Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

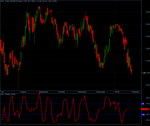

TD REI for Amibroker (AFL)

TD range expansion index (REI). Indicator was posted by another user. I have modified it to follow TD’s rules. See my comments in the code for further info..

By milostea – rcarjunk1206 [at] charter.ent

Screenshots

Indicator / Formula

_SECTION_BEGIN("TDREI-w-TDPOQ");

/*

* TD's Range Expansion Index (TD REI)

* with Price Oscillator Qualifier (TD POQ)

*

* Notes: Code was modified to follow TD's rules.

* Improvements: plenty of bug fixes.

*

* Buy when the "varPrimaryBuySetupSignal" is 1

* Sell when the "varPrimarySellSetupSignal" is 1

*

*/

varPeriod = Param("Periods", 5, 1, 8, 1); //default is 5.

varSignal = Param("Signal", 40, 35, 45, 1);// default is 40.

varOversoldSignal = (0-1)*varSignal;

varOverboughtSignal = varSignal;

// End set variables

HighMom = H - Ref( H, -2 );

LowMom = L - Ref( L, -2 );

Cond1 = ( H >= Ref( L,-5) OR H >= Ref( L, -6 ) ) OR ( Ref( H, -2 ) >= Ref( C,-7 ) OR Ref( H, -2 ) >= Ref( C, -8 ) );

Cond2 = ( L <= Ref( H, -5 ) OR L <= Ref( H, -6) ) OR ( Ref( L, -2 ) <= Ref( C,-7 ) OR Ref( L, -2 ) <= Ref( C, -8 ) );

Cond = ( Cond1 AND Cond2 );

Num = IIf( Cond, HighMom + LowMom, 0 );

Den = abs( HighMom ) + abs( LowMom );

TDREI = 100 * Sum( Num, varPeriod )/Sum( Den, varPeriod ) ;

// Identify oversold conditions

nOversold = 0;

nOverbought = 0;

nOversold = Sum( TDREI <= varOversoldSignal, 6 ) == 6 OR

Sum( TDREI <= varOversoldSignal, 5 ) == 5 OR

Sum( TDREI <= varOversoldSignal, 4 ) == 4 OR

Sum( TDREI <= varOversoldSignal, 3 ) == 3 OR

Sum( TDREI <= varOversoldSignal, 2 ) == 2 OR

TDREI <= varOversoldSignal

;

// Identify overbought conditions

nOverbought = Sum( TDREI >= varOverBoughtSignal, 6) == 6 OR

Sum( TDREI >= varOverBoughtSignal, 5) == 5 OR

Sum( TDREI >= varOverBoughtSignal, 4) == 4 OR

Sum( TDREI >= varOverBoughtSignal, 3) == 3 OR

Sum( TDREI >= varOverBoughtSignal, 2) == 2 OR

TDREI >= varOverBoughtSignal

;

// Tom DeMark Price Oscillator Qualifier (TD POQ)

// Primary and Secondary Buy Setups apply to EOD of today

// Buy = H > (H,-1)

varPrimaryCheck = 0;

varPrimaryBuySetup = 0;

varSecondaryBuySetup = 0;

varPrimaryBuySetup = (

Ref(C,-1) > Ref (C,-2) AND O <= Ref(H,-1)

AND O<= Ref(H,-2) AND O<=Ref(H,-1)

AND O<=L

AND (H > Ref(H,-1) OR H > Ref(H,-2))

);

varPrimarySellSetup = (

Ref(C,-1) > Ref(C,-2)

AND O >= Ref(L,-1)

AND O >= Ref(L,-2)

AND O >= H

AND (L < Ref(L,-1) OR L < Ref(L,-2))

);

varPrimaryBuySetupSignal = IIf(varPrimaryBuySetup AND Ref( nOversold,-1),1,0);

varPrimarySellSetupSignal = IIf(varPrimarySellSetup AND Ref(nOverbought,-1),1,0);

// Start: Plot all lines

Graph0=TDREI;

Graph0Style=styleThick;

Graph0Color=colorRed;

Graph1=varOverboughtSignal;

Graph1Style=styleLine;

Graph1Color=colorBlue;

Graph2=varOversoldSignal;

Graph2Style=styleLine;

Graph2Color=colorBlue;

IIf(varPrimaryBuySetupSignal>0,

PlotShapes(shapeUpArrow*varPrimaryBuySetupSignal,colorGreen),0);

IIf(varPrimarySellSetupSignal>0,

PlotShapes(shapeDownArrow*varPrimarySellSetupSignal,colorRed),0);

// End: plot all lines

Title =Name() + " -TDREI: " + "("+ WriteVal ( Graph0,format=1.2)+")";

_SECTION_END();0 comments

Leave Comment

Please login here to leave a comment.

Back