Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

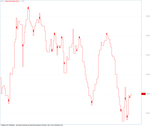

KPL System for Amibroker (AFL)

The KPL Swing is a simple trend following mechanical trading system which automates the entry and exit.

The system works with a hard stoploss and a trailing stoploss for exit with profitable trades. No targets are given as no one knows how high (or low) a stock can move. A trailing stoploss locks in the gains and removes emotions from trading.

Source: http://vfmdirect.com/kplswing/

Screenshots

Similar Indicators / Formulas

Indicator / Formula

/* my entry is very simple(daily data for trading) kpl system for entry only & exit as follow: 1 st exit at x % from entry price only 1/3 quantity.(ie 1st profit target) 2 nd exit when exit Signal comes from kpl sys remaining 1/3 quantity. 3. scale-in to initial quantity if new kpl Buy Signal comes. re-do above scaling-out & scaling-in till filal exit. 4. final exit all quantity when Close below 21 Day EMA. kpl system code bellow : */ //AFL by Kamalesh Langote. Email:kpl@... no=Param( "Swing", 2, 1, 55 ); tsl_col=ParamColor( "Color", colorCycle ); res=HHV(H,no); sup=LLV(L,no); avd=IIf(C>Ref(res,-1),1,IIf(C<Ref(sup,-1),-1,0)); avn=ValueWhen(avd!=0,avd,1); tsl=IIf(avn==1,sup,res); Buy=Cross(C,tsl) ; Sell= Cross(tsl,C) ; Plot(tsl, _DEFAULT_NAME(), tsl_col, styleStaircase); shape=Buy*shapeUpArrow + Sell*shapeDownArrow; PlotShapes(shape,IIf(Buy,tsl_col,tsl_col),0,IIf(Buy,Low,High)); SetPositionSize(300,spsShares); ApplyStop(0,1,10,1);

2 comments

Leave Comment

Please login here to leave a comment.

Back

Simple & sweet

it works well with higher frames