Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

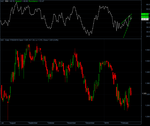

RSI Trendlines and Wedges for Amibroker (AFL)

The formula plots recent [or previous] RSI trendlines in Indicator Builder mode.

In Automatic Analysis mode, explore for the n=1 last quotations for Ascending or Descending Wedges and the respective probable bearish or bullish breakouts.

By Dimitris Tsokakis – tsokakis [at] oneway.gr

Screenshots

Similar Indicators / Formulas

Indicator / Formula

/*RSI Trendlines and Wedges*/ G=0;// set G=1, 2, 3, ... to see previous Resistance trendlines GG=0;// set G=1, 2, 3, ... to see previous Support trendlines x = Cum(1); per = 1;// sensitivity calibration s1=RSI();s11=RSI(); Plot(RSI(),"RSI",2,8); pS = TroughBars( s1, per, 1 ) == 0; endt= LastValue(ValueWhen( pS, x, 1+GG )); startt=LastValue(ValueWhen( pS, x, 2+GG )); dtS =endt-startt; endS = LastValue(ValueWhen( pS, s1, 1+GG ) ); startS = LastValue( ValueWhen( pS, s1, 2+GG )); aS = (endS-startS)/dtS; bS = endS; trendlineS = aS * ( x -endt ) + bS;// the Support trendline equation Plot(IIf(x>startt-6 AND TRENDLINES>0 AND TRENDLINES<100,trendlineS,-1e10),"Support",IIf(as>0,5,4),8); pR = PeakBars( s11, per, 1 ) == 0; endt1= LastValue(ValueWhen( pR, x, 1+G )); startt1=LastValue(ValueWhen( pR, x, 2+G )); dtR =endt1-startt1; endR = LastValue(ValueWhen( pR, s11, 1+G ) ); startR = LastValue( ValueWhen( pR, s11, 2 +G )); aR = (endR-startR)/dtR; bR = endR; trendlineR = aR * ( x -endt1 ) + bR;// the Resistance trendline equation Plot(IIf(x>startT1-6 AND TRENDLINER>0 AND TRENDLINER<100,trendlineR,-1e10),"Resistance",IIf(Ar>0,5,4),8); Ascwedge=Ar>0.5 AND As>sqrt(2)*Ar AND trendlineR>trendlineS; Descwedge= As<-0.5 AND As>Ar/sqrt(2) AND trendlineR>trendlineS; Filter=1; AddColumn(Ascwedge,"AscWedge",1.0); AddColumn(DescWedge,"DesWedge",1.0); AddColumn(Ascwedge AND trendlineS>50 AND RSI()>50,"Probable Bearish Breakout",1.0); AddColumn(Descwedge AND trendlineR<50 AND RSI()<50,"Probable Bullish Breakout",1.0);

0 comments

Leave Comment

Please login here to leave a comment.

Back