Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

Isfandi Trading System II for Amibroker (AFL)

Formulation System: ADX candle, Sigma Band, Channel Trendline Breakout, Calculation Bar, Pivot Finder, MA Swing and many indicator recommendation.

Best Regards,

Isfandi

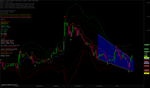

Screenshots

Similar Indicators / Formulas

Indicator / Formula

_SECTION_BEGIN("ADX Candle stick ");

SetChartOptions(0,chartShowArrows|chartShowDates);

_N(Title = StrFormat("{{NAME}} - {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

if (SetBarFillColor( IIf( (C < O) AND (C < Ref( C, -1)), colorPlum, colorDarkGreen ) ) );

else

(SetBarFillColor( IIf( (C > O)AND (C < Ref( C, -1)), colorWhite,colorWhite)));

Plot( C, "Close",IIf( Close < Ref( Close, -1), colorRed, colorGreen ), styleCandle );

_SECTION_END();

_SECTION_BEGIN("Detecting double tops and bottoms");

/* Detecting double tops and bottoms (for come into view, by Isfandi)*/

percdiff = 5; /* peak detection threshold */

fwdcheck = 5; /* forward validity check */

mindistance = 10;

validdiff = percdiff/400;

PK= Peak( H, percdiff, 1 ) == High;

TR= Trough( L, percdiff, 1 ) == Low;

x = Cum( 1 );

XPK1 = ValueWhen( PK, x, 1 );

XPK2 = ValueWhen( PK, x, 2 );

xTR1 = ValueWhen( Tr, x, 1 );

xTr2 = ValueWhen( Tr, x, 2 );

peakdiff = ValueWhen( PK, H, 1 )/ValueWhen( PK, H, 2 );

Troughdiff=ValueWhen( tr, L, 1 )/ValueWhen( tr, L, 2 );

doubletop = PK AND abs( peakdiff - 1 ) < validdiff AND (Xpk1 -Xpk2)>mindistance AND High > HHV( Ref( H, fwdcheck ), fwdcheck - 1 );

doubleBot=tr AND abs( troughdiff - 1 ) < validdiff AND (Xtr1 -Xtr2)>mindistance AND Low < LLV( Ref( L, fwdcheck ), fwdcheck - 1 );

Buy = doublebot;

Sell = doubletop;

for( i = 0; i < BarCount; i++ )

{

if( Buy[i] ) PlotText( "BOT " , i, L[ i ],colorYellow );

if( Sell[i] ) PlotText( "TOP" , i, H[ i ], colorWhite );

}

WriteIf( Highest( doubletop ) == 1, "AmiBroker has detected some possible

double top patterns for " + Name() + "\nLook for green arrows on the price

chart.", "There are no double top patterns for " + Name() );

WriteIf(Lowest( doublebot)==1,"AmiBroker has detected some possible double

bottom patterns for " + Name() + "\nLook for red arrows on the price

chart.", "There are no double bottom patterns for " + Name() );

_SECTION_END();

_SECTION_BEGIN("My Name");

GfxSetBkColor(colorBlack);

GfxSetTextColor( colorGrey40 );

GfxSelectFont("Impact", 12, 500, True );

GfxTextOut("Isfandi Trading System II", 10 , 848 );

_SECTION_END();

_SECTION_BEGIN("Wall Indicator System_Isfandi");

//---- pivot points

DayH = TimeFrameGetPrice("H", inDaily, -1);// yesterdays high

DayL = TimeFrameGetPrice("L", inDaily, -1);//low

DayC = TimeFrameGetPrice("C", inDaily, -1);//close

DayO = TimeFrameGetPrice("O", inDaily);// current day open

HiDay = TimeFrameGetPrice("H", inDaily);

LoDay = TimeFrameGetPrice("L", inDaily);

PP = (DayH + DayL + DayO + DayO) / 4 ;

R1 = (2 * PP) - DayL;

S1 = (2 * PP) - DayH;

R2 = PP + R1 - S1;

S2 = PP + S1 - R1;

R3 = R2 + (R1 - PP);

S3 = S2 - (PP - S1);

// OTHER INDICATOR

MOMETUM =RSI(14);

radius = 0.1 * Status("pxheight"); // get pixel height of the chart and use 45% for pie chart radius

textoffset = 0.1 * radius;

GfxSelectFont("Arial", 9, 500, True );

GfxSetTextColor( colorGrey50 );

GfxTextOut("PIVOT POINT", textoffset , 288 );

GfxSetTextColor( colorGrey50 );

GfxTextOut("SIGNAL", textoffset , 188 );

GfxSetTextColor( colorGrey50);

GfxTextOut( "TREND", textoffset ,386 );

GfxSelectFont("Arial", 9 );

GfxSetTextColor( colorGreen);

GfxTextOut( "R1 =" + R1, textoffset + 1, 320 );

GfxSetTextColor( colorLime );

GfxTextOut( "R2 = " +R2, textoffset + 1, 305 );

GfxSetTextColor( colorWhite );

GfxTextOut( "PP = " +PP, textoffset + 1, 335 );

GfxSetTextColor( colorOrange );

GfxTextOut( "S1 = " +S1, textoffset + 1, 350 );

GfxSetTextColor( colorRed );

GfxTextOut( "S2 = " +S2, textoffset + 1, 365 );

GfxSelectFont("Arial", 9 );

_SECTION_END();

//////////////////////////////////////////////////////////////////////

_SECTION_BEGIN("Elder Impulse");

GfxSelectFont("Arial", 8, 500, True );

///////////////////////////////////////////////////

SetChartOptions(0,chartShowArrows|chartShowDates);

EnableTextOutput(False);

// User-defined parameter for EMA periods

EMA_Type = Param("EMA-1, TEMA-2, JMA-3", 2, 1, 3, 1);

EMA_prds = Param("EMA_periods", 7, 1, 30, 1);

Std_MACD = Param("Standard MACD? No-0, Yes-1", 1, 0, 1, 1);

Plot_fashion = Param("Bar+Arrows-1, Impulse Bars-2", 2, 1, 2, 1);

// Allow user to define Weekly and Monthly Ribbon Location and Height

WR_P1 = Param("Weekly Ribbon Location", 5.2, -1000, 1000, 0.1);

WR_P2 = Param("Weekly Ribbon Height", 199, -0.001, 500, 0.1);

//MR_P1 = Param("Monthly Ribbon Location", 5.2, -1000, 1000, 0.1);

//MR_P2 = Param("Monthly Ribbon Height", 199, -0.001, 500, 0.1);

// Compute EMA and MACD Histogram

if(EMA_Type == 1)

{

DayEMA = EMA(Close, EMA_prds);

}

if (EMA_Type == 2)

{

DayEMA = TEMA(Close, EMA_prds);

}

Histogram = MACD() - Signal();

// Determine if we have an Impulse UP, DOWN or None

Impulse_Up = DayEMA > Ref(DayEMA, -1) AND Histogram > Ref(Histogram, -1);

Impulse_Down = DayEMA < Ref(DayEMA, -1) AND Histogram < Ref(Histogram, -1);

Impulse_None = (NOT Impulse_UP) AND (NOT Impulse_Down);

// Compute Weekly MACD and determine whether rising or falling

TimeFrameSet(inWeekly);

if (Std_MACD == 0)

{

MACD_val = MACD(5, Cool);

Signal_val = Signal(5, 8, 5);

}

else

{

MACD_val = MACD(12, 26);

Signal_val = Signal(12, 26, 9);

}

Hist_in_w = MACD_val - Signal_val;

wh_rising = Hist_in_w > Ref(Hist_in_w, -1);

wh_falling = Hist_in_w < Ref(Hist_in_w, -1);

wh_none = (NOT wh_rising) AND (NOT wh_falling);

TimeFrameRestore();

// Now get Monthly MACD Histogram....

TimeFrameSet(inMonthly);

MACD_val = MACD(5, 8);

Signal_val = Signal(5, 8, 5);

Hist_in_m = MACD_val - Signal_val;

mh_rising = Hist_in_m > Ref(Hist_in_m, -1);

mh_falling = Hist_in_m < Ref(Hist_in_m, -1);

TimeFrameRestore();

wh_rising = TimeFrameExpand( wh_rising, inWeekly, expandLast );

wh_falling = TimeFrameExpand( wh_falling, inWeekly, expandLast);

wh_none = TimeFrameExpand( wh_none, inWeekly, expandLast);

mh_rising = TimeFrameExpand(mh_rising, inMonthly, expandLast);

mh_falling = TimeFrameExpand(mh_falling, inMonthly, expandLast);

kol = IIf( wh_rising, colorBrightGreen, IIf(wh_falling, colorRed, IIf(wh_none, colorCustom11, colorLightGrey)));

mkol = IIf( mh_rising, colorBlue, IIf(mh_falling, colorYellow, colorLightGrey));

if (Plot_fashion == 1)

{

}

else

{

bar_kol = IIf(impulse_UP, colorBrightGreen, IIf(impulse_Down, colorRed, colorCustom11));

}

Impulse_State = WriteIf(Impulse_Up, "Bulllish", WriteIf(Impulse_Down, "Bearish", "Neutral"));

GfxSetTextColor( colorPink );

GfxTextOut( "IMPULSE STATE = " +Impulse_State, textoffset + 1, 402 );

// Set the background color for Impulse Status Column

Impulse_Col = IIf(Impulse_Up, colorGreen, IIf(Impulse_Down, colorRed, colorGrey40));

// Determine Weekly Trend. Display as Text Column

Weekly_Trend = WriteIf(wh_rising, "Rising", WriteIf(wh_falling, "Falling", "Flat!"));

Weekly_Col = IIf(wh_rising, colorGreen, IIf(wh_falling, colorRed, colorLightGrey));

GfxSetTextColor( colorPink);

GfxTextOut( "WEEKLT TREND = " +Weekly_Trend, textoffset + 1, 417 );

// Determine Monthly Trend. Display as Text Column

Monthly_Trend = WriteIf(mh_rising, "Rising", WriteIf(mh_falling, "Falling", "Flat!"));

Monthly_Col = IIf(mh_rising, colorGreen, IIf(mh_falling, colorRed, colorLightGrey));

GfxSetTextColor( colorPink );

GfxTextOut( "MONTHLY TREND = " +Monthly_Trend, textoffset + 1, 432 );

// Determine how many bars has the current state existed

bars_in_bull = Min(BarsSince(impulse_none), BarsSince(impulse_down));

bars_in_bear = Min(BarsSince(impulse_up), BarsSince(impulse_none));

bars_in_neut = Min(BarsSince(impulse_down), BarsSince(impulse_up));

// Set a single variable to show number of bars in current state depending upon

// actual Impulse Status - Bullish, Bearish or Neutral

bars_in_state = IIf(Impulse_Up, bars_in_bull, IIf(Impulse_down, bars_in_bear, bars_in_neut));

//weekly pivot

k1=-1;

SetChartBkColor(16 ) ;

k=IIf(ParamList("select type","daily|next day")=="daily",-1,0);

k1=-1;

TimeFrameSet(inDaily);

day_h= LastValue(Ref(H,K));

day_l= LastValue(Ref(L,K));

day_c= LastValue(Ref(C,K));

TimeFrameRestore();

// day

DH=Day_h;

DL=Day_L;

DC=Day_C;

// DAY PIVOT Calculation

pd = ( DH+ DL + DC )/3;

sd1 = (2*pd)-DH;

sd2 = pd -(DH - DL);

sd3 = Sd1 - (DH-DL);

rd1 = (2*pd)-DL;

rd2 = pd +(DH -DL);

rd3 = rd1 +(DH-DL);

WriteVal( StochK(39) - StochK(12) );

GfxSelectFont("Arial", 8 );

_SECTION_END();

_SECTION_BEGIN("STOCHASTIC");

periods = Param( "Periods", 15, 1, 200, 1 );

Ksmooth = Param( "%K avg", 3, 1, 200, 1 );

a = StochK( periods , Ksmooth);

Dsmooth = Param( "%D avg", 3, 1, 200, 1 );

b = StochD( periods , Ksmooth, DSmooth );

Buy = Cross( a, b );

Sell = Cross( b, a );

STOCH =WriteIf(a>b , "BUY","SELL");

GfxSetTextColor( colorYellow );

GfxTextOut( "STOCH = " +STOCH, textoffset + 1, 229 );

GfxSelectFont("Arial", 8 );

_SECTION_BEGIN("Van K Tharp Efficient Stocks");

// Mark Keitel 12-05

// Van K Tharp Efficient Stocks

GfxSelectFont("Arial", 8, 500, True );

ATRD180 = ATR(180);

ATRD90 = ATR(90);

ATRD45 = ATR(45);

ATRD20 = ATR(20);

ATRD5 = ATR(5);

DifferenceD180 = Close - Ref(Close,-180);

DifferenceD90 = Close - Ref(Close,-90);

DifferenceD45 = Close - Ref(Close,-45);

DifferenceD20 = Close - Ref(Close,-20);

DifferenceD5 = Close - Ref(Close,-5);

EfficiencyD180 = IIf(ATRD180!=0,DifferenceD180/ATRD180,1);

EfficiencyD90 = IIf(ATRD90!=0,DifferenceD90/ATRD90,1);

EfficiencyD45 = IIf(ATRD45!=0,DifferenceD45/ATRD45,1);

EfficiencyD20 = IIf(ATRD20!=0,DifferenceD20/ATRD20,1);

EfficiencyD5 = IIf(ATRD5!=0,DifferenceD5/ATRD5,1);

Averageeff = (EfficiencyD180 + EfficiencyD90 + EfficiencyD45 +

EfficiencyD20 ) / 4;

//Plot( averageeff, "AvgEff", colorLightBlue, styleLine );

x = Param ( "Add Results to a Watchlist? Yes = 1, No = 2" , 2 , 1 , 2 , 1 ) ; // select whether to add results to watchlist or not

y = Param("Set Watchlist Number", 25, 2, 60,1); // sets the watchlist number, but reserves the first 2 and last 4 watchlists

// -------- Parameter Variables for Exploration --------------------------------

TCH = Param("High close value ", 20, 5, 300, 0.5);

TCL = Param("Low close value " , 5, 1, 10, 0.25);

AVP = Param("Period for Avg Vol " , 21, 10, 240, 1);

SV = Param("Stock minimum Avg Vol " , 125000, 50000, 1000000, 500000);

// -------------- Organize the exploration results ------------------------------------

P = Param("Period for Price Delta Comparisons", 1, 1, 120, 1);

P1 = Param("Period for Other Delta Comparisons", 3, 1, 120, 1);

PATR = Param("Period for ATR", 5,1,21,1);

PADX = Param("Period for ADX", 14, 3, 34,1);

PRSI = Param("Period for RSI", 13, 3, 34,1);

ADX_TREND =WriteIf(PDI(PADX)>MDI(PADX),"_ TREND UP","_TREND DOWN");

GfxSetTextColor( colorRed );

GfxTextOut( "RSI(14) = " + MOMETUM + ADX_TREND , textoffset + 1,465 );

ADX_14 = ADX(14);

GfxSetTextColor( colorLightBlue );

GfxTextOut( "ADX_TREND = " +ADX_14+ ADX_TREND, textoffset + 1, 452 );

_SECTION_END();

_SECTION_BEGIN("Gann HiLo");

/*Gann HiLo*/

pds=Param("Stop Period",4,2,10,0.25);

barcolor=

IIf(Outside(),colorYellow,

IIf(L<Ref(L,-1) && H<=Ref(H,-1),colorRed,

IIf(H>Ref(H,-1) && L>=Ref(L,-1),colorBrightGreen,colorBlue)));

Hld = IIf(C > Ref(MA(H, 2), -1), 1, IIf(C < Ref(MA(L, 2), -1), -1, 0));

Hlv = ValueWhen(Hld != 0, Hld, 1);

Hilo = IIf(Hlv == -1, MA(H, 2), MA(L, 2));

Trigger = IIf(C>Hilo, colorBrightGreen, colorRed);

Buy = Close > Hilo;

Sell = Close < Hilo;

GannHiLo =WriteIf(C>Hilo,"BUY","SELL");

GfxSetTextColor( colorBrightGreen );

GfxTextOut( "GannHiLo = " +GannHiLo, textoffset + 1, 255 );

GfxSelectFont("Arial", 8 );

_SECTION_END();

_SECTION_BEGIN("Indicator ZeroLag W%R");

/*ZeroLag W%R*/

"========";

R = ((HHV(H,12) - C) /(HHV (H,14) -LLV (L,14))) *-100;

Period= 10;

EMA1= EMA(R,Period);

EMA2= EMA(EMA1,5);

Difference= EMA1 - EMA2;

ZeroLagEMA= EMA1 + Difference;

PR=100-abs(ZeroLagEMA);

Buy=Cross(R,ZeroLagEMA);

Sell=Cross(ZeroLagEMA,R);

ZeroLagEMA =WriteIf(R > ZeroLagEMA, "BUY","SELL");

GfxSetTextColor( colorOrange );

GfxTextOut( "William%R = " +ZeroLagEMA, textoffset + 1, 216 );

GfxSelectFont("Arial", 8 );

_SECTION_END();

_SECTION_BEGIN("PVR");

"PVR";

P1=Ref(C,-1);

V1=Ref(V,-1);

PVR=IIf(C>P1 AND V>V1,4,

IIf(C>P1 AND V<V1,3,

IIf(C<P1 AND V<V1,2,1)));

GraphXSpace=10;

A=EMA(PVR,5);

B=EMA(A,3);

Buy = Cross(A, B);

Sell = Cross(B, A);

PVR =WriteIf(A > B, "BUY","SELL");

GfxSetTextColor( colorRed );

GfxTextOut( "PVR = " +PVR, textoffset + 1, 203 );

GfxSelectFont("Arial", 8 );

_SECTION_END();

_SECTION_BEGIN("ASHISHDA MACD");

a=TSF(C,3)+TSF(C,5)+TSF(C,8)+TSF(C,13)+TSF(C,17)+TSF(C,26);

b=TSF(C,8)+TSF(C,13)+TSF(C,26)+TSF(C,35)+TSF(C,50)+TSF(C,56);

mova= TSF(a,3);

movb=TSF(b,26);

diff= a + mova;

diff1= b + movb;

m= diff - diff1;

m1= TSF(m,5)*.5;

Buy = Cross(m1,Ref(m1, -1));

Sell = Cross(Ref(m1, -1),m1);

QuickMACD =WriteIf(m1>Ref(m1, -1), "BUY","SELL");

GfxSetTextColor( colorGreen);

GfxTextOut( "MACD = " +QuickMACD, textoffset + 1, 242 );

GfxSelectFont("Arial", 8 );

_SECTION_END();

_SECTION_BEGIN("SECONDARY LANDIS");

x = ((StochK(9,3)*0.05)+(StochK(182,9)*0.43)+(StochK(34,13)*0.26)+(StochK(34,8)*0.16)+(StochK(21,5)*0.10));

y = MA(x,15);

Buy= Cross (x,y);

Sell= Cross (y,x);

LANDIS =WriteIf(x > y, "SECONDARY UPTREND","SECONDARY DOWNTREND");

GfxSetTextColor( colorPink );

GfxTextOut( "LANDIS = " +LANDIS, textoffset + 1, 491 );

GfxSelectFont("Arial", 8 );

//xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

_SECTION_BEGIN("Average");

P = ParamField("Field");

Type = ParamList("Type", "Weighted,Lagless-21,Hull-26,Linear Regression-45,Exponential,Double Exponential,Tripple Exponential,Wilders,Simple");

Periods = Param("Periods", 14, 2, 100 );

Displacement = Param("Displacement", 1, -50, 50 );

m = 0;

if( Type == "Weighted" ) m= WMA( P, Periods );

if( Type == "Lagless-21" ) m= 2*EMA(P, Periods)-EMA(EMA(P, Periods), Periods);

if( Type == "Hull-26" ) m= WMA(2*(WMA(P, Periods/2))-WMA(P, Periods) ,4 );

if( Type == "Linear Regression-45" ) m= LinearReg( P, Periods );

if( Type == "Exponential" ) m = EMA( P, Periods );

if( Type == "Double Exponential" ) m = DEMA( P, Periods );

if( Type == "Tripple Exponential" ) m = TEMA( P, Periods );

if( Type == "Wilders" ) m = Wilders( P, Periods );

if( Type == "Simple" ) m = MA( P, Periods );

Buy=Cover=Cross(C,m);

Sell=Short=Cross(m,C);

AveragePrice =WriteIf(C > m, "ABOVE AVERAGE","BELOW AVERAGE");

GfxSetTextColor( colorDarkYellow );

GfxTextOut( "PRICE = " +averageprice, textoffset + 1, 504 );

GfxSelectFont("Arial", 8 );

_SECTION_BEGIN("SAR ARROW");

Plot( Close, "C", colorBlack, styleCandle );

acc = Param("Acceleration", 0.02, 0, 1, 0.001 );

accm = Param("Max. acceleration", 0.2, 0, 1, 0.001 );

S = SAR();

Buy = Cross( Close, S );

Sell = Cross( S, Close );

SARPhase =WriteIf(Close>S,"BUY","SELL");

GfxSetTextColor( colorRed);

GfxTextOut( "S A R = " +SARPhase, textoffset + 1, 517 );

GfxSelectFont("Arial", 8 );

_SECTION_END();

_SECTION_BEGIN("Stochastic Momentum Index");

period1 = 12;

period2 = 6;

period3 = 6;

SMI =

100 * ( EMA( EMA( C - (0.5 * ( HHV(H,period1) + LLV(L,period1))),period2),period3)/(0.5*EMA( EMA( HHV(H,period1) - LLV(L,period1),period2),period3)));

Buy= Cross (SMI,MA( SMI, 6 ));

Sell= Cross (MA( SMI, 6 ),SMI);

Momentum =WriteIf(SMI > MA( SMI, 6 ), "BUY","SELL");

GfxSetTextColor( colorOrange );

GfxTextOut( "Stoch Momentum = " +Momentum, textoffset + 1, 530 );

GfxSelectFont("Arial", 8 );

_SECTION_END();

_SECTION_BEGIN("JMAHiLo");

function JMA( array, per )

{

TN1=MA(array,per);

s1=0;

for( i = 0; i < per; i=i+1 )

{

s1=s1+((per-(2*i)-1)/2)*Ref(array,-i);

}

return TN1+(((per/2)+1)*S1)/((per+1)*per);

}

JMAperiods = Param( "JMA Periods", 10, 1, 200, 1 );

_SECTION_BEGIN("RWIHILO");

minperiods = Param( "Min Periods", 2, 1, 200, 1 );

maxperiods = Param( "Max Periods", 8, 1, 200, 1 );

varLo = RWILo( minperiods, maxperiods);

minperiods = Param( "Min Periods", 2, 1, 200, 1 );

maxperiods = Param( "Max Periods", 8, 1, 200, 1 );

varHi = RWIHi( minperiods, maxperiods) ;

Buy= Cross (JMA(varHi ,JMAperiods),JMA(varLo ,JMAperiods));

Sell=Cross (JMA(varLo ,JMAperiods),JMA(varHi ,JMAperiods));

JMAHiLo =WriteIf(JMA(varHi ,JMAperiods) > JMA(varLo ,JMAperiods), "BUY","SELL");

GfxSetTextColor( colorGreen );

GfxTextOut( "JMAHiLo = " +JMAHiLo, textoffset + 1, 543 );

GfxSelectFont("Arial", 8 );

_SECTION_END();

_SECTION_BEGIN("SmoothHeikin MA Swing");

SetBarsRequired(200,0);

GraphXSpace = 5;

SetChartOptions(0,chartShowArrows|chartShowDates);

k = Param("K", 1.5, 1, 5, 0.1);

Per = Param("ATR", 3, 1, 30, 0.50);

k1 = Optimize("K", 1, 0.1, 5, 0.1);

Per1 = Optimize("ATR", 3, 1, 30, 0.50);

HACLOSE=(O+H+L+C)/4;

HaOpen = AMA( Ref( HaClose, -1 ), 0.5 );

HaHigh = Max( H, Max( HaClose, HaOpen ) );

HaLow = Min( L, Min( HaClose, HaOpen ) );

j=Haclose;

//=======================================================================================================================

//=========================Indicator==============================================================================================

f=ATR(14);

rfsctor = WMA(H-L, Per);

revers = k * rfsctor;

Trend = 1;

NW[0] = 0;

for(i = 1; i < BarCount; i++)

{

if(Trend[i-1] == 1)

{

if(j[i] < NW[i-1])

{

Trend[i] = -1;

NW[i] = j[i] + Revers[i];

}

else

{

Trend[i] = 1;

if((j[i] - Revers[i]) > NW[i-1])

{

NW[i] = j[i] - Revers[i];

}

else

{

NW[i] = NW[i-1];

}

}

}

if(Trend[i-1] == -1)

{

if(j[i] > NW[i-1])

{

Trend[i] = 1;

NW[i] = j[i] - Revers[i];

}

else

{

Trend[i] = -1;

if((j[i] + Revers[i]) < NW[i-1])

{

NW[i] = j[i] + Revers[i];

}

else

{

NW[i] = NW[i-1];

}

}

}

}

//===============system================

Plot(NW, "", IIf(Trend == 1, 3, 25), 1);

Buy=Cover=Cross(j,nw);

Sell=Short=Cross(nw,j);

SWING =WriteIf(j > nw, "UPTREND","DOWNTREND");

GfxSetTextColor( colorLightBlue );

GfxTextOut( "SWING = " +SWING, textoffset + 1, 268 );

GfxSelectFont("Arial", 8 );

shape = Buy * shapeCircle + Sell * shapeCircle;

_SECTION_END();

_SECTION_BEGIN("Sigma Bands");

A = Param("Periods?",21,1,300,1);

x = MA(C,a);

x1 = x+1*StDev(C,a);

x2 = x+2*StDev(C,a);

x3 = x+3*StDev(C,a);

y1 = x-1*StDev(C,a);

y2 = x-2*StDev(C,a);

y3 = x-3*StDev(C,a);

Plot(x1, "", colorDarkGreen, styleDashed);

Plot(x2, "", colorDarkGreen, styleThick | styleDashed);

Plot(x3, "", colorDarkGreen, styleThick);

Plot(y1, "", colorDarkRed, styleDashed);

Plot(y2, "", colorDarkRed, styleThick | styleDashed);

Plot(y3, "", colorDarkRed, styleThick);

_SECTION_END();

_SECTION_BEGIN("Pivot_Finder");

/* **********************************

Code to automatically identify pivots

********************************** */

// -- what will be our lookback range for the hh and ll?

farback=Param("How Far back to go",100,0,5000,10);

nBars = Param("Number of bars", 12, 5, 40);

GraphXSpace=7;

// -- Create 0-initialized arrays the size of barcount

aHPivs = H - H;

aLPivs = L - L;

// -- More for future use, not necessary for basic plotting

aHPivHighs = H - H;

aLPivLows = L - L;

aHPivIdxs = H - H;

aLPivIdxs = L - L;

nHPivs = 0;

nLPivs = 0;

lastHPIdx = 0;

lastLPIdx = 0;

lastHPH = 0;

lastLPL = 0;

curPivBarIdx = 0;

// -- looking back from the current bar, how many bars

// back were the hhv and llv values of the previous

// n bars, etc.?

aHHVBars = HHVBars(H, nBars);

aLLVBars = LLVBars(L, nBars);

aHHV = HHV(H, nBars);

aLLV = LLV(L, nBars);

// -- Would like to set this up so pivots are calculated back from

// last visible bar to make it easy to "go back" and see the pivots

// this code would find. However, the first instance of

// _Trace output will show a value of 0

aVisBars = Status("barvisible");

nLastVisBar = LastValue(Highest(IIf(aVisBars, BarIndex(), 0)));

_TRACE("Last visible bar: " + nLastVisBar);

// -- Initialize value of curTrend

curBar = (BarCount-1);

curTrend = "";

if (aLLVBars[curBar] <

aHHVBars[curBar]) {

curTrend = "D";

}

else {

curTrend = "U";

}

// -- Loop through bars. Search for

// entirely array-based approach

// in future version

for (i=0; i<farback; i++) {

curBar = (BarCount - 1) - i;

// -- Have we identified a pivot? If trend is down...

if (aLLVBars[curBar] < aHHVBars[curBar]) {

// ... and had been up, this is a trend change

if (curTrend == "U") {

curTrend = "D";

// -- Capture pivot information

curPivBarIdx = curBar - aLLVBars[curBar];

aLPivs[curPivBarIdx] = 1;

aLPivLows[nLPivs] = L[curPivBarIdx];

aLPivIdxs[nLPivs] = curPivBarIdx;

nLPivs++;

}

// -- or current trend is up

} else {

if (curTrend == "D") {

curTrend = "U";

curPivBarIdx = curBar - aHHVBars[curBar];

aHPivs[curPivBarIdx] = 1;

aHPivHighs[nHPivs] = H[curPivBarIdx];

aHPivIdxs[nHPivs] = curPivBarIdx;

nHPivs++;

}

// -- If curTrend is up...else...

}

// -- loop through bars

}

// -- Basic attempt to add a pivot this logic may have missed

// -- OK, now I want to look at last two pivots. If the most

// recent low pivot is after the last high, I could

// still have a high pivot that I didn't catch

// -- Start at last bar

curBar = (BarCount-1);

candIdx = 0;

candPrc = 0;

lastLPIdx = aLPivIdxs[0];

lastLPL = aLPivLows[0];

lastHPIdx = aHPivIdxs[0];

lastHPH = aHPivHighs[0];

if (lastLPIdx > lastHPIdx) {

// -- Bar and price info for candidate pivot

candIdx = curBar - aHHVBars[curBar];

candPrc = aHHV[curBar];

if (

lastHPH < candPrc AND

candIdx > lastLPIdx AND

candIdx < curBar) {

// -- OK, we'll add this as a pivot...

aHPivs[candIdx] = 1;

// ...and then rearrange elements in the

// pivot information arrays

for (j=0; j<nHPivs; j++) {

aHPivHighs[nHPivs-j] = aHPivHighs[nHPivs-

(j+1)];

aHPivIdxs[nHPivs-j] = aHPivIdxs[nHPivs-(j+1)];

}

aHPivHighs[0] = candPrc ;

aHPivIdxs[0] = candIdx;

nHPivs++;

}

} else {

// -- Bar and price info for candidate pivot

candIdx = curBar - aLLVBars[curBar];

candPrc = aLLV[curBar];

if (

lastLPL > candPrc AND

candIdx > lastHPIdx AND

candIdx < curBar) {

// -- OK, we'll add this as a pivot...

aLPivs[candIdx] = 1;

// ...and then rearrange elements in the

// pivot information arrays

for (j=0; j<nLPivs; j++) {

aLPivLows[nLPivs-j] = aLPivLows[nLPivs-(j+1)];

aLPivIdxs[nLPivs-j] = aLPivIdxs[nLPivs-(j+1)];

}

aLPivLows[0] = candPrc;

aLPivIdxs[0] = candIdx;

nLPivs++;

}

}

// -- Dump inventory of high pivots for debugging

for (k=0; k<nHPivs; k++) {

_TRACE("High pivot no. " + k

+ " at barindex: " + aHPivIdxs[k] + ", "

+ WriteVal(ValueWhen(BarIndex()==aHPivIdxs[k],

DateTime(), 1), formatDateTime)

+ ", " + aHPivHighs[k]);

}

// -- OK, let's plot the pivots using arrows

PlotShapes(

IIf(aHPivs==1, shapeHollowSquare, shapeNone), colorRed, 0, H, 15);

PlotShapes(

IIf(aLPivs==1, shapeHollowSquare , shapeNone), colorLime, 0, L, -15);

_SECTION_BEGIN("Graphics");

GrpPrm=Param("Graphic Space",1,0,10);

GraphXSpace=GrpPrm;

_SECTION_END();

_SECTION_BEGIN("channels");

//Pattern Recognition graph

//with shading

/*TRENDLINES BREAKOUT*/

x = Cum(1);

per = Param("Percent",3,1,5,1);

s1=L;

s11=H;

pS = TroughBars( s1, per, 1 ) == 0;

endt= LastValue(ValueWhen( pS, x, 1 ));

startt=LastValue(ValueWhen( pS, x, 2 ));

endS = LastValue(ValueWhen( pS, s1, 1 ) );

startS = LastValue( ValueWhen( pS, s1, 2 ));

dtS =endt-startt;

aS = (endS-startS)/dtS;

bS = endS;

trendlineS = aS * ( x -endt ) + bS;

pR = PeakBars( s11, per, 1 ) == 0;

endt1= LastValue(ValueWhen( pR, x, 1 ));

startt1=LastValue(ValueWhen( pR, x, 2 ));

endR = LastValue(ValueWhen( pR, s11, 1 ) );

startR = LastValue( ValueWhen( pR, s11, 2 ));

DTR=ENDT1-STARTT1;

aR = (endR-startR)/dtR;

bR = endR;

trendlineR = aR * ( x -endt1 ) + bR;

BEGIN=Min(STARTT,STARTT1);

TRS = IIf(x>BEGIN-10,trendlineS,-1e10);

TRR = IIf(x>BEGIN-10,trendlineR,-1e10);

Condcolor=(Cross(C,trendlineR) AND X>ENDT1) OR (Cross(trendlineS,C) AND

X>ENDT);

BarColor=IIf(Condcolor,7,1);

Plot(C,"Close",BarColor,styleCandle);

Plot(TRS,"Support",colorYellow,styleLine);

Plot(TRR,"Resist",colorYellow,styleLine);

/////////////////////////////////////

// Shading //

////////////////////////////////////

fill=Param("style",2,1,2,1);

style=IIf(fill==1,styleHistogram,IIf(fill==2,styleArea,Null));

x=IIf(trs > trr,trr,trs);

Plot(x,"",colorBlack,style);

Plot(trr,"",colorDarkTeal,style);

////////////////////////////////////////////

// Pattern Recognition in title bar //

///////////////////////////////////////////

Lowline=Ends-starts;

Highline=endr-startr;

Wedge=IIf(Highline <0 AND Lowline > 0,1,0);

DecendingTriangle=IIf(Highline < 0 AND Lowline==0,1,0);

AscendingTriangle=IIf(Highline==0 AND Lowline > 0,1,0);

DownChannel=IIf(Highline<0 AND Lowline<0,1,0);

UpChannel=IIf(Highline>0 AND Lowline>0,1,0);

BroadeningWedge=IIf(Highline > 0 AND Lowline < 0,1,0);

///////////////////////////////////

// Bullish or Bearish breakout //

//////////////////////////////////

BullishBreakout=Cross(C,trendlineR);

BearishBreakout=Cross(trendlineS,C);

Breakout =WriteIf(C > trendlineR, "Bullish","Bearish");

GfxSetTextColor( colorWhite );

GfxTextOut( "Breakout = " +Breakout, textoffset + 1, 558 );

GfxSelectFont("Arial", 8 );

Title=Name()+ WriteIf(wedge==1," Wedge","")+WriteIf(DecendingTriangle==1," Decending Triangle","")+WriteIf(AscendingTriangle==1,"Ascending Triangle","")/*+WriteVal(Lowline)*/+WriteIf(DownChannel==1," Downward Sloping Channel","")+WriteIf(UpChannel==1," Upward Sloping Channel","")+WriteIf(broadeningWedge==1," Broadening Wedge","")+"\n"+EncodeColor(colorGreen)+WriteIf(bullishbreakout,"Bullish Breakout",EncodeColor(colorRed)+WriteIf(bearishbreakout,"Bearish Breakout",""))/*+WriteVal(highline)*/;

/////////////////////////////////////

// Automatic Analysis //

////////////////////////////////////

Filter=AscendingTriangle OR DecendingTriangle OR Wedge OR DownChannel OR UpChannel OR BroadeningWedge OR Bullishbreakout OR bearishbreakout;

AddTextColumn(WriteIf(bullishbreakout,"bullish Breakout",""),"BullBreak");

AddTextColumn(WriteIf(bearishBreakout,"Bearish Breakout",""),"BearBreak");

AddTextColumn(WriteIf(ascendingtriangle,"Ascending Triangle",WriteIf(decendingtriangle,"Decending Triangle",WriteIf(Wedge,"Wedge",WriteIf(DownChannel,"Down Channel",WriteIf(UpChannel,"Up Channel",WriteIf(BroadeningWedge,"Broadening Wedge","")))))),"Pattern");

_SECTION_END();

_SECTION_BEGIN("Calculation Bar");

Version(4.70); // needs AmiBroker 4.70

function msPattPos( element )

{

Value1 = Ref( H, -1 );

Value2 = Ref( L, -1 );

Value3 = ( Value1 + Value2 )/2;

Dist = Ref( ATR( 10 ), -1 );

Value4 = Value1 + Dist;

Value5 = Value2 - Dist;

result = IIf( element < Value5, 0,

IIf( element < Value2, 1,

IIf( element < Value3, 2,

IIf( element < Value1, 3,

IIf( element < Value4, 4,

5 ) ) ) ) );

return result;

}

function msPattToText( patt )

{

result =

WriteIf( patt == 0, " is below previous (Low - ATR 10) ",

WriteIf( patt == 1, " is above (at) previous (Low - ATR 10) and below previous Low ",

WriteIf( patt == 2, " is above (at) previous Low and below previous Midpoint ",

WriteIf( patt == 3, " is above (at) previous Midpoint and below previous High ",

WriteIf( patt == 4, " is above (at) previous High and below (High + ATR 10) ",

" is above (at) previous (High + ATR(10) " ) ) ) ) );

return result;

}

function msRecognize()

{

return 1000 * msPattPos( Open ) + 100 * msPattPos( High ) +

10 * msPattPos( Low ) + msPattPos( Close );

}

function msPatternDescription( patt )

{

return "Open: " + msPattToText( round( ( patt / 1000 ) % 10 ) ) + "\n" +

"High: " + msPattToText( round( ( patt / 100 ) % 10 ) ) + "\n" +

"Low: " + msPattToText( round( ( patt / 10 ) % 10 ) ) + "\n" +

"Close: " + msPattToText( round( patt % 10 ) );

}

patts = msRecognize();

// by default use pattern occuring at selected bar

DesiredPattern = SelectedValue( patts );

// if you want manual-entry of pattern code from parameter dialog

// then uncomment the line below

//DesiredPattern=Param("Pattern to look for", 3434, 0, 5555, 0 );

Title = StrFormat("{{NAME}} - {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g", O, H, L, C);

Title = Title + "\nPattern code is : " + DesiredPattern + "\n" + msPatternDescription( DesiredPattern );

//Plot(C, "Price", ParamColor("Color", colorGrey40), styleNoTitle | ParamStyle("Style") | GetPriceStyle() );

PattCloseAbove = DesiredPattern == patts AND Ref( Close > Open, 1 );

PattCloseBelow = DesiredPattern == patts AND Ref( Close < Open, 1 );

//PlotShapes( ( DesiredPattern == patts ) * shapeCircle , IIf( PattCloseAbove, colorDarkGreen, IIf( PattCloseBelow, colorDarkRed, colorDarkBlue ) ), 0, High, 30 );

NumPatterns = LastValue( Cum( DesiredPattern == patts ) );

NumPattCloseAbove = LastValue( Cum( PattCloseAbove ) );

NumPattCloseBelow = LastValue( Cum( PattCloseBelow ) );

NumPattCloseEqual = NumPatterns - NumPattCloseAbove - NumPattCloseBelow;

Title = Title +

"\n\nTotal number of Patterns: " + NumPatterns +

"\n% on Total Bars: " + 100 * NumPatterns/BarCount +

"\nIn the next bar\n" +

EncodeColor(colorGreen) +

"Close has been above the open " + NumPattCloseAbove +

" (" + NumPattCloseAbove / NumPatterns + "%) times\n" +

EncodeColor(colorRed) +

"Close has been below the open " + NumPattCloseBelow + " (" +

NumPattCloseBelow / NumPatterns +" %) times\n" +

EncodeColor(colorGrey50) +

"Close has been equal to the open " + NumPattCloseEqual + " (" +

NumPattCloseEqual / NumPatterns +" %)times";

_SECTION_END();24 comments

Leave Comment

Please login here to leave a comment.

Back

interesting afl.

anyone can add codes for exploration ?

getting error

Thanks a lot Isfandi Brother.

Somebody explain this AFL plz…

Dear Isfandi and ADMIN, am very much like to use this AFL, but am seeing some syntex error, pls followup the error.. am using AMI 5…am waiting ur valuable reply..thx..

Hi Guys.. please instal complete PLUGINS first before use my system

http://www.4shared.com/file/0eIUPRdZ/Plugins.html

Thank you.

Thank you very much , great one, I have problem , to see one hour chart,,other wise 5min, 15,min is too good,

plz add me to your messeger yahoo. ma80rao Help me with one hour chart

regards

Rani

great one , thanks.

- — -

good one….

Sorry, the link is expired. Anyone can upload again ? Plz

super

Are signals coming in realtime? Does this AFL have disappearing signals? ( because back testing is not there, so I doubt… )

i try to download plugin but get error please give me any other source or correct link nagartrilok@gmail.com

good

Noted the request for the Plugins. Here they are, uploaded 01 Mar 2015. Remember that the file may be deleted later by the 4shared server. This is not under my control.

http://www.4shared.com/zip/msyH4Gy9ce/Isfandi_afl_Plugins_1736.html

Enjoy. * Parfumeur *can i have the plugin for this afl please..since the link below has expired..thank you

Hello,

You will find the plugins needed here..

hi

thank’s alot..ill try it now..

dear administrator

if im trying to scan with isfandi trading system II afl, there will be an error.

error 10 Array subcrict out of range, you must not access array elements outside 0 (bar count-1).

this line

if (aLLVBars[curBar] < aHHVBars[curBar]) {

could you help me how to fix it please? thank you

@teta I have tested the indicator and havn’t seen the problem you described.

dear admin

just solved the problem…it doesnt work with all stocks. So i need to make watchlist.

thank you

@teta

sir can you please name some stocks it will probably work on ??

thanks