Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

Trending Stocks Scanner for Amibroker (AFL)

Initial Trend Score is zero.

1 point is added for each Bullish condition met.

If no Bullish conditions met then Trend score=0, if all Bullish conditions met then Trend score=7.

This is a good code I’ve found on Tradingtuitions.

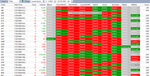

Screenshots

Indicator / Formula

_SECTION_BEGIN("Trending Stocks Screener");

i=0;

//52 Week High Low

High52 = HHV(High,250);

Low52 = LLV(Low,250);

//Bollinger Band

BB1=C>BBandTop(C,20,2) AND Ref(C,-1)<Ref(BBandTop(C,20,2),-1);

BB2=C<BBandBot(C,20,2) AND Ref(C,-1)>Ref(BBandBot(C,20,2),-1);

BBStatus=WriteIf(BB1,"Above Top",WriteIf(BB2,"Below Bottom",WriteIf(IsNull(MA(C,20)),"N/A","Neutral")));

BBColor=IIf(BB1,colorRed,IIf(BB2,colorGreen,colorLightGrey));

IIf(BB2,i+1,i);

//Moving Average (Short, Mid & Long Term)

MAShort = C>MA(C,15);

IIf(MAShort,i+1,i);

MAMid = C>MA(C,45);

IIf(MAMid,i+1,i);

MALong = C>MA(C,100);

IIf(MALong,i+1,i);

ShortStatus = WriteIf(MAShort,"Bullish",WriteIf(IsNull(MA(C,15)) ,"N/A","Bearish"));

ShortColor = IIf(MAShort,colorGreen,colorRed);

MidStatus = WriteIf(MAMid,"Bullish",WriteIf(IsNull(MA(C,45))," N/A","Bearish"));

MidColor = IIf(MAMid,colorGreen,colorRed);

LongStatus = WriteIf(MALong,"Bullish",WriteIf(IsNull(MA(C,100)) ,"N/A","Bearish"));

LongColor = IIf(MALong,colorGreen,colorRed);

//MACD

MACDBull=MACD(12,26)>Signal(12,26,9);

IIf(MACDBull,i+1,i);

MACDStatus=WriteIf(MACDBull,"Bullish",WriteIf(IsNull(MACD(12,26)),"N/A","Bearish"));

MACDColor=IIf(MACDBull,colorGreen,colorRed);

//Aroon

Period=14;

LLVBarsSince=LLVBars(L,Period)+1;

HHVBarsSince=HHVBars(H,Period)+1;

AroonDown=100*(Period-LLVBarsSince)/(Period-1);

AroonUp=100*(Period-HHVBarsSince)/(Period-1);

AroonOsc=AroonUp-AroonDown;

Aroon=AroonOsc>0;

IIf(Aroon,i+1,i);

AroonStatus=WriteIf(Aroon,"Bullish",WriteIf(IsNull (RSI(14)),"N/A","Bearish"));

AroonColor=IIf(Aroon,colorGreen,IIf(IsNull(RSI(14) ),colorLightGrey,colorRed));

//Stochastic

StochKBull=StochK(14,3)>StochD(14,3,3);

IIf(StochKBull,i+1,i);

StochKStatus=WriteIf(StochKBull,"Bullish",WriteIf( IsNull(StochK(14,3)),"N/A","Bearish"));

StochKColor=IIf(StochKBull,colorGreen,colorRed);

//RSI

R1=RSI(14)>30 AND Ref(RSI(14),-1)<30 AND Ref(RSI(14),-2)<30;

R2=RSI(14)<70 AND Ref(RSI(14),-1)>70 AND Ref(RSI(14),-2)>70;

IIf(R1,i+1,i);

RSIStatus=WriteIf(R1,"Improving",WriteIf(R2,"Decli ning",WriteIf(IsNull(RSI(14)),"N/A","Neutral")));

RSIColor=IIf(R1,colorGreen,IIf(R2,colorRed,colorLightGrey));

//MFI

M1=MFI(14)>80;

M2=MFI(14)<20;

IIf(M2,i+1,i);

MFIStatus=WriteIf(M1,"Overbought",WriteIf(M2,"Over sold",WriteIf(IsNull(MFI(14)),"N/A","Neutral")));

MFIColor=IIf(M1,colorRed,IIf(M2,colorGreen,colorLightGrey));

TrendScore =

IIf(BB2,1,0)+

IIf(MAShort,1,0)+

IIf(MAMid,1,0) +

IIf(MAMid,1,0) +

IIf(MALong,1,0)+

IIf(MACDBull,1,0) +

IIf(Aroon,1,0) +

IIf(StochKBull,1,0)+

IIf(R1,1,0) +

IIf(M2,1,0) ;

Filter = 1;

//AddColumn(High52,"52 Week High");

//AddColumn(Low52,"52 Week Low");

AddColumn(C,"Close",1,IIf(C>Ref(C,-1),colorGreen,colorRed));

AddColumn(V,"Volume",1,IIf(V>Ref(V,-1),colorGreen,colorRed));

AddTextColumn(BBStatus,"BBand",1,colorWhite,BBColor);

AddTextColumn(ShortStatus,"Short MA(15)",1,colorWhite,ShortColor);

AddTextColumn(MidStatus,"Mid MA(45)",1,colorWhite,MidColor);

AddTextColumn(LongStatus,"Long MA(100)",1,colorWhite,LongColor);

AddTextColumn(MACDStatus,"MACD",1,colorWhite,MACDColor);

AddTextColumn(AroonStatus,"Aroon",1,colorWhite,AroonColor);

AddTextColumn(StochKStatus,"Stochastic",1,colorWhite,StochKColor);

AddTextColumn(RSIStatus,"RSI(14)",1,colorWhite,RSIColor);

AddTextColumn(MFIStatus,"MFI(14)",1,colorWhite,MFIColor);

AddColumn(TrendScore,"Score");

_SECTION_END();7 comments

Leave Comment

Please login here to leave a comment.

Back

PURCHASE SIDE COUNTING OK BUT NO COUNTING SHOWING FOR SHORT SIDE PLZ MODIFY IT IF POSSIBLE

Don’t understand what’s your mean. This counts the bullish and bearish levels. If all is bearish, counter is zero. If all is bullish, counter is 7 or 8. You can follow that level to decision the long/short order

super

How t o Use this Indicator for Intraday.

perfect

superb, use this in addition to your indicator.

Sir how to download this scanner , pls help