Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

My Trend Master for Amibroker (AFL)

This is “My Trend Master V.1” trading system, developed by Rashed Chowdhry; You will require T3_include function and 2 more plugin ‘JurikLib’ and ‘kpami’

dll file to use this AFL. If you experience any problem of using it, plz contact me,,,rashedbgd@gmail.com;

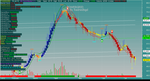

There are some combinations….all indicators of left-side are self-explanatory. Blue candle means..trend up, yellow candle means sideway AND red candle means down trend.

There are 2 trend detection line, will cross while falling OR rising, AND they will chanage their color,,,green means uptrend, red means downtrend.

There LRC too, upper-channel means danger zone and Lower channel area means safer zone. Middle line will change its color at changind any stock’s direction. Buy-sell arrow, support& resistance and pivot point is also visible. It works fine with me.

Enjoy !!!

Screenshots

Similar Indicators / Formulas

Indicator / Formula

/*

This is "My Trend Master V.1" trading system, developed by Rashed Chowdhry; You will require T3_include afl and 2 more plugin 'JurikLib' and 'kpami'

dll file to use this AFL. if you experience any problem Of using it, plz Contact me,,,rashedbgd@gmail.com;

There are some combinations....all indicator of left-side are self-explanatory. Blue candle means..trend up, yellow candle means sideway AND red candle means down trend.

There are 2 trend detection line, will Cross while falling OR rising, AND they will chanage their color,,,green means uptrend, red means downtrend.

There LRC too, upper-channel means danger zone AND Lower channel area means safer zone. Middle line will change its color at changind any stock's direction.

Enjoy !!! 16 July 2012.

*/

_SECTION_BEGIN("Trend Lines");

p1 = Param("TL 1 Periods", 20, 5, 50, 1);

p2 = Param("TL 2 Periods", 5, 3, 25, 1);

TL1 = LinearReg(C, p1);

TL2 = EMA(TL1, p2);

Col1 = IIf(TL1 > TL2, ParamColor("TL Up Colour", colorGreen), ParamColor("TL Dn Colour", colorRed));

Plot(TL1, "TriggerLine 1", Col1, styleLine|styleThick|styleNoLabel);

Plot(TL2, "TriggerLine 2", Col1, styleLine|styleThick|styleNoLabel);

Buy=Cross(TL1, TL2);

Sell = Cross(TL2, TL1);

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorGreen, 0, L, Offset=-40);

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorLime, 0,L, Offset=-50);

PlotShapes(IIf(Buy, shapeUpArrow, shapeNone),colorWhite, 0,L, Offset=-45);

PlotShapes(IIf(Sell, shapeSquare, shapeNone),colorRed, 0, H, Offset=40);

PlotShapes(IIf(Sell, shapeSquare, shapeNone),colorOrange, 0,H, Offset=50);

PlotShapes(IIf(Sell, shapeDownArrow, shapeNone),colorWhite, 0,H, Offset=-45);

_SECTION_END();

_SECTION_BEGIN("Rashedbgd");

SetChartOptions(0,chartShowArrows|chartShowDates);

//_N(Title = StrFormat("{{NAME}} - {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) Vol " +WriteVal( V, 1.0 ) +" {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 )) ));

SetChartBkGradientFill(ParamColor("Top", colorTeal), ParamColor("Bottom", colorLightGrey), ParamColor("Title", colorDarkOliveGreen));

SetChartBkColor(colorTeal);

SetChartOptions(0,chartShowArrows | chartShowDates);

P = ParamField("Price field",-1);

Length = 150;

Daysback = Param("Period for Liner Regression Line",Length,1,240,1);

shift = Param("Look back period",0,0,240,1);

x = Cum(1);

lastx = LastValue( x ) - shift;

aa = LastValue( Ref(LinRegIntercept( p, Daysback), -shift) );

bb = LastValue( Ref(LinRegSlope( p, Daysback ), -shift) );

y = Aa + bb * ( x - (Lastx - DaysBack +1 ) );

LRColor = ParamColor("LR Color", colorCycle );

LRStyle = ParamStyle("LR Style");

LRLine = IIf( x > (lastx - Daysback) AND BarIndex() < Lastx, y, Null );

LRStyle = ParamStyle("LR Style");

Angle = Param("Angle", 0.05, 0, 1.5, 0.01);// A slope higher than 0.05 radians will turn green, less than -0.05 will turn red and anything in between will be white.

LRLine = IIf( x > (lastx - Daysback) AND BarIndex() < Lastx, y, Null );

Pi = 3.14159265 * atan(1); // Pi

SlopeAngle = atan(bb)*(180/Pi);

LineUp = SlopeAngle > Angle;

LineDn = SlopeAngle < - Angle;

if(LineUp)

{

Plot(LRLine, "Lin. Reg. Line Up", IIf(LineUp, colorBrightGreen, colorWhite), LRStyle);

}

else

{

Plot(LRLine, "Lin. Reg. Line Down", IIf(LineDn, colorDarkRed, colorWhite), LRStyle);

}

SDP = Param("Standard Deviation", 1.5, 0, 6, 0.1);

SD = SDP/2;

width = LastValue( Ref(SD*StDev(p, Daysback),-shift) ); //Set width of inside chanels here.

SDU = IIf( x > (lastx - Daysback) AND BarIndex() < Lastx, y+width , Null ) ;

SDL = IIf( x > (lastx - Daysback) AND BarIndex() < Lastx, y-width , Null ) ;

SDColor = ParamColor("SD Color", colorCycle );

SDStyle = ParamStyle("SD Style");

Plot( SDU , "Upper Lin Reg", colorWhite,SDStyle ); //Inside Regression Lines

Plot( SDL , "Lower Lin Reg", colorWhite,SDStyle ); //Inside Regression Lines

SDP2 = Param("2d Standard Deviation", 2.0, 0, 6, 0.1);

SD2 = SDP2/2;

width2 = LastValue( Ref(SD2*StDev(p, Daysback),-shift) ); //Set width of outside chanels here.

SDU2 = IIf( x > (lastx - Daysback) AND BarIndex() < Lastx, y+width2 , Null ) ;

SDL2 = IIf( x > (lastx - Daysback) AND BarIndex() < Lastx, y-width2 , Null ) ;

SDColor2 = ParamColor("2 SD Color", colorCycle );

SDStyle2 = ParamStyle("2 SD Style");

Plot( SDU2 , "Upper Lin Reg", colorWhite,SDStyle2 );

Plot( SDL2 , "Lower Lin Reg", colorWhite,SDStyle2 );

Trend = IIf(LRLine > Ref(LRLine,-1),colorGreen,colorRed);

Plot( LRLine , "LinReg", Trend, LRSTYLE );

//============================ End Indicator Code =========

_SECTION_BEGIN("Haiken");

Show_color = ParamToggle("Display CandleColor", "No|Yes", 1);

r1 = Param( "ColorFast avg", 5, 2, 200, 1 );

r2 = Param( "ColorSlow avg", 10, 2, 200, 1 );

r3 = Param( "ColorSignal avg", 5, 2, 200, 1 );

Prd1=Param("ATR Period",4,1,20,1);

Prd2=Param("Look Back",7,1,20,1);

green = HHV(LLV(L,Prd1)+ATR(Prd1),Prd2);

red = LLV(HHV(H,Prd1)-ATR(Prd1),Prd2);

HaClose =EMA((O+H+L+C)/4,3); // Woodie

HaOpen = AMA( Ref( HaClose, -1 ), 0.5 );

HaHigh = Max( H, Max( HaClose, HaOpen ) );

HaLow = Min( L, Min( HaClose, HaOpen ) );

Temp = Max(High, HaOpen);

Temp = Min(Low,HaOpen);

m1=MACD(r1,r2);

s1=Signal(r1,r2,r3);

mycolor=IIf(m1<0 AND m1>s1, ColorRGB(230,230,0),IIf(m1>0 AND m1>s1,ColorRGB(0,0,100),IIf(m1>0 AND m1<s1,colorOrange,colorDarkRed)));

if(Show_color)

{

ColorHighliter = myColor;

SetBarFillColor( ColorHighliter );

}

//////////

m1=MACD(r1,r2);

s1=Signal(r1,r2,r3);

mycolor=IIf(m1<0 AND m1>s1, ColorRGB(230,230,0),IIf(m1>0 AND m1>s1,ColorRGB(0,0,100),IIf(m1>0 AND m1<s1,colorOrange,colorDarkRed)));

if(Show_color)

{

ColorHighliter = mycolor;

SetBarFillColor( ColorHighliter );

}

barColor=IIf(C>Green ,colorBlue,IIf(C < RED,colorRed,colorYellow));

barColor2=IIf(Close > Open, colorWhite, colorRed);

if( ParamToggle("Plot Normal Candle", "No,Yes", 1 ) )

PlotOHLC( HaOpen, HaHigh, HaLow, HaClose, " " , barcolor, styleCandle | styleThick );

else

PlotOHLC( Open, High, Low, Close, " " , barcolor2, styleCandle | styleThick );

_SECTION_END();

_SECTION_BEGIN("Line");

a = Param("Average Pds", 5, 1, 10, 1 );

n = Param("Short Pds", 8, 5, 21, 1 );

m = Param("Long Pds", 60, 0, 90, 1 );

Var4 =(Low+High+2*Close)/4;

OP = EMA(Var4,a);

res1 = HHV(OP,n);

res2 =HHV(OP,m);

sup2 =LLV(OP,m);

sup1 =LLV(OP,n);

Linecolor = IIf(Op==sup1,colorCustom12,IIf(Op==res1,10,7));

_SECTION_BEGIN("Rays1");

line=ParamToggle("Line","No|Yes",1);

if(line)

{

Pp1=Param("Ray_Period1",3,1,20,1);

Pp2=Param("ATR_Period1",4,1,20,1);

Cal=HHV(LLV(HaHigh,Pp1)-ATR(Pp2),5);

positive= Cross(HaClose,Cal);

negative=Cross(Cal,HaClose);

PlotShapes( IIf( positive, shapeHollowSmallCircle, shapeNone ), colorBrightGreen, layer = 0, yposition = HaLow, offset = -4);

PlotShapes( IIf( negative, shapeHollowSmallCircle, shapeNone ), colorRed, layer = 0, yposition = HaHigh, offset = 4);

}

_SECTION_END();

_SECTION_BEGIN("OsSetting");

Ovos = ParamToggle("Display_OVOS", "No|Yes", 0);

OBSetting=Param("Setting",40,1,500,1);

Bline = StochD(OBSetting);

Oversold=Bline<=30;

Overbought=Bline>=85;

if(Ovos)

{

PlotShapes (IIf(Oversold, shapeHollowSmallCircle, shapeNone) ,38, layer = 0, yposition = haLow, offset = -8 );

PlotShapes (IIf(Overbought, shapeHollowSmallCircle, shapeNone) ,colorBrown, layer = 0, yposition = haHigh, offset = 7 );

}

_SECTION_END();

_SECTION_BEGIN("TSKPPIVOT");

CHiPr = 0;

CLoPr = 9999999;

blsLong = 0;

PrevCOBar = 0;

NumBars = 0;

PrePP = 0;

PrevLowVal = 9999999;

BuySig = 0;

blsShort = 0;

PrevHiVal = 0;

blsNewCO = 0;

BarDif = 0;

KPA900Val = E_TSKPA900(Close);

KPAutoStopVal = E_TSKPAUTOSTOP(High,Low,Close);

// -- Create 0-initialized arrays the size of barcount

aHPivs = haHigh - haHigh;

aLPivs = haLow - haLow;

aHiVal = haHigh - haHigh;

aLoVal = haLow - haLow;

Ctmpl = E_TSKPCOLORTMPL(Open,High,Low,Close,Volume);

sctotal = 0;

sctotal = sctotal + IIf(tskp_colortmplcnd0 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd1 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd2 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd3 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd4 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd5 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd6 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd7 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd8 > 0, 1, -1);

for (curBar=0; curBar < BarCount-1; curBar++)

{

if ( curBar == 0 )

{

CHiPr = haHigh[curBar];

CHiBar = curBar;

CLoPr = haLow[curBar];

CLoBar = curBar;

blsLong = 0;

blsShort = 0;

blsNewCO = 0;

PrePP = 0;

PrevCOBar = 0;

PrevHiVal = haHigh[curBar];

PrevLowVal = haLow[curBar];

BuySig = 0;

SellSig = 0;

blsLL = 0;

}

if (haHigh[CurBar] >= CHiPr) {

CHiPr = haHigh[CurBar];

ChiBar = CurBar;

}

if (haLow[CurBar] <= CLoPr) {

CLoPr = haLow[CurBar];

CLoBar = CurBar;

}

if ( (KPA900Val[curBar] >= KPAutoStopVal[curbar]) AND (PrePP != -1) AND (blsLong != 1) ){

BarDif = CurBar - PrevCOBar;

if (BarDif >= NumBars) {

blsLong = 1;

blsShort = 0;

blsNewCO = 1;

PrevCOBar = CurBar;

}

}

if ( (KPA900Val[curBar] <= KPAutoStopVal[curbar]) AND (PrePP != 1) AND (blsShort != 1) ){

BarDif = CurBar - PrevCOBar;

if (BarDif >= NumBars) {

blsLong = 0;

blsShort = 1;

blsNewCO = 1;

PrevCOBar = CurBar;

}

}

if ( (blsNewCO == 1) AND (sctotal[CurBar] >= 5) AND (blsLong == 1) ) {

LVal = CurBar - CLoBar;

for (j= CLoBar-1; j <= CLoBar+1; j++)

{

if (j >=0) {

aLPivs[j] = 1;

aLoVal[j] = CLoPr;

}

}

PrePP = -1;

blsNewCO = 0;

CHiPr = haHigh[CurBar];

CHiBar = CurBar;

CLoPr = haLow[Curbar];

CLoBar = CurBar;

}

else if ((blsNewCO == 1) AND (sctotal[CurBar] <= -5) AND (blsShort == 1) ) {

HVal = CurBar - CHiBar;

for (j= CHiBar-1; j <= CHiBar+1; j++)

{

if (j >=0) {

aHPivs[j] = 1;

aHiVal[j] = CHiPr;

}

}

PrePP = 1;

blsNewCO = 0;

CHiPr = haHigh[CurBar];

CHiBar = CurBar;

CLoPr = haLow[Curbar];

CLoBar = CurBar;

}

}

PlotShapes(IIf(aHPivs == 1, shapeHollowSmallSquare,shapeNone), 25,0, aHiVal+0.05,Offset = 6);

PlotShapes(IIf(aLPivs == 1, shapeHollowSmallSquare,shapeNone), colorCustom11,0, aLoVal-0.05, Offset = -6);

_SECTION_END();

_SECTION_BEGIN("TSKPMoMo");

blsLong = 0;

KPStopLine = E_TSKPSTOPLINE(High,Low,Close);

// tskp_upsell, tskp_triggerline, tskp_triggerlinevma

sw = E_TSKPUPSELL(Open,High,Low,Close,Volume);

KPTriggerLine = tskp_triggerline;

KPFast3Val = IIf((E_TSKPFAST3(Open,High,Low,Close,Volume)> 0),1, -1);

//tskp_fast2val1, tskp_fast2val2

dummy = E_TSKPFAST2(Open,High,Low,Close,Volume);

KPFast2Val = IIf ((tskp_fast2val1 > 0),1,-1);

Ctmpl = E_TSKPCOLORTMPL(Open,High,Low,Close,Volume);

sctotal = 0;

sctotal = sctotal + IIf(tskp_colortmplcnd0 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd1 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd2 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd3 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd4 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd5 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd6 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd7 > 0, 1, -1);

sctotal = sctotal + IIf(tskp_colortmplcnd8 > 0, 1, -1);

// tskp_mediumma,tskp_mediumup,tskp_mediumdown

dummy = E_TSKPMEDIUM(Close);

KPMediumUP = tskp_mediumup;

KPMediumDwn = tskp_mediumdown;

KPMediumMA = tskp_mediumma;

// -- Create 0-initialized arrays the size of barcount

aHPivs = H - H;

aLPivs = L - L;

aHiVal = H - H;

aLoVal = L - L;

for (curBar=5; curBar < BarCount-1; curBar++)

{

if( (blsLong == -1) OR (blsLong == 0))

{

if ((sctotal[CurBar] >= 5) AND (KPMediumUP[CurBar] > KPMediumMA[CurBar] ) AND (KPFast3Val[CurBar] == 1) AND

(KPFast2Val[CurBar] == 1) AND (KPTriggerLine[CurBar] >= KPStopLine[CurBar] ))

{

blsLong = 1;

aLPivs[CurBar] = 1;

aLoVal[CurBar] = Low[CurBar];

}

}

if( (blsLong == 1) OR (blsLong == 0))

{

if ((sctotal[CurBar] <= -5) AND (KPMediumDwn[CurBar] < KPMediumMA[CurBar] ) AND (KPFast3Val[CurBar] == -1) AND

(KPFast2Val[CurBar] == -1) AND (KPTriggerLine[CurBar] <= KPStopLine[CurBar] ))

{

blsLong = -1;

aHPivs[Curbar] = 1;

aHiVal[Curbar] = High[Curbar];

}

}

if ((blsLong == 1) AND ((sctotal[CurBar] < 5) OR (KPMediumUP[CurBar] < KPMediumMA[CurBar] ) OR

(KPFast2Val[CurBar] < 1) OR (KPFast3Val[CurBar] < 1) OR (KPTriggerLine[CurBar] < KPStopLine[CurBar] )) )

{

blsLong= 0;

}

if ((blsLong == -1) AND ((sctotal[CurBar] > -5) OR (KPMediumDwn[CurBar] > KPMediumMA[CurBar] ) OR

(KPFast2Val[CurBar] > -1) OR (KPFast3Val[CurBar] > -1) OR

(KPTriggerLine[CurBar] > KPStopLine[CurBar] )) )

{

blsLong = 0;

}

}

PlotShapes (IIf(aHPivs == 1, shapeSmallCircle, shapeNone) ,colorOrange, layer = 0, yposition = haHigh, offset = 7 );

PlotShapes (IIf(aLPivs == 1, shapeSmallCircle, shapeNone) ,10, layer = 0, yposition = haLow, offset = -8 );

_SECTION_END();

_SECTION_BEGIN("Pivot");

nBars = Param("Number of bars", 12, 3, 40);

LP=Param("LookBack Period",150,1,500,1);

bShowTCZ = Param("Show TCZ", 0, 0, 1);

nExploreBarIdx = 0;

nExploreDate = 0;

nCurDateNum = 0;

DN = DateNum();

DT = DateTime();

bTCZLong = False;

bTCZShort = False;

nAnchorPivIdx = 0;

ADX8 = ADX(8);

if(Status("action")==1) {

bDraw = True;

bUseLastVis = 1;

} else {

bDraw = False;

bUseLastVis = False;

bTrace = 1;

nExploreDate = Status("rangetodate");

for (i=LastValue(BarIndex());i>=0;i--) {

nCurDateNum = DN[i];

if (nCurDateNum == nExploreDate) {

nExploreBarIdx = i;

}

}

}

if (bDraw) {

}

aHPivs = HaHigh - HaHigh;

aLPivs = HaLow - HaLow;

aHPivHighs = HaHigh - HaHigh;

aLPivLows = HaLow - HaLow;

aHPivIdxs = HaHigh - HaHigh;

aLPivIdxs = HaLow - HaLow;

aAddedHPivs = HaHigh - HaHigh;

aAddedLPivs = HaLow - HaLow;

aLegVol = HaHigh - HaHigh;

aRetrcVol = HaHigh - HaHigh;

nHPivs = 0;

nLPivs = 0;

lastHPIdx = 0;

lastLPIdx = 0;

lastHPH = 0;

lastLPL = 0;

curPivBarIdx = 0;

aHHVBars = HHVBars(HaHigh, nBars);

aLLVBars = LLVBars(HaLow, nBars);

aHHV = HHV(HaHigh, nBars);

aLLV = LLV(HaLow, nBars);

nLastVisBar = LastValue(

Highest(IIf(Status("barvisible"), BarIndex(), 0)));

curBar = IIf(nlastVisBar > 0 AND bUseLastVis, nlastVisBar,

IIf(Status("action")==4 AND nExploreBarIdx > 0, nExploreBarIdx,

LastValue(BarIndex())));

curTrend = "";

if (aLLVBars[curBar] < aHHVBars[curBar])

curTrend = "D";

else

curTrend = "U";

if (curBar >= LP) {

for (i=0; i<LP; i++) {

curBar = IIf(nlastVisBar > 0 AND bUseLastVis,

nlastVisBar-i,

IIf(Status("action")==4 AND nExploreBarIdx > 0,

nExploreBarIdx-i,

LastValue(BarIndex())-i));

if (aLLVBars[curBar] < aHHVBars[curBar]) {

if (curTrend == "U") {

curTrend = "D";

curPivBarIdx = curBar - aLLVBars[curBar];

aLPivs[curPivBarIdx] = 1;

aLPivLows[nLPivs] = HaLow[curPivBarIdx];

aLPivIdxs[nLPivs] = curPivBarIdx;

nLPivs++;

}

} else {

if (curTrend == "D") {

curTrend = "U";

curPivBarIdx = curBar - aHHVBars[curBar];

aHPivs[curPivBarIdx] = 1;

aHPivHighs[nHPivs] = HaHigh[curPivBarIdx];

aHPivIdxs[nHPivs] = curPivBarIdx;

nHPivs++;

}

}

}

}

curBar =

IIf(nlastVisBar > 0 AND bUseLastVis,

nlastVisBar,

IIf(Status("action")==4 AND nExploreBarIdx > 0,

nExploreBarIdx,

LastValue(BarIndex()))

);

if (nHPivs >= 2 AND nLPivs >= 2) {

lastLPIdx = aLPivIdxs[0];

lastLPL = aLPivLows[0];

lastHPIdx = aHPivIdxs[0];

lastHPH = aHPivHighs[0];

nLastHOrLPivIdx = Max(lastLPIdx, lastHPIdx);

nAddPivsRng = curBar - nLastHOrLPivIdx;

aLLVAfterLastPiv = LLV(HaLow, nAddPivsRng);

nLLVAfterLastPiv = aLLVAfterLastPiv[curBar];

aLLVIdxAfterLastPiv = LLVBars(HaLow, nAddPivsRng);

nLLVIdxAfterLastPiv = curBar - aLLVIdxAfterLastPiv[curBar];

aHHVAfterLastPiv = HHV(HaHigh, nAddPivsRng);

nHHVAfterLastPiv = aHHVAfterLastPiv[curBar];

aHHVIdxAfterLastPiv = HHVBars(HaHigh, nAddPivsRng);

nHHVIdxAfterLastPiv = curBar - aHHVIdxAfterLastPiv[curBar];

if (lastHPIdx > lastLPIdx) {

if (aHPivHighs[0] < aHPivHighs[1]) {

if (nLLVAfterLastPiv < aLPivLows[0] AND

(nLLVIdxAfterLastPiv - lastHPIdx - 1) >= 1

AND nLLVIdxAfterLastPiv != curBar ) {

aLPivs[nLLVIdxAfterLastPiv] = 1;

aAddedLPivs[nLLVIdxAfterLastPiv] = 1;

for (j=0; j<nLPivs; j++) {

aLPivLows[nLPivs-j] = aLPivLows[nLPivs-(j+1)];

aLPivIdxs[nLPivs-j] = aLPivIdxs[nLPivs-(j+1)];

}

aLPivLows[0] = nLLVAfterLastPiv;

aLPivIdxs[0] = nLLVIdxAfterLastPiv;

nLPivs++;

}

} else {

if (nLLVAfterLastPiv > aLPivLows[0] AND

(nLLVIdxAfterLastPiv - lastHPIdx - 1) >= 1

AND nLLVIdxAfterLastPiv != curBar ) {

aLPivs[nLLVIdxAfterLastPiv] = 1;

aAddedLPivs[nLLVIdxAfterLastPiv] = 1;

for (j=0; j<nLPivs; j++) {

aLPivLows[nLPivs-j] = aLPivLows[nLPivs-(j+1)];

aLPivIdxs[nLPivs-j] = aLPivIdxs[nLPivs-(j+1)];

}

aLPivLows[0] = nLLVAfterLastPiv;

aLPivIdxs[0] = nLLVIdxAfterLastPiv;

nLPivs++;

}

}

/* ****************************************************************

Still finding missed pivot(s). Here, the last piv is a low piv.

**************************************************************** */

} else {

// -- First case, lower highs

if (aHPivHighs[0] < aHPivHighs[1]) {

if (nHHVAfterLastPiv < aHPivHighs[0] AND

(nHHVIdxAfterLastPiv - lastLPIdx - 1) >= 1

AND nHHVIdxAfterLastPiv != curBar ) {

aHPivs[nHHVIdxAfterLastPiv] = 1;

aAddedHPivs[nHHVIdxAfterLastPiv] = 1;

for (j=0; j<nHPivs; j++) {

aHPivHighs[nHPivs-j] = aHPivHighs[nHPivs-(j+1)];

aHPivIdxs[nHPivs-j] = aHPivIdxs[nhPivs-(j+1)];

}

aHPivHighs[0] = nHHVAfterLastPiv;

aHPivIdxs[0] = nHHVIdxAfterLastPiv;

nHPivs++;

}

} else {

// -- Where I have higher highs,

if (nHHVAfterLastPiv > aHPivHighs[0] AND

(nHHVIdxAfterLastPiv - lastLPIdx - 1) >= 1

AND nHHVIdxAfterLastPiv != curBar ) {

aHPivs[nHHVIdxAfterLastPiv] = 1;

aAddedHPivs[nHHVIdxAfterLastPiv] = 1;

for (j=0; j<nHPivs; j++) {

aHPivHighs[nHPivs-j] = aHPivHighs[nHPivs-(j+1)];

aHPivIdxs[nHPivs-j] = aHPivIdxs[nhPivs-(j+1)];

}

aHPivHighs[0] = nHHVAfterLastPiv;

aHPivIdxs[0] = nHHVIdxAfterLastPiv;

nHPivs++;

}

}

}

}

/* ****************************************

// -- Done with finding pivots

***************************************** */

if (bDraw) {

PlotShapes( IIf(aAddedHPivs==1, shapeHollowSmallSquare, shapeNone), colorCustom12,layer = 0, yposition = HaHigh, offset = 13);

PlotShapes( IIf(aAddedLPivs==1, shapeHollowSmallSquare, shapeNone), colorYellow, layer = 0, yposition = HaLow, offset = -13);

}

// -- I'm going to want to look for possible retracement

risk = 0;

profInc = 0;

nLeg0Pts = 0;

nLeg0Bars = 0;

nLeg0Vol = 0;

nLeg1Pts = 0;

nLeg1Bars = 0;

nLeg1Vol = 0;

nLegBarsDiff = 0;

nRtrc0Pts = 0;

nRtrc0Bars = 0;

nRtrc0Vol = 0;

nRtrc1Pts = 0;

nRtrc1Bars = 0;

nRtrc1Vol = 0;

minRtrc = 0;

maxRtrc = 0;

minLine = 0;

maxLine = 0;

triggerLine = 0;

firstProfitLine = 0;

triggerInc = 0;

triggerPrc = 0;

firstProfitPrc = 0;

retrcPrc = 0;

retrcBar = 0;

retrcBarIdx = 0;

retrcRng = 0;

aRetrcPrc = HaHigh-HaHigh;

aRetrcPrcBars = HaHigh-HaHigh;

aRetrcClose = HaClose;

retrcClose = 0;

// -- Do TCZ calcs. Arrangement of pivs very specific

if (nHPivs >= 2 AND

nLPivs >=2 AND

aHPivHighs[0] > aHPivHighs[1] AND

aLPivLows[0] > aLPivLows[1]) {

tcz500 =

(aHPivHighs[0] -

(.5 * (aHPivHighs[0] - aLPivLows[1])));

tcz618 =

(aHPivHighs[0] -

(.618 * (aHPivHighs[0] - aLPivLows[1])));

tcz786 =

(aHPivHighs[0] -

(.786 * (aHPivHighs[0] - aLPivLows[0])));

retrcRng = curBar - aHPivIdxs[0];

aRetrcPrc = LLV(HaLow, retrcRng);

aRetrcPrcBars = LLVBars(HaLow, retrcRng);

retrcPrc = aRetrcPrc[curBar];

retrcBarIdx = curBar - aRetrcPrcBars[curBar];

retrcClose = aRetrcClose[retrcBarIdx];

bTCZLong = (

tcz500 >= (tcz786 * (1 - .005))

AND

tcz618 <= (tcz786 * (1 + .005))

AND

retrcClose >= ((1 - .01) * tcz618)

AND

retrcPrc <= ((1 + .01) * tcz500)

);

} else if (nHPivs >= 2 AND nLPivs >=2

AND aHPivHighs[0] < aHPivHighs[1]

AND aLPivLows[0] < aLPivLows[1]) {

tcz500 =

(aHPivHighs[1] -

(.5 * (aHPivHighs[1] - aLPivLows[0])));

tcz618 =

(aHPivHighs[0] -

(.618 * (aHPivHighs[1] - aLPivLows[0])));

tcz786 =

(aHPivHighs[0] -

(.786 * (aHPivHighs[0] - aLPivLows[0])));

retrcRng = curBar - aLPivIdxs[0];

aRetrcPrc = HHV(HaHigh, retrcRng);

retrcPrc = aRetrcPrc[curBar];

aRetrcPrcBars = HHVBars(HaHigh, retrcRng);

retrcBarIdx = curBar - aRetrcPrcBars[curBar];

retrcClose = aRetrcClose[retrcBarIdx];

bTCZShort = (

tcz500 <= (tcz786 * (1 + .005))

AND

tcz618 >= (tcz786 * (1 - .005))

AND

retrcClose <= ((1 + .01) * tcz618)

AND

retrcPrc >= ((1 - .01) * tcz500)

);

}

if (bTCZShort OR bTCZLong) {

if (bTCZShort) {

if (aLPivIdxs[0] > aHPivIdxs[0]) {

nRtrc0Pts = aHPivHighs[0] - aLPivLows[1];

nRtrc0Bars = aHPivIdxs[0] - aLPivIdxs[1] + 1;

nRtrc1Pts = retrcPrc - aLPivLows[0];

nRtrc1Bars = retrcBarIdx - aLPivIdxs[0] + 1;

} else {

nRtrc0Pts = aHPivHighs[1] - aLPivLows[1];

nRtrc0Bars = aHPivIdxs[1] - aLPivIdxs[1] + 1;

nRtrc1Pts = aHPivHighs[0] - aLPivLows[0];

nRtrc1Bars = aHPivIdxs[0] - aLPivIdxs[0] + 1;

}

} else { // bLongSetup

if (aLPivIdxs[0] > aHPivIdxs[0]) {

nRtrc0Pts = aHPivHighs[0] - aLPivLows[1];

nRtrc0Bars = aHPivIdxs[0] - aLPivIdxs[1] + 1;

nRtrc1Pts = retrcPrc - aLPivLows[0];

nRtrc1Bars = retrcBarIdx - aLPivIdxs[0] + 1;

} else {

nRtrc0Pts = aHPivHighs[1] - aLPivLows[0];

nRtrc0Bars = aLPivIdxs[0] - aHPivIdxs[1] + 1;

nRtrc1Pts = aHPivHighs[0] - aLPivLows[0];

nRtrc1Bars = aLPivIdxs[0] - aHPivIdxs[0] + 1;

}

}

if (bShowTCZ) {

Plot(

LineArray( IIf(bTCZLong, aHPivIdxs[0], aLPivIdxs[0]),

tcz500, curBar, tcz500 , 0),

"tcz500", colorPaleBlue, styleLine);

Plot(

LineArray( IIf(bTCZLong, aHPivIdxs[0], aLPivIdxs[0]),

tcz618, curBar, tcz618, 0),

"tcz618", colorPaleBlue, styleLine);

Plot(

LineArray( IIf(bTCZLong, aHPivIdxs[0], aLPivIdxs[0]),

tcz786, curBar, tcz786, 0),

"tcz786", colorTurquoise, styleLine);

}

// -- if (bShowTCZ)

}

_SECTION_END();

W52_High=WriteVal(HHV(H,260),1.2);

W52_Low=WriteVal(LLV(L,260),1.2);

Cg = Foreign("00DSEGEN", "C");

Cgo= Ref(Cg,-1);

//Longterm Bullish or Bearish

Bullg = Cg > WMA(Cg,200);

Bearg= Cg <WMA(Cg,200);

//Midterm Bullish or Bearish

mBullg = Cg >WMA(Cg,50);

mBearg= Cg <WMA(Cg,50);

//Shortterm Bullish or Bearish

sBullg = Cg >WMA(Cg,15);

sBearg= Cg <WMA(Cg,15);

////////////////////////////////

xChange1=Cg - Ref(Cg,-1);

Change1 = StrFormat("%1.2f% ",xChange1);

barche1= xChange1>=0;

Comche1= xChange1<0;

xperchange1 = xChange1/100;

perchange1 = StrFormat("%1.2f% ",xperchange1);

positivechange1 = xperchange1>0;

negativechange1 = xperchange1<0;

//=================Trend & Signals ===============================

#include <T3_Include.afl>;

Bull = C > WMA(C,200);

Bear= C <WMA(C,200);

mBull = C >WMA(C,50);

mBear= C <WMA(C,50);

sBull = C >WMA(C,15);

sBear= C <WMA(C,15);

//--------------------------------------------------------

//Long-term Price Trend(LTPT)

rc= C > EMA (C,50) AND C < EMA(C,200) AND EMA(C,50) < EMA(C,200);

ac= C > EMA (C,50) AND C > EMA(C,200) AND EMA(C,50) < EMA(C,200);

bl= C > EMA (C,50) AND C > EMA(C,200) AND EMA(C,50) > EMA(C,200);

wr= C < EMA (C,50) AND C > EMA(C,200) AND EMA(C,50) > EMA(C,200);

ds= C < EMA (C,50) AND C < EMA(C,200) AND EMA(C,50) > EMA(C,200);

br= C < EMA (C,50) AND C < EMA(C,200) AND EMA(C,50) < EMA(C,200);

//------------------------

//Trend Strength

_SECTION_BEGIN("JSB_Pic_DMX_3");

SetBarsRequired(100000, 100000);

JSB_InitLib();

range=Param( "Length ", 9, 0, 500);

aup = JSB_JDMX(C,range) > 0;

adown = JSB_JDMX(C,range) < 0;

achoppy = JSB_JDMX(C,range) < JSB_JDMXplus(C,range) AND JSB_JDMX(C,range) < JSB_JDMXminus(C,range);

adxBuy = Cross(JSB_JDMXplus(C,range), JSB_JDMXminus(C,range));

adxSell = Cross(JSB_JDMXminus(C,range), JSB_JDMXplus(C,range));

adxBuy = ExRem(adxBuy, adxSell);

adxSell = ExRem(adxSell, adxBuy);

adxbuy1 = JSB_JDMXplus(C,range) > JSB_JDMXminus(C,range);

adxsell1 = JSB_JDMXminus(C,range)> JSB_JDMXplus(C,range);

_SECTION_END();

_SECTION_BEGIN("Breakout Setting");

Buyperiods=Param("Breakout periods",5,1,100,1,1);

BuyBreakout= C>Ref(HHV(H,Buyperiods),-1);

Buyperiods2=Param("2 Breakout periods",17,1,100,1,1);

BuyBreakout2= Cross( C, Ref( HHV(H,Buyperiods2), -1 ) );

_SECTION_END();

HIV = C > Ref (C,-1) AND V > (MA(V,15)*2);

LIV = C < Ref (C,-1) AND V < (MA(V,15)*2);

//------------------------------------------------------------

//Initial Buy Signal

Ibuy = Cross(RSI(14), EMA(RSI(14),9));

Isell = Cross(EMA(RSI(14),9), RSI(14));

Ibuy = ExRem(Ibuy, ISell);

Isell = ExRem(ISell, Ibuy);

BlRSI = RSI(14) > EMA(RSI(14),9);

BrRSI = RSI(14) < EMA(RSI(14),9);

//PriceSmoothing -T3

TBuy = Cross (T3(C,3), T3(C,5));

TSell = Cross (T3(C,5), T3(C,3));

TBuy = ExRem(TBuy, TSell);

TSell = ExRem(TSell, TBuy);

T33 = T3(C,3) > T3(C,5);

T333 = T3(C,3) < T3(C,5);

//Tillson's Part (RSI Smoothing)

TillsonBuy = Cross (t3(RSI(9),3), t3(RSI(9),5));

TillsonSell = Cross (t3(RSI(9),5), t3(RSI(9),3));

TB = t3(RSI(9),3)> t3(RSI(9),5);

TS = t3(RSI(9),3)< t3(RSI(9),5);

//ZerolagEMA & T-3 Crosses

P = ParamField("Price field",-1);

Periods = Param("Periods", 4, 2, 200, 1, 10 );

EMA1=EMA(P,Periods);

EMA2=EMA(EMA1,Periods);

Difference=EMA1-EMA2;

ZerolagEMA=EMA1+Difference;

ebuy = Cross(ZerolagEma, t3(ZerolagEma,3));

esell = Cross(t3(ZerolagEma,3), ZerolagEma);

ebuy1 = ZerolagEma > t3(ZerolagEma,3);

esell1= t3(ZerolagEma,3)>ZerolagEma;

//Stochastics Part

StochKval = StochK(10,5);

StochDval = StochD(10,5,5);

StochBuy = Cross(StochK(10,5), StochD(10,5,5));

StochSell = Cross (StochD(10,5,5), StochK(10,5));

StBuy=StochK(10,5)>StochD(10,5,5);

StSell=StochK(10,5)<StochD(10,5,5);

///////////////////////////

//MACD Signal Crosses

MB= Cross (MACD(), Signal());

MS = Cross( Signal(), MACD());

MB = ExRem(MB, MS);

MS = ExRem(MS, MB);

MB1= MACD() > Signal();

MS1= MACD() < Signal();

//30 Week New High-New Low

HI2 = High > Ref(HHV(High,130),-1);

LI2 = Low < Ref(LLV(Low,130),-1);

HIV2=Ref(HHV(High,130),-1);

LIV2=Ref(LLV(Low,130),-1);

//52 Week New High-New Low

HI = High > Ref(HHV(High,260),-1);

LI = Low < Ref(LLV(Low,260),-1);

HIV1= Ref(HHV(High,260),-1);

LIV1=Ref(LLV(Low,260),-1);

TRH = IIf(Ref(C, -1) > H, Ref(C, -1), H);

TRL = IIf(Ref(C, -1) < L, Ref(C, -1), L);

ad = IIf(C > Ref(C, -1), C - TRL, IIf(C < Ref(C, -1), C - TRH, 0));

WAD = Cum(ad);

wu = wad > Ref(wad,-1);

wd = wad < Ref(wad,-1);

pdyear = Param("6-Month Back",1300,65,2600,65);

pdyear1=pdyear/260;

HI3 = High > Ref(HHV(High,pdyear),-1);

LI3 = Low < Ref(LLV(Low,pdyear),-1);

HIV3= Ref(HHV(High,pdyear),-1);

LIV3=Ref(LLV(Low,pdyear),-1);

R = ((HHV(H,14) - C) /(HHV (H,14) -LLV (L,14))) *-100;

MaxGraph=10;

Period= 10;

EMA1= EMA(R,Period);

EMA2= EMA(EMA1,5);

Difference= EMA1 - EMA2;

ZeroLagEMA= EMA1 + Difference;

PR=100-abs(ZeroLagEMA);

MoveAvg=MA(PR,5);

ZBuy = Cross(PR,moveAvg) AND PR<30;

ZSell = Cross(moveAvg,PR) AND PR>70;

ZBuy1= PR>= MoveAvg AND PR>= Ref(PR,-1) ;

ZSell1=(PR < MoveAvg) OR PR>= MoveAvg AND PR< Ref(PR,-1) ;

_SECTION_END();

CPRbuy=O<(L+0.2*(H-L)) AND C>(H-0.2*(H-L)) AND H<Ref(H,-1) AND L<Ref(L,-1) AND C>Ref(C,-1);

CPRsell=O>(L+0.8*(H-L)) AND C<(H-0.8*(H-L)) AND H>Ref(H,-1) AND L>Ref(L,-1) AND C<Ref(C,-1);

HRbuy=O<(L+0.2*(H-L)) AND C>(H-0.2*(H-L)) AND H<Ref(H,-1) AND L>Ref(L,-1);

HRsell=O>(L+0.8*(H-L)) AND C<(H-0.8*(H-L)) AND H<Ref(H,-1) AND L>Ref(L,-1);

IRbuy=Ref(L,-2)>Ref(H,-1) AND L>Ref(H,-1);

IRsell=Ref(H,-2)<Ref(L,-1) AND H<Ref(L,-1);

KRbuy=O<Ref(C,-1) AND L<Ref(L,-1) AND C>Ref(H,-1);

KRsell=O>Ref(C,-1) AND H>Ref(H,-1) AND C<Ref(L,-1);

OCRbuy=O<(L+0.2*(H-L)) AND C>(H-0.2*(H-L)) AND H<Ref(H,-1) AND L<Ref(L,-1) AND C<Ref(C,-1);

OCRsell=O>(L+0.8*(H-L)) AND C<(H-0.8*(H-L)) AND H>Ref(H,-1) AND L>Ref(L,-1) AND C>Ref(C,-1);

PPRbuy=Ref(L,-1)<Ref(L,-2) AND Ref(L,-1)<L AND C>Ref(H,-1);

PPRsell=Ref(H,-1)>Ref(H,-2) AND Ref(H,-1)>H AND C<Ref(L,-1);

Buyr=Cover=CPRbuy OR HRbuy OR IRbuy OR KRbuy OR OCRbuy OR PPRbuy;

Sellr=Short=CPRsell OR HRsell OR IRsell OR KRsell OR OCRsell OR PPRsell;

Buyr=ExRem(Buyr,Sellr); Sellr=ExRem(Sellr,Buyr); Short=ExRem(Short,Cover); Cover=ExRem(Cover,Short);

Filter= CPRbuy OR CPRsell OR HRbuy OR HRsell OR IRbuy OR IRsell OR KRbuy OR KRsell OR OCRbuy OR OCRsell OR PPRbuy OR PPRsell;

Filter=Buyr OR Sellr OR Short OR Cover;

//-----------------------------------------------------------------------------

p=Param("Cross Period 1",4,1,20,1); //4

MAp=T3(C,p);

k=Param("Cross Period 2",5,1,20,1);//6

MAk=T3(C,k);

y=p*T3(C,p)-(p-1)*Ref(T3(C,p-1),-1);

tClose=(p*(k-1)*T3(C,k-1)-k*(p-1)*T3(C,p-1))/(k-p);

DescCrossPrediction=Cross(tClose,C);

AscCrossPrediction=Cross(C,tClose);

ExpectMAcross=DescCrossPrediction OR AscCrossPrediction;

Confirmed=Cross(MAk,MAp) OR Cross(MAp,MAk);

UR=2*Highest(ROC(C,1));LR=2*Lowest(ROC(C,1));

Ucoeff=1+UR/100;Lcoeff=1+LR/100;

Filter=tClose<Lcoeff*C OR tClose>Ucoeff*C;

AddColumn(MAp,"MAp");

AddColumn(MAk,"MAk");

bars=BarsSince(Cross(MAp,MAk) OR Cross(MAk,MAp));

expect=NOT(Filter);

orBuy=AscCrossPrediction;

orSell=DescCrossPrediction;

orBuy1=(C>tClose);

orSell1=(tClose>C);

_SECTION_END();

//////////////////////////////////////////////////////////////////////////////

Vol=(ROC(V,1));

CP=(ROC(C,1));

_SECTION_BEGIN("Bull vs Bear Volume");

C1 = Ref(C, -1);

uc = C > C1; dc = C <= C1;

ud = C > O; dd = C <= O;

green = 1; blue = 2; yellow = 3; red = 4; white = 5;

VType = IIf(ud,

IIf(uc, green, yellow),

IIf(dd,

IIf(dc, red, blue), white));

gv = IIf(VType == green, V, 0);

yv = IIf(VType == yellow, V, 0);

rv = IIf(VType == red, V, 0);

bv = IIf(VType == blue, V, 0);

uv = gv + bv; uv1 = Ref(uv, -1); /* up volume */

dv = rv + yv; dv1 = Ref(dv, -1); /* down volume */

VolPer = Param("Adjust Vol. MA per.", 34, 1, 255, 1);

ConvPer = Param("Adjust Conv. MA per.", 9, 1, 255, 1);

MAuv = TEMA(uv, VolPer ); mauv1 = Ref(mauv, -1);

MAdv = TEMA(dv, VolPer ); madv1 = Ref(madv, -1);

MAtv = TEMA(V, VolPer );//total volume

OscillatorOnly = Param("Show Oscillator Only", 0, 0, 1, 1);

CompareBullVolume = Param("Show Bull Level", 1, 0, 1, 1);

if(CompareBullvolume AND !OscillatorOnly){

}

CompareBearVolume = Param("Show Bear Level", 1, 0, 1, 1);

if(CompareBearVolume AND !OscillatorOnly){

}

bullvolume = Param("Show Bull Volume", 1, 0, 1, 1);

bearvolume = Param("Show Bear Volume", 1, 0, 1, 1);

totalvolume = Param("Show Total Volume", 1, 0, 1, 1);

bearToFront = Param("Show Bear Vol in Front", 0, 0, 1, 1);

if(bearToFront AND !OscillatorOnly){

}

if(bullvolume AND !OscillatorOnly){

}

if(bearvolume AND !OscillatorOnly){

}

if(totalVolume AND !OscillatorOnly){

}

if(bullvolume AND !OscillatorOnly){

}

if(bearvolume AND !OscillatorOnly){

}

Converge = (TEMA(MAuv - MAdv, ConvPer));

Converge1 = Ref(Converge, -1);

ConvergeUp = Converge > Converge1;

ConvergeOver = Converge > 0;

rising = ConvergeUp AND ConvergeOver;

falling = !ConvergeUp AND ConvergeOver;

convergenceOscillator = Param("Show Oscillator", 0, 0, 1, 1);

if(convergenceOscillator OR OscillatorOnly){

}

riseFallColor = IIf(rising, 14,15); //my custom shadow greys

riseFallShadows = Param("Show RiseFallShadows", 0, 0, 1, 1);

if(riseFallShadows){

}

_SECTION_END();

_SECTION_BEGIN("Haiken-Ashi");

function ZeroLagTEMA( array, period )

{

TMA1 = TEMA( array, period );

TMA2 = TEMA( TMA1, period );

Diff = TMA1 - TMA2;

return TMA1 + Diff ;

}

haClose = ( haClose + haOpen + haHigh + haLow )/4;

period = Param("Avg. TEMA period", 55, 1, 100 );

ZLHa = ZeroLagTEMA( haClose, period );

ZLTyp = ZeroLagTEMA( Avg, period );

TMBuy = Cross( ZLTyp, ZLHa );

TMSell = Cross( ZLHa, ZLTyp );

TMBuy1= ZLTyp> ZLHa ;

TMSell1=ZLHa> ZLTyp ;

_SECTION_END();

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////

//Volume Price Analysis AFL - VPA Version 1.0

//AFL by Karthikmarar. Detailed explanation available at www.vpanalysis.blogspot.com

//====================================================================================

_SECTION_BEGIN("Volume Price Analysis by Mr.Karthik ");

SetChartOptions(0,chartShowArrows|chartShowDates);

//=======================================================================================

DTL=Param("Linear regression period",60,10,100,10);

wbf=Param("WRB factor",1.5,1.3,2.5,.1);

nbf=Param("NRB factor",0.7,0.3,0.9,0.1);

TL=LinRegSlope(MA(C, DTL),2);

Vlp=Param("Volume lookback period",30,20,300,10);

Vrg=MA(V,Vlp);

St = StDev(Vrg,Vlp);

Vp3 = Vrg + 3*st;

Vp2 = Vrg + 2*st;;

Vp1 = Vrg + 1*st;;

Vn1 = Vrg -1*st;

Vn2 = Vrg -2*st;

rg=(H-L);

arg=Wilders(rg,30);

wrb=rg>(wbf*arg);

nrb=rg<(nbf*arg);

Vl=V<Ref(V,-1) AND V<Ref(V,-2);

upbar=C>Ref(C,-1);

dnbar=C<Ref(C,-1);

Vh=V>Ref(V,-1) AND Ref(V,-1)>Ref(V,-2);

Cloc=C-L;

x=rg/Cloc;

x1=IIf(Cloc==0,arg,x);

Vb=V>Vrg OR V>Ref(V,-1);

ucls=x1<2;

dcls=x1>2;

mcls=x1<2.2 AND x1>1.8 ;

Vlcls=x1>4;

Vhcls=x1<1.35;

j=MA(C,5);

TLL=LinRegSlope(j,40) ;

Tlm=LinRegSlope(j,15) ;

tls=LinRegSlope(j,5);

mp=(H+L)/2;

_SECTION_END();

//==========================================================================================

utbar=wrb AND dcls AND tls>0 ;

utcond1=Ref(utbar,-1) AND dnbar ;

utcond2=Ref(utbar,-1) AND dnbar AND V>Ref(V,-1);

utcond3=utbar AND V> 2*Vrg;

trbar=Ref(V,-1)>Vrg AND Ref(upbar,-1) AND Ref(wrb,-1) AND dnbar AND dcls AND wrb AND tll>0 AND H==HHV(H,10);

Hutbar=Ref(upbar,-1) AND Ref(V,-1)>1.5*Vrg AND dnbar AND dcls AND NOT wrb AND NOT utbar;

Hutcond=Ref(Hutbar,-1) AND dnbar AND dcls AND NOT utbar;

tcbar=Ref(upbar,-1) AND H==HHV(H,5)AND dnbar AND (dcls OR mcls) AND V>vrg AND NOT wrb AND NOT Hutbar ;

Scond1=(utcond1 OR utcond2 OR utcond3) ;

Scond2=Ref(scond1,-1)==0;

scond=scond1 AND scond2;

stdn0= tll<0 AND V>Ref(V,-1) AND Ref(dnbar,-1) AND upbar AND (ucls OR mcls) AND tls<0 AND tlm<0;

stdn= V>Ref(V,-1) AND Ref(dnbar,-1) AND upbar AND (ucls OR mcls) AND tls<0 AND tlm<0;

stdn1= tll<0 AND V>(vrg*1.5) AND Ref(dnbar,-1) AND upbar AND (ucls OR mcls)AND tls<0 AND tlm<0;

stdn2=tls<0 AND Ref(V,-1)<Vrg AND upbar AND vhcls AND V>Vrg;

bycond1= stdn OR stdn1;

bycond= upbar AND Ref(bycond1,-1);

stvol= L==LLV(L,5) AND (ucls OR mcls) AND V>1.5*Vrg AND tll<0;

ndbar=upbar AND nrb AND Vl AND dcls ;

nsbar=dnbar AND nrb AND Vl AND dcls ;

nbbar= C>Ref(C,-1) AND Vl AND nrb AND x1<2;

nbbar= IIf(C>Ref(C,-1) AND V<Ref(V,-1) AND V<Ref(V,-2) AND x1<1.1,1,0);

lvtbar= vl AND L<Ref(L,-1) AND ucls;

lvtbar1= V<Vrg AND L<Ref(L,-1) AND ucls AND tll>0 AND tlm>0 AND wrb;

lvtbar2= Ref(Lvtbar,-1) AND upbar AND ucls;

dbar= V>2*Vrg AND dcls AND upbar AND tls>0 AND tlm>0 AND NOT Scond1 AND NOT utbar;

eftup=H>Ref(H,-1) AND L>Ref(L,-1) AND C>Ref(C,-1) AND C>=((H-L)*0.7+L) AND rg>arg AND V>Ref(V,-1);

eftupfl=Ref(eftup,-1) AND (utbar OR utcond1 OR utcond2 OR utcond3);

eftdn=H<Ref(H,-1) AND L<Ref(L,-1) AND C<Ref(C,-1) AND C<=((H-L)*0.25+L) AND rg>arg AND V>Ref(V,-1);

_SECTION_END();

_SECTION_BEGIN("Commentary");

Vpc= utbar OR utcond1 OR utcond2 OR utcond3 OR stdn0 OR stdn1 OR stdn2 OR stdn OR lvtbar1 OR Lvtbar OR Lvtbar2 OR Hutbar OR Hutcond OR ndbar OR stvol OR tcbar;

if( Status("action") == actionCommentary )

(

printf ( "=========================" +"\n"));

printf ( "VOLUME PRICE ANALYSIS" +"\n");

//printf ( "www.vpanalysis.blogspot.com" +"\n");

printf ( "=========================" +"\n");

printf ( Name() + " - " +Interval(2) + " - " + Date() +" - " +"\n"+"High-"+H+"\n"+"Low-"+L+"\n"+"Open-"+O+"\n"+

"Close-"+C+"\n"+ "Volume= "+ WriteVal(V)+"\n");

WriteIf(Vpc,"=======================","");

WriteIf(Vpc,"VOLUME ANALYSIS COMMENTARY:\n","");

WriteIf(utbar , "Up-thrusts are designed to catch stops and to mislead as many traders as possible.

They are normally seen after there has been weakness in the background. The market makers know that the

market is weak, so the price is marked up to catch stops, encourage traders to go long in a weak market,

AND panic traders that are already Short into covering their very good position.","")+

WriteIf(utcond3,"This upthrust bar is at high volume.This is a sure sign of weakness. One may even seriously

consider ending the Longs AND be ready to reverse","")+WriteIf(utbar OR utcond3," Also note that A wide spread

down-bar that appears immediately after any up-thrust, tends to confirm the weakness (the market makers are

locking in traders into poor positions). With the appearance of an upthrust you should certainly be paying attention to your trade AND your stops. On many upthrusts you will find that the market will

'test' almost immediately.","")+WriteIf(utcond1 , "A wide spread down bar following a Upthrust Bar. This confirms weakness. The Smart Money is locking in Traders into poor positions","");

WriteIf(utcond2 , "Also here the volume is high( Above Average).This is a sure sign of weakness. The Smart Money is

locking in Traders into poor positions","")+ WriteIf(stdn, "Strength Bar. The stock has been in a down Trend. An upbar

with higher Volume closing near the High is a sign of strength returning. The downtrend is likely to reverse soon. ","")+

WriteIf(stdn1,"Here the volume is very much above average. This makes this indication more stronger. ","")+

WriteIf(bycond,"The previous bar saw strength coming back. This upbar confirms strength. ","")+

WriteIf(Hutbar," A pseudo Upthrust. This normally appears after an Up Bar with above average volume. This looks like an upthrust bar

closing down near the Low. But the Volume is normally Lower than average. this is a sign of weakness.If the Volume is High then weakness

increases. Smart Money is trying to trap the retailers into bad position. ","")+

WriteIf(Hutcond, "A downbar after a pseudo Upthrust Confirms weakness. If the volume is above average the weakness is increased. ","")+

WriteIf(Lvtbar2,"The previous bar was a successful Test of supply. The current bar is a upbar with higher volume. This confirms strength","")+

WriteIf(dbar,"A wide range, high volume bar in a up trend closing down is an indication the Distribution is in progress. The smart money

is Selling the stock to the late Comers rushing to Buy the stock NOT to be Left Out Of a Bullish move. ","")+

WriteIf(Lvtbar2,"The previous bar was a successful Test of supply. The current bar is a upbar with higher volume. This confirms strength","")+

WriteIf(tcbar,"The stock has been moving up on high volume. The current bar is a Downbar with high volume. Indicates weakness and probably end of the up move","")+

WriteIf(eftup,"Effort to Rise bar. This normally found in the beginning of a Markup Phase and is bullish sign.These may be found at the top of an Upmove as the Smart money makes a

last effort to move the price to the maximum","")+

WriteIf(eftdn,"Effort to Fall bar. This normally found in the beginning of a Markdown phase.","")+

WriteIf(nsbar,"No Supply. A no supply bar indicates supply has been removed and the Smart money can markup the price. It is better to wait for confirmation","")+

WriteIf(stvol,"Stopping Volume. This will be an downbar during a bearish period closing towards the Top accompanied by High volume.

A stopping Volume normally indicates that smart money is absorbing the supply which is a Indication that they are Bullishon the MArket.

Hence we Can expect a reversal in the down trend. ","")+

WriteIf(ndbar, "No Demand

Brief Description:

Any up bar which closes in the middle OR Low, especially if the Volume has fallen off,

is a potential sign of weakness.

Things to Look Out for:

if the market is still strong, you will normally see signs of strength in the next few bars,

which will most probably show itself as a:

* Down bar with a narrow spread, closing in the middle OR High.

* Down bar on Low Volume.","");

_SECTION_END();

//=====================================================================

//background stock name (works only on Amibroker version 5.00 onwards.

//=====================================================================

_SECTION_BEGIN("Mabiuts-Mr.Karthik");

mabBuy=EMA(C,13)>EMA(EMA(C,13),9) AND Cross (C,Peak(C,5,1));

mabSell=Cross (EMA(EMA(C,13),9),EMA(C,13));

mabBuy1= EMA(C,13)>EMA(EMA(C,13),9) AND C>Peak(C,2,1);

mabSell1 =EMA(C,13)>EMA(EMA(C,13),9) AND C<Peak(C,2,1);

_SECTION_END();

//------------------------------------------------------------------------------

//WEEKLY TREND

weeklyprice=C;

Weekly=ValueWhen(DayOfWeek() > Ref( DayOfWeek(),1),WeeklyPrice);

W6ema = EMA(weekly,30);// 6 weeks * 5 days per week - default 30

W13ema = EMA(weekly,65);// 13 weeks * 5 days per week - default 65

MACDSignal = EMA((W6ema - W13ema),25);// 5 weeks * 5 days per week default 25

ROCMACD = MACDSignal - Ref(MACDSignal,-25);//ROC of MACD Signal default 25

//Cond1 - "V" bottom, start of climb

Cond1 = IIf(ROCMACD > Ref(ROCMACD,-5) AND Ref(ROCMACD,-5) <= Ref(ROCMACD,-10),1,0);

//Cond2 - "V" top, start of drop

Cond2 = IIf(ROCMACD < Ref(ROCMACD,-5) AND Ref(ROCMACD,-5) >= Ref(ROCMACD,-10),1,0);

//cond3 - Steady up trend

Cond3 = IIf(ROCMACD> Ref(ROCMACD,-5) AND Ref(ROCMACD,-5) >= Ref(ROCMACD,-10),1,0);

//Cond4 - Steady down trend

Cond4 = IIf(ROCMACD < Ref(ROCMACD,-5) AND Ref(ROCMACD,-5) <= Ref(ROCMACD,-10),1,0);

//Cond5 - no change - flat

Cond5 = IIf(ROCMACD == Ref(ROCMACD,-5) ,1,0);

/////////////////////////////////////////////////////////////

_SECTION_END();

_SECTION_BEGIN("Weekly_trend-mrtq13");

Prd1=Param("Weekly_Period1",3,1,200,1);

Prd2=Param("Weekly_Period2",5,1,200,1);

TimeFrameSet (inWeekly);

TM = T3 ( Close , Prd1 ) ;

TM2 = T3 ( Close , Prd2 ) ;

UTM = IIf(Close>TM AND Close<TM2,8,

IIf(Close>TM AND Close>TM2,5,

IIf(Close<TM AND Close>TM2,13,

IIf(Close<TM AND Close<TM2,4,2))));

//up=Close>TM AND Close<TM2;

wup=Close>TM AND Close>TM2;

wflat=Close<TM AND Close>TM2;

wdown=Close<TM AND Close<TM2;

TimeFrameRestore();

_SECTION_END();

//Pivot Cal

Pp = ((High +Low + Close) / 3);

R1 = (Pp * 2) - Low;

R2 = (Pp + High) - Low;

R3 = R1 +(High-Low);

S1 = (Pp * 2) - High;

S2 = (Pp - High) + Low;

S3 = S1 - (High-Low);

_SECTION_BEGIN("Spiker_Shadow");

C1 = Ref(C, -1);

uc = C > C1; dc = C <= C1;

ud = C > O; dd = C <= O;

green = 1; blue = 2; yellow = 3; red = 4; white = 5;

VType = IIf(ud,

IIf(uc, green, yellow),

IIf(dd,

IIf(dc, red, blue), white));

/* green volume: up-day and up-close*/

gv = IIf(VType == green, V, 0);

/* yellow volume: up-day but down-close */

yv = IIf(VType == yellow, V, 0);

/* red volume: down-day and down-close */

rv = IIf(VType == red, V, 0);

/* blue volume: down-day but up-close */

bv = IIf(VType == blue, V, 0);

uv = gv + bv; uv1 = Ref(uv, -1); /* up volume */

dv = rv + yv; dv1 = Ref(dv, -1); /* down volume */

VolPer = Param("Adjust Vol. MA per.", 34, 1, 255, 1);//12

ConvPer = Param("Adjust Conv. MA per.", 9, 1, 255, 1);//6

MAuv = TEMA(uv, VolPer ); mauv1 = Ref(mauv, -1);

MAdv = TEMA(dv, VolPer ); madv1 = Ref(madv, -1);

MAtv = TEMA(V, VolPer );//total volume

Converge = (TEMA(MAuv - MAdv, ConvPer));

Converge1 = Ref(Converge, -1);

ConvergeUp = Converge > Converge1;

ConvergeOver = Converge > 0;

rising = ConvergeUp AND ConvergeOver;

falling = !ConvergeUp AND ConvergeOver;

_SECTION_END();

_SECTION_BEGIN("VSA by Mr.Karthik");

Pp1=Param("NumberOfDays",30,1,200,1);

Pp2=Param("VolOfDays",15,1,200,1);

numDays = Pp1;

dwWideSpread = 1.8;

dwNarrowSpread = 0.8;

dwSpreadMiddle = 0.5;

dwHighClose = 0.7;

dwLowClose = 0.3;

volNumDays = Pp2;

dwUltraHighVol = 2;

dwVeryHighVol = 1.75; // was 1.8

dwHighVol = 1.75; // was 1.8

dwmoderateVol = 1.10; // was 1.8

dwLowVol = 0.75; // was 0.8

////////////////////////////////////////////////////////////////////////////////////

//

// Classify each bar...

//

////////////////////////////////////////////////////////////////////////////////////

upBar = C > Ref(C,-1);

downBar = C < Ref(C,-1);

spread = H-L;

avgRange = Sum(spread, numDays) / numDays;

wideRange = spread >= (dwWideSpread * avgRange);

narrowRange = spread <= (dwNarrowSpread * avgRange);

testHighClose = L + (spread * dwHighClose);

testLowClose = L + (spread * dwLowClose);

testCloseMiddle = L + (spread * dwSpreadMiddle);

upClose = C > testHighClose;

downClose = C < testLowClose;

middleClose = C >= testLowClose AND C <= testHighClose;

avgVolume = EMA(V, volNumDays);

highVolume = V > (avgVolume * dwHighVol);

moderateVol= V > (avgVolume * dwmoderateVol);

veryHighVolume = V > (avgVolume * dwVeryHighVol);

ultraHighVolume = V > (avgVolume * dwUltraHighVol);

LowVolume = V < (avgVolume * dwLowVol);

////////////////////////////////////////////////////////////////////////////////////

//

// Basic patterns...

//

////////////////////////////////////////////////////////////////////////////////////

upThrustBar = downClose AND H > Ref(H,-1) AND (C == L) AND downClose AND (NOT narrowRange);

noDemandBar = narrowRange AND LowVolume AND upBar AND (NOT upClose);

//noDemandBar = narrowRange AND LowVolume AND upBar AND (V < Ref(V,-1)) AND (V < Ref(V,-2));

noSupplyBar = narrowRange AND LowVolume AND downBar AND (V < Ref(V,-1)) AND (V < Ref(V,-2));

absorption = Ref(downbar, -1) AND Ref(highVolume, -1) AND upBar;

support = Ref(downBar,-1) AND (NOT Ref(downClose,-1)) AND Ref(highVolume,-1) AND upBar;

stoppingVolume = Ref(downBar,-1) AND Ref(highVolume,-1) AND C > testCloseMiddle AND (NOT downBar);

bullishsign=moderateVol+UpThrustBar;

////////////////////////////////////////////////////////////////////////////////////

//

// Strength and Weakness

//

////////////////////////////////////////////////////////////////////////////////////

weakness = upThrustBar OR noDemandBar OR

(narrowRange AND (H > Ref(H,-1)) AND highVolume) OR

(Ref(highVolume,-1) AND Ref(upBar,-1) AND downBar AND (H < Ref(H,-1)));

_SECTION_END();

_SECTION_BEGIN("Pivot Box");

Hi=Param("High_Period",7,1,50,1);

Lo=Param("Low_Period",7,1,50,1);

A1=ExRemSpan(Ref(High,-2)==HHV(High,Hi),3);

A2=ExRemSpan(Ref(Low,-2)==LLV(Low,Lo),3);

A3=Cross(A1,0.9);

A4=Cross(A2,0.9);

TOP=Ref(haHigh,-BarsSince(A3));

YY1=TOP;

bot=Ref(haLow,-BarsSince(A4));

XX1=bot;

// 33 bar high low

HIVg=Ref(HHV(High,33),1);

LIVg=Ref(LLV(Low,33),1);

Hchg=(C-HIVg)/HIVg*100;

Lchg=(C-LIVg)/LIVg*100;

Echg=(HIVg-C)/C*100;

_SECTION_END();

_SECTION_BEGIN("Trend");

// Trend Detection

function Rise( Pd, perd, Pl, perl )

{

MAD = DEMA(Pd,perd);

MAL = LinearReg(Pl,perl);

CondR = ROC(MAD,1)>0 AND ROC(MAL,1)>0;

CondF = ROC(MAD,1)<0 AND ROC(MAL,1)<0;

R[0] = C[0]>(H[0]+L[0])/2;

for(i=1;i<BarCount;i++)

{

if( CondR[i] )

{

R[i] = 1;

}

else

{

if( CondF[i] )

{

R[i] = 0;

}

else

{

R[i] = R[i-1];

}

}

}

return R;

}

PrD = C;

PrL = H/2+L/2;

PrdD = PrdL = PrdM = Param("Prd",12,2,40,1);

permax = Max(prdd,prdl);

Rs = IIf( BarIndex()<permax, 0, Rise(PrD, PrdD, PrL, PrdL) );

Fs = IIf( BarIndex()<permax, 0, 1-Rs );

Confirm = MA(C,prdm);

function DirBar( dr, df )

{

B[0] = 0;

for(i=1;i<BarCount;i++)

{

if( dr[i-1] && df[i] )

{

B[i] = 1;

}

else

{

if( df[i-1] && dr[i] )

{

B[i] = 1;

}

else

{

B[i] = B[i-1] + 1;

}

}

}

return B;

}

Bs = DirBar( Rs, Fs );

Direction = ROC(Confirm,1) > 0 AND ROC(Confirm,5) > 0;

Downward = ROC(Confirm,1) < 0 AND ROC(Confirm,5) < 0;

Select = Rs AND Ref(Fs,-1);

Caution = Fs AND Ref(Rs,-1);

_SECTION_END();

Chg=Ref(C,-1);

Title = EncodeColor(colorYellow)+ Title = Name() + " " + EncodeColor(2) + Date() +EncodeColor(11)+ " ~My Trend Master V.1~ " + EncodeColor(colorWhite) + "{{INTERVAL}} " +

EncodeColor(55)+ " Open: "+ EncodeColor(colorWhite)+ WriteVal(O,format=1.2) +

EncodeColor(55)+ " High: "+ EncodeColor(colorWhite) + WriteVal(H,format=1.2) +

EncodeColor(55)+ " Low: "+ EncodeColor(colorWhite)+ WriteVal(L,format=1.2) +

EncodeColor(55)+ " Close: "+ WriteIf(C> Chg,EncodeColor(colorBrightGreen),EncodeColor(colorRed))+ WriteVal(C,format=1.2)+

EncodeColor(55)+ " Change: "+ WriteIf(C> Chg,EncodeColor(colorBrightGreen),EncodeColor(colorRed))+ WriteVal(ROC(C,1),format=1.2)+ "%"+

EncodeColor(55)+ " Volume: "+ EncodeColor(colorWhite)+ WriteVal(V,1)

+EncodeColor(colorWhite) + " G.Index: "+ WriteIf(Cg>Cgo,EncodeColor(08),EncodeColor(04))+WriteVal(Cg,format=1.2)+WriteIf(positivechange1, EncodeColor(colorBrightGreen),"")+WriteIf(negativechange1,EncodeColor(colorRed), "")+" ( "+WriteIf(barche1,"\\c08"+Change1,"")+WriteIf(barche1,"\\c08 ","")+WriteIf(Comche1,"\\c04"+Change1,"")+ WriteIf(Comche1,"\\c04 ","")+""+") "

+"\n"+EncodeColor(colorWhite)+"Market Trend: "+ WriteIf(sBullg,EncodeColor(colorBrightGreen)+"UP",WriteIf(sBearg,EncodeColor(colorRed)+"Dwn",EncodeColor(colorYellow)+"Flat"))

+EncodeColor(colorWhite) + " | "

+ WriteIf(mBullg,EncodeColor(colorBrightGreen)+"UP",WriteIf(mBearg,EncodeColor(colorRed)+"Dwn",EncodeColor(colorYellow)+"Flat"))

+EncodeColor(colorWhite) + " | "

+ WriteIf(Bullg,EncodeColor(colorBrightGreen)+"UP",WriteIf(Bearg,EncodeColor(colorRed)+"Dwn",EncodeColor(colorYellow)+"Flat"))

+"\n"+EncodeColor(41)+"WeeklyTrend: " +WriteIf(wup,EncodeColor(colorBrightGreen)+"Up ", WriteIf(wdown,EncodeColor(colorRed)+"Down", WriteIf(wflat,EncodeColor(colorWhite)+"Flat ","")))

+EncodeColor(colorWhite)

+"\n"+EncodeColor(26)+"S.TermTrend: " + WriteIf(sBull,EncodeColor(colorBrightGreen)+"UP",WriteIf(sBear,EncodeColor(colorRed)+"Down","Neutral"))

+EncodeColor(colorWhite) + " | "

+WriteIf(Rs,EncodeColor(colorBrightGreen)+"UP",WriteIf(Fs,EncodeColor(colorRed)+"Down","Neutral"))

+EncodeColor(26)+"M.TermTrend: " + WriteIf(mBull,EncodeColor(colorBrightGreen)+"UP",WriteIf(mBear,EncodeColor(colorRed)+"Down","Neutral"))

+EncodeColor(colorWhite) + " | " +WriteIf(tlm>0,EncodeColor(colorLime)+"UP",EncodeColor(colorRed)+"Down")

+"\n"+EncodeColor(26)+"L.TermTrend: " + WriteIf(Bull,EncodeColor(colorBrightGreen)+"UP",WriteIf(Bear,EncodeColor(colorRed)+"Down","Neutral"))

+EncodeColor(colorWhite) + " | " +WriteIf(tll>0,EncodeColor(colorLime)+"Up",EncodeColor(colorRed)+"Down")

+"\n"+EncodeColor(colorPink)+"---------------------------------------- "

+"\n"+EncodeColor(47)+"Signal(IBuy): " + WriteIf(Ibuy,EncodeColor(colorBrightGreen)+"BuyWarning",WriteIf(Isell,EncodeColor(colorRed)+"SellWarning",WriteIf(BlRSI,EncodeColor(colorBrightGreen)+"BullishZone",WriteIf(BrRSI,EncodeColor(colorRed)+"BearishZone","Neutral"))))

+"\n"+EncodeColor(47)+"Signal(T3) : " + WriteIf(TBuy,EncodeColor(colorBrightGreen)+"Buy",WriteIf(TSell,EncodeColor(colorRed)+"Sell",WriteIf(T33,EncodeColor(colorBrightGreen)+"Bullish",WriteIf(T333,EncodeColor(colorRed)+"Bearish","Neutral"))))

+"\n"+EncodeColor(47)+"Signal(ZLW) : " + WriteIf(ZBuy,EncodeColor(colorBrightGreen)+"Buy",WriteIf(ZSell,EncodeColor(colorRed)+"Sell",WriteIf(ZBuy1,EncodeColor(colorBrightGreen)+"Bullish",WriteIf(ZSell1,EncodeColor(colorRed)+"Bearish","Neutral"))))

+"\n"+EncodeColor(47)+"Signal(Mab) : " + WriteIf(mabBuy,EncodeColor(colorBrightGreen)+"Buy",WriteIf(mabSell,EncodeColor(colorRed)+"Sell",WriteIf(mabBuy1,EncodeColor(colorBrightGreen)+"Bullish",WriteIf(mabSell1,EncodeColor(47)+"Neutral",EncodeColor(colorRed)+"Bearish"))))

+"\n"+EncodeColor(47)+"Signal(TMA) : " + WriteIf(TMBuy,EncodeColor(colorBrightGreen)+"Buy",WriteIf(TMSell,EncodeColor(colorRed)+"Sell",WriteIf(TMBuy1,EncodeColor(colorBrightGreen)+"Bullish",WriteIf(TMSell1,EncodeColor(colorRed)+"Bearish","Neutral"))))

+"\n"+EncodeColor(47)+"Signal(T3-RSI) : " + WriteIf(TillsonBuy,EncodeColor(colorBrightGreen)+"Buy",WriteIf(TillsonSell,EncodeColor(colorRed)+"Sell", WriteIf(TB,EncodeColor(colorBrightGreen)+"Bullish",WriteIf(TS,EncodeColor(colorRed)+"Bearish","Neutral"))))

+"\n"+EncodeColor(47)+"Signal(ADX) : " + WriteIf(adxBuy,EncodeColor(colorBrightGreen)+"Buy",WriteIf(adxSell,EncodeColor(colorRed)+"Sell",WriteIf(adxBuy1,EncodeColor(colorBrightGreen)+"Bullish",WriteIf(adxSell1,EncodeColor(colorRed)+"Bearish","Neutral"))))

+"\n"+EncodeColor(47)+"Signal(MACD) : " + WriteIf(MB,EncodeColor(colorBrightGreen)+"Buy",WriteIf(MS,EncodeColor(colorRed)+"Sell",WriteIf(MB1,EncodeColor(colorBrightGreen)+"Bullish",WriteIf(MS1,EncodeColor(colorRed)+"Bearish","Neutral"))))

+"\n"+EncodeColor(47)+"Signal(Stoch) : " + WriteIf(StochBuy,EncodeColor(colorBrightGreen)+"Buy",WriteIf(StochSell,EncodeColor(colorRed)+"Sell",WriteIf(StBuy,EncodeColor(colorBrightGreen)+"Bullish",WriteIf(StSell,EncodeColor(colorRed)+"Bearish","Neutral"))))

+"\n"+EncodeColor(47)+"Signal(TM) : "+ WriteIf(orBuy,EncodeColor(colorBrightGreen)+"Buy",WriteIf(orSell,EncodeColor(colorRed)+"Sell",WriteIf(orBuy1,EncodeColor(colorBrightGreen)+"Bullish",WriteIf(orSell1,EncodeColor(colorRed)+"Bearish","Neutral"))))

+"\n"+EncodeColor(47)+"Signal(P5/15):" + WriteIf(Buybreakout,EncodeColor(colorBrightGreen)+"BreakOut1",WriteIf(Buybreakout2>Buybreakout,EncodeColor(colorBrightGreen)+"BreakOut2","Neutral"))

+"\n"+EncodeColor(47)+"Signal(B):"+WriteIf(C>YY1,EncodeColor(colorBrightGreen)+"BreakOut",WriteIf(C<XX1,EncodeColor(colorRed)+"BreakDown","Neutral"))

+"\n"+EncodeColor(colorPink)+"----------------------------------------"

+"\n"+EncodeColor(07)+"Volume: "+WriteIf(V>Vp2,EncodeColor(colorLime)+"Very High",WriteIf(V>Vp1,EncodeColor(colorLime)+" High",WriteIf(V>Vrg,EncodeColor(colorLime)+"Above Average",

WriteIf(V<Vrg AND V>Vn1,EncodeColor(colorRed)+"Less than Average",WriteIf(V<Vn1,EncodeColor(colorRed)+"Low","")))))

+"\n"+EncodeColor(colorYellow)+"Spread: "+WriteIf(rg >(arg*2),EncodeColor(colorLime)+" Wide",WriteIf(rg>arg,EncodeColor(colorLime)+" Above Average",EncodeColor(colorRed)+" Narrow"))

+"\n"+(EncodeColor(colorYellow)+"Close: ")+WriteIf(Vhcls,EncodeColor(colorLime)+"Very High",WriteIf(ucls,EncodeColor(colorLime)+"High",WriteIf(mcls,EncodeColor(colorYellow)+"Mid",

WriteIf(dcls,EncodeColor(colorRed)+"Down","Very Low"))))

+"\n"+EncodeColor(colorYellow) + "Zone : " +WriteIf(rising , EncodeColor(colorBrightGreen) + "Accumulation",WriteIf(falling , EncodeColor(colorCustom12) + "Distirbution",EncodeColor(colorAqua) + "Flat")) + " "

+"\n"+

EncodeColor(colorYellow) + "Status : " +

WriteIf(Weakness , EncodeColor(colorRed) + "Weak",

WriteIf(stoppingVolume , EncodeColor(colorCustom12) + "StoppingVol",

WriteIf(noSupplyBar , EncodeColor(colorLightOrange) + "NoSupply",

WriteIf(support , EncodeColor(colorLightBlue) + "SupportVol",

WriteIf(noDemandBar , EncodeColor(colorPink) + "NoDemand",

WriteIf(absorption, EncodeColor(colorSkyblue) + "Absorption",

WriteIf(upThrustBar, EncodeColor(colorBlue) + "Upthrust",

WriteIf(bullishsign, EncodeColor(colorPaleGreen) + "STRONG",

EncodeColor(colorTan) + "Neutral")))))))) + " "

+"\n"+EncodeColor(colorPink)+"----------------------------------------"

+"\n"+EncodeColor(49)+"KeyReversal : " + WriteIf(Buyr,EncodeColor(colorBrightGreen)+"ReverseUP",WriteIf(Sellr,EncodeColor(colorRed)+"ReverseDown","Flat"))

+"\n"+EncodeColor(49) +"Phaze(LTPT) : " + WriteIf(rc,EncodeColor(26)+"Recovery",WriteIf(ac,EncodeColor(colorGreen)+"Accumulation",WriteIf(bl,EncodeColor(colorBrightGreen)+"Bullish",WriteIf(wr,EncodeColor(colorOrange)+"Warning",WriteIf(ds,EncodeColor(colorRed)+"Distribution",WriteIf(br,EncodeColor(colorRed)+"Bearish","Neutral"))))))

+"\n"+EncodeColor(49)+"PV BreakOut : " + WriteIf(HIV,EncodeColor(colorBrightGreen)+"Positive",WriteIf(LIV,EncodeColor(colorRed)+"Negative","Neutral"))

+"\n"+EncodeColor(49)+"A/D : " + WriteIf(wu,EncodeColor(colorBrightGreen)+"Accumulation",WriteIf(wd,EncodeColor(colorRed)+"Distribution","Neutral"))

+"\n"+ EncodeColor(49) +"Vol Change:" + WriteIf(Vol>0,EncodeColor(08),EncodeColor(04)) +WriteVal(Vol,format=1.2)+ "%"

+WriteIf(MAuv>MAdv,EncodeColor(colorBrightGreen)+" : BullVol",WriteIf(MAuv<MAdv,EncodeColor(colorRed)+" : BearVol",": Neutral"))+WriteIf(rising,EncodeColor(colorBrightGreen)+" Rising",WriteIf(falling,EncodeColor(colorRed)+" Falling"," Flat"))

+"\n"+ EncodeColor(49) +"RSI: " +WriteIf(RSI(15)>30 AND RSI(15)<70,EncodeColor(08),WriteIf(RSI(15)<30 ,EncodeColor(07),EncodeColor(04))) + WriteVal(RSI(15),format=1.2)

+WriteIf(RSI(15)>30 AND RSI(15)<70," Range"+EncodeColor(08),WriteIf(RSI(15)<30 ," OverSold"+EncodeColor(07)," OverBought"+EncodeColor(04)))

+"\n"+EncodeColor(49)+"52 WHL: " + HIV1+" : "+LIV1+" - "+WriteIf(H>HIV1,EncodeColor(colorBrightGreen)+"High",WriteIf(L<LIV1,EncodeColor(colorRed)+"Low","Neutral"))

+"\n"+EncodeColor(49)+"HL:"+"("+pdyear1+" Yerars"+"):"+ HIV3+" :"+LIV3+"-"+WriteIf(H>HIV3,EncodeColor(colorBrightGreen)+"High",WriteIf(L<LIV3,EncodeColor(colorRed)+"Low","Neutral"))

+"\n"+EncodeColor(colorRose)+"-------------------------------------------------"

+"\n"+EncodeColor(11)+"R1 "+StrFormat("%1.2f",R1)+" R2 "+StrFormat("%1.2f",R2)+" R3 "+StrFormat("%1.2f",R3)

+"\n"+EncodeColor(02)+"PivotPoint: "+StrFormat("%1.2f",Pp)

+"\n"+EncodeColor(colorCustom11)+"S1 "+StrFormat("%1.2f",S1)+" S2 "+StrFormat("%1.2f",S2)+" S3 "+StrFormat("%1.2f",S3)

+"\n"+EncodeColor(colorRose)+"===========================";

_SECTION_END();

_SECTION_BEGIN("Vol-Trend");

uptrend=PDI(20)>MDI(10)AND Signal(29)<MACD(13);

downtrend=MDI(10)>PDI(20)AND Signal(29)>MACD(13);

Plot( 2, /* defines the height of the ribbon in percent of pane width */"ribbon",

IIf( uptrend, colorGreen, IIf( downtrend, colorRed, 0 )), /* choose color */

styleOwnScale|styleArea|styleNoLabel, -0.5, 100 );

Plot(V,"",IIf(C>O,colorGreen,IIf(C<O,4,7)),2|4|32768,5);

GfxSetOverlayMode(0);

GfxSelectFont("Tahoma", Status("pxheight")/36);

GfxSetTextAlign( 6 );// center alignment

GfxSetTextColor( colorLightGrey );

GfxSetBkMode(0); // transparent

GfxTextOut( Name(), Status("pxwidth")/2, Status("pxheight")/15 );

GfxTextOut( "Chart By Rashedbgd", Status("pxwidth")/2, Status("pxheight")/10 );

GfxSelectFont("Tahoma", Status("pxheight")/40 );

_SECTION_END();32 comments

Leave Comment

Please login here to leave a comment.

Back

Plugins are available here: http://www.mediafire.com/?znmwud2jdwt

is this is southwind sister AFL

Lots of error messages indicating variables used without being initialised plus some syntax errors in Amibroker 5.1

thnks Rashed chowdhury brother ..its amazing..Its great,thnks for hard work

Wow ~~ Grate !!! How fantastic the AFL is !!!! I got a lot from a single home.

Hats off…..Mr Rashed Chowdhury for sharing this nice afl. Plz continue to update us for you next effort.

//mahesh.aranake

Lots of error messages indicating variables used without being initialised plus some syntax errors in Amibroker 5.1//

I think you are missing DLL file and T3 include afl which is required to run this AFL. It is working with me fine…and not getting any err.

Lol Polash You Seeing Pic Commenting Fantastic Afl :P

Nava Chokra Hey Kya ?

//mahesh.aranake

Lots of error messages indicating variables used without being initialised plus some syntax errors in Amibroker 5.1//

//I think you are missing DLL file and T3 include afl which is required to run this AFL. It is working with me fine…and not getting any err.//

Thanks – I unnecessarily tried to modify formula with first error – now is working fine

Thanks once again

Very good work!

Rashed chowdhury sir thank you for your afl….good work..and thanks for sharing your knowledge …..

guys I am getting Error 29. I have used the plugins and include afl but still getting error. Any help???

Dear,

At first take my “Salaam”.I have seen your AFL named MY trend Master.It is seem to me that very useful but very unfortunately it can not be read properly specially about middle line.Could you please explain the meaning of the colour of middle line.

Best Regards,

Sunny

hi,

After downloading the plugins , how to use them in amibroker.I dont know abt it, pls someone help me.

Thanks

seehra

Hi,

This is southwind system, but Rashhed has done great job by putting buy/sell & also trend band.

Its very good, one issue is : profit booking

Thanks

Viswanath

very good indicator…

thanks…

Good work..and thanks for sharing your knowledge

Hello

I am getting error report mentioned as

Ln 140 , Col:16: Error 30, syntax error

Ln 150 , Col:16: Error 30, syntax error

kinldy help

I like it

I WANT USE INDICATOR PLEASE HELP ME MY NO IS 09867389947

SEND NUMBER I CALL YOU

I get error message in

KPA900Val = E_TSKPA900(Close);

as

Syntax error expected “(” if there a semicolon missing at the end of previous line ?

( include and plugins are inplace )

plz

paste working code if you have to vinod.nhce@gmail.com

plz check it needs fondation by southwind plugin

Wow !! What an AFL.

Thx a lot Rasheed

Brgds

Ravi

Dear Mr.Rashed,

Thank you very much for your AFL of “My Trend Master” , in fact this is an amazing afl I found ever.

Can you please include the few information as attached. It will very helpful if you can include the information.

Another thing, I want to learn AFL code writing, can you please give me source how I can learn from beginning step by step.

Your respond on this mail will be highly appreciated.

Best regards,

Shahadat

Can you please add these information to your MY TREND MASTER

PLUGIN DOWNALOD

http://www.mediafire.com/download/6aqaizlzgc5w2mu/Foundation-Int.rar

#include <T3_Include.afl>;

Where to download ? Please advise ?

You can find T3 over here

Thanks so much. It works and so useful.

@shahadat Here is Amibroker’s document: https://www.amibroker.com/guide/

Thank you. It working fine

I get error message in

KPA900Val = E_TSKPA900(Close);

as

Syntax error expected “(” if there a semicolon missing at the end of previous line ?

( include and plugins are inplace

This is “My Trend Master V.1” trading system, developed by Rashed Chowdhry; You will require T3_include function and 2 more plugin ‘JurikLib’ and ‘kpami’

dll file to use this AFL. If you experience any problem of using it, plz contact me,,,rashedbgd@gmail.com;

I can not do it to work

Please can you help me?

thank you

66 error

no work Amibroker 5.9 end 6.2.1 end 6.30

no work Amibroker 5.9 end 6.2.1 end 6.30