Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

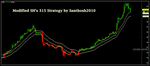

Modified SH's 315 Strategy by Santhosh2010 for Amibroker (AFL)

The first step is to understand what is 315 .. its advantages and disadvantages.

The second step is to understand some rules I have derived to use it effectively. Rules are related to effective entries, effective SL management, effective profit bookings, effective re-entries and in the end effective money management or effective safeguarding the capital.

In this post I would focus on step 1 i.e what is 315 etc.

315 Strategy for swing trading

315 is a simple swing technique which tries to identify a trend very early. In this strategy we use only EMAs name EMA 3 & EMA 15 (hence the name 315).

People ask me why EMA 3 and EMA 15 …. for me last 3 days define the immediate average price … to find the slightly longer term trend i use the factor of 5. This is becuase 5 has an interesting relevance to markets…. we have approx 5 hours of trading everyday, 5 trading days in a week, almost 5 trading weeks in a month …. So I simply multiple 3 by 5 to get my 15 EMA which defines my medium term average price.

Now in simple terms, if our immediate average price is higher than the medium term average price that means we are entering in a bull swing … and visa versa. Hence the strategy entries are:

We are using Total 3 Moving averages :-

Ema 15 based on High.

Ema 15 based on Low.

Ema 3 based on close.(signal line)

1 Enter Long when 3 EMA goes above 15 EMA (High)

2 Enter Short when 3 EMA goes below 15 EMA (Low)

Advantages of following 315 strategy

1. A simple technique using just 2 EMAs, no other oscilattors or indicators required. NO advanced charting softwares required.

2. System is based on following the ULTIMATE indicator available i.e price action.

3. Keeps a trader in the trend, lets the full swing to complete. Never gets a trader against the trend.

4. Since we are just following price action, we dont need to worry about divergences etc.

Disadvantages of 315 Strategy

1. Works brilliantly in a trending market but can whipsaw in extremely ranging markets. However this can be overcome by certain rules and money management to be explained later in this thread.

Screenshots

Similar Indicators / Formulas

Indicator / Formula

_SECTION_BEGIN("MA Cross");

//Modified SH's 315 Strategy by Santhosh2010

// Traderji id :Santhosh2010

e1=EMA(C,3);

e2=EMA(H,15);

e3=EMA(L,15);

Plot(e1,"",colorYellow,styleDashed |styleThick);

Plot(e2,"",colorLightYellow,styleDots );

Plot(e3,"",colorLightYellow,styleDots );

b1=Cross(e1,e2);

s1=Cross(e3,e1);

Buysetup=Flip(b1,s1);

Shortsetup=Flip(s1,b1);

trend=IIf(BarsSince(Buysetup)<BarsSince(Shortsetup ),1,0);

Col=IIf(trend==1,colorGreen,4);

SetBarFillColor(Col);

Plot(C,"Close",Col,64);

_SECTION_END(); 10 comments

Leave Comment

Please login here to leave a comment.

Back

Thanks for sharing the strategy alongwith appropriate reason behind it . Can you specify the timeframe to be used for intraday and positional trade. Thank again and waiting for SL , reentries classification. Rating 5/5 .

hello mam….very nice, it offers good clarity over trend. I usually

follow money flow index that can identify whipsaws in advance. awaiting

your method of identifying whipsaws….five stars….

tnx to santosh ji & priya ji

very interesting loookig forward to introduce it in my trading

really helpful code after a long time..

thanx you

kindly share money management rules

Brilliant and reliable: I just used it with a Danish stock (moving side ways at the moment).

Thanks for sharing.

Filter = e1 > e3 ;

Buy= e1 > e3 AND e1 < e2 ;

you can add 2 above lines for explore and get buy signals.

nice strategy, thanks !

Excellent setup, to me you deserve 5 stars.