Stock Portfolio Organizer

The ultimate porfolio management solution.

Shares, Margin, CFD's, Futures and Forex

EOD and Realtime

Dividends and Trust Distributions

And Much More ....

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

Advanced Adaptive Indicators

Advanced Pattern Exploration

Neural Networks

And Much More ....

Divergence Detector for Amibroker (AFL)

Rating:

4 / 5 (Votes 12)

Tags:

amibroker, exploration

To explore divergence

Screenshots

Similar Indicators / Formulas

GapUp and Bearish Close (Reversal) _Daily

Submitted

by indraji2001 over 11 years ago

General Market Exploration by XeL

Submitted

by xel over 13 years ago

Scanning Gap Up and Gap Down

Submitted

by vinodsk over 12 years ago

Deel - Average Dollar Price Volatility

Submitted

by kaiji about 16 years ago

Vol Peak 5 Day [Scan only]

Submitted

by lusmomoney over 12 years ago

TEMA_Regression Crossover

Submitted

by marcheur over 12 years ago

Indicator / Formula

Copy & Paste Friendly

SetChartOptions(3,chartGridMiddle);

SetChartOptions(0,chartShowArrows|chartShowDates);

EnableTextOutput(False);

mfyperiod=Param("MFI period",14,5,100);

rsyperiod=Param("RSI period",14,5,100);

procedure CalDivergence()

{

global stchbulld;

global stchbeard;

global rsybulld;

global rsybeard;

global mfybulld;

global mfybeard;

global ispeak;

global istrough;

zzg=Zig(C,5);

// find the Peaks and trough of Close

ispeak=zzg>Max(Ref(zzg,-1),Ref(zzg,1));

istrough=zzg<Min(Ref(zzg,-1),Ref(zzg,1));

// Get the value of Price At Peaks

yp2=LastValue(ValueWhen(ispeak,C,2));

yp1=LastValue(ValueWhen(ispeak,C,1));

//yp2=(ValueWhen(ispeak,C,2));

//yp1=(ValueWhen(ispeak,C,1));

// Get the value of Price At Troughs

yb2=LastValue(ValueWhen(istrough,C,2));

yb1=LastValue(ValueWhen(istrough,C,1));

//yb2=(ValueWhen(istrough,C,2));

//yb1=(ValueWhen(istrough,C,1));

stchbulld=(yb1<yb2)*(LastValue(ValueWhen(istrough,StochK(15,3),1))>LastValue(ValueWhen(istrough,StochK(15,3),2)));

stchbeard=(yp1>yp2)*(LastValue(ValueWhen(ispeak,StochK(15,3),1))<LastValue(ValueWhen(ispeak,StochK(15,3),2)));

rsybulld=(yb1<yb2)*(LastValue(ValueWhen(istrough,RSI(rsyperiod),1))>LastValue(ValueWhen(istrough,RSI(rsyperiod),2)));

rsybeard=(yp1>yp2)*(LastValue(ValueWhen(ispeak,RSI(rsyperiod),1))<LastValue(ValueWhen(ispeak,RSI(rsyperiod),2)));

mfybulld=(yb1<yb2)*(LastValue(ValueWhen(istrough,MFI(mfyperiod),1))>LastValue(ValueWhen(istrough,MFI(mfyperiod),2)));

mfybeard=(yp1>yp2)*(LastValue(ValueWhen(ispeak,MFI(mfyperiod),1))<LastValue(ValueWhen(ispeak,MFI(mfyperiod),2)));

}

procedure DrawPrice()

{

_N(Title = StrFormat("{{NAME}} - {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) Vol " +WriteVal( V, 1.0 ) +" {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 )) ));

Plot( C, "Close", colorBlack, styleNoTitle | ParamStyle("Style") | GetPriceStyle() );

x=Cum(1);

// Get the x-ordinate of Close at Peaks

xp1=LastValue(ValueWhen(ispeak,x,1))-1;

xp2=LastValue(ValueWhen(ispeak,x,2))-1;

//Get the x-ordinate of Close at Troughs

xb1=LastValue(ValueWhen(istrough,x,1))-1;

xb2=LastValue(ValueWhen(istrough,x,2))-1;

// Get the value of Price At Peaks

yp2=LastValue(ValueWhen(ispeak,C,2));

yp1=LastValue(ValueWhen(ispeak,C,1));

// Get the value of Price At Troughs

yb2=LastValue(ValueWhen(istrough,C,2));

yb1=LastValue(ValueWhen(istrough,C,1));

PlotShapes(IIf(x==xb1+1,shapeStar,shapeNone),colorDarkGreen,0,L,-8);

//PlotShapes(IIf(istrough,shapeStar,shapeNone),colorDarkGreen,0,L,-8);

PlotShapes(IIf(x==xb2+1,shapeStar,shapeNone),colorDarkGreen,0,L,-8);

PlotShapes(IIf(x==xp1+1,shapeStar+shapePositionAbove,shapeNone),colorRed,0,H,-8);

PlotShapes(IIf(x==xp2+1,shapeStar+shapePositionAbove,shapeNone),colorRed,0,H,-8);

}

CalDivergence();

DrawPrice();

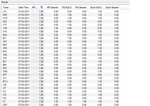

Filter=mfybulld+mfybeard+rsybulld+rsybeard+stchbulld+stchbeard;

AddColumn(mfybulld,"MFI Bull.D");

AddColumn(mfybeard,"MFI Bearish");

AddColumn(rsybulld,"RSI Bull.D");

AddColumn(rsybeard,"RSI Bearish");

AddColumn(stchbulld,"Stoch Bull.D");

AddColumn(stchbeard,"Stoch Bearish");5 comments

Leave Comment

Please login here to leave a comment.

Back

Very good afl, can scanning be done when there is a star shown in the chart.

good*…

One of my very favorite afl. Frankly speaking I don’t trust any afl but this one is exception which is worthy to draw respect. Thanks lot for sharing. I would request the author or any coder to add scan option which would be greatly beneficial for a layman like me.From explore report it is really time killing and annoying to find out the potential stocks. thanks in advance.

appears nice, but the usage of zig function requires careful evaluation, it seems.

very nice, thank you !