Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

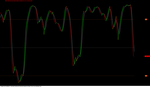

SMI - Stochastic Momentum Index for Amibroker (AFL)

SMI was created by William Blau in January 1993 issue of Technical Analysis of Stocks & Commodities.

The result is an oscillator that ranges between +/- 100 and is a bit less erratic than an equal period Stochastic Oscillator.

The interpretation of the SMI is virtually identical to the Stochastic Oscillator.

Screenshots

Similar Indicators / Formulas

Indicator / Formula

_SECTION_BEGIN("SMI - Stochastic Momentum Index");

SetChartBkColor( colorBlack ) ;

LookBack = Optimize("LookBack",Param("Lookback", 10, 1, 100 ),1,30,1);

Smooth1 = Optimize("Smooth 1",Param("Smooth 1", 3, 1, 100 ),1,30,1);

Smooth2 = Param("Smooth 2", 3, 1, 20 );

Trigger = Param("Signal", 3, 1, 10);

PP = ParamField("Price field",-1);

SMILevel = Param("Level", 60, 10, 60, 10);

HH = HHV( H, LookBack );

LL = LLV( L, LookBack );

StoMom = 100 * EMA( EMA( PP - 0.5 * ( HH + LL ), Smooth1 ), Smooth2 ) /

( 0.5 * EMA( EMA( HH - LL, Smooth1 ), Smooth2 ) );

StoSig = MA(StoMom,3);

Buy = Cover = Cross(StoMom,StoSig);

Short = Short = Cross(StoSig,StoMom);

Plot (StoMom,_DEFAULT_NAME(),IIf(StoMom> Ref(StoMom,-1),colorBrightGreen,colorRed), styleLine+styleThick);

Plot (StoSig,"",colorWhite,styleLine+styleNoLabel);

Plot(0,"",31,styleNoLabel);

Plot( SMILevel,"",colorOrange,styleDashed);

Plot(-SMILevel,"",colorOrange,styleDashed);

_SECTION_END();2 comments

Leave Comment

Please login here to leave a comment.

Back

Cool!

Tested on SPY for past 6 years resut.

Having more losers than winners.

Reverse the Buy/Sell & Short/Cover would bring positive result.

there are no buy sell signals. On what ground you tested the results? This is just an indicator, no signals… you have to change the parameters for better results.