Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

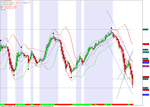

Trading Trix bars for Amibroker (AFL)

Trix based system with support and resistance lines. The indicator also display pivots and the parabolic SAR

Screenshots

Similar Indicators / Formulas

Indicator / Formula

_SECTION_BEGIN("Candle");

SetBarsRequired(200,0);

GraphXSpace = 5;

SetChartOptions(0,chartShowArrows|chartShowDates);

k = Optimize("K",Param("K",1,0.25,5,0.25),0.25,5,0.25);

Per= Optimize("atr",Param("atr",4,3,20,1),3,20,1);

HACLOSE=(O+H+L+C)/4;

HaOpen = AMA( Ref( HaClose, -1 ), 0.5 );

HaHigh = Max( H, Max( HaClose, HaOpen ) );

HaLow = Min( L, Min( HaClose, HaOpen ) );

PlotOHLC( HaOpen, HaHigh, HaLow, HaClose, "" + Name(), colorBlack, styleCandle | styleNoLabel );

j=Haclose;

_SECTION_END();

_SECTION_BEGIN("Advanced Support & Resistance");

SetChartOptions(0,chartShowArrows|chartShowDates);

_N(Title = StrFormat("{{NAME}} - {{INTERVAL}} {{DATE}} ,{{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

//Plot(C, "", IIf(O>=C, colorRed, colorBlue),styleCandle);

//SetChartBkGradientFill( ParamColor("Inner panel upper",colorBlack),ParamColor("Inner panel lower",colorBlack));

_N(Title = EncodeColor(colorWhite)+StrFormat(" {{NAME}} - {{INTERVAL}} {{DATE}} Open:%g, Close:%g ,{{VALUES}}",O,C ));

////////////////////////////////////////////////////////

//Plot(MA(C,15),"",colorViolet);

////////////////////////////////////////////////////////

per1=Param ("per1", 0.1,0.1,50,0.10);

per=per1;

x = Cum(1);

s1=L;

s11=H;

pS = TroughBars( s1, per, 1 ) == 0;

endt= SelectedValue(ValueWhen( pS, x, 1 ));

startt=SelectedValue(ValueWhen( pS, x, 2 ));

dtS =endt-startt;

endS = SelectedValue(ValueWhen( pS, s1, 1 ) );

startS = SelectedValue( ValueWhen( pS, s1, 1 ));

aS = (endS-startS)/dtS;

bS = endS;

trendlineS = aS * ( x -endt ) + bS;

g3= IIf(x>startt-10,trendlineS,-1e10);

//Plot(g3,"",colorRed,styleDots,styleThick);

Plot(g3,"",colorTeal,styleThick);

pR = PeakBars( s11, per, 1 ) == 0;

endt1= SelectedValue(ValueWhen( pR, x, 1 ));

startt1=SelectedValue(ValueWhen( pR, x, 2 ));

dtR =endt1-startt1;

endR = SelectedValue(ValueWhen( pR, s11, 1 ) );

startR = SelectedValue( ValueWhen( pR, s11, 1 ));

aR = (endR-startR)/dtR;

bR = endR;

trendlineR = aR * ( x -endt1 ) + bR;

g4= IIf(x>startT1-10,trendlineR,-1e10);

//Plot(g4,"",colorGreen,styleDots,styleThick);

Plot(g4,"",colorTeal,styleThick);

///////////////////////////////////////////////////////////////

perc=per1;

x=BarIndex();xx=SelectedValue(x);

t1=SelectedValue(ValueWhen(PeakBars(C,perc)==0,x)) ;

H1=SelectedValue(ValueWhen(PeakBars(C,perc)==0,C)) ;

t11=SelectedValue(ValueWhen(TroughBars(C,perc)==0, x));

H11=SelectedValue(ValueWhen(TroughBars(C,perc)==0, C));

g=t1>t11;

shape=IIf(g,shapeDownArrow*(x==t1),shapeUpArrow*(x ==t11));

Color=IIf(g,colorRed,colorGreen);

PlotShapes(shape,color);

//////////////////////////////////////////////////////////

per=per1;

x = Cum(1);

s1=C;

s11=C;

pS = TroughBars( s1, per, 1 ) == 0;

endt= SelectedValue(ValueWhen( pS, x, 1 ));

startt=SelectedValue(ValueWhen( pS, x, 2 ));

dtS =endt-startt;

endS = SelectedValue(ValueWhen( pS, s1, 1 ) );

startS = SelectedValue( ValueWhen( pS, s1, 2 ));

aS = (endS-startS)/dtS;

bS = endS;

trendlineS = aS * ( x -endt ) + bS;

g3= IIf(x>startt-10,trendlineS,-1e10);

Plot(g3,"",colorTeal,styleThick);

pR = PeakBars( s11, per, 1 ) == 0;

endt1= SelectedValue(ValueWhen( pR, x, 1 ));

startt1=SelectedValue(ValueWhen( pR, x, 2 ));

dtR =endt1-startt1;

endR = SelectedValue(ValueWhen( pR, s11, 1 ) );

startR = SelectedValue( ValueWhen( pR, s11, 2 ));

aR = (endR-startR)/dtR;

bR = endR;

trendlineR = aR * ( x -endt1 ) + bR;

g4= IIf(x>startT1-10,trendlineR,-1e10);

Plot(g4,"",colorTeal,styleThick);

_SECTION_END();

_SECTION_BEGIN("Volume");

Plot( Volume, _DEFAULT_NAME(), ParamColor("Color", colorBlue ), styleNoTitle | ParamStyle( "Style", styleHistogram | styleOwnScale | styleThick | styleNoLabel, maskHistogram ), 2 );

_SECTION_END();

_SECTION_BEGIN("Zig zag trend");

//z_ZigZagValid

// ******** CHARTING

Plot(MA(C,15),"",colorViolet);

per=Param ("per1", 0.325,0.1,50,0.10);

PercentChange = per;

mystartbar = SelectedValue(BarIndex()); // FOR GRAPHING

mystartbardate = LastValue(ValueWhen(mystartbar == BarIndex(), DateNum(),1));

InitialValue = LastValue(ValueWhen(mystartbardate == DateNum(), C , 1 ) ) ;

Temp1 = IIf(BarIndex() >= mystartbar, InitialValue, Null) ;

//Plot(Temp1, " ", colorBlack,styleLine);

//Plot((1+(LastValue(PercentChange)/100))*(Temp1), " ", colorRed, styleLine) ;

//Plot((1-(LastValue(PercentChange)/100))*(Temp1), " ", colorGreen, styleLine) ;

ZZ = Zig(C,LastValue(PercentChange)) ;

PivotLow = Ref(IIf(Ref(ROC(ZZ,1),-1) < 0 AND ROC(ZZ,1) > 0, 1, Null),1);

PivotHigh = Ref(IIf(Ref(ROC(ZZ,1),-1) > 0 AND ROC(ZZ,1) < 0, 1, Null),1);

//PlotShapes( shapeCircle*PivotLow, colorRed,0, L, -20) ;

//PlotShapes( shapeCircle*PivotHigh,colorGreen,0,H, 20) ;

Buy_Valid = IIf(C>(1+(LastValue(PercentChange)/100))*(ValueWhen(PivotLow, C,1))

AND ROC(ZZ,1) > 0,1,0);

Sell_Valid = IIf(C<(1-(LastValue(PercentChange)/100))*(ValueWhen(PivotHigh, C,1))

AND ROC(ZZ,1) < 0,1,0);

Buy_Valid = ExRem(Buy_Valid,Sell_Valid);

Sell_Valid = ExRem(Sell_Valid,Buy_Valid);

//PlotShapes( shapeUpArrow*Buy_Valid, colorRed,0, L, -20);

//PlotShapes( shapeDownArrow*Sell_Valid, colorGreen,0,H, -20) ;

BarColors =

IIf(BarsSince(Buy_Valid) < BarsSince(Sell_Valid)

AND BarsSince(Buy_Valid)!=0, colorGreen,

IIf(BarsSince(Sell_Valid) < BarsSince(Buy_Valid)

AND BarsSince(Sell_Valid)!=0, colorRed, colorDarkTeal));

//Plot(C, " ", BarColors, styleCandle ) ;

//Plot(ZZ," ", colorLightGrey,styleLine|styleThick);

//Plot(ZZ," ", BarColors,styleDots|styleLine);

Plot(ZZ," ", colorLightGrey,styleLine|styleNoLabel);

Plot(ZZ," ", BarColors,styleDots|styleLine|styleNoLabel);

Title = Name() + " " + Date() + WriteIf(PivotLow, " Up Pivot","")+WriteIf(PivotHigh," Down Pivot ","")+ WriteIf(Buy_Valid, " Buy Point ","") + WriteIf(Sell_Valid, " Sell Point ", "") ;

_SECTION_END();

//_SECTION_BEGIN("MACD Trend Bars");

//ShortPds = Param("Fast period", 12, 1, 50, 1 );

//LongPds = Param("Slow period", 26, 3, 50, 1 );

//aperiod = Param("Signal period", 9, 1, 30, 1 );

//ml = MACD( ShortPds, LongPds );

//sl = Signal(ShortPds, LongPds,aperiod);

//InsideMacd = (sl < Ref(sl , -1) AND

// ml > Ref(ml, -1)) OR

// (sl > Ref(sl , -1) AND

// ml < Ref(ml, -1));

//Color = IIf( InsideMacd, ParamColor("Inside bar", colorPlum), IIf(sl > ml, ParamColor("down bar", colorRed), ParamColor("up bar", colorGreen)));

//Plot(1, "", Color, styleOwnScale|styleArea|styleNoLabel, -0.5,100);

//_SECTION_END();

_SECTION_BEGIN("Trix bars");

// Trix Bars number

// Trix Bars number for each swing

periods = Param( "Periods", 9, 3, 13, 2 );

//periods = Param( "Periods", 5, 2, 200, 1 );

TrixOnClose = Trix( periods );

uptx = TrixOnClose >= Ref( TrixOnClose, -1 );

dntx = TrixOnClose <= Ref( TrixOnClose, -1 );

Peaktrix = TrixOnClose > Ref( TrixOnClose, -1 )AND TrixOnClose > Ref(TrixOnClose, 1 );

Troughtrix = TrixOnClose < Ref( TrixOnClose, -1 )AND TrixOnClose < Ref(TrixOnClose, 1 ) ;

BarsUp = BarsSince( dntx );

BarsDn = BarsSince( uptx );

Colortx = IIf( uptx , colorGreen, IIf( dntx , colorRed, colorGreen ) );

//Plot( TrixOnClose, "Trix (" + periods + ")" , Colortx, styleThick );

// Trix's ribbon

Ribbon = IIf( uptx , colorBrightGreen, IIf( dntx , colorRed, colorBrightGreen ));

Plot( 1, "", Ribbon , styleOwnScale | styleArea | styleNoLabel, 0, 100 );

_SECTION_END();

_SECTION_BEGIN("Indicatori");

// Supporto e Resistenza

p = (H+L+C)/3;

r1 = (2*p)-L;

s1 = (2*p)-H;

r2 = p +(r1 - s1);

s2 = p -(r2 - s1);

r3 = P + (r2 - s2);

s3 = p - (r3 - s2);

//TRIX

trx=0;

trxh = 0;

periods = Param( "Periods", 9, 3, 13, 2 );

//periods = Param( "Periods", 5, 2, 200, 1 );

trx=Trix(periods);

trxh=C/100;

//under study

tx=(Trix(3)*Trix(5)*Trix(7))/100;

tm=MA(tx,3);

Ch1=tx - tm;

//RSI & Zig Zag

p = Param("Periods", 14, 2, 200, 1 );

r = RSI( p );

ZZ = Zig(C,LastValue(PercentChange)) ;

PivotLow = Ref(IIf(Ref(ROC(ZZ,1),-1) < 0 AND ROC(ZZ,1) > 0, 1, Null),1);

PivotHigh = Ref(IIf(Ref(ROC(ZZ,1),-1) > 0 AND ROC(ZZ,1) < 0, 1, Null),1);

Title = EncodeColor(colorBrown)+ Name () + EncodeColor(colorBrown)+ Date () + EncodeColor(colorBrown)+"]"+"\n"+

EncodeColor(colorBlue)+"O: "+EncodeColor(colorBlue)+O+

EncodeColor(colorGreen)+" H: "+EncodeColor(colorGreen)+H+

EncodeColor(colorRed)+" L: "+EncodeColor(colorRed)+L+

EncodeColor(colorBlue)+" C: "+EncodeColor(colorBlue)+C+

EncodeColor(colorOrange)+" Vol:"+EncodeColor(colorOrange)+WriteVal(V,1,0)+"\n"+

//EncodeColor(colorGreen)+" s1 "+EncodeColor(colorGreen)+s1+"\n"+

//EncodeColor(colorGreen)+" s2 "+EncodeColor(colorGreen)+s2+"\n";

EncodeColor(colorGreen)+"S3 "+EncodeColor(colorGreen)+s3+

//EncodeColor(colorRed)+" r1 "+EncodeColor(colorRed)+r1+

//EncodeColor(colorRed)+" r2 "+EncodeColor(colorRed)+r2+

EncodeColor(colorRed)+" R3 "+EncodeColor(colorRed)+r3+"\n"+

EncodeColor(colorDarkBlue)+"TRIX: "+WriteIf(trx > Ref(trx ,-1) AND trx < trxh ,EncodeColor(colorRed)+" Buy ",WriteIf( trx < Ref(trx ,-1) AND trx < 0 ,EncodeColor(colorRed)+" Strong buy ",WriteIf( trx > Ref(trx ,-1) AND trx > trxh ,EncodeColor(colorGreen)+" strong sell ", EncodeColor(colorGreen)+" Sell " )))+

EncodeColor(colorDarkBlue)+WriteIf(trx > trxh OR trx < 0 ,EncodeColor(colorRed)+WriteVal(trx), EncodeColor(colorBlue)+WriteVal(trx))+"\n"+

EncodeColor(colorDarkBlue)+"RSI: "+ WriteIf(r > Ref(r ,-1) AND r < 30 AND r > 70 ,EncodeColor(colorRed)+" Buy ",WriteIf( r < Ref(r ,-1) AND r < 30 ,EncodeColor(colorRed)+" Strong buy ",WriteIf( r > Ref(r ,-1) AND r > 70 ,EncodeColor(colorGreen)+" Strong sell ", EncodeColor(colorGreen)+" Sell " )))+

EncodeColor(colorDarkBlue)+WriteIf(r > 70 OR r < 30 ,EncodeColor(colorRed)+WriteVal(r), EncodeColor(colorBlue)+WriteVal(r))+"\n"+

EncodeColor(colorDarkBlue)+"Zig Zag: "+ WriteIf(PivotLow, " line up","")+WriteIf(PivotHigh," line down ","")+ WriteIf(Buy_Valid, " buy point ","") + WriteIf(Sell_Valid, " sell point ", "");

//EncodeColor(colorPlum) + WriteIf(InsideMacd," ","" ) + EncodeColor(colorGreen) + WriteIf(sl>ml,"Rialzo","") + EncodeColor(colorRed) + WriteIf(sl<ml,"Ribasso","" );

Ribbon = IIf( uptx , colorBrightGreen, IIf( dntx , colorRed, colorBrightGreen ));

Plot( 1, "", Ribbon , styleOwnScale | styleArea | styleNoLabel, 0, 100 );

//Color = IIf( InsideMacd, ParamColor("Inside bar", colorPlum), IIf(sl > ml, ParamColor("down bar", colorRed), ParamColor("up bar", colorGreen)));

//Plot(1, "", Color, styleOwnScale|styleArea|styleNoLabel, -0.5,100);

//EncodeColor(colorPlum) + WriteIf(TSU,"tendenza al rialzo","" ) + EncodeColor(colorIndigo) + WriteIf(TSD,"tendenza al ribasso","" )+"\n"+

_SECTION_END();

_SECTION_BEGIN("Trend mobile");

N = 30; // Periodo - in questo caso un mese ma si può fare una settimana, 1 ora, 15 minuti, ecc...

Start = 1;

X = Cum(Start); // Set up the x cordinate array of the Linear Regression Line

Y = Avg; // Set the y co-ordinate of the Linear Regression line

/* Calculate the slope (bconst) AND the y intercept (aconst) of the line */

SUMX = LastValue(Sum(X,N));

SUMY = LastValue(Sum(Y,N));

SUMXY = LastValue(Sum(X*Y,N));

SUMXSqd = LastValue(Sum(X*X,N));

SUMSqdX = LastValue(SUMX * SUMX);

bconst = (N * SUMXY - SUMX * SUMY)/(N * SUMXSqd - SUMSqdX);

aconst = (SUMY - bconst * (SUMX))/N;

/* Force the x value to be very negative so the graph does not apear before the lookback period */

Domain = IIf ( X > LastValue(X) - N, 1 , -1e10);

Xvar = X * Domain;

/* Linear Regression Line */

Yvar = aconst + bconst * Xvar;

/* Plot the graphs */

/* Linear Regression Lines */

Colore=colorBlue;

//Plot(Yvar,"Pivot",colorWhite);

Plot(Yvar + LastValue(StDev(High,N))," trend_up",colorBlue);

Plot(Yvar - LastValue(StDev(Low,N))," trend_down",colorBlue);

_SECTION_END();

_SECTION_BEGIN("Parabolic Sar");

accel = Param("Acceleration", 0.02, 0, 1, 0.001);

mx = Param("Max. acceleration", 0.2, 0, 1, 0.001);

Psar = SAR(accel,mx);

colordots = IIf(Psar < L,colorGreen,IIf(Psar > H,colorRed,colorWhite));

Buy = Cross(C,Psar); Buy = Ref(Buy,-1); BuyPrice = L;

Sell = Cross(Psar,C); Sell = Ref(Sell,-1); SellPrice = H;

SetBarsRequired(-2,-2);

SetChartOptions(0, chartShowDates);

Plot(Psar ,"\nPsar",colordots,styleDots|styleNoLine);

//PlotShapes(IIf(Buy,shapeUpArrow,shapeNone),colorRed,0,L,-35);

//PlotShapes(IIf(Buy,shapeHollowUpArrow,shapeNone),colorRed,0,L,-35);

//PlotShapes(IIf(Buy,shapeHollowCircle,shapeNone),colorBlue,0,BuyPrice,0);

//PlotShapes(IIf(Sell,shapeDownArrow,shapeNone),colorBrightGreen,0,H,-35);

//PlotShapes(IIf(Sell,shapeHollowDownArrow,shapeNone),colorBrightGreen,0,H,-35);

//PlotShapes(IIf(Sell,shapeHollowCircle,shapeNone),colorOrange,0,SellPrice,0);

_SECTION_END();

_SECTION_BEGIN("Pivot");

nBars = Param("Number of bars", 30, 5, 40);

LP=Param("LookBack Period",250,1,500,1);

bShowTCZ = Param("Show TCZ", 0, 0, 1);

nExploreBarIdx = 0;

nExploreDate = 0;

nCurDateNum = 0;

DN = DateNum();

DT = DateTime();

bTCZLong = False;

bTCZShort = False;

nAnchorPivIdx = 0;

ADX14 = ADX(14);

if(Status("action")==1) {

bDraw = True;

bUseLastVis = 1;

} else {

bDraw = False;

bUseLastVis = False;

bTrace = 1;

nExploreDate = Status("rangetodate");

for (i=LastValue(BarIndex());i>=0;i--) {

nCurDateNum = DN[i];

if (nCurDateNum == nExploreDate) {

nExploreBarIdx = i;

}

}

}

GraphXSpace=7;

if (bDraw) {

}

aHPivs = H - H;

aLPivs = L - L;

aHPivHighs = H - H;

aLPivLows = L - L;

aHPivIdxs = H - H;

aLPivIdxs = L - L;

aAddedHPivs = H - H;

aAddedLPivs = L - L;

aLegVol = H - H;

aRetrcVol = H - H;

nHPivs = 0;

nLPivs = 0;

lastHPIdx = 0;

lastLPIdx = 0;

lastHPH = 0;

lastLPL = 0;

curPivBarIdx = 0;

aHHVBars = HHVBars(H, nBars);

aLLVBars = LLVBars(L, nBars);

aHHV = HHV(H, nBars);

aLLV = LLV(L, nBars);

nLastVisBar = LastValue(

Highest(IIf(Status("barvisible"), BarIndex(), 0)));

curBar = IIf(nlastVisBar > 0 AND bUseLastVis, nlastVisBar,

IIf(Status("action")==4 AND nExploreBarIdx > 0, nExploreBarIdx,

LastValue(BarIndex())));

curTrend = "";

if (aLLVBars[curBar] < aHHVBars[curBar])

curTrend = "D";

else

curTrend = "U";

if (curBar >= LP) {

for (i=0; i<LP; i++) {

curBar = IIf(nlastVisBar > 0 AND bUseLastVis,

nlastVisBar-i,

IIf(Status("action")==4 AND nExploreBarIdx > 0,

nExploreBarIdx-i,

LastValue(BarIndex())-i));

if (aLLVBars[curBar] < aHHVBars[curBar]) {

if (curTrend == "U") {

curTrend = "D";

curPivBarIdx = curBar - aLLVBars[curBar];

aLPivs[curPivBarIdx] = 1;

aLPivLows[nLPivs] = L[curPivBarIdx];

aLPivIdxs[nLPivs] = curPivBarIdx;

nLPivs++;

}

} else {

if (curTrend == "D") {

curTrend = "U";

curPivBarIdx = curBar - aHHVBars[curBar];

aHPivs[curPivBarIdx] = 1;

aHPivHighs[nHPivs] = H[curPivBarIdx];

aHPivIdxs[nHPivs] = curPivBarIdx;

nHPivs++;

}

}

}

}

curBar =

IIf(nlastVisBar > 0 AND bUseLastVis,

nlastVisBar,

IIf(Status("action")==4 AND nExploreBarIdx > 0,

nExploreBarIdx,

LastValue(BarIndex()))

);

if (nHPivs >= 2 AND nLPivs >= 2) {

lastLPIdx = aLPivIdxs[0];

lastLPL = aLPivLows[0];

lastHPIdx = aHPivIdxs[0];

lastHPH = aHPivHighs[0];

nLastHOrLPivIdx = Max(lastLPIdx, lastHPIdx);

nAddPivsRng = curBar - nLastHOrLPivIdx;

aLLVAfterLastPiv = LLV(L, nAddPivsRng);

nLLVAfterLastPiv = aLLVAfterLastPiv[curBar];

aLLVIdxAfterLastPiv = LLVBars(L, nAddPivsRng);

nLLVIdxAfterLastPiv = curBar - aLLVIdxAfterLastPiv[curBar];

aHHVAfterLastPiv = HHV(H, nAddPivsRng);

nHHVAfterLastPiv = aHHVAfterLastPiv[curBar];

aHHVIdxAfterLastPiv = HHVBars(H, nAddPivsRng);

nHHVIdxAfterLastPiv = curBar - aHHVIdxAfterLastPiv[curBar];

if (lastHPIdx > lastLPIdx) {

/* There are at least two possibilities here. One is that

the previous high was higher, indicating that this is a

possible short retracement or one in the making.

The other is that the previous high was lower, indicating

that this is a possible long retracement in the working.

However, both depend on opposing pivots. E.g., if I find

higher highs, what if I have lower lows?

If the highs are descending, then I can consider:

- a lower low, and leave it at that

- a higher high and higher low

- a lower low and another lower high

*/

if (aHPivHighs[0] < aHPivHighs[1]) {

if (nLLVAfterLastPiv < aLPivLows[0] AND

(nLLVIdxAfterLastPiv - lastHPIdx - 1) >= 1

AND nLLVIdxAfterLastPiv != curBar ) {

// -- OK, we'll add this as a pivot.

// Mark it for plotting...

aLPivs[nLLVIdxAfterLastPiv] = 1;

aAddedLPivs[nLLVIdxAfterLastPiv] = 1;

// ...and then rearrange elements in the

// pivot information arrays

for (j=0; j<nLPivs; j++) {

aLPivLows[nLPivs-j] = aLPivLows[nLPivs-(j+1)];

aLPivIdxs[nLPivs-j] = aLPivIdxs[nLPivs-(j+1)];

}

aLPivLows[0] = nLLVAfterLastPiv;

aLPivIdxs[0] = nLLVIdxAfterLastPiv;

nLPivs++;

// -- Test whether to add piv given last piv is high

// AND we have lower highs

}

// -- Here, the last piv is a high piv, and we have

// higher-highs. The most likely addition is a

// Low piv that is a retracement.

} else {

if (nLLVAfterLastPiv > aLPivLows[0] AND

(nLLVIdxAfterLastPiv - lastHPIdx - 1) >= 1

AND nLLVIdxAfterLastPiv != curBar ) {

// -- OK, we'll add this as a pivot.

// Mark it for plotting...

aLPivs[nLLVIdxAfterLastPiv] = 1;

aAddedLPivs[nLLVIdxAfterLastPiv] = 1;

// ...and then rearrange elements in the

// pivot information arrays

for (j=0; j<nLPivs; j++) {

aLPivLows[nLPivs-j] = aLPivLows[nLPivs-(j+1)];

aLPivIdxs[nLPivs-j] = aLPivIdxs[nLPivs-(j+1)];

}

aLPivLows[0] = nLLVAfterLastPiv;

aLPivIdxs[0] = nLLVIdxAfterLastPiv;

nLPivs++;

// -- Test whether to add piv given last piv is high

// AND we have lower highs

}

// -- The last piv is a high and we have higher highs

// OR lower highs

}

/* ****************************************************************

Still finding missed pivot(s). Here, the last piv is a low piv.

**************************************************************** */

} else {

// -- First case, lower highs

if (aHPivHighs[0] < aHPivHighs[1]) {

if (nHHVAfterLastPiv < aHPivHighs[0] AND

(nHHVIdxAfterLastPiv - lastLPIdx - 1) >= 1

AND nHHVIdxAfterLastPiv != curBar ) {

// -- OK, we'll add this as a pivot.

// Mark that for plotting

aHPivs[nHHVIdxAfterLastPiv] = 1;

aAddedHPivs[nHHVIdxAfterLastPiv] = 1;

// ...and then rearrange elements in the

// pivot information arrays

for (j=0; j<nHPivs; j++) {

aHPivHighs[nHPivs-j] = aHPivHighs[nHPivs-(j+1)];

aHPivIdxs[nHPivs-j] = aHPivIdxs[nhPivs-(j+1)];

}

aHPivHighs[0] = nHHVAfterLastPiv;

aHPivIdxs[0] = nHHVIdxAfterLastPiv;

nHPivs++;

// -- Test whether to add piv given last piv is high

// AND we have lower highs

}

// -- Second case when last piv is a low piv, higher highs

// Most likely addition is high piv that is a retracement.

// Considering adding a high piv as long as it is higher

} else {

// -- Where I have higher highs,

if (nHHVAfterLastPiv > aHPivHighs[0] AND

(nHHVIdxAfterLastPiv - lastLPIdx - 1) >= 1

AND nHHVIdxAfterLastPiv != curBar ) {

// -- OK, we'll add this as a pivot.

// Mark it for plotting...

aHPivs[nHHVIdxAfterLastPiv] = 1;

aAddedHPivs[nHHVIdxAfterLastPiv] = 1;

// ...and then rearrange elements in the

// pivot information arrays

for (j=0; j<nHPivs; j++) {

aHPivHighs[nHPivs-j] = aHPivHighs[nHPivs-(j+1)];

aHPivIdxs[nHPivs-j] = aHPivIdxs[nhPivs-(j+1)];

}

aHPivHighs[0] = nHHVAfterLastPiv;

aHPivIdxs[0] = nHHVIdxAfterLastPiv;

nHPivs++;

// -- Test whether to add piv given last piv is high

// AND we have lower highs

}

}

}

// -- If there are at least two of each

}

/* ****************************************

// -- Done with finding pivots

***************************************** */

if (bDraw) {

// -- OK, let's plot the pivots using arrows

PlotShapes( IIf(aHPivs==1, shapeSmallSquare, shapeNone), colorCustom12, layer = 0, yposition = High, offset = 9);

PlotShapes( IIf(aHPivs==1, shapeSmallSquare, shapeNone), colorBlack, layer = 0, yposition = High, offset = 12);

PlotShapes( IIf(aAddedHPivs==1, shapeSmallSquare, shapeNone), colorCustom10,layer = 0, yposition = High, offset = 9);

PlotShapes( IIf(aAddedHPivs==1, shapeSmallSquare, shapeNone), colorBlack, layer = 0, yposition = High, offset = 12);

PlotShapes( IIf(aLPivs==1, shapeSmallSquare, shapeNone), colorBrightGreen, layer = 0, yposition = Low, offset = -9);

PlotShapes( IIf(aLPivs==1, shapeSmallSquare, shapeNone), colorBlack, layer = 0, yposition = Low, offset = -12);

PlotShapes( IIf(aAddedLPivs==1, shapeSmallSquare, shapeNone), colorYellow, layer = 0, yposition = Low, offset = -10);

PlotShapes( IIf(aAddedLPivs==1, shapeSmallSquare, shapeNone), colorBlack, layer = 0, yposition = Low, offset = -13);

}

/* ****************************************

// -- Done with discovering and plotting pivots

***************************************** */

// -- I'm going to want to look for possible retracement

risk = 0;

profInc = 0;

nLeg0Pts = 0;

nLeg0Bars = 0;

nLeg0Vol = 0;

nLeg1Pts = 0;

nLeg1Bars = 0;

nLeg1Vol = 0;

nLegBarsDiff = 0;

nRtrc0Pts = 0;

nRtrc0Bars = 0;

nRtrc0Vol = 0;

nRtrc1Pts = 0;

nRtrc1Bars = 0;

nRtrc1Vol = 0;

minRtrc = 0;

maxRtrc = 0;

minLine = 0;

maxLine = 0;

triggerLine = 0;

firstProfitLine = 0;

triggerInc = 0;

triggerPrc = 0;

firstProfitPrc = 0;

retrcPrc = 0;

retrcBar = 0;

retrcBarIdx = 0;

retrcRng = 0;

aRetrcPrc = H-H;

aRetrcPrcBars = H-H;

aRetrcClose = C;

retrcClose = 0;

// -- Do TCZ calcs. Arrangement of pivs very specific

// for this setup.

if (nHPivs >= 2 AND

nLPivs >=2 AND

aHPivHighs[0] > aHPivHighs[1] AND

aLPivLows[0] > aLPivLows[1]) {

tcz500 =

(aHPivHighs[0] -

(.5 * (aHPivHighs[0] - aLPivLows[1])));

tcz618 =

(aHPivHighs[0] -

(.618 * (aHPivHighs[0] - aLPivLows[1])));

tcz786 =

(aHPivHighs[0] -

(.786 * (aHPivHighs[0] - aLPivLows[0])));

retrcRng = curBar - aHPivIdxs[0];

aRetrcPrc = LLV(L, retrcRng);

aRetrcPrcBars = LLVBars(L, retrcRng);

retrcPrc = aRetrcPrc[curBar];

retrcBarIdx = curBar - aRetrcPrcBars[curBar];

retrcClose = aRetrcClose[retrcBarIdx];

// -- bTCZLong setup?

bTCZLong = (

// -- Are retracement levels arranged in

// tcz order?

// .500 is above .786 for long setups

tcz500 >= (tcz786 * (1 - .005))

AND

// .681 is below .786 for long setups

tcz618 <= (tcz786 * (1 + .005))

AND

// -- Is the low in the tcz range

// -- Is the close >= low of tcz range

// and low <= high of tcz range

retrcClose >= ((1 - .01) * tcz618)

AND

retrcPrc <= ((1 + .01) * tcz500)

);

// -- risk would be high of signal bar minus low of zone

//risk = 0;

// -- lower highs and lower lows

} else if (nHPivs >= 2 AND nLPivs >=2

AND aHPivHighs[0] < aHPivHighs[1]

AND aLPivLows[0] < aLPivLows[1]) {

tcz500 =

(aHPivHighs[1] -

(.5 * (aHPivHighs[1] - aLPivLows[0])));

tcz618 =

(aHPivHighs[0] -

(.618 * (aHPivHighs[1] - aLPivLows[0])));

tcz786 =

(aHPivHighs[0] -

(.786 * (aHPivHighs[0] - aLPivLows[0])));

retrcRng = curBar - aLPivIdxs[0];

aRetrcPrc = HHV(H, retrcRng);

retrcPrc = aRetrcPrc[curBar];

aRetrcPrcBars = HHVBars(H, retrcRng);

retrcBarIdx = curBar - aRetrcPrcBars[curBar];

retrcClose = aRetrcClose[retrcBarIdx];

bTCZShort = (

// -- Are retracement levels arranged in

// tcz order?

// .500 is below .786 for short setups

tcz500 <= (tcz786 * (1 + .005))

AND

// .681 is above .786 for short setups

tcz618 >= (tcz786 * (1 - .005))

AND

// -- Is the close <= high of tcz range

// and high >= low of tcz range

retrcClose <= ((1 + .01) * tcz618)

AND

retrcPrc >= ((1 - .01) * tcz500)

);

// -- Risk would be top of zone - low of signal bar

//risk = 0;

}

// -- Show zone if present

if (bTCZShort OR bTCZLong) {

// -- Be prepared to see symmetry

if (bTCZShort) {

if (aLPivIdxs[0] > aHPivIdxs[0]) {

// -- Valuable, useful symmetry information

nRtrc0Pts = aHPivHighs[0] - aLPivLows[1];

nRtrc0Bars = aHPivIdxs[0] - aLPivIdxs[1] + 1;

nRtrc1Pts = retrcPrc - aLPivLows[0];

nRtrc1Bars = retrcBarIdx - aLPivIdxs[0] + 1;

} else {

nRtrc0Pts = aHPivHighs[1] - aLPivLows[1];

nRtrc0Bars = aHPivIdxs[1] - aLPivIdxs[1] + 1;

nRtrc1Pts = aHPivHighs[0] - aLPivLows[0];

nRtrc1Bars = aHPivIdxs[0] - aLPivIdxs[0] + 1;

}

} else { // bLongSetup

if (aLPivIdxs[0] > aHPivIdxs[0]) {

nRtrc0Pts = aHPivHighs[0] - aLPivLows[1];

nRtrc0Bars = aHPivIdxs[0] - aLPivIdxs[1] + 1;

nRtrc1Pts = retrcPrc - aLPivLows[0];

nRtrc1Bars = retrcBarIdx - aLPivIdxs[0] + 1;

} else {

nRtrc0Pts = aHPivHighs[1] - aLPivLows[0];

nRtrc0Bars = aLPivIdxs[0] - aHPivIdxs[1] + 1;

nRtrc1Pts = aHPivHighs[0] - aLPivLows[0];

nRtrc1Bars = aLPivIdxs[0] - aHPivIdxs[0] + 1;

}

}

if (bShowTCZ) {

Plot(

LineArray( IIf(bTCZLong, aHPivIdxs[0], aLPivIdxs[0]),

tcz500, curBar, tcz500 , 0),

"tcz500", colorPaleBlue, styleLine);

Plot(

LineArray( IIf(bTCZLong, aHPivIdxs[0], aLPivIdxs[0]),

tcz618, curBar, tcz618, 0),

"tcz618", colorPaleBlue, styleLine);

Plot(

LineArray( IIf(bTCZLong, aHPivIdxs[0], aLPivIdxs[0]),

tcz786, curBar, tcz786, 0),

"tcz786", colorTurquoise, styleLine);

}

// -- if (bShowTCZ)

}

// **************************

// END INDICATOR CODE

// **************************

_SECTION_END();

_SECTION_BEGIN("explorer");

fastmalenght=15;

slowmalength=30;

fastma=MA( C, fastmalenght );

slowma=MA( C, slowmalength );

eBuy=Cross( fastma , slowma );

xbuy=ADX()>10;

eSell=Cross( slowma , fastma );

Buy=eBuy AND xbuy;

/* exrem is one method to remove surplus strade signals. It removes excessive signals of arrow */

Buy = ExRem(Buy, Sell);

Sell = ExRem(Sell, Buy);

ApplyStop(stopTypeLoss,stopModePercent,Optimize( "maX. loss stop level", 12, 2, 30, 1 ),True );

_SECTION_END();

_SECTION_BEGIN("Bollinger Bands");

P = ParamField("Price field",-1);

Periods = Param("Periods", 15, 2, 100, 1 );

Width = Param("Width", 2, 0, 10, 0.05 );

Color = ParamColor("Color", colorCycle );

Style = ParamStyle("Style");

//Plot( BBandTop( P, Periods, Width ), "BBup", colorCustom12, Style );

//Plot( BBandBot( P, Periods, Width ), "BBdown", colorCustom12, Style );

bb1col=IIf(BBandTop(C,15,2)>Ref(BBandTop(C,15,2),-1),colorLime,colorRed);

bb2col=IIf(BBandBot(C,15,2)>Ref(BBandBot(C,15,2),-1),colorLime,colorRed);

Plot( BBandTop( C, 15,2 ), "" , bb1col, styleThick );

Plot( BBandBot( C, 15,2 ), "" , bb2col, styleThick );

_SECTION_END();

_SECTION_BEGIN("Visible Max and Min");

//Plot( C, "Close", ParamColor("Color", colorBlack ), styleNoTitle |

//ParamStyle("Style") | GetPriceStyle() );

function VisibleMaxValue(Value)

{

BI = BarIndex();

FirstVisibleBarIndex = Status("FirstvisiblebarIndex");

FirstVisibleBar = FirstVisibleBarIndex == BI;

HighestVisibleValue_ = HighestSince(FirstVisibleBar, Value);

LastVisibleBarIndex = Status("LastvisiblebarIndex");

BlankBars = SelectedValue(LastVisibleBarIndex - BI);

LastVisibleBar = LastVisibleBarIndex == BI + BlankBars;

MaxValue = LastValue(ValueWhen(Lastvisiblebar, HighestVisibleValue_));

return MaxValue;

}

function VisibleMinValue(Value)

{

BI = BarIndex();

FirstVisibleBarIndex = Status("FirstvisiblebarIndex");

FirstVisibleBar = FirstVisibleBarIndex == BI;

LowestVisibleValue_ = LowestSince(FirstVisibleBar, Value);

LastVisibleBarIndex = Status("LastvisiblebarIndex");

BlankBars = SelectedValue(LastVisibleBarIndex - BI);

LastVisibleBar = LastVisibleBarIndex == BI + BlankBars;

MinValue = LastValue(ValueWhen(Lastvisiblebar, LowestVisibleValue_));

return MinValue;

}

Plot(VisibleMaxValue(High), "", colorTeal, 0);

Plot(VisibleMinValue(Low), "", colorTeal, 0);

_SECTION_END();

_SECTION_BEGIN("TrendChart");

//Coding by rmike Version 2.0 Based upon the work of Andrew cardwell

//Intellectual Copyright (for amibroker coding only) - rmike

//Works quite nicely with setting of 13 & higher on a weekly chart. For dail

// Intraday charts you will need to experiment with faster settings, the default of 9 is provided.

//You are free to distribute this chart afl with the proviso that it is not modified or edited

//in any way and is distributed with due acknowledgement/ reference to the original author.

pertrix = Param("period Trix", 9, 3, 13, 2 );

persig = Param("period signal", 5, 2, 200,1);

//p=Param("RSI Periods", 14, 2, 100,1);

//p=Param("RSI Periods", 9, 2, 100,1);

A=MA(C,15);

A1=MA(C,30);

//A=EMA(C,9);

//A1=WMA(C,45);

B=EMA(Trix(pertrix),9);

B1=WMA(Signal(persig),5);

TU=A>A1 AND B>B1;

TD=A<=A1 AND B<=B1;

TSU=A>A1 AND B<=B1;

TSD=A<=A1 AND B>B1;

_SECTION_END();

_SECTION_BEGIN("Super TEMA");

//Super TEMA by Cù Chulainn V1.0

n=25; Av=12; Av1=16; Av2=2; stp=2;

//n=15; Av=12; Av1=16; Av2=2; stp=2;

n = Optimize("Periods",n,2,30,1);

av = Optimize("Average",av,10,30,1);

av1 = Optimize("Average1",av1,10,30,1);

av2 = Optimize("Average2",av2,2,5,1);

stp = Optimize("Stop",stp,4,15,1);

Var1= TEMA(Close,n);

Var2= TEMA(var1,av);

Var3= (var1-var2)+var1;

Var1= TEMA(var3,av1);

Var4= MA((var1-var2)+var1,av2);

Var5=(Var1-Var2)+Var1;

Buy=Cover=Cross(Var5,Var4);

Sell=Short=Cross(Var4,VAR5);

Buy=Cover=Cross(Var5,Ref(Var5,-1));

Sell=Short=Cross(Ref(Var5,-1),VAR5);

Plot(Var5,"Super TEMA" + "("+WriteVal( n, 1.0 )+","+WriteVal(Av, 1.0 )+"," +WriteVal(Av1, 1.0 )+","+WriteVal(Av2, 1.0 )+")" ,IIf(Var5>Ref(Var5,-1),6,4));

Plot( Flip( Buy, Sell ), "Trade", colorLavender, styleArea | styleOwnScale, 0, 1 );

//Plot( Flip( Buy, Sell ), "Trade", colorPaleGreen, styleArea | styleOwnScale, 0, 1 );

_SECTION_END();10 comments

Leave Comment

Please login here to leave a comment.

Back

its very nice formula but theres an error we cannot edite it

What’s the problem?

i have problem:

“ln:816, col:22 error 31, syntax error, expecting ‘(’

ln:820, col:69 error 31, syntax error, expecting ‘(’

ln:829, col:68 error 31, syntax error, expecting ‘(’

ln:833, col:68 error 31, syntax error, expecting ‘(’

ln:821, col:17error 29, varible ‘maxvalue’ used without having initialized

"

thanks.

I have fixed it. Please try it again.

It’s very nice! Thanks.

Thank you, I love it.

Nice indicators out look! Thanks!!!

Nice indicator…thanks

Very Nice

Nice FORMULA.