Stock Portfolio Organizer

The ultimate porfolio management solution.

Shares, Margin, CFD's, Futures and Forex

EOD and Realtime

Dividends and Trust Distributions

And Much More ....

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

Advanced Adaptive Indicators

Advanced Pattern Exploration

Neural Networks

And Much More ....

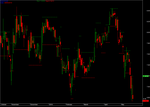

ATR Trading System for Amibroker (AFL)

Rating:

3 / 5 (Votes 3)

Tags:

trading system, amibroker

Atr Trading System with Support and resistance

Screenshots

Similar Indicators / Formulas

weighted moving average scan

Submitted

by naninn almost 15 years ago

Kase Peak Osc. V2 batu

Submitted

by batu1453 over 11 years ago

Kase CD V2batu

Submitted

by batu1453 over 11 years ago

Ichimoku

Submitted

by prashantrdx over 11 years ago

EMA System Ribbon

Submitted

by yo123 almost 15 years ago

Three-Bar Inside Bar Pattern

Submitted

by EliStern almost 15 years ago

Indicator / Formula

Copy & Paste Friendly

_SECTION_BEGIN("ATR Trading System");

k=1; /* multiplication factor*/

n=10; /*period*/

f=ATR(n);

R[0] = Close[0];

S[0] = C[0];

for( i = 11; i < BarCount; i++ )

{

R[i]=R[i-1];

S[i]=S[i-1];

if ( C[i-1] >R[i-1] )

{

r[i] = C[i-1]+k*f[i-1];

s[i]= C[i-1]-k*f[i-1];

}

if ( C[i-1] <S[i-1] )

{

r[i] = C[i-1]+k*f[i-1];

s[i]= C[i-1]-k*f[i-1];

}

Buy=Close>R;

Sell=Close<S;

Cump=IIf(Close>R,1,0);

Vanz=IIf(Close<S,1,0);

}

Plot(Close,"Close",colorBlack,styleCandle);

Plot(R, "Rez:",colorGreen,styleDots|styleNoLine);

Plot(S, "Sup:",colorRed,styleDots|styleNoLine);

Buy = ExRem( Buy, Sell ); //Elimina semnalele buy consecutive

Sell = ExRem( Sell, Buy ); //Elimina semnalele sell consecutive

shape = Buy * shapeUpArrow + Sell * shapeDownArrow;

fig=Cump*shapeHollowUpArrow + Vanz*shapeHollowDownArrow;

PlotShapes( fig, IIf( Cump, colorPaleGreen , colorPink), 0, IIf( Cump, Low-50, High+50)); //Pentru a vizualiza semnalele consecutive eliminate de ExRem

PlotShapes( shape, IIf( Buy, colorGreen, colorRed ), 0, IIf( Buy, Low-50, High+50));

AlertIf( Buy, "", "Experiment", 1 );

AlertIf( Sell, "", "Experiment",2);

GraphXSpace = 3;

Title=EncodeColor(colorBlue)+"Experiment"+EncodeColor(colorBlack)+ " Open:"+O+" High:"+H+" Low:"+L+" Close:"+C+EncodeColor(colorGreen)+" Rez:"+R+EncodeColor(colorRed)+" Sup:"+S+EncodeColor(colorBlue)+

" \nDate: "+EncodeColor(colorRed)+Date();

_SECTION_END();0 comments

Leave Comment

Please login here to leave a comment.

Back