Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

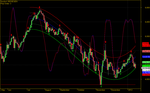

Center of Gravity new Verson for Amibroker (AFL)

COG afl is available in wisestocktrader afl section but not this one.I told you earlier that i cant code but i like/love to tricks/tweaks with it . In this verson i just add buy sell arrow nothing special but easy to visualize .if you like it then please give your+- comments to inspire me.HAts of and all respect to original coder/creator.

Screenshots

Similar Indicators / Formulas

Indicator / Formula

_SECTION_BEGIN("L Center of gravity");

// Center of Gravity (COG) indicator, original idea from El Mostafa Belkhayate

// Amibroker AFL code by E.M.Pottasch, 2011

// Based on code by Fred Tonetti, 2006, n-th order Polynomial fit (see Amibroker Lib)

// JohnCW provided Gaussian_Eliminationsv function based on static variables.

//SetBarsRequired(sbrAll,sbrAll);

BI=BarIndex();

PF_EndBar=LastValue(BI);

PF_Y=(H+L)/2;

PF_Order=Param("nth Order",3,1,8,1);

PF_ExtraB=Param("Extrapolate Backwards",0,0,50,1);

PF_ExtraF=Param("Extrapolate Forwards",0,0,50,1);

Lookback=Param("Lookback Period",10,50,500,1);

sv=ParamToggle("Use Selected Value","Off|On",1);

norm=ParamToggle("Error Levels","Fibonacci|Normal",1);

if (sv)

{

PF_EndBar=SelectedValue(bi);

PF_BegBar=PF_EndBar-Lookback;

}

else

{

PF_BegBar=PF_EndBar-Lookback;

}

function D2Set(L_value,i,j,L_name)

{

local L_value,L_name,i,j;

StaticVarSet(L_name + ":" + i + "," + j, L_value);

}

function D2Get(i,j,L_name)

{

local L_name,i,j;

return(Nz(StaticVarGet(L_name + ":" + i + "," + j),0));

}

function Gaussian_Eliminationsv(GE_Order,GE_N,GE_SumXn,GE_SumYXn)

{

w=0;Coeff=0;

n=GE_Order+1;

for(i=1;i<=n;i++ )

{

for(j=1;j<=n;j++)

{

if (i==1 AND j==1)

D2Set(GE_N,i,j,"b");

else

D2Set(GE_SumXn[i+j-2],i,j,"b");

}

w[i]=GE_SumYXn[i];

}

n1=n-1;

for(i=1;i<=n1;i++)

{

big=abs(D2Get(i,i,"b"));

q=i;

i1=i+1;

for(j=i1;j<=n;j++)

{

ab=abs(D2Get(j,i,"b"));

if(ab>=big)

{

big=ab;

q=j;

}

}

if (big!=0)

{

if (q!=i)

{

for (j=1;j<=n;j++)

{

Temp=D2Get(q,j,"b");

D2Set(D2Get(i,j,"b"),q,j,"b");

D2Set(Temp,i,j,"b");

}

Temp=w[i];

w[i]=w[q];

w[q]=Temp;

}

}

for(j=i1;j<=n;j++)

{

t=D2Get(j,i,"b")/D2Get(i,i,"b");

for(k=i1;k<=n;k++)

{

D2Set(D2Get(j,k,"b")-t*D2Get(i,k,"b"),j,k,"b");

}

w[j]=w[j]-t*w[i];

}

}

if(D2Get(n,n,"b")!=0)

{

Coeff[n]=w[n]/D2Get(n,n,"b");

i=n-1;

while(i>0)

{

SumY=0;

i1=i+1;

for(j=i1;j<=n;j++)

{

SumY=SumY+D2Get(i,j,"b")*Coeff[j];

}

Coeff[i]=(w[i]-SumY)/D2Get(i,i,"b");

i=i-1;

}

}

return Coeff;

}

function PolyFit(GE_Y,GE_BegBar,GE_EndBar,GE_Order,GE_ExtraB,GE_ExtraF)

{

BI=BarIndex();

GE_N=GE_EndBar-GE_BegBar+1;

GE_XBegin=-(GE_N-1)/2;

GE_X=IIf(BI<GE_BegBar,0,IIf(BI>GE_EndBar,0,(GE_XBegin+BI-GE_BegBar)));

GE_X_Max=LastValue(Highest(GE_X));

GE_X=GE_X/GE_X_Max;

X1=GE_X;

GE_Y=IIf(BI<GE_BegBar,0,IIf(BI>GE_EndBar,0,GE_Y));

GE_SumXn=Cum(0);

GE_SumXn[1]=LastValue(Cum(GE_X));

GE_X2=GE_X*GE_X;GE_SumXn[2]=LastValue(Cum(GE_X2));

GE_X3=GE_X*GE_X2;GE_SumXn[3]=LastValue(Cum(GE_X3));

GE_X4=GE_X*GE_X3;GE_SumXn[4]=LastValue(Cum(GE_X4));

GE_X5=GE_X*GE_X4;GE_SumXn[5]=LastValue(Cum(GE_X5));

GE_X6=GE_X*GE_X5;GE_SumXn[6]=LastValue(Cum(GE_X6));

GE_X7=GE_X*GE_X6;GE_SumXn[7]=LastValue(Cum(GE_X7));

GE_X8=GE_X*GE_X7;GE_SumXn[8]=LastValue(Cum(GE_X8));

GE_X9=GE_X*GE_X8;GE_SumXn[9]=LastValue(Cum(GE_X9));

GE_X10=GE_X*GE_X9;GE_SumXn[10]=LastValue(Cum(GE_X10));

GE_X11=GE_X*GE_X10;GE_SumXn[11]=LastValue(Cum(GE_X11));

GE_X12=GE_X*GE_X11;GE_SumXn[12]=LastValue(Cum(GE_X12));

GE_X13=GE_X*GE_X12;GE_SumXn[13]=LastValue(Cum(GE_X13));

GE_X14=GE_X*GE_X13;GE_SumXn[14]=LastValue(Cum(GE_X14));

GE_X15=GE_X*GE_X14;GE_SumXn[15]=LastValue(Cum(GE_X15));

GE_X16=GE_X*GE_X15;GE_SumXn[16]=LastValue(Cum(GE_X16));

GE_SumYXn=Cum(0);

GE_SumYXn[1]=LastValue(Cum(GE_Y));

GE_YX=GE_Y*GE_X;GE_SumYXn[2]=LastValue(Cum(GE_YX));

GE_YX2=GE_YX*GE_X;GE_SumYXn[3]=LastValue(Cum(GE_YX2));

GE_YX3=GE_YX2*GE_X;GE_SumYXn[4]=LastValue(Cum(GE_YX3));

GE_YX4=GE_YX3*GE_X;GE_SumYXn[5]=LastValue(Cum(GE_YX4));

GE_YX5=GE_YX4*GE_X;GE_SumYXn[6]=LastValue(Cum(GE_YX5));

GE_YX6=GE_YX5*GE_X;GE_SumYXn[7]=LastValue(Cum(GE_YX6));

GE_YX7=GE_YX6*GE_X;GE_SumYXn[8]=LastValue(Cum(GE_YX7));

GE_YX8=GE_YX7*GE_X;GE_SumYXn[9]=LastValue(Cum(GE_YX8));

GE_Coeff=Cum(0);

GE_Coeff=Gaussian_Eliminationsv(GE_Order,GE_N,GE_SumXn,GE_SumYXn);

for (i = 1; i <= GE_Order + 1; i++) printf(NumToStr(i, 1.0) + " = " + NumToStr(GE_Coeff[i], 1.9) + "\n");

GE_X=IIf(BI<GE_BegBar-GE_ExtraB-GE_ExtraF,0,IIf(BI>GE_EndBar,0,(GE_XBegin+BI-GE_BegBar+GE_ExtraF)/GE_X_Max));

GE_X2=GE_X*GE_X;GE_X3=GE_X2*GE_X;GE_X4=GE_X3*GE_X;GE_X5=GE_X4*GE_X;GE_X6=GE_X5*GE_X;

GE_X7=GE_X6*GE_X;GE_X8=GE_X7*GE_X;GE_X9=GE_X8*GE_X;GE_X10=GE_X9*GE_X;GE_X11=GE_X10*GE_X;

GE_X12=GE_X11*GE_X;GE_X13=GE_X12*GE_X;GE_X14=GE_X13*GE_X;GE_X15=GE_X14*GE_X;GE_X16=GE_X15*GE_X;

GE_Yn=IIf(BI<GE_BegBar-GE_ExtraB-GE_ExtraF,-1e10,IIf(BI>GE_EndBar,-1e10,GE_Coeff[1]+

GE_Coeff[2]*GE_X+GE_Coeff[3]*GE_X2+GE_Coeff[4]*GE_X3+GE_Coeff[5]*GE_X4+GE_Coeff[6]*GE_X5+

GE_Coeff[7]*GE_X6+GE_Coeff[8]*GE_X7+GE_Coeff[9]*GE_X8));

return GE_Yn;

}

Yn=PolyFit(PF_Y,PF_BegBar,PF_EndBar,PF_Order,PF_ExtraB,PF_ExtraF);

SetChartOptions(0, chartShowDates);

Title = "Symbol: "+ Name()+ "\nPoly Order: "+PF_Order;

Plot(C, "Close",colorLightGrey,styleCandle);

Plot(Yn,"",IIf(BI>PF_EndBar-PF_ExtraF,colorWhite,IIf(BI<PF_BegBar-PF_ExtraF,colorWhite,colorBlue)),styleThick,Null,Null,PF_ExtraF);

if(norm)

{

se=StdErr((C-Yn),LookBack);se=se[PF_EndBar];

//se=StDev(C,LookBack);se=se[PF_EndBar];

seh2=Yn+ValueWhen(Yn,se*2);

sel2=Yn-ValueWhen(Yn,se*2);

seh1=Yn+ValueWhen(Yn,se*1);

sel1=Yn-ValueWhen(Yn,se*1);

Plot(seh2,"",IIf(BI>PF_EndBar-PF_ExtraF,colorWhite,IIf(BI<PF_BegBar-PF_ExtraF,colorWhite,ColorRGB(255,0,0))),styleThick,Null,Null,PF_ExtraF);

Plot(sel2,"",IIf(BI>PF_EndBar-PF_ExtraF,colorWhite,IIf(BI<PF_BegBar-PF_ExtraF,colorWhite,ColorRGB(0,255,0))),styleThick,Null,Null,PF_ExtraF);

Plot(seh1,"",IIf(BI>PF_EndBar-PF_ExtraF,colorWhite,IIf(BI<PF_BegBar-PF_ExtraF,colorWhite,ColorRGB(255,100,100))),styleDashed,Null,Null,PF_ExtraF);

Plot(sel1,"",IIf(BI>PF_EndBar-PF_ExtraF,colorWhite,IIf(BI<PF_BegBar-PF_ExtraF,colorWhite,ColorRGB(100,255,100))),styleDashed,Null,Null,PF_ExtraF);

}

else

{

se=StDev(C,LookBack);se=se[PF_EndBar];

r1=(1+5^0.5)/2;

se=se*r1;

seh3=Yn+ValueWhen(Yn,se);

sel3=Yn-ValueWhen(Yn,se);

seh2=Yn+ValueWhen(Yn,se/(1.382));

sel2=Yn-ValueWhen(Yn,se/(1.382));

seh1=Yn+ValueWhen(Yn,se/(1.382*1.618));

sel1=Yn-ValueWhen(Yn,se/(1.382*1.618));

Plot(seh3,"",IIf(BI>PF_EndBar-PF_ExtraF,colorWhite,IIf(BI<PF_BegBar-PF_ExtraF,colorWhite,ColorRGB(255,0,0))),styleThick,Null,Null,PF_ExtraF);

Plot(sel3,"",IIf(BI>PF_EndBar-PF_ExtraF,colorWhite,IIf(BI<PF_BegBar-PF_ExtraF,colorWhite,ColorRGB(0,255,0))),styleThick,Null,Null,PF_ExtraF);

Plot(seh2,"",IIf(BI>PF_EndBar-PF_ExtraF,colorWhite,IIf(BI<PF_BegBar-PF_ExtraF,colorWhite,ColorRGB(255,100,100))),styleDashed,Null,Null,PF_ExtraF);

Plot(sel2,"",IIf(BI>PF_EndBar-PF_ExtraF,colorWhite,IIf(BI<PF_BegBar-PF_ExtraF,colorWhite,ColorRGB(100,255,100))),styleDashed,Null,Null,PF_ExtraF);

Plot(seh1,"",IIf(BI>PF_EndBar-PF_ExtraF,colorWhite,IIf(BI<PF_BegBar-PF_ExtraF,colorWhite,ColorRGB(255,200,200))),styleDashed,Null,Null,PF_ExtraF);

Plot(sel1,"",IIf(BI>PF_EndBar-PF_ExtraF,colorWhite,IIf(BI<PF_BegBar-PF_ExtraF,colorWhite,ColorRGB(200,255,200))),styleDashed,Null,Null,PF_ExtraF);

}

SetTradeDelays(0,0,0,0);

BuyPrice = C;

SellPrice = C;

SetBarsRequired(200, 0);

function CGOscillator(Price, Length)

{

Result = 0;

for (i=length; i< BarCount; i++)

{

Num = 0;

Denom = 0;

for (j=0; j<Length; j++)

{

Num = Num + (1 + j) * Price[i-j];

Denom = Denom + Price[i-j];

}

if (Denom != 0) Result[i]

= 100.0 * ((-Num / Denom) + (Length + 1)/2);

}

return Result;

}

Price = (H + L) / 2;

CGOLength = Param("CGOLength", 13, 1, 250, 10);

CGO = CGOscillator(Price, CGOLength);

SmLength = Param("SmLength", 2, 1, 20, 2);

CGOSmoothed = DEMA(CGO,SmLength);

Buy = Cross(CGO,CGOSmoothed);

HoldDays = Param("HoldDays",6,1,10,1);

Sell = Cross(CGOSmoothed, CGO)

OR (BarsSince(Buy) >= HoldDays);

Sell = ExRem (Sell,Buy);

e = Equity();

shape = Buy * shapeUpArrow + Sell * shapeDownArrow;

Plot( Close, "Price", colorWhite, styleCandle );

PlotShapes( shape, IIf( Buy, colorGreen, colorRed ),

0, IIf( Buy, Low, High ) );

GraphXSpace = 5;

Plot(e,"Equity",colorRed,styleLine|styleOwnScale);

Plot(CGO, "CG Oscillator", colorRed,

styleLine|styleLeftAxisScale);

Plot(CGOSmoothed, "CGO Smoothed", colorBlue,

styleLine|styleLeftAxisScale);

//Figure 10.1 Center of Gravity

_SECTION_END();2 comments

Leave Comment

Please login here to leave a comment.

Back

great tweak

Thanks :)