice - (2*SellDifference)));

tar3 = IIf(Buy OR Long AND NOT Relax AND NOT Sell AND NOT Cover, (BuyPrice + (4*BuyDifference)), (SellPrice - (4*SellDifference)));

// User-defined parameter for EMA periods

EMA_Type = Param("EMA-1, TEMA-2, JMA-3", 2, 1, 3, 1);

EMA_prds = Param("EMA_periods", 7, 1, 30, 1);

Std_MACD = Param("Standard MACD? No-0, Yes-1", 1, 0, 1, 1);

Plot_fashion = Param("Bar+Arrows-1, Impulse Bars-2", 2, 1, 2, 1);

// Allow user to define Weekly and Monthly Ribbon Location and Height

WR_P1 = Param("Weekly Ribbon Location", -10.5, -1000, 1000, 0.1);

WR_P2 = Param("Weekly Ribbon Height", 366.5, -0.001, 500, 0.1);

MR_P1 = Param("Monthly Ribbon Location", 5.2, -1000, 1000, 0.1);

MR_P2 = Param("Monthly Ribbon Height", 199, -0.001, 500, 0.1);

// Compute EMA and MACD Histogram

if(EMA_Type == 1)

{

DayEMA = EMA(Close, EMA_prds);

}

if (EMA_Type == 2)

{

DayEMA = TEMA(Close, EMA_prds);

}

if(EMA_Type == 3)

{

// Line below to be used with Jurik JMA

// DayEMA = JurikJMA(C, EMA_Prds);

}

Histogram = MACD() - Signal();

// Determine if we have an Impulse UP, DOWN or None

Impulse_Up = DayEMA > Ref(DayEMA, -1) AND Histogram > Ref(Histogram, -1);

Impulse_Down = DayEMA < Ref(DayEMA, -1) AND Histogram < Ref(Histogram, -1);

Impulse_None = (NOT Impulse_UP) AND (NOT Impulse_Down);

// Compute Weekly MACD and determine whether rising or falling

// Note: uses "non-standard" parameters!

TimeFrameSet(inWeekly);

if (Std_MACD == 0)

{

MACD_val = MACD(5, 8);

Signal_val = Signal(5, 8, 5);

}

else

{

MACD_val = MACD(12, 26);

Signal_val = Signal(12, 26, 9);

}

Hist_in_w = MACD_val - Signal_val;

wh_rising = Hist_in_w > Ref(Hist_in_w, -1);

wh_falling = Hist_in_w < Ref(Hist_in_w, -1);

TimeFrameRestore();

// Now get Monthly MACD Histogram....

TimeFrameSet(inMonthly);

MACD_val = MACD(5, 8);

Signal_val = Signal(5, 8, 5);

Hist_in_m = MACD_val - Signal_val;

mh_rising = Hist_in_m > Ref(Hist_in_m, -1);

mh_falling = Hist_in_m < Ref(Hist_in_m, -1);

TimeFrameRestore();

wh_rising = TimeFrameExpand( wh_rising, inWeekly, expandLast );

wh_falling = TimeFrameExpand( wh_falling, inWeekly, expandLast);

mh_rising = TimeFrameExpand(mh_rising, inMonthly, expandLast);

mh_falling = TimeFrameExpand(mh_falling, inMonthly, expandLast);

kol = IIf( wh_rising, colorGreen, IIf(wh_falling, colorRed,

colorLightGrey));

mkol = IIf( mh_rising, colorBlue, IIf(mh_falling, colorYellow,

colorLightGrey));

// Plot them all!

if (Plot_fashion == 1)

{

Plot(Close, "Close", colorTeal, styleBar);

PlotShapes(shapeUpArrow * Impulse_Up, colorBlue, 0, Low, -12);

PlotShapes(shapeDownArrow * Impulse_Down, colorRed, 0, High, -12);

PlotShapes(shapeSmallCircle * Impulse_None, colorWhite, 0, High, 5);

}

else

{

bar_kol = IIf(impulse_UP, colorBlue, IIf(impulse_Down, colorRed,

colorWhite));

//Plot(C, "Close", bar_kol, styleBar);

}

Plot(10, "ribbon", kol, styleOwnScale|styleArea|styleNoLabel, WR_P1, WR_P2);//Weekly trend

Plot(10, "ribbon", mkol, styleOwnScale|styleArea|styleNoLabel, MR_P1,

MR_P2); // Monthly Trend

// Explorer Section

// Determine if Impulse status is bullish, neutral or bearish. Display as Text Column.

Impulse_State = WriteIf(Impulse_Up, "Bul", WriteIf(Impulse_Down,

"Bear", "Neut"));

// Set the background color for Impulse Status Column

Impulse_Col = IIf(Impulse_Up, colorGreen, IIf(Impulse_Down, colorRed,

colorLightGrey));

// Determine Weekly Trend. Display as Text Column

Weekly_Trend = WriteIf(wh_rising, "Rising", WriteIf(wh_falling, "Falling",

"Flat!"));

Weekly_Col = IIf(wh_rising, colorGreen, IIf(wh_falling, colorRed,

colorLightGrey));

// Determine Monthly Trend. Display as Text Column

Monthly_Trend = WriteIf(mh_rising, "Rising", WriteIf(mh_falling, "Falling",

"Flat!"));

Monthly_Col = IIf(mh_rising, colorGreen, IIf(mh_falling, colorRed,

colorLightGrey));

// Determine how many bars has the current state existed

bars_in_bull = Min(BarsSince(impulse_none), BarsSince(impulse_down));

bars_in_bear = Min(BarsSince(impulse_up), BarsSince(impulse_none));

bars_in_neut = Min(BarsSince(impulse_down), BarsSince(impulse_up));

// Set a single variable to show number of bars in current state depending upon

// actual Impulse Status - Bullish, Bearish or Neutral

bars_in_state = IIf(Impulse_Up,bars_in_bull, IIf(Impulse_down, bars_in_bear,bars_in_neut));

//AddColumn(Close,"Close",1.2);

// Columns for display in Explorer

//AddTextColumn(Impulse_State, "Status", 1, colorWhite, Impulse_Col);

//AddColumn(bars_in_state, "Bars", 1, colorWhite, Impulse_col);

//Action = WriteIf(Buy, "BUY", WriteIf(Sell, "SELL", " "));

//i=0;

//bars_in_statee = IIf(Buy, BarCount[i], IIf(Sell, BarCount[i],bars_in_neut));

//bars=BarsSince(IIf(Buy+BarCount+1),OR( Sell-BarCount+1));

AddColumn(bars_in_state ,"Bars", 1, colorWhite, Impulse_col);

//AddTextColumn(Weekly_Trend, "W Trend", 1, colorWhite, Weekly_Col);

//AddTextColumn(Monthly_Trend, "M Trend", 1, colorWhite, Monthly_Col);

//Filter = 1;

_SECTION_END();

//Settings for exploration

H1 = SelectedValue( TimeFrameGetPrice( "H", inDaily, -1 ) );

L1 = SelectedValue( TimeFrameGetPrice( "L", inDaily, -1 ) );

C1 = SelectedValue( TimeFrameGetPrice( "C", inDaily, -1 ) );

H2 = SelectedValue( TimeFrameGetPrice( "H", inDaily, 0 ) );

L2 = SelectedValue( TimeFrameGetPrice( "L", inDaily, 0 ) );

O1 = SelectedValue( TimeFrameGetPrice( "open", inDaily, 0 ) );

F4 = 0;

D1 = ( H1 - L1 );

D2 = ( H2 - L2 );

F1 = D1 * 0.433;

F2 = D1 * 0.766;

F3 = D1 * 1.35;

if ( D2 <= F1 )

F4 = F1;

else

if ( D2 <= F2 )

F4 = F2;

else

F4 = F3;

S_P = ( O1 - F4 );

B_P = ( O1 + F4 );

BP = ( L2 + F4 );

BPTGT = ( BP + ( BP * .0065 ) );//.0015 brokerage

BPSTPLS = ( BP - ( BP * .0085 ) );

SP = ( H2 - F4 );

SPTGT = ( SP - ( SP * .0065 ) );

SPSTPLS = ( SP + ( SP * .0085 ) );

p = ( H1 + L1 + C1 ) / 3;

s1 = ( H1 );

r1 = ( L1 );

r2 = SelectedValue( L2 );

s2 = SelectedValue( H2 );

//CONDITION

if (ParamToggle("Tooltip shows", "All Values|Only Prices"))

{

ToolTip = StrFormat("Open: %g\nHigh: %g\nLow: %g\nClose: %g (%.1f%%) \nVolume: " + NumToStr(V, 1), O, H, L, C, SelectedValue(ROC(C, 1)));

}

//space = Param("Space on Chart", 20, - 15, 50, 1);

//GraphXSpace = space;

//SetChartBkColor(ParamColor("Background Color", colorBlack));

// ================= Rasheed's original code (with Lookback and Shift default set to his specs) =================

H0 = H;

L0 = L;

C0 = C;

O0 = O;

Lookback = Param("LookBack", 10, 10, 50, 1); // Default for interday commodity currency trading

shift = Param("Shift", 5, 1, 50, 1); // ?

x0 = LastValue(Cum(1));

x1 = x0 - shift;

H = Ref(H, - shift + 1);

L = Ref(L, - shift + 1);

H1 = LastValue(Ref(HHV(H, Lookback), - 1));

L1 = LastValue(Ref(LLV(L, Lookback), - 1));

Plot(H1, "H1", colorYellow);

Plot(L1, "L1", colorYellow);

H = H0;

L = L0;

C = C0;

O = O0;

up = Cross(H, H1)AND Cum(1) > x1;

dn = Cross(L1, L)AND Cum(1) > x1;

//Plot(C, "Close", IIf(Cum(1) > x1 - Lookback AND Cum(1) <= x1, colorBlue, IIf(Up, colorBrightGreen, IIf(Dn, colorRed, IIf(C > O, colorGreen, colorRed)))), 64);

//PlotShapes(shapeDownArrow *(Cum(1) == x1 + 1), colorBlue);

// ======================= Exploration and Signal Code =================

TRIGGER = ParamToggle("Trigger ", "CLOSE|HIGH OR LOW");

XH1 = Cross(C, H1);

XL1 = Cross(L1, C);

XH2 = Cross(H, H1);

XL2 = Cross(L1, L);

if (TRIGGER == 0)

{

//Buy = XH1;

//Sell = XL1;

}

else

{

//Buy = XH2;

//Sell = XL2;

}

TradeDisplay = ParamToggle("Remove Extra Trades?", "No|Yes");

if(TradeDisplay != 0){

//Buy = ExRem(Buy, Sell);

//Sell = ExRem(Sell, Buy); // THIS WILL REMOVE EXESS SIGNALS ON A CHART OR IN AN EXPLORATION

}

Filter = Buy OR Sell;

Action = WriteIf(Buy, "BUY", WriteIf(Sell, "SELL", " "));

//AddTextColumn(IndustryID(1), "Industry Sector ", 30.0, colorBlue, colorYellow);

AddColumn(C, "Last ", 2.2, colorWhite, colorBlue);

AddTextColumn(Action, "Action", 8.0, IIf(XH1, colorDarkGreen, colorDarkRed), colorWhite);

AddColumn(IIf(XH1, H1, L1), "BREAKOUT LEVEL", 3.2, colorYellow, IIf(XH1, colorDarkGreen, colorDarkRed));

// ----------------------------------------------------------------------------------- Arrow signals --- FOR TRADES ----------------------------------------------------------

//PlotShapes(Buy *shapeUpArrow, colorBrightGreen, 0, L /* ENTRY_TRAILARRAY */, - 30);

//PlotShapes(Sell *shapeDownArrow, colorLightYellow, 0, H, - 30);

_SECTION_END();

_SECTION_BEGIN("Volume At Price");

PlotVAPOverlay(Param("Lines", 1000, 100, 1000, 10), Param("Width", 15, 1, 100, 1), ParamColor("Color", colorBlue), ParamToggle("Side", "Left|Right", 1) | 4 *ParamToggle("Z-order", "On top|Behind", 1));

_SECTION_END();

//Filter = Buy OR Sell;

//AddColumn( IIf( Buy, 66, 1 ), "Buy", formatChar, 1, bkcolor = IIf( Buy, 43, 33 ) );

//AddColumn( IIf( Sell, 83, 1 ), "Sell", formatChar, 1, bkcolor = IIf( Sell, 25, 32 ) );

//AddColumn( C, "CMP", 1.2, colorDefault, colorLightBlue );

//AddColumn( BP, "SELL PRICE", 1.2, colorDefault, colorGreen );

//AddColumn( BPTGT, "TGT PRICE", 1.2, colorDefault, colorBrown );

//AddColumn( BPSTPLS, "STPLS BUY", 1.2, colorDefault, colorRed );

AddColumn( p, "PIVOT", 1.2, colorDefault, colorYellow );

//AddColumn( SPSTPLS, "STPLS SELL", 1.2, colorDefault, colorRed );

//AddColumn( SP, "SELL PRICE", 1.2, colorDefault, colorGreen );

//AddColumn( SPTGT, "TGT PRICE", 1.2, colorDefault, colorBrown );

//Settings for exploration

Filter=Buy OR Short;

AddColumn( IIf( Buy, 66 , 83 ), "Signal", formatChar, colorDefault, IIf( Buy , colorGreen, colorRed ) );

AddColumn(Close,"Entry Price",1.4, colorDefault, IIf( Buy , colorGreen, colorRed ));

AddColumn(dtsl,"Stop Loss",1.4, colorDefault, IIf( Buy , colorGreen, colorRed ));

AddColumn(tar1,"Target 1",1.4, colorDefault, IIf( Buy , colorGreen, colorRed ));

AddColumn(tar2,"Target 2",1.4, colorDefault, IIf( Buy , colorGreen, colorRed ));

AddColumn(tar3,"Target 3",1.4, colorDefault, IIf( Buy , colorGreen, colorRed ));

AddColumn(ROC(V,1),"RVol ",1.2, IIf(ROC(V,1) > 0, colorGreen, colorRed));

AddColumn(Volume,"Volume",1.0, colorDefault, IIf ((Volume > 1.25 * EMA( Volume, 34 )),colorBlue,colorYellow));

AddColumn( H1, "PRE-HIGH" );

AddColumn( L1, "PRE-LOW" );

AddColumn( D1, "PRE-DIFF" );

AddColumn( F1, "0.433" );

AddColumn( F2, "0.766" );

AddColumn( F3, "1.35" );

AddColumn( H2, "D-HIGH" );

AddColumn( L2, "D-LOW" );

AddColumn( D2, "D-DIFF" );

AddColumn( F4, "SELECT FACT" );

AlertIf( Buy , "SOUND C:\\Windows\\Media\\chimes.wav", "Audio alert", 2 );

AlertIf( Sell , "SOUND C:\\Windows\\Media\\alert.wav", "Audio alert", 2 );

}

Short=Sell;

Cover=Buy;

Long=Flip(Buy,Sell);

Shrt=Flip(Short,Cover);

SellPrice=ValueWhen(Short,C,1);

BuyPrice=ValueWhen(Buy,C,1);

Edc=(

WriteIf (Buy AND Ref(shrt,-1), " BUY @ "+C+" ","")+

WriteIf (Sell AND Ref(Long,-1), " SEll @ "+C+" ","")+

WriteIf(Sell , "Last Trade Profit Rs."+(C-BuyPrice)+"","")+

WriteIf(Buy , "Last Trade Profit Rs."+(SellPrice-C)+"",""));

//============== TITLE ==============

_SECTION_BEGIN("Tops and bottom");

pd = Param("Periods",13,5,144,1);

pds = 2*pd-1;// (Adjustment for Wilders MA)

aa = Close-Ref(Close,-1);

uu = EMA(Max(0,aa),pds);

dd= EMA((Max(0,0-aa)),pds);

rf = IIf(C>2,1000,10000);

c1 = Param("Upper Level",70,50,90,1);

qq1 =100/(100-c1)-1;

ff1 = qq1*dd-uu;

ff2 = ff1/qq1;

f1 = Max(ff1,ff2);

UL = Close + f1*(pds-1)/2;

UL = IIf(UL>C,floor(UL*rf),ceil(UL*rf))/rf;

c2 = Param("Equilibrium",50,50,50,0);

qq2 =100/(100-c2)-1;// [=1]

ff = dd-uu;

MM = Close + ff*(pds-1)/2;

MM = IIf(MM>C,floor(MM*rf),ceil(MM*rf))/rf;

c3 = Param("Lower Level",30,10,50,1);

qq3 =100/(100-c3)-1;

ff1 = qq3*dd-uu;

ff2 = ff1/qq3;

f3 = Min(ff1,ff2);

LL = Close + f3*(pds-1)/2;

LL = IIf(LL>C,floor(LL*rf),ceil(LL*rf))/rf;

band = Param("band width",4,0,15,0.25);

mmu = MM+band;

mmd = MM-band;

_SECTION_BEGIN("Pivot calc");

TimeFrameSet( in15Minute*2 );

DH=Ref(H,-1);

DL=Ref(L,-1);

DC=Ref(C,-1);

pd = ( DH+ DL + DC )/3;

sd1 = (2*pd)-DH;

sd2 = pd -(DH - DL);

sd3 = Sd1 - (DH-DL);

rd1 = (2*pd)-DL;

rd2 = pd +(DH -DL);

rd3 = rd1 +(DH-DL);

if(ChangeTitle==1)

{

_SECTION_BEGIN("Title");

no=Param( "Swing", 6, 1, 55 );

res=HHV(H,no);

sup=LLV(L,no);

avd=IIf(C>Ref(res,-1),1,IIf(C<Ref(sup,-1),-1,0));

avn=ValueWhen(avd!=0,avd,1);

tsl=IIf(avn==1,sup,res);

dec = (Param("Decimals",2,0,7,1)/10)+1;

if( Status("action") == actionIndicator )

(

Title = EncodeColor(55)+ Title = Name() + " " + EncodeColor(32) + Date() +

" " + EncodeColor(5) + "{{INTERVAL}} " +

EncodeColor(55)+ " Open = "+ EncodeColor(52)+ WriteVal(O,dec) +

EncodeColor(55)+ " High = "+ EncodeColor(5) + WriteVal(H,dec) +

EncodeColor(55)+ " Low = "+ EncodeColor(32)+ WriteVal(L,dec) +

EncodeColor(55)+ " Close = "+ EncodeColor(52)+ WriteVal(C,dec)+

EncodeColor(55)+ " Volume = "+ EncodeColor(52)+ WriteVal (V ,1.25)

+"\n"+EncodeColor(colorBrightGreen)+

WriteIf (Buy , "Signal: Go Long - Entry Price: "+WriteVal(C)+" - Traget: "+WriteVal((BuyPrice-tsl)+BuyPrice)

+" - StopLoss:"+WriteVal(tsl)+" "

,"")+

"\n"+EncodeColor(colorRed)+

WriteIf (Sell , "Signal: Go Short - Entry Price: "+WriteVal(C)+" - Target: "+WriteVal((tsl-SellPrice)-SellPrice)+" - StopLoss:"+WriteVal(tsl)+" ","")+

EncodeColor(colorTurquoise)+

WriteIf(Long AND NOT Buy, "Trade: Long - Entry Price: "+WriteVal((BuyPrice))+" - Profit: "+WriteVal((C-BuyPrice))+" "+EncodeColor(colorLime)+"Let your profit runs!","")+

EncodeColor(colorLightOrange)+

WriteIf(shrt AND NOT Sell, "Trade: Short - Entry Price: "+WriteVal((SellPrice))+" - Profit: "+WriteVal((C-SellPrice))+" - "+EncodeColor(colorLime)+"Let your profit runs!","")+

EncodeColor(colorBrightGreen)+ "

\n R3 : "+

EncodeColor(colorWhite)+RD3+

EncodeColor(colorBrightGreen)+ "\n R2 : "+

EncodeColor(colorWhite)+RD2+

EncodeColor(colorBrightGreen)+ "\n R1 : " +

EncodeColor(colorWhite)+RD1 +

EncodeColor(colorBrightGreen)+ " UP TGT : "+

EncodeColor(colorWhite)+UL+

EncodeColor(colorBlue)+ "\n Pivot : "+

EncodeColor(colorWhite)+pd+

EncodeColor(colorBlue)+ " MIDPOINT : "+

EncodeColor(colorWhite)+MM+

EncodeColor(colorRed)+ "\n S1 : "+

EncodeColor(colorWhite)+SD1 +

EncodeColor(colorRed)+ " BOT TGT : "+

EncodeColor(colorWhite)+LL+

EncodeColor(colorRed)+ "\n S2 : "+

EncodeColor(colorWhite)+SD2+

EncodeColor(colorRed)+ "\n S3 : "+

EncodeColor(colorWhite)+SD3

);

_SECTION_END();

}

if(Buyselllable==1)

{

dist = 1.5*ATR(10);

dista = 0.5*ATR(10);

for( i = 0; i < BarCount; i++ )

{

if( Buy[i] ) PlotText( "Buy \n"+C[i] , i, L[ i ]-dist[i], colorBlack,colorGreen );

if( Sell[i] ) PlotText( "Sell \n"+C[i], i, H[ i ]+dist[i], colorBlack, colorRed );

//if( Buy[i] ) PlotText( "B" , i, L[ i ]-dist[i], colorBlack,colorGreen );

//if( Sell[i] ) PlotText( "S" , i, H[ i ]+dist[i], colorBlack, colorRed );

if( Sell[i] ) PlotText( "Top" , i, H[ i ]+dista[i], colorGreen, colorBlack );

if( Buy[i] ) PlotText( "Bottom", i, L[ i ]-dista[i], colorRed, colorBlack );

} }5 comments

Leave Comment

Please login here to leave a comment.

Back

error 718 x1=IIf(Cloc=0,arg,x);

and then, too,

Dear Sir

Please mail AFL formula to my mail ID: bchandra1981@gmail.com , Thanks in advance

error

Interesting Exploration. However I would like to change “Filter” to:

Filter = C <60 AND C >2 AND Volume > 80000 AND C> Ref(C,-1);

I tried to do but it didn’t work. Let know how to accomplish as my target isn’t extremely high price stocks.

Thanks

Dick Hoierman

Giving Error in Line no 718.

x1=IIf(Cloc=0,arg,x);

Warning 501. Assignment within Conditional. Did you mean == instead of =?

How to solve ?

Thanks in advance.

Raja