Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

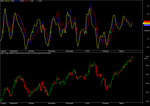

Gauss Kernel System for Amibroker (AFL)

Plots deviation of Close from its Kernel Gauss Filter, and normalized to the rms of the deviations. A simple strategy is built around it.

Screenshots

Similar Indicators / Formulas

Indicator / Formula

function Kernel(Input, Length)

{

Norm = 0;

sigma = (Length+1)/4.0;

for (i = 0; i <= Length; i++)

{

Norm = Norm + exp(-((Length/2 - i)*(Length/2 - i))/(2*sigma*sigma));

}

array = Input;

for (j = Length; j < BarCount; j++)

{

Filtered = 0;

for (k = 0; k <= Length; k++)

{

Filtered = Filtered + exp(-((Length/2 - k)*(Length/2 - k))/(2*sigma*sigma))*Input[j - k];

}

array[j] = Filtered/Norm;

}

return array;

}

function Kernel_HMA(Input, N)

{

f = Kernel(2 * Kernel(Input,round(N/2)) - Kernel(Input,N), round(sqrt(N)));

return f;

}

Length1 = Param("Length1", 8, 2, 50, 1);

Length2 = Param("Length2", 13, 2, 50, 1);

Length3 = Param("Length3", 21, 2, 50, 1);

Smoothx = Kernel(C, Length1);

Smoothy = Kernel(C, Length2);

Smoothz = Kernel(C, Length3);

x = C - Smoothx;

y = C - Smoothy;

z = C - Smoothz;

Normx = Kernel_HMA(x/sqrt(Kernel(x^2,Length1)),2);

Normy = Kernel_HMA(y/sqrt(Kernel(y^2,Length2)),2);

Normz = Kernel_HMA(z/sqrt(Kernel(z^2,Length3)),2);

Buy = ( Cross(Normx,0) OR Cross(Normy,0) OR Cross(Normz,0)) AND (Normx > Ref(Normx,-1) AND Normy > Ref(Normy,-1) AND Normz > Ref(Normz,-1));

Sell = ( Cross(0,Normx) OR Cross(0,Normy) OR Cross(0,Normz) ) AND (Normx < Ref(Normx,-1) AND Normy < Ref(Normy,-1) AND Normz < Ref(Normz,-1));

Short = Sell;

Cover = Buy;

Buy = ExRem(Buy,Sell);

Sell = ExRem(Sell,Buy);

shape = Buy * shapeUpArrow + Sell * shapeDownArrow;

PlotShapes( shape, IIf( Buy, colorBrightGreen, colorRed ), 0, IIf( Buy, 0 , 0));

Plot(Normx, "Normx", colorYellow, styleThick);

Plot(Normy, "Normy", colorBlue, styleThick);

Plot(Normz, "Normz", colorRed, styleThick);

Plot(0, "Zero", colorBlack, styleThick);0 comments

Leave Comment

Please login here to leave a comment.

Back