Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

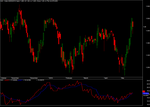

Hilbert study for Amibroker (AFL)

Using the Hilbert Metastock code, my interpetation of this indicator that indicates whether a stock is trending or not. This is set up as a system buying in at the start of a trend.

Author: Steve Wiser

Screenshots

Similar Indicators / Formulas

Indicator / Formula

/* Hilbert Study */

EnableScript("VBScript");

value1=((H+L)/2) - Ref(((H+L)/2),-6);

value2= Ref(value1,-3);

value3=0.75*(value1-Ref(value1,-6)) + 0.25*(Ref(value1,-2)-Ref(value1,-4));

<%

value1 = AFL("Value1")

value2 = AFL("Value2")

value3 = AFL("Value3")

Close = AFL("Close")

inphase = Close

quad = inphase

Call Setup()

Function Setup()

for i = 1 to Ubound(close)

inphase(i) = 0.33 * value2(i) + (0.67 * inphase(i-1) )

quad(i) = 0.20 * value3(i) + ( 0.8 * quad(i-1) )

next

End Function

AFL.Var("inphase") = inphase

AFL.Var("quad") = quad

%>

p1 = Atan(

Abs(quad+Ref(quad,-1) ) / Abs(inphase+Ref(inphase,-1) )

)

* 360 /3.1416;

phase = IIf(inphase<0 AND quad>0, 180-p1,

IIf(inphase<0 AND quad<0, 180+p1,

IIf(inphase>0 AND quad<0, 360-p1,p1)));

dp = IIf(Ref(phase,-1)<90 AND phase>270, 360+Ref(phase,-1)-phase,Ref(phase,-1)-phase);

dp2 = IIf(dp < 1, 1,

IIf(dp > 60, 60, dp));

Graph1 = dp2;

HilbertCyclePeriod1a = dp2;

value = dp2;

HCycleCount1a=

IIf(Sum(value,6)>=360 AND Sum(value,5)<360 ,6,0) +

IIf(Sum(value,7)>=360 AND Sum(value,6)<360 ,7,0) +

IIf(Sum(value,8)>=360 AND Sum(value,7)<360 ,8,0) +

IIf(Sum(value,9)>=360 AND Sum(value,8)<360 ,9,0) +

IIf(Sum(value,10)>=360 AND Sum(value,9)<360 ,10,0) +

IIf(Sum(value,11)>=360 AND Sum(value,10)<360 ,11,0) +

IIf(Sum(value,12)>=360 AND Sum(value,11)<360 ,12,0) +

IIf(Sum(value,13)>=360 AND Sum(value,12)<360 ,13,0) +

IIf(Sum(value,14)>=360 AND Sum(value,13)<360 ,14,0) +

IIf(Sum(value,15)>=360 AND Sum(value,14)<360 ,15,0);

HCycleCount2a =

IIf(Sum(value,16)>=360 AND Sum(value,15)<360 ,16,0) +

IIf(Sum(value,17)>=360 AND Sum(value,16)<360 ,17,0) +

IIf(Sum(value,18)>=360 AND Sum(value,17)<360 ,18,0) +

IIf(Sum(value,19)>=360 AND Sum(value,18)<360 ,19,0) +

IIf(Sum(value,20)>=360 AND Sum(value,19)<360 ,20,0) +

IIf(Sum(value,21)>=360 AND Sum(value,20)<360 ,21,0) +

IIf(Sum(value,22)>=360 AND Sum(value,21)<360 ,22,0) +

IIf(Sum(value,23)>=360 AND Sum(value,22)<360 ,23,0) +

IIf(Sum(value,24)>=360 AND Sum(value,23)<360 ,24,0) +

IIf(Sum(value,25)>=360 AND Sum(value,24)<360 ,25,0);

HCyclecount3a =

IIf(Sum(value,26)>=360 AND Sum(value,25)<360 ,26,0) +

IIf(Sum(value,27)>=360 AND Sum(value,26)<360 ,27,0) +

IIf(Sum(value,28)>=360 AND Sum(value,27)<360 ,28,0) +

IIf(Sum(value,29)>=360 AND Sum(value,28)<360 ,29,0) +

IIf(Sum(value,30)>=360 AND Sum(value,29)<360 ,30,0) +

IIf(Sum(value,31)>=360 AND Sum(value,30)<360 ,31,0) +

IIf(Sum(value,32)>=360 AND Sum(value,31)<360 ,32,0) +

IIf(Sum(value,33)>=360 AND Sum(value,32)<360 ,33,0) +

IIf(Sum(value,34)>=360 AND Sum(value,33)<360 ,34,0) +

IIf(Sum(value,35)>=360 AND Sum(value,34)<360 ,35,0);

c1= HCycleCount1a + HCycleCount2a + HCycleCount3a;

/*

graph0 = HCycleCount1a;

graph1 = HCyclecount2a;

Graph2 = HCyclecount3a;

Graph0Style=Graph1Style=Graph2Style=5;

*/

<%

c1 = AFL("c1")

c2 = c1

c3 = c1

for i = 1 to Ubound(c1)

IF c1(i) = 0 then c2(i) = c2(i-1) else c2(i) = c1(i)

c3(i) = 0.25*c2(i) + 0.75*c3(i-1)

next

AFL.Var("quad") = c1

%>

graphXspace = 1;

/* playing a little here with moving averages, the Hilbert curve

using Amibroker seems a lot more jagged than the one

produced using Metastock. I do not understand this

difference but using a moving average produces a curve

that is closer to Metastocks results than the one that I

produced as an interpetation. */

fast = 2/(2+1);

slow = 2/(30+1);

dir=abs(close-ref(close,-5));

vol=sum(abs(close-ref(close,-1)),5);

ER=dir/vol;

sc =( ER*(fast-slow)+slow)^2;

graph0 = c1;

graph1 = ama( c1, sc );

graph2 = ema(c1,9);

graph0style=graph1style=graph2style=4;

/* Squelch here is used as 15 instead of 20 on the site */

Squelch = 15;

var1 = graph2;

buy = IIF(var1 < Squelch , 0 , 1);

sell = IIF( var1 < Squelch , 1, 0 );

buy = exrem(buy,sell);

sell = exrem(sell,buy);

/* Exploration code */

/* filter is setup so that you can test any particular date and

see the followup performance. Just make sure that that

date is at least 3 * first days in the past from the current

date, otherwise the future references will produce the

wrong information or no information useful */

Filter = Buy==1;

first=1;

/* First is the number of days for each ROC interval for reviewing performance */

numcolumns = 7;

column0 = C;

column0format = 1.2;

column0name = "Close";

column1 = ref(C, 1+first);

column1name = "Close+i ";

column1format = 1.2;

column2 = ref(C,1+first*2);

column2name = "Close+i*2 ";

column2format = 1.2;

column3 = ref(C,1+first*3);

column3name = "Close+i*3 ";

column3format = 1.2;

column4= ref(C,first*1+1) - C;

column4name="ROC+i";

column4format = 1.2;

column5= ref(C,first*2+1) - C;

column5name="ROC+2i";

column5format = 1.2;

column6= ref(C,first*3+1) - C;

column6name="ROC+3i";

column6format = 1.2;

/* End of Exploration Code. */

1 comments

Leave Comment

Please login here to leave a comment.

Back

how to erase the moving average the black line in this formula