Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

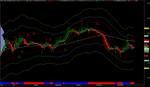

Boll Fibo Ashi Band for Amibroker (AFL)

This formula is mixture of Bollinger Band Fibonacci Ratio and Heikin Ashi. Just Follow the Signal.

Recently I found “WISESTOCKTRADER” , this is very useful site and this is my 1st attempt posting Formula.

Thanks.

Screenshots

Similar Indicators / Formulas

Indicator / Formula

_SECTION_BEGIN("DispWMA");

P = ParamField("Field");

Type = ParamList("Type", "Weighted,Simple,Exponential,Double Exponential,Tripple Exponential,Wilders");

Periods16 = Param("Periods16", 16, 2, 300 );

Displacement3 = Param("Displacement3", 3, -50, 50 );

Plot( WMA( P, Periods16 ), _DEFAULT_NAME(), colorRed, styleStaircase, 0, 0, Displacement3 );

m = 0;

Periods8 = Param("Periods8", 8, 2, 300 );

Displacement2 = Param("Displacement2", 2, -50, 50 );

Plot( WMA( P, Periods8 ), _DEFAULT_NAME(), colorSkyblue,styleLine, 0, 0, Displacement2 );

m =0;

Periods5 = Param("Periods5", 5, 2, 300 );

Displacement1 = Param("Displacement1", 1, -50, 50 );

Plot( WMA( P, Periods5 ), _DEFAULT_NAME(), colorTan,styleLine, 0, 0, Displacement1 );

m = 0;

_SECTION_END();

_SECTION_BEGIN("Speed Lines");

P2 = 2;

Plot( EMA( C, P2 ), "Spd 2" , colorBrightGreen,styleStaircase | styleThick );

_SECTION_END();

_SECTION_BEGIN("trend candle");

////////////////////////////////////

// Heikin_Ashi For Amibroker

////////////////////////////////////

HaClose =EMA((O+H+L+C)/4,3);

HaOpen = AMA( Ref( HaClose, -1 ), 0.5 );

HaHigh = Max( H, Max( HaClose, HaOpen ) );

HaLow = Min( L, Min( HaClose, HaOpen ) );

PlotOHLC( HaOpen, HaHigh, HaLow, HaClose, "Modified " + Name(), colorBrown, styleCandle | styleNoLabel );

//SetChartBkGradientFill( ParamColor("BgTop", colorBrightGreen),ParamColor("BgBottom", colorSeaGreen));

Title="";

_SECTION_END();

_SECTION_BEGIN("MABIUTS");

SetChartOptions(0,chartShowArrows|chartShowDates);

_N(Title = StrFormat("{{NAME}} - {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) Vol " +WriteVal( V, 1.0 ) +" {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 )) ));

Buy=EMA(C,13)>EMA(EMA(C,13),9) AND Cross (C,Peak(C,5,1));

Sell=Cross (EMA(EMA(C,13),9),EMA(C,13));

MYcolor = IIf( EMA(C,13)>EMA(EMA(C,13),9) AND C>Peak(C,2,1), colorGreen, IIf(EMA(C,13)>EMA(EMA(C,13),9) AND C<Peak(C,2,1),colorBlue, colorBrown ));

PlotOHLC( Open, High, Low, Close, "", Mycolor, styleBar );

shape = Buy * shapeHollowStar + Sell * shapeHollowStar;

PlotShapes( shape, IIf( Buy, colorGreen, colorRed ),0, IIf( Buy, Low, High ) );

GraphXSpace = 5;

dist = 1.5*ATR(10);

for( i = 0; i < BarCount; i++ )

{

if( Buy[i] ) PlotText( "Buy\n@" + C[ i ], i, L[ i ]-dist[i], colorGreen );

if( Sell[i] ) PlotText( "Sell\n@" + C[ i ], i, H[ i ]+dist[i], colorRed);

}

_SECTION_END();

_SECTION_BEGIN("WMA89");

P = ParamField("Field");

Type = ParamList("Type", "Weighted,Simple,Exponential,Double Exponential,Tripple Exponential,Wilders");

Periods89 = Param("Periods89", 89, 2, 300 );

Displacement2 = Param("Displacement2", 2, -50, 50 );

Plot( WMA( P, Periods89 ), _DEFAULT_NAME(), colorLightYellow, styleStaircase, 0, 0, Displacement2 );

_SECTION_END();

_SECTION_BEGIN("7_Volume At Price");

PlotVAPOverlay( Param("Lines", 300, 100, 1000, 1 ), Param("Width", 5, 1, 100, 1 ), ParamColor("Color", colorBlueGrey ), ParamToggle("Side", "Right" ) | 4*ParamToggle("Z-order", "On top|Behind", 1 ) );

_SECTION_END();

_SECTION_BEGIN("swing");

SetChartOptions(0,chartShowArrows|chartShowDates);

//_N(Title = StrFormat("{{NAME}} - {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

//Plot( C, "Close", ParamColor("Color", colorGrey50 ), styleNoTitle | ParamStyle("Style") | GetPriceStyle() );

no=Param( "Swing", 2, 0, 55 );

tsl_col=ParamColor( "Color", colorGrey50 );

res=HHV(H,no);

sup=LLV(L,no);

avd=IIf(C>Ref(res,-1),1,IIf(C<Ref(sup,-1),-1,0));

avn=ValueWhen(avd!=0,avd,1);

tsl=IIf(avn==1,sup,res);

//Plot(tsl, _DEFAULT_NAME(), tsl_col, styleStaircase);

Buy=Cross(C,tsl);

Sell=Cross(tsl,C);

shape=Buy*shapeUpArrow + Sell*shapeDownArrow;

PlotShapes(shape,IIf(Buy,tsl_col,tsl_col),0,IIf(Buy,Low,High));

_SECTION_END();

_SECTION_BEGIN("Bollinger Fibonacci Bands");

// Bollinger Fibonacci Bands - Beachie41 26/11/04 //

/* as used in the VT trading platform -

see outline of FX trading system by mezarashii on

Moneytec http://www.moneytec.com/forums/_showthread/_threadid-11630/_s-

*/

GraphXSpace = 3;

per = Param("Period",21,8,55,1);

TH =IIf(Ref(C,-1) > H,Ref(C,-1),H);

TL=IIf(Ref(C,-1) < L,Ref(C,-1),L);

TR = TH-TL;

TRa= Wilders(TR,per);

UpperBand3 =MA( C, per) + ( 4.2360 * TRa);

UpperBand2=MA( C, per) + ( 2.6180 * TRa);

UpperBand1=MA( C, per) + ( 1.6180 * TRa);

MidPoint=MA(C, per);

LowerBand1=MA( C, per) - ( 1.6180 * TRa);

LowerBand2=MA( C, per) - ( 2.6180 * TRa);

LowerBand3=MA( C, per) - ( 4.2360 * TRa);

Plot(MidPoint,"",colorGreen,4);

Plot(UpperBand1,"",colorRed,1);

Plot(LowerBand1,"",colorRed,1);

Plot(UpperBand2,"",colorAqua,1);

Plot(LowerBand2,"",colorAqua,1);

Plot(UpperBand3,"",colorYellow,1);

Plot(LowerBand3,"",colorYellow,1);

//PlotOHLC(O,H,L,C,"",colorWhite,64);

_SECTION_END();

_SECTION_BEGIN("Ribbon");

// ribbon code

Plot( 2, "Ribbon",IIf(C>tsl,colorBlue,colorRed),styleOwnScale|styleArea|styleNoLabel, -0.5, 100 );

_SECTION_END();

/* **********************************

Code to automatically identify pivots

********************************** */

// -- what will be our lookback range for the hh and ll?

farback=Param("How Far back to go",100,50,5000,10);

nBars = Param("Number of bars", 12, 5, 40);

// -- Title.

//Title = Name() + " (" + StrLeft(FullName(), 15) + ") O: " + Open + ",

//H: " + High + ", L: " + Low + ", C: " + Close;

// -- Plot basic candle chart

//PlotOHLC(Open, High, Low, Close,

//"BIdx = " + BarIndex() +

//"\n" + "O = " + O + "\n"+"H = "+ H + "\n"+"L = " + L

//+ "\n"+"C ",

//colorBlack, styleCandle);

GraphXSpace=7;

// -- Create 0-initialized arrays the size of barcount

aHPivs = H - H;

aLPivs = L - L;

// -- More for future use, not necessary for basic plotting

aHPivHighs = H - H;

aLPivLows = L - L;

aHPivIdxs = H - H;

aLPivIdxs = L - L;

nHPivs = 0;

nLPivs = 0;

lastHPIdx = 0;

lastLPIdx = 0;

lastHPH = 0;

lastLPL = 0;

curPivBarIdx = 0;

// -- looking back from the current bar, how many bars

// back were the hhv and llv values of the previous

// n bars, etc.?

aHHVBars = HHVBars(H, nBars);

aLLVBars = LLVBars(L, nBars);

aHHV = HHV(H, nBars);

aLLV = LLV(L, nBars);

// -- Would like to set this up so pivots are calculated back from

// last visible bar to make it easy to "go back" and see the pivots

// this code would find. However, the first instance of

// _Trace output will show a value of 0

aVisBars = Status("barvisible");

nLastVisBar = LastValue(Highest(IIf(aVisBars, BarIndex(), 0)));

_TRACE("Last visible bar: " + nLastVisBar);

// -- Initialize value of curTrend

curBar = (BarCount-1);

curTrend = "";

if (aLLVBars[curBar] <

aHHVBars[curBar]) {

curTrend = "D";

}

else {

curTrend = "U";

}

// -- Loop through bars. Search for

// entirely array-based approach

// in future version

for (i=0; i<farback; i++) {

curBar = (BarCount - 1) - i;

// -- Have we identified a pivot? If trend is down...

if (aLLVBars[curBar] < aHHVBars[curBar]) {

// ... and had been up, this is a trend change

if (curTrend == "U") {

curTrend = "D";

// -- Capture pivot information

curPivBarIdx = curBar - aLLVBars[curBar];

aLPivs[curPivBarIdx] = 1;

aLPivLows[nLPivs] = L[curPivBarIdx];

aLPivIdxs[nLPivs] = curPivBarIdx;

nLPivs++;

}

// -- or current trend is up

} else {

if (curTrend == "D") {

curTrend = "U";

curPivBarIdx = curBar - aHHVBars[curBar];

aHPivs[curPivBarIdx] = 1;

aHPivHighs[nHPivs] = H[curPivBarIdx];

aHPivIdxs[nHPivs] = curPivBarIdx;

nHPivs++;

}

// -- If curTrend is up...else...

}

// -- loop through bars

}

// -- Basic attempt to add a pivot this logic may have missed

// -- OK, now I want to look at last two pivots. If the most

// recent low pivot is after the last high, I could

// still have a high pivot that I didn't catch

// -- Start at last bar

curBar = (BarCount-1);

candIdx = 0;

candPrc = 0;

lastLPIdx = aLPivIdxs[0];

lastLPL = aLPivLows[0];

lastHPIdx = aHPivIdxs[0];

lastHPH = aHPivHighs[0];

if (lastLPIdx > lastHPIdx) {

// -- Bar and price info for candidate pivot

candIdx = curBar - aHHVBars[curBar];

candPrc = aHHV[curBar];

if (

lastHPH < candPrc AND

candIdx > lastLPIdx AND

candIdx < curBar) {

// -- OK, we'll add this as a pivot...

aHPivs[candIdx] = 1;

// ...and then rearrange elements in the

// pivot information arrays

for (j=0; j<nHPivs; j++) {

aHPivHighs[nHPivs-j] = aHPivHighs[nHPivs-

(j+1)];

aHPivIdxs[nHPivs-j] = aHPivIdxs[nHPivs-(j+1)];

}

aHPivHighs[0] = candPrc ;

aHPivIdxs[0] = candIdx;

nHPivs++;

}

} else {

// -- Bar and price info for candidate pivot

candIdx = curBar - aLLVBars[curBar];

candPrc = aLLV[curBar];

if (

lastLPL > candPrc AND

candIdx > lastHPIdx AND

candIdx < curBar) {

// -- OK, we'll add this as a pivot...

aLPivs[candIdx] = 1;

// ...and then rearrange elements in the

// pivot information arrays

for (j=0; j<nLPivs; j++) {

aLPivLows[nLPivs-j] = aLPivLows[nLPivs-(j+1)];

aLPivIdxs[nLPivs-j] = aLPivIdxs[nLPivs-(j+1)];

}

aLPivLows[0] = candPrc;

aLPivIdxs[0] = candIdx;

nLPivs++;

}

}

// -- Dump inventory of high pivots for debugging

/*

for (k=0; k<nHPivs; k++) {

_TRACE("High pivot no. " + k

+ " at barindex: " + aHPivIdxs[k] + ", "

+ WriteVal(ValueWhen(BarIndex()==aHPivIdxs[k],

DateTime(), 1), formatDateTime)

+ ", " + aHPivHighs[k]);

}

*/

// -- OK, let's plot the pivots using arrows

PlotShapes(

IIf(aHPivs==1, shapeDownArrow, shapeNone), colorRed, 0,

High, Offset=-15);

PlotShapes(

IIf(aLPivs==1, shapeUpArrow , shapeNone), colorGreen, 0,

Low, Offset=-15);1 comments

Leave Comment

Please login here to leave a comment.

Back

Hi !!

Thanks for posting an exciting formulation. I will try it on trading analysis.

Atul