Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

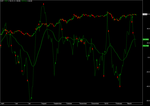

CCT CMO trading system for Amibroker (AFL)

I got this formula from book “quantitative trading systems”, and the author backtested this formula and got about ~10% return from the market annually.

Screenshots

Similar Indicators / Formulas

Indicator / Formula

CMOperiods=Optimize("pds",Param("CMO periods",21,2,100,2),2,100,2);

//CMOperiods=20;

AMAAvg=Optimize("AMA Avg",Param("AMA Avg",50,2,100,2),2,100,2);

//AMAAvg=40;

//trgAvg=Optimize("Trg Avg",Param("trigger Avg",3,2,20,1),2,20,1);

trgAvg=3;

SumUp=Sum(IIf(C>Ref(C,-1),(C-Ref(C,-1)),0), CMOperiods);

SumDn=Sum(IIf(C<Ref(C,-1),(Ref(C,-1)-C),0), CMOperiods);

CMO=100*(SumUp-SumDn)/(SumUp+SumDn);

Plot(CMO,"CMO",colorGreen,styleLine);

CMOAvg=DEMA(CMO,AMAAvg);

trigger=DEMA(CMOAvg,trgAvg);

Buy=Cross(CMOAvg,trigger);

Sell=Cross(trigger,CMOAvg) OR BarsSince(Buy)>=50;

Buy=ExRem(Buy,Sell);

Sell=ExRem(Sell,Buy);

Short=Cross(trigger,CMOAvg);

Cover=Cross(CMOAvg,trigger) OR BarsSince(Short)>=50;

Plot(C,"C",colorWhite,styleCandle);

PlotShapes(Buy*shapeUpArrow+Sell*shapeDownArrow,IIf(Buy,colorGreen,colorRed));

Plot(CMOAvg,"CMOAvg",colorGreen,style=styleLine|styleOwnScale|styleThick,-100,100);0 comments

Leave Comment

Please login here to leave a comment.

Back