Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

ITF and RSI for Amibroker (AFL)

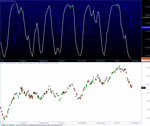

Combination of two Indicators RSI and ITF work very good with Intraday trading.

This is the Inverse Fisher Transform (IFT) of the Relative Strength Index (RSI),

across multiple timeframes. It only shows two timeframes at any given time — the

currrent chart time frame, AND the next largest time frame (see code for details).

Hourly chart: When the IFT is oversold on the daily IFT, AND lifting up above the

oversold line — AND the hourly IFT is also rising — this is a good Buy Signal.

The reverse is True for a Short Signal.

This may be used with 5 Min., hourly, daily, AND weekly charts.

Included is Tom DeMark-style duration analysis, which includes trend strength arrows. These arrows are NOT Buy OR Sell signals. Instead, they represent extreme conditions, which usually end up with a strong rebound, OR a strong continuation of the trend. Use something like the Volume Flow Indicator (VFI) to help determine which way the trend will go.

The white IFT line always represents the smaller time frame (i.e, the default time

frame for the chart).

You may want to build a Version of this that uses Tom DeMark’s Range Expansion

Index, instead of the IFT OR RSI. This works well to help determine what this

IFT indicator will likely do next

Screenshots

Similar Indicators / Formulas

Indicator / Formula

_SECTION_BEGIN("Background");

SetChartOptions(0,chartShowArrows|chartShowDates);

if( ParamToggle("Tooltip shows", "All Values|Only Prices" ) )

{

ToolTip=StrFormat("Open: %g\nHigh: %g\nLow: %g\nClose: %g

(%.1f%%)\nVolume: "+NumToStr( V, 1 ), O, H, L, C, SelectedValue( ROC( C, 1

)));

}

SetChartBkColor(ParamColor("Outer panel color ",colorBlack)); // color of outer border

SetChartBkGradientFill( ParamColor("Inner panel color upper half",colorDarkTeal),

ParamColor("Inner panel color lower half",colorBlack)); //color of inner panel

_SECTION_END();

/* IFT-RSI */

TimeFrameSet(in5Minute);

pr_5m = (H+L)/2;

len_5m = 10;

maxh_5m = HHV(pr_5m,len_5m);

minl_5m = LLV(pr_5m,len_5m);

Array1_5m = .33*2*((pr_5m-minl_5m)/(maxh_5m-minl_5m)-.5);

val1_5m = AMA(Array1_5m,.67);

value1_5m = IIf(val1_5m>.99,.999,IIf(val1_5m<-.99,-.999,val1_5m));

Array2_5m = .5*log((1+value1_5m)/(1-value1_5m));

fish_5m = AMA(Array2_5m,.5);

/* IFT-RSI */

TimeFrameSet(inHourly);

pr_h = (H+L)/2;

len_h = 10;

maxh_h = HHV(pr_h,len_h);

minl_h = LLV(pr_h,len_h);

Array1_h = .33*2*((pr_h-minl_h)/(maxh_h-minl_h)-.5);

val1_h = AMA(Array1_h,.67);

value1_h = IIf(val1_h>.99,.999,IIf(val1_h<-.99,-.999,val1_h));

Array2_h = .5*log((1+value1_h)/(1-value1_h));

fish_h = AMA(Array2_h,.5);

/* IFT-RSI */

TimeFrameSet(inDaily);

pr_d = (H+L)/2;

len_d = 10;

maxh_d = HHV(pr_d,len_d);

minl_d = LLV(pr_d,len_d);

Array1_d = .33*2*((pr_d-minl_d)/(maxh_d-minl_d)-.5);

val1_d = AMA(Array1_d,.67);

value1_d = IIf(val1_d>.99,.999,IIf(val1_d<-.99,-.999,val1_d));

Array2_d = .5*log((1+value1_d)/(1-value1_d));

fish_d = AMA(Array2_d,.5);

/* IFT-RSI */

TimeFrameSet(inWeekly);

pr_w = (H+L)/2;

len_w = 10;

maxh_w = HHV(pr_w,len_w);

minl_w = LLV(pr_w,len_w);

Array1_w = .33*2*((pr_w-minl_w)/(maxh_w-minl_w)-.5);

val1_w = AMA(Array1_w,.67);

value1_w = IIf(val1_w>.99,.999,IIf(val1_w<-.99,-.999,val1_w));

Array2_w = .5*log((1+value1_w)/(1-value1_w));

fish_w = AMA(Array2_w,.5);

/* IFT-RSI */

TimeFrameSet(inMonthly);

pr_mo = (H+L)/2;

len_mo = 10;

maxh_mo = HHV(pr_mo,len_mo);

minl_mo = LLV(pr_mo,len_mo);

Array1_mo = .33*2*((pr_mo-minl_mo)/(maxh_mo-minl_mo)-.5);

val1_mo = AMA(Array1_mo,.67);

value1_mo = IIf(val1_mo>.99,.999,IIf(val1_mo<-.99,-.999,val1_mo));

Array2_mo = .5*log((1+value1_mo)/(1-value1_mo));

fish_mo = AMA(Array2_mo,.5);

TimeFrameRestore();

varOverboughtSignal = 0.20;

varOversoldSignal = -0.20;

PlotGrid(varOverboughtSignal);

PlotGrid(varOversoldSignal);

/// DURATION ANALYSIS for Hourly ///

// Identify oversold conditions, marked with red arrow to denote downtrend

varOversold_h = IIf( Ref(fish_h,-7)<=varOversoldSignal

AND Ref(fish_h,-6)<=varOversoldSignal

AND Ref(fish_h,-5)<=varOversoldSignal

AND Ref(fish_h,-4)<=varOversoldSignal

AND Ref(fish_h,-3)<=varOversoldSignal

AND Ref(fish_h,-2)<=varOversoldSignal

AND Ref(fish_h,-1)<=varOversoldSignal

AND fish_h<=varOversoldSignal ,1,0);

IIf(VarOversold_h>0,PlotShapes(shapeHollowDownArrow*varOversold_h,colorRed),0);

// Identify overbought conditions, marked with green arrow to denote uptrend

varOverbought_h = IIf( Ref(fish_h,-7)>=varOverboughtSignal

AND Ref(fish_h,-6)>=varOverboughtSignal

AND Ref(fish_h,-5)>=varOverboughtSignal

AND Ref(fish_h,-4)>=varOverboughtSignal

AND Ref(fish_h,-3)>=varOverboughtSignal

AND Ref(fish_h,-2)>=varOverboughtSignal

AND Ref(fish_h,-1)>=varOverboughtSignal

AND fish_h>=varOverboughtSignal ,1,0);

IIf(varOverbought_h>0,PlotShapes(shapeHollowUpArrow*varOverbought_h,colorGreen),0);

Plot(TimeFrameExpand(fish_5m, in5Minute), "IFT_5m", colorWhite, styleThick);

Plot(TimeFrameExpand(fish_h, inHourly), "IFT_h", colorOrange, styleThick);

Plot(TimeFrameExpand(fish_d, inDaily), "IFT_d", colorRed, styleThick);

Plot(TimeFrameExpand(fish_w, inWeekly), "IFT_w", colorBlue, styleThick);

Plot(TimeFrameExpand(fish_mo, inMonthly), "IFT_m", colorBlack, styleThick);

Title="IFT-RSI TimeFrame";1 comments

Leave Comment

Please login here to leave a comment.

Back

Very Nice…

Thank You.