Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

MultiCycle 1.0 for Amibroker (AFL)

MultiCycle 1.0 created by Brian Richard in the year 2004.

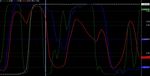

This looks at four different cyclic indicators together at one time. When

three oscillators synchronize, this signals a strong buy or sell.

The white dotted line is the Volume Flow Indicator, or VFI. If the VFI is

above the zero line, look for synchronized oscillators rising out of an

oversold condition — this is a good buy signal. If VFI is below zero, look

for overbought conditions and short, instead.

The REI is Tom DeMark’s Range Expansion Index. This is the most leading

indicator included here. The DSS is a double-smoothed stochastic, good for

timing and exact buy or sell point. And the IFT is the Inverse Fisher

Transform function.

This indicator works well for any time frame. All it takes is a little

getting used to before you become intuitive with it.

Screenshots

Similar Indicators / Formulas

Indicator / Formula

_SECTION_BEGIN("MultiCycle 1.0");

//------------------------------------------------------------------------------

//

// This looks at four different cyclic indicators together at one time. When

// three oscillators synchronize, this signals a strong buy or sell.

//

// The white dotted line is the Volume Flow Indicator, or VFI. If the VFI is

// above the zero line, look for synchronized oscillators rising out of an

// oversold condition -- this is a good buy signal. If VFI is below zero, look

// for overbought conditions and short, instead.

//

// The REI is Tom DeMark's Range Expansion Index. This is the most leading

// indicator included here. The DSS is a double-smoothed stochastic, good for

// timing and exact buy or sell point. And the IFT is the Inverse Fisher

// Transform function.

//

// This indicator works well for any time frame. All it takes is a little

// getting used to before you become intuitive with it.

//

// I named it the MultiCycle for lack of a better name.

//

//------------------------------------------------------------------------------

/*

MULTICYCLE 1.0

By Brian Richard

*/

/* Volume Flow Indicator */

Period = Param("VFI Period",26,26,1300,1);

Coef=0.2;

VCoef=Param("Max. vol. cutoff",2.5,2.5,50,1);

inter = log(Avg)-log(Ref(Avg,-1));

Vinter = StDev(inter,30);

Cutoff=Coef*Vinter*Close;

Vave=Ref(MA(V,Period),-1);

Vmax=Vave*Vcoef;

Vc=Min(V,VMax);

MF=Avg-Ref(Avg,-1);

VCP=IIf(MF>Cutoff,VC,IIf(MF<-Cutoff,-VC,0));

VFI1=Sum(VCP,Period)/Vave;

VFI=EMA(VFI1,3);

/* Double Smoothed Stochastic - DSS */

Slw = 4; Pds = 4;

A = EMA((Close-LLV(Low,Pds))/(HHV(H,pds)-LLV(L,Pds)),Slw)*100;

DSS = EMA((A-LLV(A,pds))/(HHV(A,Pds)-LLV(A,Pds)),Slw)*100;

/* Tom DeMark's Range Expansion Index */

HighMom = H - Ref( H, -2 );

LowMom = L - Ref( L, -2 );

Cond1 = ( H >= Ref( L,-5) OR H >= Ref( L, -6 ) );

Cond2 = ( Ref( H, -2 ) >= Ref( C, -7 ) OR Ref( H, -2 ) >= Ref( C, -8 ) );

Cond3 = ( L <= Ref( H, -5 ) OR L <= Ref( H, -6) );

Cond4 = ( Ref( L, -2 ) <= Ref( C, -7 ) OR Ref( L, -2 ) <= Ref( C, -8 ) );

Cond = ( Cond1 OR Cond2 ) AND ( Cond3 OR Cond4 );

Num = IIf( Cond, HighMom + LowMom, 0 );

Den = abs( HighMom ) + abs( LowMom );

TDREI = 100 * Sum( Num, 5 )/Sum( Den, 5 ) ;

// General - purpose Inverse Fisher Transform function

function InvFisherTfm1( array1 )

{

e2y1 = exp( 2 * array1 );

return ( e2y1 - 1 )/( e2y1 + 1 );

}

function InvFisherTfm2( array2 )

{

e2y2 = exp( 2 * array2 );

return ( e2y2 - 1 )/( e2y2 + 1 );

}

function InvFisherTfm3( array3 )

{

e2y3 = exp( 2 * array3 );

return ( e2y3 - 1 )/( e2y3 + 1 );

}

function InvFisherTfm4( array4 )

{

e2y4 = exp( 2 * array4 );

return ( e2y4 - 1 )/( e2y4 + 1 );

}

Value1 = 0.1 * (DSS-55);

Value2 = WMA( Value1, 5 );

Value3 = 0.1 * ( RSI( 5 ) - 50 );

Value4 = WMA( Value3, 10 );

Value5 = 0.03 * (TDREI);

Value6 = WMA( Value5, 10 );

Value10 = VFI;

Value11 = EMA(VFI,10);

Plot( InvFisherTfm1( Value2 ), "DSS", colorDarkGreen, styleThick );

Plot( InvFisherTfm2( Value4 ), "RSI", colorBlue, styleThick );

Plot( InvFisherTfm3( Value6 ), "REI", colorRed, styleThick );

Plot( InvFisherTfm4( Value11 ), "VFI", colorWhite, styleDots );

Plot(0,"",colorDarkBlue,styleDots);

PlotGrid( 0.5 );

PlotGrid(-0.5 );

_SECTION_END();3 comments

Leave Comment

Please login here to leave a comment.

Back

Excellent thanks

Hi, it is good. Have coded buy sell signals for this system ?

Hi this is good indicator, thanks for share