Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

Keltner Band Trading System for Amibroker (AFL)

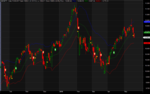

Keltner Band is a promising indicator to determine trend breakouts accurately. And experienced traders might very well know that catching accurate trend breakouts is as good a finding a fortune. Keltner band calculates the price range based on ATR (average true range), which is different from standard deviation calculation that Bollinger band uses. In this post, we would understand Keltner band calculation steps and explore a trading system based on it. This trading system is backtested on NSE Nifty for past 18 years and results are decent enough.

Get it from tradingtuitions.com. Thank guys.

Screenshots

Indicator / Formula

//------------------------------------------------------

//

// Formula Name: Keltner Channel trading System

// Author/Uploader: Trading Tuitions

// E-mail: support@tradingtuitions.com

// Website: www.tradingtuitions.com

//------------------------------------------------------

_SECTION_BEGIN("Keltner Channel trading System");

SetChartOptions(0,chartShowArrows|chartShowDates);

_N(Title = StrFormat("{{FULLNAME}} - {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

//Initial Parameters

SetTradeDelays( 0,0,0, 0 );

SetOption( "InitialEquity", 200000);

SetOption("FuturesMode" ,True);

SetOption("MinShares",1);

SetOption("CommissionMode",2);

SetOption("CommissionAmount",50);

SetOption("AccountMargin",10);

SetOption("RefreshWhenCompleted",True);

SetPositionSize(150,spsShares);

SetOption( "AllowPositionShrinking", True );

Plot( Close, "Price", colorWhite, styleCandle );

//Keltner Band Code

KMid = MA (Close, 20); //Middle Line

ATRPeriod = 10; //ATR Period

KFactor = 2; //Multiplier

KValue = ATR(ATRPeriod) * KFactor;

KTop = KMid + KValue; //Upper Band

KBottom = KMid - KValue; //Lower Ban

printf("\nKTop : " + KTop );

printf("\nKBottom : " + KBottom );

printf("\nKMid : " + KMid );

Plot(KTop,"KTop",colorBlue,styleLine);

Plot(KMid,"KMid",colorGreen,styleLine);

Plot(KBottom,"KBottom",colorRed,styleLine);

Buy=Cross(High,KTop);

Short=Cross(KBottom,Low);

Sell=Cross(KMid,Low);

Cover=Cross(High,KMid);

BuyPrice=KTop;

SellPrice=KMid;

ShortPrice=KBottom;

CoverPrice=KMid;

Buy = ExRem(Buy,Sell);

Sell = ExRem(Sell,Buy);

Short=ExRem(Short,Cover);

Cover=ExRem(Cover,Short);

printf("\nBuy : " + Buy );

printf("\nSell : " + Sell );

printf("\nShort : " + Short );

printf("\nCover : " + Cover );

/* Plot Buy and Sell Signal Arrows */

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorGreen, 0, L, Offset=-25);

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorLime, 0,L, Offset=-35);

PlotShapes(IIf(Buy, shapeUpArrow, shapeNone),colorWhite, 0,L, Offset=-30);

PlotShapes(IIf(Short, shapeSquare, shapeNone),colorRed, 0, H, Offset=25);

PlotShapes(IIf(Short, shapeSquare, shapeNone),colorOrange, 0,H, Offset=35);

PlotShapes(IIf(Short, shapeDownArrow, shapeNone),colorWhite, 0,H, Offset=-30);

PlotShapes(IIf(Sell, shapeStar, shapeNone),colorGold, 0, L, Offset=-15);

PlotShapes(IIf(Cover, shapeStar, shapeNone),colorGold, 0,L, Offset=-15);

_SECTION_END();2 comments

Leave Comment

Please login here to leave a comment.

Back

it did not show anything. Is the code broken somewhere?

Works fine here.