Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

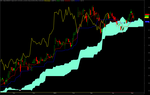

Ichimoku Chart & Exploration for Amibroker (AFL)

Ichimoku chart consists of 5 lines. Four of them are calculated simply by taking the average of the highest price and the lowest price.

1. Tenkan-Sen = Conversion Line = (Highest High + Lowest Low) / 2, used for 9 sessions

2. Kijun-Sen = Base Line = (Highest High + Lowest Low) / 2, used for 26 sessions

3. Chikou Span = Lagging Span = Today’s closing price, drawn for the next 26 sessions

4. Senkou Span A = Leading Span A = (Tenkan-Sen + Kijun-Sen) / 2, drawn for the first 26 sessions

Senkou Span B = Leading Span B = (Highest High + Lowest Low) / 2, used for 52 sessions, drawn for the first 26 sessions. Also, the distance between Leading Span A and B is called “Kumo” or “Cloud”.

Ichimoku used the three main standard sessions: 9, 26 and 52. When Ichimoku was first created (in 1930), a week of trading was 6 days and the standard was chosen as 1, 1, 1, 2 and 2 months respectively. month. But now 1 week is only 5 days, the standard is 7, 22 and 44 respectively.

Screenshots

Indicator / Formula

//////////////////////////////////////////

//// - ICHIMOKU CHART - ////

//////////////////////////////////////////

SetSortColumns(-6);

_SECTION_BEGIN("ChikouSpan");

PlotOHLC(0,Close,Close,Close,"ChikouSpan", colorYellow, styleThick,Null,Null,-25);

_SECTION_END();

_SECTION_BEGIN("Price");

SetChartOptions(0,chartShowArrows|chartShowDates);

_N(Title = StrFormat("{{NAME}} - {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%), Vol " +WriteVal( V, 1.0 ) +" {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

SetBarFillColor( IIf( C > O AND C > Ref(C,-1), colorBlack,

IIf( C < O AND C > Ref(C,-1), colorBrightGreen,

IIf( C > O AND C < Ref(C,-1), colorBlack,

IIf( C < O AND C < Ref(C,-1), colorRed,

IIf( C == Ref(C,-1) AND C > Ref(C, -2) AND C > O, colorBlack,

IIf( C == Ref(C,-1) AND C > Ref(C, -2) AND C < O, colorBrightGreen,

IIf( C == Ref(C,-1) AND C < Ref(C, -2) AND C > O, colorBlack,

IIf( C == Ref(C,-1) AND C < Ref(C, -2) AND C < O, colorRed,

IIf( C == Ref(C,-1) AND C == Ref(C, -2) AND C > Ref(C, -3) AND C > O, colorBlack,

IIf( C == Ref(C,-1) AND C == Ref(C, -2) AND C > Ref(C, -3) AND C < O, colorBrightGreen,

IIf( C == Ref(C,-1) AND C == Ref(C, -2) AND C < Ref(C, -3) AND C > O, colorBlack,

IIf( C == Ref(C,-1) AND C == Ref(C, -2) AND C < Ref(C, -3) AND C < O, colorRed,

Null ))))))))))))

);

Plot( C, "Close", IIf( C > Ref(C,-1), colorBrightGreen, IIf( C < Ref(C,-1), colorRed,

IIf( C == Ref(C,-1) AND C > Ref(C, -2), colorBrightGreen, IIf( C == Ref(C,-1) AND C < Ref(C, -2), colorRed,

IIf( C == Ref(C,-1) AND C == Ref(C, -2) AND C > Ref(C, -3), colorBrightGreen,

IIf( C == Ref(C,-1) AND C == Ref(C, -2) AND C < Ref(C, -3), colorRed, Null )))))), styleCandle );

_SECTION_END();

_SECTION_BEGIN("TenkanSen");

TS=(HHV(High,9)+LLV(Low,9))/2;

Plot(TS,"TenkanSen",colorRed , styleThick);

_SECTION_END();

_SECTION_BEGIN("KijunSen");

KJ=(HHV(High,26)+LLV(Low,26))/2;

Plot(KJ,"KijunSen",colorBlue , styleThick);

_SECTION_END();

_SECTION_BEGIN("Cloud");

SpanA=(TS+KJ)/2;

SenkouSpanA =Ref((TS+KJ)/2,-26);

SpanB=(HHV(High,52)+LLV(Low,52))/2;

SenkouSpanB =Ref((HHV(High,52)+LLV(Low,52))/2,-26);

PlotOHLC(0,SpanA,SpanB,SpanB,"Cloud",IIf(SpanA>SpanB,ParamColor("Color Up",colorAqua),ParamColor("Color Down",colorPink)),styleCloud+styleNoTitle+styleNoLabel,Null,Null,26);

_SECTION_END();

sa=SenkouSpanA;

sb=SenkouSpanB;

dk_date = (DateNum() > 10000 * (2017 - 1900) + 100 * 9 + 13);

// Strong //

Buy_s1 = Cross(TS,KJ) AND TS > SenkouSpanA AND KJ > SenkouSpanA AND TS > SenkouSpanB AND KJ > SenkouSpanB AND C > Ref(C,-25);

Sell_s1 = Cross(KJ,TS) AND TS < SenkouSpanA AND KJ < SenkouSpanA AND TS < SenkouSpanB AND KJ < SenkouSpanB AND C < Ref(C,-25);

Buy_s2 = Cross(C,KJ) AND KJ > SenkouSpanA AND KJ > SenkouSpanB AND C > SenkouSpanA AND C > SenkouSpanB AND C > Ref(C,-25);

Sell_s2 = Cross(KJ,C) AND KJ < SenkouSpanA AND KJ < SenkouSpanB AND C < SenkouSpanA AND C < SenkouSpanB AND C < Ref(C,-25);

Buy_s3 = Cross(C,Ref(H,-25)) AND C > SenkouSpanA AND C > SenkouSpanB;

Sell_s3 = Cross(Ref(H,-25),C) AND C < SenkouSpanA AND C < SenkouSpanB;

Buy_s4 = C > SenkouSpanA AND C > SenkouSpanB;

// Medium //

Buy_m1 = Cross(TS,KJ) AND IIf(SenkouSpanA > SenkouSpanB, (TS < SenkouSpanA AND KJ < SenkouSpanA AND TS > SenkouSpanB AND KJ > SenkouSpanB),

(TS > SenkouSpanA AND KJ > SenkouSpanA AND TS < SenkouSpanB AND KJ < SenkouSpanB));

Sell_m1 = Cross(KJ,TS) AND IIf(SenkouSpanA > SenkouSpanB, (TS < SenkouSpanA AND KJ < SenkouSpanA AND TS > SenkouSpanB AND KJ > SenkouSpanB),

(TS > SenkouSpanA AND KJ > SenkouSpanA AND TS < SenkouSpanB AND KJ < SenkouSpanB));

Buy_m2 = Cross(C,KJ) AND IIf(SenkouSpanA > SenkouSpanB, (C < SenkouSpanA AND KJ < SenkouSpanA AND C > SenkouSpanB AND KJ > SenkouSpanB),

(C > SenkouSpanA AND KJ > SenkouSpanA AND C < SenkouSpanB AND KJ < SenkouSpanB));

Sell_m2 = Cross(KJ,C) AND IIf(SenkouSpanA > SenkouSpanB, (C < SenkouSpanA AND KJ < SenkouSpanA AND C > SenkouSpanB AND KJ > SenkouSpanB),

(C > SenkouSpanA AND KJ > SenkouSpanA AND C < SenkouSpanB AND KJ < SenkouSpanB));

// Weak //

Buy_w1 = Cross(TS,KJ) AND TS < SenkouSpanA AND KJ < SenkouSpanA AND TS < SenkouSpanB AND KJ < SenkouSpanB

AND IIf(C < Ref(C,-25), (TS > Ref(C,-25) AND KJ > Ref(C,-25)), (TS < Ref(C,-25) AND KJ < Ref(C,-25)));

Sell_w1 = Cross(KJ,TS) AND TS > SenkouSpanA AND KJ > SenkouSpanA AND TS > SenkouSpanB AND KJ > SenkouSpanB

AND IIf(C < Ref(C,-25), (TS > Ref(C,-25) AND KJ > Ref(C,-25)), (TS < Ref(C,-25) AND KJ < Ref(C,-25)));

Buy_w2 = Cross(C,KJ) AND C < SenkouSpanA AND KJ < SenkouSpanA AND C < SenkouSpanB AND KJ < SenkouSpanB;

Sell_w2 = Cross(KJ,C) AND C > SenkouSpanA AND KJ > SenkouSpanA AND C > SenkouSpanB AND KJ > SenkouSpanB;

//---------------------------------------------------------------------------------------------------------------//

Filter=C>1 AND V>1000;

AddColumn(Buy_s1, "TS_KJ", 1.0, colorBlue);

AddColumn(Buy_s2, "C_KJ", 1.0, colorBlue);

AddColumn(Buy_s3, "Chikou", 1.0, colorBlue);

AddColumn((Buy_s1 + Buy_s2 + Buy_s3 ), "TT_Buy", 1.0, colorBlue);

AddColumn(V, " Volume ", 1.0, IIf(V>=2*MA(V,10), colorViolet, IIf(V> MA(V,10) AND V<2*MA(V,10), colorBrightGreen, colorRed)));

AddColumn(MA(V,10), " MA(V,10) ", 1.0, colorBlack);

AddColumn(MA(V,20), " MA(V,20) ", 1.0, colorBlack);

AddColumn(C, " Price ", 1.0, IIf(C>Ref(H,-25), colorBrightGreen, colorRed));

3 comments

Leave Comment

Please login here to leave a comment.

Back

9 SESSION = 1.5 WEEK SO standard SETTING IS 8 DAYS (7.5 DAYS) AND 22(ONE MONTH), 44(2 MONTHS).

Comment hidden - Show

Thanks for the exploration