Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

Nirvana Modified for Amibroker (AFL)

The original Nirvana code was created by MRTQ13 and uploaded by Agoon. In addition to cleaning up the original code for performance some features have been added. Trend Lines that extend beyond the final price bar have been added, user can select whether to use Zig % or Fractals for pivot recognition. Trend Lines exist for 1st, 2nd & 3rd Hi & Lo pivots. Use trend line from 2nd to 3rd pivot to avoid looking into future. Price labels have been added for the pivots including last highest and lowest prices since most recent pivots. Colors have been added to the short band lines for easy visual trend identification. An Optional setting has been added for overlaying standard price bars on Heiken-Ashi Candles. The Fib setup in the Gordon Rose version pivots has been modified and works well for intraday trading. I am a discretionary trader and avoid bloated code so I have not created exploration or Buy Sell filters for the setup. The fibs only appear when the proper symmetry exists – the conditions are noted in the code – they work well.

Kudos to MRTQ13 for some nice work on the original code – my thanks to Agoon for posting it. Just a note to all – when using code that was originated by someone else – DON"T PLAGIARIZE – provide the name of the original author of the work!!

Thanks

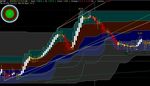

Screenshots

Similar Indicators / Formulas

Indicator / Formula

//=============================

_SECTION_BEGIN("Chart Settings");

//=============================

Version(5.40);

//Original code created by MRTQ13 May,2012

//Modified by D. Keleher May 2012 with following:

//1. Clean version of Gordon Rose pivots with modified Fib Retraces

//2. Added Loop Price Labels and Lowest / Highest price since last pivots

//3. Added TrendLines with selectable Fractal or Zig % settings

//4. Provide functionality for extending trendlines beyond last bar

//5. Added "Bar Overlay" option for Price plotting

//6. Provided Line Colors for Short Bands indicating trend direction

//7. Cleaned up code for minor performance improvement

// To do list includes explorations and scans for price patterns

// and indicator signals

SetChartOptions(0,chartShowArrows|chartShowDates);

GraphXSpace=Param("GraphXSpace",10,0,300,1);

SetChartBkColor(ParamColor("Outer Panel",53));

SetChartBkGradientFill(ParamColor("Upper Chart",16),ParamColor("Lower Chart",16));

//==========================

_SECTION_BEGIN("Forex Main");

//==========================

global hO,hH,hL,hC,fO,fH,fL,fC,bc,Lx,x;

x=BarIndex(); bc=BarCount; Lx=LastValue(x);

//Flower OHLC

fC=EMA((O+H+L+C)/4,3); fO=EMA((Ref(O,-1)+Ref(fC,-1))/2,3);

fH=EMA(Max(Max(H,fO),fC),3); fL=EMA(Min(Min(L,fO),fC),3);

//Heiken Ashi OHLC

hC=EMA((O+H+L+C)/4,3); hO=AMA(Ref(hC,-1),0.5);

hH=Max(H,Max(hC,hO)); hL=Min(L,Min(hC,hO));

function ti3(y,t) {

s=0.84;

e1=EMA(y,t); e2=EMA(e1,t); e3=EMA(e2,t);

e4=EMA(e3,t); e5=EMA(e4,t); e6=EMA(e5,t);

c1=-s*s*s; c2=3*s*s+3*s*s*s;

c3=-6*s*s-3*s-3*s*s*s;

c4=1+3*s+s*s*s+3*s*s;

return T3=c1*e6+c2*e5+c3*e4+c4*e3; }

_SECTION_END();

//===========================

_SECTION_BEGIN("HEIKIN-ASHI");

//===========================

//by Dan Valcu S&C Traders Tips Feb, 2004

bsl=ParamToggle("Candle Type","HA,Std",0);

olb=ParamToggle("Overlay Bars","Off|On",0);

sco= ParamToggle("CandleFill Color","Std|Macd",1);

r1=5; r2=10; r3=5;//MACD Fast,Slow & Signal Periods

ap=4;//ATR & Hi Lo Periods

pd=7;//HHV LLV Lookback

atv=ATR(ap); sup=HHV(LLV(L,ap)+atv,pd); res=LLV(HHV(H,ap)-atv,pd);

fC=EMA((O+H+L+C)/4,3);//Flower Close

hC=(O+H+L+C)/4; hO=AMA(Ref(fC,-1),0.5);

hH=Max(H,Max(fC,hO)); hL=Min(L,Min(fC,hO));

m1=MACD(r1,r2); s1=Signal(r1,r2,r3); uc=ColorRGB(230,230,0);

mco=IIf(m1<0 AND m1>s1,uc,IIf(m1>0 AND m1>s1,55,IIf(m1>0 AND m1<s1,25,24)));

if(sco)SetBarFillColor(mco);

if(bsl==1)PlotOHLC(O,H,L,C,"",IIf(C>O,55,32),64);

if(bsl==0)PlotOHLC(hO,hH,hL,fC,"",IIf(C>sup,55,IIf(C<res,32,42)),64);

bco=IIf(m1<0 AND m1>s1,uc,IIf(m1>0 AND m1>s1,43,IIf(m1>0 AND m1<s1,32,42)));

if(bsl==0 AND olb)Plot(C,"",bco,128|4096,0,0,0,1);

_SECTION_END();

//===========================

_SECTION_BEGIN("Line Style's");

//===========================

nr= ParamToggle("No Rescale","Off|On",1)*2048;

al= ParamToggle("Axis Labels","On|Off",1)*4096;

s01=1|al|nr; s04=4|al|nr; s08=8|al|nr;

s32=32|al|nr; s36=36|al|nr; s41=41|al|nr;

s51=512|al|nr; s52=512|4|al|nr;

xp=BarCount+2;

//================================

_SECTION_BEGIN("Breakout Setting");

//================================

bpd=Param("Breakout periods best is usually 18",5,1,100,1,1);

spd=Param("Exit Breakout",5,1,100,1,1);

Buy=C>Ref(HHV(H,bpd),-1); Sell=C<Ref(LLV(L,spd),-1);

Buy=ExRem(Buy,Sell); Sell=ExRem(Sell,Buy);

PlotShapes(Buy*shapeSmallCircle,55,0,hL,-10);

PlotShapes(Sell*shapeSmallCircle,32,0,hH,10);

_SECTION_END();

//===========================

_SECTION_BEGIN("Pivot Box");

//===========================

Hi=Param("Hi Periods",7,1,50,1);

Lo=Param("Lo Periods",7,1,50,1);

A1=ExRemSpan(Ref(H,-2)==HHV(H,Hi),3);

A2=ExRemSpan(Ref(L,-2)==LLV(L,Lo),3);

A3=Cross(A1,0.9); A4=Cross(A2,0.9);

Top=Ref(hH,-BarsSince(A3));

tbk=Param("Hi Breakout Periods",10,2,30,0.1);

yr=IIf(x>=bc-tbk,EndValue(Top),Null);

Plot(yr,"",ParamColor("Line Color",25),s52);

//Plot(top,"",11,styleDots+styleLine+styleThick);

bot=Ref(hL,-BarsSince(A4));

bbk=Param("Lo Breakout Periods",10,2,30,0.1);

ys=IIf(x>=bc-bbk,EndValue(bot),Null);

Plot(ys,"",ParamColor("Support Color",43) ,s52);

//Plot(bot,"",6,styleDots+styleLine);

_SECTION_END();

//============================

_SECTION_BEGIN("Price Line");

//============================

p= ParamField("Price Field",3);

bk= Param("Bars Back",500,10,900,1);

yy=IIf(x>=bc-bk,EndValue(p),Null);

Plot(yy,"Price",colorGrey40,s36);

_SECTION_END();

//===========================

_SECTION_BEGIN("MA Averages");

//===========================

if(ParamToggle("Plot MA-21","Off|On",0))Plot(MA(C,21),"",27,s01);

if(ParamToggle("Plot MA-55","Off|On",0))Plot(MA(H,55),"",55,s01);

if(ParamToggle("Plot MA-233","Off|On",0))Plot(MA(H,233),"",52,s01);

_SECTION_END();

//===========================

_SECTION_BEGIN("WMA Averages");

//===========================

if(ParamToggle("Plot WMA-20","Off|On",0))Plot(WMA(C,20),"",26,s08,0,0,1);

if(ParamToggle("Plot WMA-60","Off|On",0))Plot(WMA(C,60),"",19,s08,0,0,1);

if(ParamToggle("Plot WMA-100","Off|On",0))Plot(WMA(C,100),"",30,s08,0,0,1);

if(ParamToggle("Plot WMA-120","Off|On",0))Plot(WMA(C,120),"",12,s08,0,0,1);

if(ParamToggle("Plot WMA-180","Off|On",0))Plot(WMA(C,180),"",31,s08,0,0,1);

if(ParamToggle("Plot WMA-500","Off|On",0))Plot(WMA(C,500),"",47,s08,0,0,1);

//===========================

_SECTION_BEGIN("Avg I Select");

//===========================

s=ParamList("AverageType","Off|DEMA|EMA|HMA|Lagless|LinReg|MA|TEMA|Weighted|Wilders",0);

t=Param("Periods",20,2,200);

d=Param("Displacement",1,0,50,1);

p=hC; m=Null;

if(s=="DEMA")m=DEMA(p,t); if(s=="EMA")m=EMA(p,t); if(s=="HMA")m=WMA(2*(WMA(P,t/2))-WMA(p,t),4);

if(s=="Lagless")m=2*EMA(p,t)-EMA(EMA(p,t),t); if(s=="LinReg")m=LinearReg(p,t);

if(s=="MA")m=MA(p,t); if(s=="TEMA")m=TEMA(P,t);

if(s=="Weighted")m=WMA(p,t); if(s=="Wilders")m=Wilders(p,t);

Plot(m,"",ParamColor("Color",26),s01,d);

_SECTION_END();

//===========================

_SECTION_BEGIN("Avg II Select");

//===========================

s=ParamList("AverageType","Off|DEMA|EMA|HMA|Lagless|LinReg|MA|TEMA|Weighted|Wilders",0);

t=Param("Periods",60,2,200);

d=Param("Displacement",1,0,50,1);

p=hC; m=Null;

if(s=="DEMA")m=DEMA(p,t); if(s=="EMA")m=EMA(p,t); if(s=="HMA")m=WMA(2*(WMA(P,t/2))-WMA(p,t),4);

if(s=="Lagless")m=2*EMA(p,t)-EMA(EMA(p,t),t); if(s=="LinReg")m=LinearReg(p,t);

if(s=="MA")m=MA(p,t); if(s=="TEMA")m=TEMA(P,t);

if(s=="Weighted")m=WMA(p,t); if(s=="Wilders")m=Wilders(p,t);

Plot(m,"",ParamColor("Color",27),s01,d);

_SECTION_END();

//===========================

_SECTION_BEGIN("Bands Short");

//===========================

sb= ParamToggle("Short Bands Cloud","Off|On",1);

bl= ParamToggle("Short Bands Lines","Off|On",1);

bk= Param("Periods",40,10,900,1);

if(sb OR bl) { st=32|512|2048|4096;

Hi=HHV(H,bk); Lo=LLV(L,bk); kM=(Hi+Lo)/2; kH=(kM+Hi)/2; kL=(kM+Lo)/2;

if(bl) {

nhi= IIf(Hi>Ref(Hi,-1),1,IIf(Hi<Ref(Hi,-1),-1,0)); hco=IIf(ValueWhen(nhi!=0,nhi)==-1,32,34);

nlo= IIf(Lo>Ref(Lo,-1),1,IIf(Lo<Ref(Lo,-1),-1,0)); lco=IIf(ValueWhen(nlo!=0,nlo)==-1,32,43);

nkh= IIf(kH>Ref(kH,-1),1,IIf(kH<Ref(kH,-1),-1,0)); khc=IIf(ValueWhen(nkh!=0,nkh)==-1,25,34);

nkm= IIf(kM>Ref(kM,-1),1,IIf(kM<Ref(kM,-1),-1,0)); kmc=IIf(ValueWhen(nkm!=0,nkm)==-1,42,34);

nkl= IIf(kL>Ref(kL,-1),1,IIf(kL<Ref(kL,-1),-1,0)); klc=IIf(ValueWhen(nkl!=0,nkl)==-1,40,34);

Plot(Hi,"",hco,s32); Plot(Lo,"",lco,s32); Plot(kM,"",kmc,s32);

Plot(kH,"",khc,s32); Plot(kL,"",klc,s32); }

uc1=ParamColor("Up Cloud Color 1",ColorRGB(0,55,55));

uc2=ParamColor("Up Cloud Color 2",ColorRGB(60,15,0));

dc1=ParamColor("Dn Cloud Color 1",ColorRGB(0,0,83));

dc2=ParamColor("Dn Cloud Color 2",ColorRGB(43,43,89));

if(sb) {

Lo=LLV(L,22); kL=(kM+Lo)/2;

if(bl) {

nkl= IIf(kL>Ref(kL,-1),1,IIf(kL<Ref(kL,-1),-1,0)); klc=IIf(ValueWhen(nkl!=0,nkl)==-1,11,43);

nlo= IIf(Lo>Ref(Lo,-1),1,IIf(Lo<Ref(Lo,-1),-1,0)); lco=IIf(ValueWhen(nlo!=0,nlo)==-1,11,43);

Plot(Lo,"",lco,s32,0,0,0,1); Plot(kL,"",klc,s32,0,0,0,1); }

st= styleCloud||512|2048|4096|styleNoTitle;

PlotOHLC(Hi,Hi,kH,kH,"",uc1,st); PlotOHLC(kH,kH,kM,kM,"",uc2,st);

PlotOHLC(kM,kM,kL,kL,"",dc1,st); PlotOHLC(kL,kL,Lo,Lo,"",dc2,st); }

}

_SECTION_END();

//===========================

_SECTION_BEGIN("Bands Long");

//===========================

pl= ParamToggle("Long Bands Cloud","Off|On",1);

bl= ParamToggle("Long Bands Lines","Off|On",1);

srf=Param("Sup-Res Short",30,0,100,1);

ret=Param("Res Long",160,0,350,1);

sut=Param("SupLong",60,0,350,1);

x0=Param("Cloud Bar Length",300,1,500,1);

co=ParamColor("Cloud Color",23);

st=512|2048|4096;

Hf=HHV(hH,srf); Lf=LLV(hL,srf); Hr=HHV(hH,ret); Ls=LLV(hL,sut);

if(bl) { Plot(Hr,"",47,s32); Plot(Ls,"",47,32); }

if(pl) {

for(i=0;i<BarCount-x0;i++) { co[i] = colorBlack; }//hide the line except most recent 10 bars

PlotOHLC(Ls,Ls,Hr,Hr,"",co,styleCloud|st); }

_SECTION_END();

//=============================

_SECTION_BEGIN("Rose Pivots");

//=============================

//Original Code by Gordon Rose

//Modified by D. Keleher 2008

plb= ParamToggle("Pivot Price Text","Off|On",1);

txl= ParamToggle("Last Price Text","Off|On",1);

plf= ParamToggle("Fib Retracements","Off|On",1);

nbz= Param("Swing Bar Min",12,5,40);

stn= Param("Digit Length",5,1,10,1);

xMn= Param("Minimum Pivot Bars",1,1,10,1);

th= Param("Adjust Hi Label",1.4,0,10,0.1)*TickSize;

td=1.2;//String Decimals

tol= 0.01;//Price Tolerance

tpr= 0.005;//Retrace % Adjust Tolerance

lbk= 120;

expX= 0; expD= 0;//Explore Bar Index and Explore Date

dnc= 0; dn= DateNum(); ulv=1; //Use Last Visible Bar

Long=False; Shrt=False; rTitle="";

if(plf OR txl OR plf) {

// 1= Indicator 2= Commentary 3= Scan 4= Explore 5= Backtest / Optimize

if(Status("action")==1) {plf=True; } else { plf=False; ulv= False; trc= False;

expD= Status("RangeToDate");

for(i=LastValue(BarIndex());i>=0;i--) { dnc=dn[i];

if(dnc==expD) { expX=i;} }

}

//======== Initialize Arrays ========

xp= 0; xhp= 0; xlp=0; yr0=0;

xr0= 0; ys0= 0; xs0=0;

yR=H-H; xR=H-H; yS=L-L; xS=L-L;

pk= H-H; xr1=H-H; tr=L-L; xs1=L-L;

//======================

HHx= HHVBars(H,nbz); LLx= LLVBars(L,nbz);

lvb= LastValue(Highest(IIf(Status("BarVisible"),x,0)));

xx= IIf(lvb>0 AND ulv,lvb,IIf(Status("action")==4 AND expX>0,expX,LastValue(x)));

dir= "";

if(LLx[xx]<HHx[xx])dir="D"; else dir="U";

//======== Find Main Pivots ========

if(xx>=lbk) { for(i=0; i<lbk; i++) { // xx>=lbk insures enough bars exist

xx= IIf(lvb>0 AND ulv,lvb-i,IIf(Status("action")==4 AND expX>0,expX-i,LastValue(x)-i));

if(LLx[xx]<HHx[xx]) { //LLV bars < HHV Bars == Down

if(dir=="U") { dir= "D";//If direction was up change it to down

xp= xx-LLx[xx]; tr[xp]=1; yS[xlp]=L[xp]; xS[xlp]=xp; xlp++; } } //Capture pivot information

else { if(dir=="D") { dir= "U";// or if Dir was Down change it to up

xp=xx-HHx[xx]; pk[xp]=1; yR[xhp]=H[xp]; xR[xhp]=xp; xhp++; } } } }//== Found Main Pivots

//======= Find Missed Pivot(s) ======

//Start at last bar. Reestablish xx

xx= IIf(lvb>0 AND ulv,lvb,IIf(Status("action")==4 AND expX>0,expX,LastValue(x)));

if(xhp>= 2 AND xlp>= 2) { //at least two of each must exist.

xs0= xS[0]; ys0=yS[0]; xr0=xR[0]; yr0=yR[0]; xmx=Max(xs0,xr0); cbz=xx-xmx;

LLy=LLV(L,cbz); LLb=LLVBars(L,cbz); yLo=LLy[xx]; xLo=xx-LLb[xx];

HHy=HHV(H,cbz); HHb=HHVBars(H,cbz); yHi=HHy[xx]; xHi=xx-HHb[xx];

if(xr0>xs0) {

if (yR[0]<yR[1]) { //Current Hi < Previous Hi

if(yLo<yS[0] AND (xLo-xr0-1)>=xMn AND xLo!=xx) { tr[xLo]=1; xs1[xLo]=1;

for(j=0; j<xlp; j++) { yS[xlp-j]=yS[xlp-(j+1)]; xS[xlp-j] = xS[xlp-(j+1)]; }

yS[0]= yLo; xS[0]= xLo; xlp++; } }

else { if(yLo>yS[0] AND (xLo-xr0-1)>=xMn AND xLo!= xx) { tr[xLo]=1; xs1[xLo]=1;

for(j=0; j<xlp; j++) {yS[xlp-j]=yS[xlp-(j+1)]; xS[xlp-j]= xS[xlp-(j+1)]; }

yS[0]= yLo; xS[0]=xLo; xlp++; } } }

else { if(yR[0]<yR[1]) { if(yHi<yR[0] AND (xHi-xs0-1)>=xMn AND xHi!= xx) { pk[xHi]=1; xr1[xHi]=1;

for(j=0;j<xhp; j++) { yR[xhp-j]= yR[xhp-(j+1)]; xR[xhp-j]= xR[xhp-(j+1)]; }

yR[0]=yHi; xR[0]=xHi; xhp++; } }

else { if(yHi>yR[0] AND (xHi-xs0-1)>=xMn AND xHi!=xx) { pk[xHi]=1; xr1[xHi]=1;

for(j=0; j<xhp; j++) { yR[xhp-j]= yR[xhp-(j+1)];xR[xhp-j]= xR[xhp-(j+1)]; }

yR[0]=yHi; xR[0]=xHi;xhp++; } } }

}

//Retracements

bars=0; prcR= H-H; retP=0; retB= H-H;

retX=0; retC=0; retY=C;

rt0Pts=0; rt0brz=0; rt1Pts=0; rt1brz=0;

i50=Null; i62=Null; i78=Null;

//Retracement calcs. Arrangement of pivs very specific for this setup.

if(xhp>=2 AND xlp>=2 AND yR[0]>yR[1] AND yS[0]>yS[1]) {

i50=(yR[0]-(0.50*(yR[0]-yS[1])));

i62=(yR[0]-(0.62*(yR[0]-yS[1])));

i78=(yR[0]-(0.79*(yR[0]-yS[0])));

bars=xx-xR[0]; prcR=LLV(L,bars); retB=LLVBars(L,bars);

retP=prcR[xx]; retX=xx-retB[xx]; retC=retY[retX];

Long=(i50>=(i78*(1-tpr))AND i62<=(i78*(1+tpr))AND retC >=((1-tol)*i62)AND retP<=((1+tol)*i50)); }

//Lower Highs and Lower Lows

else if(xhp>=2 AND xlp>=2 AND yR[0]<yR[1] AND yS[0]<yS[1]) {

i50= (yR[1]-(0.500*(yR[1]-yS[0])));

i62= (yR[0]-(0.618*(yR[1]-yS[0])));

i78= (yR[0]-(0.786*(yR[0]-yS[0])));

bars= xx-xS[0]; prcR= HHV(H,bars); retB= HHVBars(H,bars);

retP= prcR[xx]; retX= xx-retB[xx]; retC= retY[retX];

//For Short Setups .500 is below .786 & .618 is above .786, Close is <= High & High >= Low of Ret range

//Risk is top of zone - low of signal bar

Shrt=( i50<=(i78*(1+tpr))AND i62>=(i78*(1-tpr))AND retC<=((1+tol)*i62)AND retP>=((1-tol)*i50)); }

if(Shrt OR Long) { // Show zone if present

if(Shrt) { // Check Symmetry

if(xS[0]>xR[0]) { rt0Pts=yR[0]-yS[1]; rt0brz=xR[0]-xS[1]+1; rt1Pts=retP-yS[0]; rt1brz=retX-xS[0]+1; }

else { rt0Pts=yR[1]-yS[1]; rt0brz=xR[1]-xS[1]+1; rt1Pts=yR[0]-yS[0]; rt1brz=xR[0]-xS[0]+1; } }

else { // Long Setup

if(xS[0]>xR[0]) { rt0Pts=yR[0]-yS[1]; rt0brz=xR[0]-xS[1]+1; rt1Pts=retP-yS[0]; rt1brz=retX-xS[0]+1; }

else { rt0Pts=yR[1]-yS[0]; rt0brz=xS[0]-xR[1]+1; rt1Pts=yR[0]-yS[0]; rt1brz=xS[0]-xR[0]+1; } }

}

if(plf) {

// .50 is above .786 & .62 is below .786 for long setups

// .50 is below .786 & .62 is above .786 for short setups

Plot(LineArray(IIf(Long,xR[0],xS[0]),i50,xx,i50,0),"i50",11,1|2048,0,0,0,1);

Plot(LineArray(IIf(Long,xR[0],xS[0]),i62,xx,i62,0),"i62",43,1|2048,0,0,0,1);

Plot(LineArray(IIf(Long,xR[0],xS[0]),i78,xx,i78,0),"i78",41,1|2048,0,0,0,1);

PlotText(StrRight(NumToStr(i50,td),stn)+ " - 50%",xx+2,i50,11,1);

PlotText(StrRight(NumToStr(i62,td),stn)+ " - 62%",xx+2,i62,43,1);

PlotText(StrRight(NumToStr(i62,td),stn)+ " - 78%",xx+2,i78,41,1); }

if(plb) {

for(i=LastValue(BarIndex()); i>=0;i--) {

if(tr[i] )PlotText("\n\n"+ StrRight(NumToStr(L[i],td),5),i-1,L[i],43,1);

if(pk[i])PlotText(StrRight(NumToStr(H[i],td),5),i-1,H[i]+th,42,1); } }

if(plf) {

sq=shapeHollowSmallSquare; da=shapeDownArrow; ua=shapeUpArrow;

PlotShapes(pk*sq,11,0,H,8); PlotShapes(xr1*sq,42,0,H,8);

PlotShapes(tr*sq,10,0,L,-8); PlotShapes(xs1*sq,43,0,L,-8); }

if(txl) {

pb=LastValue(BarsSince(pk)); tb=LastValue(BarsSince(tr));

fL=LastValue(LowestSince(pk,L)); xL=LastValue(ValueWhen(L==fL,x));

fH=LastValue(HighestSince(tr,H)); xH=LastValue(ValueWhen(H==fH,x));

Plot(LineArray(xL-3,fL,Lx,fL),"",43,36|4096|2048,0,0,2,1);

Plot(LineArray(xH-3,fH,Lx,fH),"",40,36|4096|2048,0,0,2,1);

PlotText(StrRight(NumToStr(fH,td),stn),Lx+2,fH,40,1);

PlotText(StrRight(NumToStr(fL,td),stn),Lx+2,fL,43,1); }

Filter= (Shrt OR Long);

AddColumn(C, "Close");

AddColumn(IIf(Long,76,83),"L/S",formatChar);

rTitle="\\c55\nRtrc 0/1 Pts: " + WriteVal(rt0Pts,2.1) + "\\c42 / \\c55" + WriteVal(rt1Pts,2.1)+

" Rtrc 0/1 Bars: " + WriteVal(rt0brz, 2.0) + " \\c42/ \\c55" + WriteVal(rt1brz,2.0);

}

_SECTION_END();

//====================================

//====== Fractal Peak Trough ======

//Peak Trough Id By D. Keleher 2008

x= BarIndex();

function PkID(nn) {

pk=H==HHV(H,2*nn) AND Ref(HHV(H,nn),nn)<H;

return pk AND LastValue(x)-ValueWhen(pk,x)>nn; }

function TrID(nn) {

tr=L==LLV(L,2*nn) AND Ref(LLV(L,nn),nn)>L;

return tr AND LastValue(x)-ValueWhen(tr,x)>nn; }

//====== Selected Value Function ======

function svp(y,x,Lb){ return SelectedValue(ValueWhen(y,x,Lb)); }

//====== Extended Line Function ======

function exln(x1,y1,x0,y0,ex,co,st) {

Plot(la=LineArray(x1-ex,y1,x0-ex,y0,1),"",co,st,0,0,ex,1);

return la; }

//===========================

_SECTION_BEGIN("Fractal Wedge");

//===========================

//original by Dimitris Tsokakis 2003

//versions by D. Keleher 2004 - 2008

pl= ParamToggle("Wedge Lines","Off|On",0);

pvt=ParamToggle("Pivot Types","Fractal|Zig %",0);

pct=Param("Percent",0.20,0.01,5,0.01);

nb= Param("Fractal Bars",5,2, 200,1);

ex= Param("Extend Right",1,0,50,1);

rs= ParamToggle("No Rescale ","Off|On",1)*2048;

st= ParamStyle("Style",4|4096)|rs; s32=36|2048;

if(pl) {

S=L; R=H;

if(pvt==0) { pS=TrID(nb); pR=PkID(nb); }

if(pvt==1) { pS=TroughBars(S,pct,1)==0; pR=PeakBars(R,pct,1)==0; }

xs1=svp(pS,x,1); xs2=svp(pS,x,2); xs3=svp(pS,x,3);

xr1=svp(pR,x,1); xr2=svp(pR,x,2); xr3=svp(pR,x,3);

ys1=svp(pS,L,1); ys2=svp(pS,L,2); ys3=svp(pS,L,3);

yr1=svp(pR,H,1); yr2=svp(pR,H,2); yr3=svp(pR,H,3);

exln(xs2,ys2,xs1,ys1,2,34,st); exln(xr2,yr2,xr1,yr1,2,32,st);

exln(xs3,ys3,xs1,ys1,2,55,st); exln(xr3,yr3,xr1,yr1,2,55,st);

exln(xs3,ys3,xs2,ys2,2,27,st); exln(xr3,yr3,xr2,yr2,2,25,st);

}

_SECTION_END();

//=============================

_SECTION_BEGIN("Daily Trend");

//=============================

GfxSelectFont("Arial",10,100); GfxSetBkMode(1); GfxSetTextColor(42);

tf=5; ts=8;

TimeFrameSet (inDaily);

tf=ti3(C,tf); ts=ti3(C,ts);

TimeFrameRestore();

Bear= WriteIf(C<tf AND C<ts,"Bear",""); revD= WriteIf(C<tf AND C>ts,"revD","");

Bull= WriteIf(C>tf AND C>ts,"Bull",""); revU= WriteIf(C>tf AND C<ts,"revU","");

if(revU=="revU") { GfxSelectSolidBrush(55); }

else if(Bull=="Bull"){ GfxSelectSolidBrush(ColorRGB(113,255,113)); }

else if(revD=="revD"){ GfxSelectSolidBrush(colorGrey40); }

else if(Bear=="Bear"){ GfxSelectSolidBrush(ColorRGB(255,113,113)); OP="M"; }

GfxSelectPen(42,1); GfxCircle(70,90,6);

//GfxTextOut( OP ,92,235) ;

RequestTimedRefresh(0);

_SECTION_END();

//=============================

_SECTION_BEGIN("Weekly Trend");

//=============================

TimeFrameSet(inWeekly);

fa=ti3(C,4); sa=ti3(C,5);

TimeFrameRestore();

Bear= WriteIf(C<fa AND C<sa,"Bearish",""); revD= WriteIf(C<fa AND C>sa,"Reverse Dn","");

Bull= WriteIf(C>fa AND C>sa,"Bullish",""); revU= WriteIf(C>fa AND C<sa,"Reverse Up","");

if(revU=="Rev Up") { GfxSelectSolidBrush(42);}

else if(Bull=="Bull") { GfxSelectSolidBrush(ColorRGB(0,50,0)); }

else if(revD=="Rev Dn"){ GfxSelectSolidBrush(colorGrey40); }

else if(Bear=="Bear") { GfxSelectSolidBrush(ColorRGB(50,0,0)); }

GfxSelectPen(20,2); GfxCircle(70,90,60);

//GfxRoundRect(2,320,150,200,5,5);

RequestTimedRefresh(0);

_SECTION_END();

//=============================

_SECTION_BEGIN("Trending Ribbon");

//=============================

TimeFrameSet (inDaily);

up=PDI()>MDI()AND Signal()<MACD(); dn=MDI()>PDI()AND Signal()>MACD();

uw=WriteIf(Up,"Up",""); dw=WriteIf(Dn,"Dn","");

if(uw=="Up") { GfxSelectSolidBrush( ColorRGB(0,70,0)); }

else if(dw=="Dn") { GfxSelectSolidBrush( ColorRGB(70,0,0)); }

else if(dw=="") { GfxSelectSolidBrush(colorPaleBlue); }

GfxSelectPen(16,0); GfxCircle(70,90,54);

TimeFrameRestore();

//GfxRoundRect(15,305,135,215,5,5);

RequestTimedRefresh(0);

_SECTION_END();

//==============================

_SECTION_BEGIN("ti3 Flower Trends");

//==============================

ti5=ti3(fC,5); ti7=ti3(fC,7); ti9=ti3(fC,9);//Trend Averages

upC5= WriteIf(fC>ti5,"upC5",""); dnC5= WriteIf(fC<ti5,"dnC5","");

Up57= WriteIf(ti5>ti7,"Up57",""); Dn57= WriteIf(ti7>ti5,"Dn57","");

Up79= WriteIf(ti7>ti9,"Up79",""); Dn79= WriteIf(ti9>ti7,"Dn79","");

xxC5= WriteIf(Cross(fC,ti5),"xxC5","");

xx75= WriteIf(Cross(ti7,ti5),"xx75","");

//======== Slow Trend ========

if(Up79=="Up79") { GfxSelectSolidBrush(ColorRGB(0,90,0)); }

else if(Dn79=="Dn79") { GfxSelectSolidBrush(ColorRGB(90,0,0)); }

else if(Dn79=="") { GfxSelectSolidBrush(colorYellow); }

GfxSelectPen(16,1); GfxCircle(70,90,48);

//======== Mid Trend ========

if(Up57=="Up57") { GfxSelectSolidBrush(ColorRGB(0,120,0)); }

else if(Dn57=="Dn57") { GfxSelectSolidBrush(ColorRGB(120,0,0)); }

else if(xx75=="xx75") { GfxSelectSolidBrush(colorYellow); }

GfxSelectPen(16,1); GfxCircle(70,90,42);

//======== Fast Trend ========

if(upC5=="upC5") { GfxSelectSolidBrush( ColorRGB(0,150,0)); }

else if(dnC5=="dnC5") { GfxSelectSolidBrush(ColorRGB(150,0,0)); }

else if(xxC5=="xxC5") { GfxSelectSolidBrush(colorYellow); }

GfxSelectPen(16,1); GfxCircle(70,90,36);

_SECTION_END();

//=============================

_SECTION_BEGIN("Rays");

//=============================

pd=3; ap=2; su=LLV(fH,pd); av=ATR(ap);

upATR= WriteIf(fC>HHV(su-av,4),"upATR","");

dnATR= WriteIf(HHV(su-av,4)>fC,"dnATR","");

if(upATR=="upATR") { GfxSelectSolidBrush(ColorRGB(0,180,0)); }

else if(dnATR=="dnATR"){ GfxSelectSolidBrush(ColorRGB(180,0,0)); }

else if(upATR=="") { GfxSelectSolidBrush(colorGrey40); }

GfxSelectPen(16,1); GfxCircle(70,90,30);

_SECTION_END();

//=============================

_SECTION_BEGIN("Profit Taker");

//=============================

pds=10; atv=1.9*ATR(10);

Ent= C>(LLV(fL,pds)+atv); Xit= C<(HHV(fH,pds)-atv);

EntU= WriteIf(Ent,"Ent",""); XitD= WriteIf(Xit,"Xit","");

if(EntU=="Ent") { GfxSelectSolidBrush(ColorRGB(0,210,0)); }

else if(XitD=="Xit") { GfxSelectSolidBrush(ColorRGB(210,0,0)); }

else if(XitD=="") { GfxSelectSolidBrush(colorGrey40); }

GfxSelectPen(16,1); GfxCircle(70,90,24);

RequestTimedRefresh(0);

_SECTION_END();

//=============================

_SECTION_BEGIN("CCI 9-2 Trend");

//=============================

up=WriteIf(CCI(9)>0,"upCCI",""); dn=WriteIf(CCI(8)<0,"dnCCI","");

if(up=="upCCI") { GfxSelectSolidBrush(ColorRGB(0,240,0)); }

else if(dn=="dnCCi") { GfxSelectSolidBrush(ColorRGB(240,0,0)); }

else if(dn=="") { GfxSelectSolidBrush(colorGrey40); }

GfxSelectPen(16,1); GfxCircle(70,90,18);

RequestTimedRefresh(0);

_SECTION_END();

//=============================

_SECTION_BEGIN("% Bol Bands 7");

//=============================

GfxSelectFont("Tahoma",12,100); GfxSetBkMode(1); GfxSetTextColor(55);

GfxSelectFont("Arial",10,100); GfxSetBkMode(1); GfxSetTextColor(16);

p=7; dv=((C+2*StDev(C,p)-MA(C,p))/(4*StDev(C,p)))*100;

upBB=WriteIf(dv>40,"upBB",""); dnBB=WriteIf(dv<40,"dnBB","");

if(upBB=="upBB") { GfxSelectSolidBrush(ColorRGB(62,255,62)); }

else if(dnBB=="bd") { GfxSelectSolidBrush(ColorRGB(255,62,62)); }

else if(dnBB=="") { GfxSelectSolidBrush(colorGrey40); }

GfxSelectPen( 16,1); GfxCircle(70,90,12);

RequestTimedRefresh(0);

_SECTION_END();

up=C> Ref(C, -1); df=C-Ref(C,-1);

Title= "\\c55" + Name () + " | \\c42" + Date() + "\\c55 | Open: \\c10" + O + "\\c55 | Hi: \\c43 " + H +

"\\c55 | Close: \\c42 " + C + "\\c55 | Change: ("+ WriteIf(up,"\\c43 ","\\c32 ") + df +

"\\c55 /" + WriteIf(up,"\\c43","\\c32") + WriteVal(ROC(C,1)) + "\\c55 % ) | Volume: " +

WriteIf(V>Ref(V,-1),"\\c43 ","\\c32 ") + WriteVal(V,1) + rTitle;

25 comments

Leave Comment

Please login here to leave a comment.

Back

Sir,

thank u for the modified AFL, am using ami 5.2, the AFL formula shwoing error, pls help me to use WITH AMI 5.2 ALSO.

thank u so much.

Thanks for the modified version of Nirvana.I am getting error 16. Please suggest , How to correct this error. I am using AB 5.10.

thank you for sharing.

ps. there is no low price in the chart title

For tigernifty and dineshpal – I believe you are receiving errors because the first line in the code sets the requirement for Amibroker to be version 5.40 or greater.

Remove the line and the code should work. If you run into additional errors after removing the Version(5.40) line then you will either have to upgrade your software or debug by eliminating code not supported in your older version of the software.

emososo – Thanks for the comment. I found a couple of things that needed some work so I will add the Low price to my list. I will upload the fix as a replacement for this code.

Gudwork sir…Nirvana is rocking…it vl b very helpful n reliable 4 trading…I think 1 vl look forward n make it an ultimate trading system…Thanx 4 posting!!

If someone can post it in a manner that works on Amibroker 5.1 it would be nice – original Nirvana works

Delete this line (Version(5.40);)it will work on Amibroker 5.1 also.

dkeleher,

My sincere regards for sharing the code.

Most of the basic funda is from southwind system.

But modification work is superb as chart looks very beautiful.

Please add also buy /sell arrowrs & exploration/scanning. People like me remember your help & conributions generations ahead.

Viswanath

dkeleher,

Can you please add pivot price text as full price.

Now it shows last 2 digits.

Is there any reason for keeping only 2 digits

Thanks

Viswanath

sir, am deleted the line VERSION 5.4, but problem not solved, again am facing error in line 175, 318 and 319..pls help me.. how to debug and solve this. am need ur help.. My cell: 9842406366. thx..

sir, good for the NIRVANA AFL, good work..thanks for submit the afl.. very use full…

the MODIFIED NIRVANA AFL ONLY (my version 5.2) am not getting chance for use..

am try to contact u for solving this, pls help me.. if possible give me ur cell number.. thanks once again…. my cell: 9842406366.

kv_maligi > “…add pivot price text as full price”

You should take the time to learn what each of the parameter settings do. “Digit Length” under Rose pivots permits the user to select the number of characters shown, Change it to whatever you desire.

Thanks dkeleher. God Bless you, Nirvana author & wisestocktrader.com

My rating 5m times

Viswanath

To all – I have found a couple of minor issues in the code that need attention – I will post and update for this code in the next couple of days – I am a discretionary trader and don’t need scans etc but I will include an exploration for patterns before uploading it again. Please post any suggestions you may have for consideration. Thanx

DK

tigernifty,

You haven’t given any kind of description regarding the errors you are having. The fact that some people have downloaded the code and are not experiencing errors means the problem is with your installation. I suggest you look to see if any line wrapping has occurred, if it has then fix it. If you can’t find the problem then start at the top of the code and use /* to disable parts of the code. Start at the top and work your way down through the code until you find the problem. Hope this helps.

DK

Dear DK sir, thanks for ur reply,

am facing the problem in line 175. col 31 (too many arguments)

line 175 col. 62 (too many arguments)

line 318, col. 61 (too many arguments)

line 319, col. 61 (too many arguments) this is the error message,.

am waiting for ur help. thx…

Cell: 9842406366

Shall be highly obliged if u cud pls include buy and sell prices in the modified afl for amateur traders to get a complete understanding of the system.

dkeleher,

Please add buy/sell arrows and exploration as per your expertise & post here nirvana

Thanks

dkeleher sir,

could u give the details how to use the nirvana system i.e.,

1. when buy and sell

2. timeframe for intraday

Thanks.

For details pls vist http://xtrator.wordpress.com/category/amibroker/afl-amibroker/

Thanks for MODIFIED to simple, it is very use full to enter and exit.

Hello,

Can this system be used for EOD trading on stocks? Or is it designed for intraday trading

thankyou..mark

Dear Contributor of this AFL and Admin,

As some of us are not having a great background, a small note on the usage of this AFL can immensely benefit us please. Greatly obliged if this request could be accommodated. Regards, Vishnu Vandana

Thanks for the modified version of Nirvana.