Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

GEN_CROSS_CONF for Amibroker (AFL)

I am not a coder but this formula i collect from this site http://lurama125.com/TradingResources.htm. You can go there to read more about this indicator.

You will need two include files that go in the include directory of Amibroker:

http://wisestocktrader.com/indicatorpasties/120-liba-afl

http://wisestocktrader.com/indicatorpasties/119-pebslib-afl

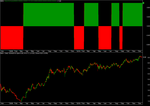

Screenshots

Similar Indicators / Formulas

Indicator / Formula

//GEN_CROSS_CONF.AFL

#include_once <LibA.afl>;

SetBarsRequired(500000);

pebstime = Hour()*60+Minute();

OptimizerSetEngine("cmae");

Lastticktime = Param("Lastticktime",9999,0,9999,1); //If like in SA there is a closing tick instead of a closing bar, then we execute immediately there instead of the usual delay of 1 bar

Firsttradetime = Param("FirstTradeTime",0,0,9999,1); //Never do any trade before this time

Lasttradetime = Param("LastTradeTime",9999,0,9999,1); //Never do any trade after this time

Firstsignaltime = Param("FirstSignalTime",0,0,9999,1); //do not trade on signals that trigger before this time, remember trade is entered usually 1 bar delay after signal

Lastsignaltime = Param("LastSignalTime",9999,0,9999,1); //do not trade on signals that trigger after this time, remember trade is entered usually 1 bar delay after signal

ExitatClose = ParamToggle("Exit at Close of Day","No|Yes");

xxxdelay = 1-(pebstime>=Lastticktime)*1; //Ignore the delay when last tick, otherwise that trade will only happen next morning

Confirm = ParamToggle("Confirming bar required","N|Y",1);

fn1 = ParamList("Fn1","ema|sma|brkema|brkema2|brkema3|brkema4|frama|kama|tsf|dema|tema|wilder|hull");

n_fn1_par = Param("n_Fn1",7,1,100,1);

fn2 = ParamList("Fn2","ema|sma|brkema|brkema2|brkema3|brkema4|frama|kama|tsf|dema|tema|wilder|hull");

n_fn2_par = Param("n_Fn2",21,1,100,1);

n_fn1_opt = ParamToggle("Optimize n_Fn1","No|Yes",1);

n_fn2_opt = ParamToggle("Optimize n_Fn2","No|Yes",1);

target_fn = ParamList("TargetFn","OHLC4|O|H|L|C|ema|sma|brkema|brkema2|brkema3|brkema4|frama|kama|tsf|dema|tema|wilder|hull");

n_targetfn_par = Param("n_TargetFn",20,1,100,1);

n_targetfn_opt = ParamToggle("Optimize n_TargetFn","No|Yes",0);

Cntxt = ParamList("Context","None|Contextfilter|Contextfilter2|Contextfilter_Hist60");

firststoptime = Param("First Stoptime",0,0,9999,1);

Laststoptime = Param("Last Stoptime",9999,0,9999,1);

TradeSL = Param("Trade stoploss",99999,0,99999,1);

TradeSP = Param("Trade stopprofit",99999,0,99999,1);

DaySL = Param("Day stoploss",99999,0,99999,1);

DaySP = Param("Day stopprofit",99999,0,99999,1);

MonthSL = Param("Month stoploss",99999,0,99999,1);

MonthSP = Param("Month stopprofit",99999,0,99999,1);

if (NOT n_fn1_opt){

n_fn1= n_fn1_par;

}

else

{

n_fn1 = Optimize("n_Fn1",n_fn1_par,1,100,1);

}

if (NOT n_fn2_opt){

n_fn2= n_fn2_par;

}

else

{

n_fn2 = Optimize("n_Fn2",n_fn2_par,1,100,1);

}

if (NOT n_targetfn_opt){

n_targetfn= n_targetfn_par;

}

else

{

n_targetfn = Optimize("n_TargetFn",n_targetfn_par,1,20,1);

}

symbol = ParamStr("Basesymbol",Name());

// trade on next bar open

SetTradeDelays( 0, 0, 0, 0 );

BuyPrice = SellPrice = Open;

ShortPrice = CoverPrice = Open;

//Points only

PositionSize = MarginDeposit = 1;

SetForeign(symbol);

switch (target_fn){

case "OHLC4":

xxx = (O+H+L+C)/4;

break;

case "O":

xxx = O;

break;

case "H":

xxx=H;

break;

case "L":

xxx=L;

break;

case "C":

xxx = C;

break;

case "ema":

xxx = EMA((O+H+L+C)/4,n_targetfn);

break;

case "sma":

xxx = MA((O+H+L+C)/4,n_targetfn);

break;

case "brkema":

xxx = brkema(n_targetfn);

break;

case "brkema2":

xxx = brkema2(n_targetfn);

break;

case "brkema3":

xxx = brkema3(n_targetfn);

break;

case "brkema4":

xxx = brkema4(n_targetfn);

break;

case "frama":

xxx = frama(n_targetfn);

break;

case "kama":

xxx = kama(n_targetfn,2,30);

break;

case "tsf":

xxx = TSF((O+H+L+C)/4,n_targetfn);

break;

case "dema":

xxx = DEMA((O+H+L+C)/4,n_targetfn);

break;

case "tema":

xxx = TEMA((O+H+L+C)/4,n_targetfn);

break;

case "wilder":

xxx = Wilders((O+H+L+C)/4,n_targetfn);

break;

case "hull":

xxx = HullMA((O+H+L+C)/4,n_targetfn,0);

break;

}

switch (fn1){

case "ema":

aaa = EMA(xxx,n_fn1);

break;

case "sma":

aaa = MA(xxx,n_fn1);

break;

case "brkema":

aaa = brkema(n_fn1);

break;

case "brkema2":

aaa = brkema2(n_fn1);

break;

case "brkema3":

aaa = brkema3(n_fn1);

break;

case "brkema4":

aaa = brkema4(n_fn1);

break;

case "frama":

aaa = frama(n_fn1);

break;

case "kama":

aaa = kama(n_fn1,2,30);

break;

case "tsf":

aaa = TSF(xxx,n_fn1);

break;

case "dema":

aaa = DEMA(xxx,n_fn1);

break;

case "tema":

aaa = TEMA(xxx,n_fn1);

break;

case "wilder":

aaa = Wilders(xxx,n_fn1);

break;

case "hull":

aaa = HullMA(xxx,n_fn1,0);

break;

}

switch (fn2){

case "ema":

bbb = EMA(xxx,n_fn2);

break;

case "sma":

bbb = MA(xxx,n_fn2);

break;

case "brkema":

bbb = brkema(n_fn2);

break;

case "brkema2":

bbb = brkema2(n_fn2);

break;

case "brkema3":

bbb = brkema3(n_fn2);

break;

case "brkema4":

bbb = brkema4(n_fn2);

break;

case "frama":

bbb = frama(n_fn2);

break;

case "kama":

bbb = kama(n_fn2,2,30);

break;

case "tsf":

bbb = TSF(xxx,n_fn2);

break;

case "dema":

bbb = DEMA(xxx,n_fn2);

break;

case "tema":

bbb = TEMA(xxx,n_fn2);

break;

case "wilder":

bbb = Wilders(xxx,n_fn2);

break;

case "hull":

bbb = HullMA(xxx,n_fn2,0);

break;

}

Confirmvalue = IIf(aaa>=bbb,( Close > ValueWhen( Cross( aaa, bbb ), Max( Open, Close ), 1 ) ),( Close < ValueWhen( Cross( bbb, aaa ), Min( Open, Close ), 1 ) ));

confirmvalue = IIf(Confirm,Confirmvalue,1);

Buysignal = (aaa>=bbb) AND Confirmvalue AND (pebstime>=firstsignaltime) AND (pebstime<=Lastsignaltime);

Sellsignal = (aaa<bbb) AND Confirmvalue AND (pebstime>=firstsignaltime) AND (pebstime<=Lastsignaltime) OR ((pebstime>=Lastticktime) AND ExitAtClose );

Shortsignal = (aaa<bbb) AND Confirmvalue AND (pebstime>=firstsignaltime) AND (pebstime<=Lastsignaltime);

Coversignal = (aaa>=bbb) AND Confirmvalue AND (pebstime>=firstsignaltime) AND (pebstime<=Lastsignaltime) OR ((pebstime>=Lastticktime) AND ExitAtClose);

//is this the best spot to remove the extra signals? i think so because after contextfilters you expect and do not want to remove consecutive buy or short signals

Buysignal = ExRem(Buysignal,Sellsignal);

Shortsignal = ExRem(Shortsignal,Coversignal);

Longstate = Flip(Buysignal,(Sellsignal OR Shortsignal));

Shortstate = Flip(Shortsignal,(Coversignal OR BuySignal));

Totalstate = Longstate*1+Shortstate*(-1);

totalstate = Ref(totalstate,-xxxdelay); //apply trade delay before applying contextfilter as contextfilters already have trade delay built in =

switch (Cntxt){

case "None":

break;

case "Contextfilter":

Totalstate = Contextfilter(Totalstate);

break;

case "Contextfilter2":

Totalstate = Contextfilter2(Totalstate);

break;

case "Contextfilter_Hist60":

Totalstate = Contextfilter_Hist60(Totalstate);

break;

}

//apply stops; delay already built in here correctly? still need to adjust for lastticktime 0 delay

totalstate = TradeSLSP(totalstate,1,tradeSL,tradeSP,firststoptime,Laststoptime,Lastticktime);

totalstate = DaySLSP(totalstate,1,DaySL,DaySP,firststoptime,Laststoptime,Lastticktime);

totalstate = MonthSLSP(totalstate,1,MonthSL,MonthSP,firststoptime,Laststoptime,Lastticktime);

Buysignal = (totalstate>0) AND (pebstime>=firsttradetime) AND (pebstime<=Lasttradetime);

Sellsignal = (totalstate<=0) AND (pebstime>=firsttradetime) AND (pebstime<=Lasttradetime);

Shortsignal = (totalstate<0) AND (pebstime>=firsttradetime) AND (pebstime<=Lasttradetime);

Coversignal = (totalstate>=0) AND (pebstime>=firsttradetime) AND (pebstime<=Lasttradetime);

RestorePriceArrays();

Buy = Buysignal;

Sell = Sellsignal;

Short = Shortsignal;

Cover = Coversignal;

Longstate = Flip(Buysignal,(Sellsignal OR Shortsignal));

Shortstate = Flip(Shortsignal,(Coversignal OR BuySignal));

Totalstate = Longstate*1+Shortstate*(-1);

//this totalstate already has the trade delay in

PlotOHLC(0,0,Totalstate,Totalstate,_DEFAULT_NAME(),IIf(Totalstate<0,colorRed,colorGreen),styleCloud);

SetChartBkColor(colorBlack);

9 comments

Leave Comment

Please login here to leave a comment.

Back

good indicator sir but not working pls guide how to install it i tried thet include also but not working can you pls tell briefly how to install it

go to the website lurama125.com, copy pebslib.afl & liba.afl and paste the afls to folder: include. it must be working well.

Totalstate = Contextfilter2(Totalstate);

ERROR 30 SHOW

CHECK IT AGAIN

copy gen_cross_conf.afl and put it to amibroker/formula/custom.

copy pebslib.afl & liba.afl and put them to amibroker/formula/include.

just do it and it must be work fine.

hi my Friend,

Pls check it again, its not work fine. Thanks

You can copy and paste the two afl in this afl starting

http://wisestocktrader.com/indicatorpasties/120-liba-afl

http://wisestocktrader.com/indicatorpasties/119-pebslib-afl

Hi SADAI – my friend,

I tried to do this by your way, but it still can’t display fine on Ami. Please help me another better way. Thank you so much and looking forward to hearing from you soon.

I pasted and replacing the third line #include . It is working

Hi SADAI – my friend,

I really high appreciate your help, I got it following your instructions. Thank you.