Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

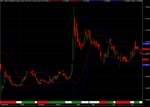

Scan Buy Sell & BB for Amibroker (AFL)

It’s a simple and efficient system for detection buy/sell signals and more, based on Bollinger Bands and others.

It is more efficient-credible when buy-signal appears after a BB-squeeze.

Screenshots

Similar Indicators / Formulas

Indicator / Formula

//PRICE

_SECTION_BEGIN("Price");

SetChartOptions(0,chartShowArrows|chartShowDates);

_N(Title = StrFormat("{{NAME}} - {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

Plot( C, "Close", ParamColor("Color", colorBlack ), styleNoTitle | ParamStyle("Style") | GetPriceStyle() );

_SECTION_END();

//==================================================================================================================

//BOLLINGER BANDS

_SECTION_BEGIN("BB");

P = ParamField("Price field",-1);

Periods = Param("Periods", 20, 1, 300, 1 );

Width = Param("Width", 1, 0, 10, 0.05 );

Color = ParamColor("Color", colorCycle );

Style = ParamStyle("Style");

Plot( BBandTop( P, Periods, Width ), "BBTop" + _PARAM_VALUES(), colorRed, Style );

Plot( BBandBot( P, Periods, Width ), "BBBot" + _PARAM_VALUES(), colorRed, Style );

_SECTION_END();

_SECTION_BEGIN("BB1");

P = ParamField("Price field",-1);

Periods = Param("Periods", 20, 2, 300, 1 );

Width = Param("Width", 2, 0, 10, 0.05 );

Color = ParamColor("Color", colorCycle );

Style = ParamStyle("Style");

Plot( BBandTop( P, Periods, Width ), "BBTop" + _PARAM_VALUES(), Color, Style );

Plot( BBandBot( P, Periods, Width ), "BBBot" + _PARAM_VALUES(), Color, Style );

_SECTION_END();

//==============================================================================================

//TRENDING RIBBON

// Paste the code below to your price chart somewhere and green ribbon means both

// both MACD and ADX trending up so if the red ribbon shows up the MACD and the ADX

// are both trending down.

_SECTION_BEGIN("trending ribbon");

uptrend=PDI()>MDI() AND MACD()>Signal();

downtrend=MDI()>PDI() AND Signal()>MACD();

Plot( 2, /* defines the height of the ribbon in percent of pane width */"ribbon",

IIf( uptrend, colorGreen, IIf( downtrend, colorRed, 0 )), /* choose color */

styleOwnScale|styleArea|styleNoLabel, -0.5, 100 );

_SECTION_END();

_SECTION_BEGIN("Price");

//SetChartOptions(0,chartShowArrows|chartShowDates);

//_N(Title = StrFormat("{{NAME}} - {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) {{VALUES}}", O, H, L, C,

//SelectedValue( ROC( C, 1 ) ) ));

//Plot( C, "Close", ParamColor("Color", colorBlack ), styleNoTitle | ParamStyle("Style") | GetPriceStyle() );

_SECTION_END();

//=================================================================================================================================

top1=BBandTop(p,20,1);

bot1=BBandBot(p,20,1);

top2=BBandTop(p,20,2);

bot2=BBandBot(p,20,2);

stocup=StochK()>StochD();

MACDup=MACD()>Signal();

Lim=ADX()<30 AND StochK()<80;

Buy=Cross(C,top1) AND C>=O OR

Cross(MACD(),Signal()) AND stocup AND C>top1 AND C>=O AND lim OR

Cross(StochK(),StochD()) AND C>top1 AND StochK()<50 AND C>=O AND Lim;

Sell=Cross(top1,C);

PlotShapes(IIf(Buy,shapeUpArrow,shapeNone),colorBlue,0,Low,Offset=-15);

PlotShapes(IIf(Sell,shapeDownArrow,shapeNone),colorRed,0,High,Offset=-15);0 comments

Leave Comment

Please login here to leave a comment.

Back